Tanzania Energy Outlook

This report is part of Africa Energy Outlook 2019

Africa Energy Outlook 2019 is the IEA’s most comprehensive and detailed work to date on energy across the African continent, with a particular emphasis on sub-Saharan Africa. It includes detailed energy profiles of 11 countries that represent three-quarters of the region’s gross domestic product and energy demand.

Key indicators and policy initiatives

|

Stated Policies |

Africa Case |

CAAGR 2018-40 |

||||||

|---|---|---|---|---|---|---|---|---|

|

2000 |

2018 |

2030 |

2040 |

2030 |

2040 |

STEPS |

AC |

|

|

GDP ($2018 billion, PPP) |

57 |

176 |

314 |

585 |

475 |

1 233 |

5.6% |

9.3% |

|

Population (million) |

34 |

59 |

83 |

108 |

83 |

108 |

2.8% |

2.8% |

|

|

11% |

37% |

70% |

80% |

100% |

100% |

3.6% |

4.7% |

|

|

2% |

6% |

46% |

76% |

100% |

100% |

12.2% |

13.7% |

|

CO2 emissions (Mt CO2) |

3 |

12 |

24 |

41 |

36 |

74 |

5.9% |

8.8% |

Note: STEPS = Stated Policies Scenario and AC = Africa Case

| Policy | Key targets and measures |

|---|---|

|

|

|

|

Industrial development targets |

|

Key energy indicators

With annual GDP growth of more than 9% in the AC, Tanzania’s economy could be seven-times larger in 2040 than today, but with an increase in energy demand limited to 150% driven by fuel efficiency gains.

In the AC, diversifying the energy mix and improving energy efficiency are the keys to achieving economic growth while limiting growth in energy demand, with oil, gas and geothermal reducing the share of bioenergy in the energy mix.

Gas accounts for more than half of current power generation, with the remainder coming from hydropower and oil, the latter used mostly for back-up generators.

Providing access for all and a growth in productive uses lead to a thirteen-fold increase of electricity demand by 2040 in the AC: this is met with an expansion of gas, hydropower and solar PV.

Oil continues to play an important role in end-use sectors, not least as a result of its use by the increasing number of buses on the road as Tanzania has a large bus fleet.

Gas and electricity use in industry is growing strongly, especially in manufacturing industries, but in the AC, energy efficiency measures have prevented consumption from being 20% higher than current levels.

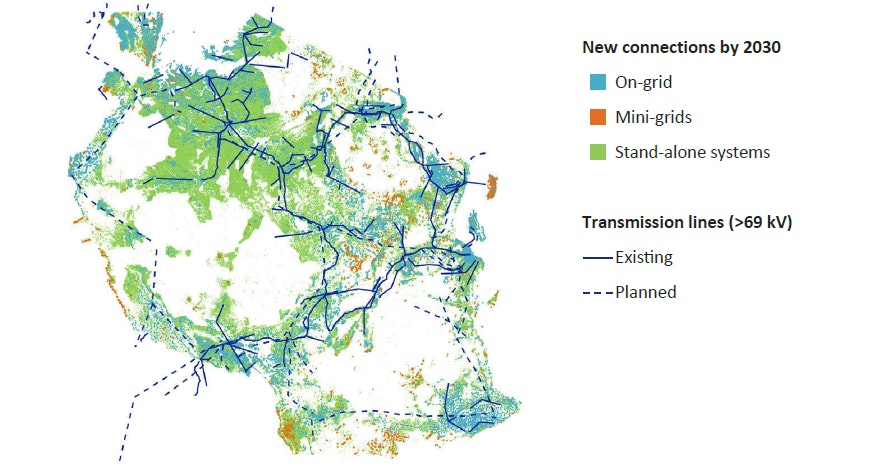

Tanzania electricity access solutions by type in the Africa Case

Despite the low access rate (37%) today, the grid represents more than half of new connections by 2030 in the AC given its existing and planned coverage.

In the AC, around one-third of the remaining population, mainly located in sparsely populated areas far from the grid, would be best reached by stand-alone systems.

Tanzania use of fuels and technologies for cooking by scenario, 2018-2030

OpenDespite policies to promote clean cooking solutions, the number of people relying on traditional use of biomass for cooking declines from 55 million people today to 44 million in 2030 as efforts to improve access outrun by high population growth in STEPS.

In the AC, LPG and biogas are the least-cost options for almost half of the population, with improved cookstoves the main way to extend access in rural areas.

Tanzania fossil fuel demand and production by scenario to 2040

Tanzania gas demand and production by scenario, 2010-2040

OpenRecent large discoveries push up gas production to almost 30 bcm by 2040 in the STEPS. Existing infrastructure helps Tanzania to increase domestic gas consumption.

Gas demand in 2040 is twice as high in the AC, helped by efforts to promote the use of gas to displace traditional biomass and by support for gas-based industries.

Tanzania cumulative investment needs, 2019-2040

OpenAlmost $80 billion of cumulative energy supply investment is needed in the STEPS, with most of it being used to widen access to gas and electricity.

This level of investment doubles in the AC, with higher amounts of capital allocated to electricity access and networks.

Tanzania policy opportunities

A rapid development of offshore resources would help to ensure greater availability of gas, and a robust framework to use export revenues in an effective manner would help to ensure that the country makes the most of those revenues.

Maintaining investment in public transport, notably in Dar es Salaam, but also in other cities and between cities and rural areas, would help to facilitate economic growth. Government should also ensure public transport is affordable for all.