Cite report

IEA (2020), Clean Energy Innovation, IEA, Paris https://www.iea.org/reports/clean-energy-innovation, Licence: CC BY 4.0

Report options

Clean energy innovation needs faster progress

Highlights

- The Covid-19 crisis represents both an opportunity and a risk for clean energy technology innovation. It offers a once-in-a-generation opportunity for governments to reprioritise and boost innovation, including R&D, as part of stimulus efforts with a view to achieving a long-term transition to net-zero emissions. But it could also result in tighter government and corporate budgets that lead reduce the pace of clean energy innovation.

- We explore two variants of the Sustainable Development Scenario to illustrate the potential impacts. In a Faster Innovation Case, we examine what would be needed in terms of even faster progress in clean energy technology innovation to deliver net-zero emissions globally by 2050, including from technologies that are currently only in the laboratory or at the stage of small prototypes. In a Reduced Innovation Case, we examine what the effects would be if demonstration projects currently in the pipeline were to be delayed by five years and if deployment rates for technologies at the critical early adoption stage were to be slowed down.

- In the Faster Innovation Case, CO2 savings from technologies currently at the prototype or demonstration stage would be more than 75% higher in 2050 than in the Sustainable Development Scenario, and 45% of all emissions savings in 2050 would come from technologies that have not yet reached the market. Such rapid deployment would require successful innovation cycles that are more rapid than any seen in recent energy technology history. Key clean energy technologies at demonstration or large prototype stage today would need to reach markets in six years from now at the latest, which is twice as fast as in the Sustainable Development Scenario. Robust market deployment of current prototypes would need to start right after the completion of only one single commercial-scale demonstration, which is not common practice.

