South Africa Energy Outlook

This report is part of Africa Energy Outlook 2019

Africa Energy Outlook 2019 is the IEA’s most comprehensive and detailed work to date on energy across the African continent, with a particular emphasis on sub-Saharan Africa. It includes detailed energy profiles of 11 countries that represent three-quarters of the region’s gross domestic product and energy demand.

Key indicators and policy initiatives

| Stated Policies | Africa Case | CAAGR 2018-40 | ||||||

|---|---|---|---|---|---|---|---|---|

| 2000 | 2018 | 2030 | 2040 | 2030 | 2040 | STEPS | AC | |

| GDP ($2018 billion, PPP) | 491 | 789 | 1010 | 1348 | 1174 | 1600 | 2.5% | 3.3% |

| Population (million) | 46 | 57 | 66 | 71 | 66 | 71 | 1.0% | 1.0% |

| • with electricity access | 77% | 95% | 100% | 100% | 100% | 100% | 0.2% | 0.2% |

| • with access to clean cooking | 56% | 87% | 90% | 93% | 100% | 100% | 0.3% | 0.7% |

| CO2 emissions (Mt CO2) | 280 | 420 | 321 | 279 | 289 | 187 | -1.8% | -3.6% |

Note: STEPS = Stated Policies Scenario and AC = Africa Case

| Policy | Key targets and measures |

|---|---|

| Performance targets |

|

| Industrial development targets |

|

Key energy indicators

The economy could double in the AC with less primary energy demand compared to today by increasing the share of renewables and gas in the energy mix.

In the AC, the role of coal in South African industry and power generation is already decreasing, while that of gas and renewables is increasing.

South Africa is reliant on coal but is making efforts to diversify as its coal-fired fleet is ageing; new projects will not fully compensate for the decline of the existing fleet.

The government is focussing on diversifying the power mix by introducing natural gas and renewables, including concentrating solar power (CSP); South Africa has excellent natural resources for CSP development.

Oil is the largest fuel in the end-use sectors; more stringent fuel economy standards would mean that a 25% increase in demand could be met with a slight increase in the amount of oil used.

The role of coal in South African industry dwindles in the AC as gas and bioenergy are increasingly used, especially in steel production and in light industries.

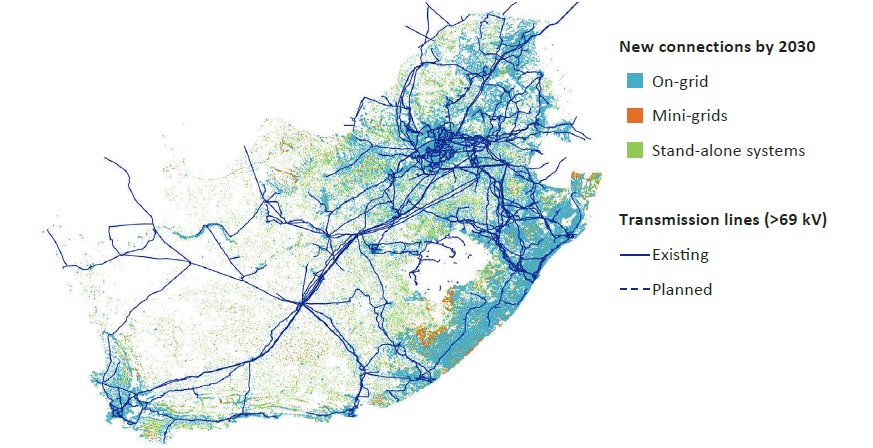

South Africa electricity access solutions by type in the Africa Case

South Africa has a well-developed electricity network and one of the highest rates of electricity access in sub-Saharan Africa.

The least-cost way to connect those without access is in most cases via the grid (81%) with the residual population served by mini-grids (12%) and stand-alone systems.

South Africa fuels and technologies used for cooking by scenario, 2018-2030

OpenIn both urban and rural areas, electricity is the favourite option for cooking in South Africa, but more than 4 million living mainly in rural areas continue to use fuelwood for heating and cooking in 2030 in the STEPS.

Improved cookstoves and LPG would help close the gap between the STEPS and the AC and eliminate the use of traditional biomass, reducing household premature deaths by 80% in 2030.

South Africa fossil fuel demand and production by scenario to 2040

South Africa gas demand and production, 2010-2040

OpenSouth Africa continues to dominate coal production in Africa. Despite declining production, falling domestic demand boosts export volumes in both scenarios.

South Africa also relies on oil and gas for its energy needs, but recent gas discoveries could reduce its import needs.

South Africa cumulative investment needs by scenario, 2019-2040

OpenNearly $220 billion of cumulative energy investment is needed in the STEPS, with renewables and electricity networks accounting for the majority.

The AC requires more investment in gas production, but overall efficiency improvements moderate the additional spending needs.

South Africa policy opportunities

Diversifying energy supply away from coal would have many benefits, including a reduction in the number of premature deaths from pollution, but the social implications of changes would need careful management.

Reforming and restructuring ESKOM would strengthen the reliably of the power system, support increased industrialisation and help efforts to diversify the energy mix.

Strengthening efficiency throughout the economy would reduce demand for both materials and energy, while the implementation of minimum energy performance standards for electric motors in the industry and mining sectors would be an important first step towards unlocking further efficiency gains.