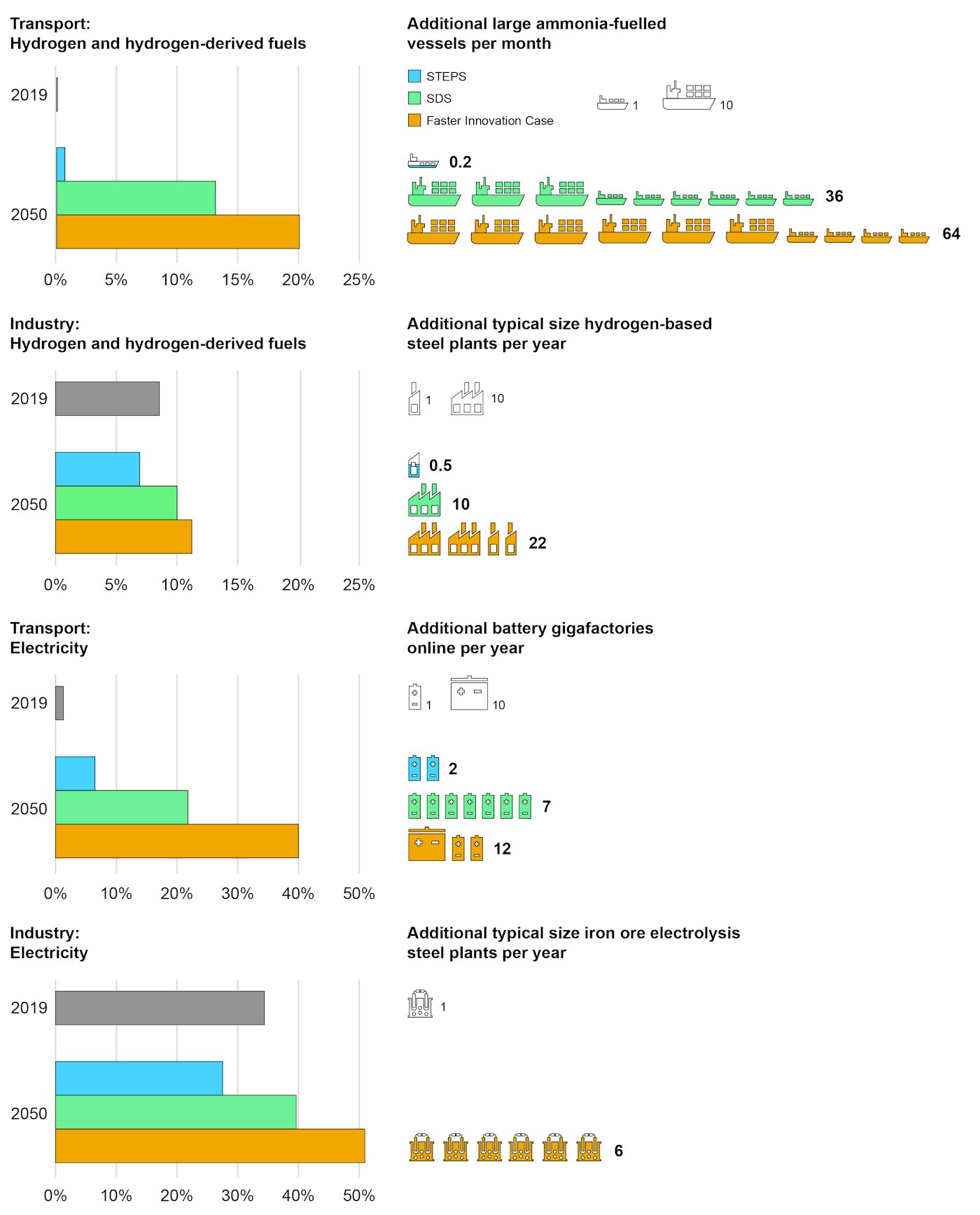

- In the Faster Innovation Case, advanced high-energy density battery chemistries would enable electrification of transport to be more widespread, and large-scale high-temperature industrial electric heating is widely deployed in sectors such as chemicals (both technologies are at concept and early prototype stage today). Demand for hydrogen and hydrogen-based fuels would grow by almost 25% in 2050 over the Sustainable Development Scenario, requiring, for example, almost two new hydrogen-based steel plants (today at prototype stage) to be installed each month from now to 2050. CO2 capture would increase by 50% to around 7.5 GtCO2 per year in 2050, while almost 90 new bioenergy plants equipped with CO2 capture and storage would be needed each year, nearly three times as much as the capacity projected in the Sustainable Development Scenario.

- In the Reduced Innovation Case, the rate of technology development would be much slower than in the Sustainable Development Scenario as a result of the Covid-19 pandemic, and emissions would be higher. The capital costs of critical technologies such as hydrogen electrolysers would rise by almost 10% by 2030 relative to the Sustainable Development Scenario, increasing the investment challenge and cost of finance, undermining the ability of the industry to scale-up production at the required pace, and requiring governments to provide additional financial support for longer until the technology becomes competitive.

Introduction

A clean energy transition of the global energy sector to net-zero emissions in the long term requires radical changes to the way we produce and consume energy. It requires us, in particular, to move away from the production and use of fossil fuels without carbon capture utilisation and storage (CCUS) and to use low-carbon and more efficient energy technologies. The Sustainable Development Scenario, presented in Chapter 3 of this ETP Special Report, describes such a low-carbon transition. It is designed to meet UN energy-related Sustainable Development Goals, including the goal of the Paris Agreement, and the transition it sets out is unprecedented in scope, depth and speed. The technology turnover and innovation needs that it details are significant, and show how much more there is to do: almost 35% of the cumulative emissions reductions by 2070 in the Sustainable Development Scenario compared with the Stated Policies Scenario hinge on technologies that are currently only at large prototype or demonstration phase, and around 40% on technologies that are not yet commercially deployed at a large scale. In other words, technologies currently available to the market at scale will not be sufficient to effect a global clean energy transition to net-zero emissions, and a continued and strong focus on RD&D is essential to the transition.

Against this background, it is clearly of paramount importance to ensure that government and corporate RD&D portfolios and priorities are aligned with a transition to net-zero emissions. There is much to do, and the challenges are formidable. As discussed in Chapters 2 and 3, technology innovation is a time‑consuming non-linear process in which some ideas get abandoned while new ones are being generated. History shows that bringing new energy technologies to sizeable deployment after the first prototype can take between 20 and almost 70 years: the journey took around 30 years even for recent highly successful clean energy technologies, such as solar photovoltaic (PV) and lithium-ion (Li-ion) batteries to power electric vehicles. The impact of the Covid-19 pandemic has greatly affected economic activity, including in the energy sector, thus adding to the challenges. In response, governments are now increasingly looking at economic stimulus packages: these offer an important opportunity for action that helps to ensure continued security of energy supplies while supporting clean energy transitions, including the technology innovation that they depend on.

In this chapter, we complement the Sustainable Development Scenario by analysing two additional variants that serve to illustrate the importance of prioritising clean energy innovation in stimulus packages and more widely:

- We analyse a Faster Innovation Case that explores just how much more clean energy technology innovation would be needed to bring forward the time at which the Sustainable Development Scenario reaches net-zero emissions from 2070 to 2050. This case serves to underline the importance of governments grasping the opportunity provided by stimulus packages in the context of Covid-19 to review their RD&D portfolios and priorities and align them with their long-term clean energy transition objectives.

- We then analyse a Reduced Innovation Case that explores the risks associated with a potential slowdown in innovation activities arising from delays in demonstration projects or a slow uptake of technologies currently at an early stage of adoption. This brings out the likely consequences if governments fail to prioritise clean energy technology innovation in stimulus packages and more widely.

Is clean energy technology innovation at risk following the Covid-19 crisis?

With the global economic crisis unfolding after the pandemic, there is a risk that the innovation efforts of governments and companies could be deprioritised and that the development and deployment of key clean energy technologies could be delayed as a result. Early signs are generally encouraging, however, indicating that governments and companies understand the importance for clean energy transitions of a continuing strong focus on RD&D.

The Covid-19 outbreak has affected critical electricity-based technologies. Heat pumps sales reported for 2020 suggest a temporary levelling off or decrease in some markets. Air-source heat pump sales increased by 5% in the United States from January to March 2020 relative to 2019, but decreased 15% year-on-year in April (AHRI, 2020). The Japanese producer Daikin projects an almost 9% drop in sales for 2020 (Daikin, 2020), while the European Heat Pump Association estimates that the European market could register a decline of up to 10%. However, manufacturers seem confident in a bright future for heat pumps. As of June 2020, heat pump manufacturing outputs returned to pre-pandemic levels in China and Europe, although a number of factories were still closed in India. Daikin (accounting for an estimated third of the global heat pump market) also plans to maintain its R&D spending in 2020 relative to 2019, and the company is strengthening R&D capacity in Germany (Daikin, 2020a; 2020b). Governments are seizing the opportunity to include heat pumping technology in Covid-19 stimulus packages: for example, the Italian “Super Eco-bonus” provides a 110% fiscal incentive (up to EUR 30 000) for A-class heating and cooling systems, on top of other renovation measures (Gazzetta Ufficiale, 2020).

In transport, the outbreak of the Covid-19 pandemic brought about a dramatic decline in electric car sales in some regions. In China, the decline was largest in February, with electric car sales falling by around 60% from the same month in 2019: sales rebounded strongly in April, however, reaching around 80% of the level they were at a year earlier. In the United States, electric car sales in April more than halved from a year earlier. In the largest European car markets combined (France, Germany, Italy and the United Kingdom), however, sales of electric cars in the first four months of 2020 reached more than 145 000 electric cars, about 90% higher than in the same period last year, as a result of recently revitalised supportive policy schemes.

For carbon capture utilisation and storage (CCUS), short-term uncertainty has been tempered by recent project and funding announcements. In March 2020, the United Kingdom confirmed its pledge to invest GBP 800 million (USD 995 million) in CCUS infrastructure: its plans involve establishing CCUS in at least two locations. In Europe, the EUR 10‑billion Innovation Fund will be available to support CCUS projects (and other clean energy technologies) from 2020, while in May the Australian government announced plans to make CCUS eligible for existing funding programmes. Direct air capture research also received a boost in March 2020 when the US Department of Energy earmarked USD 22 million in research and development grants (US DoE, 2020). Recent industry commitments to CCUS include an announcement by the Oil and Gas Climate Initiative in April 2020 to invest in a natural gas CCUS power plant in the United States, and a commitment in May 2020 by Equinor, Shell and Total to invest more than USD 700 million in the Northern Lights offshore CO2 storage project. In addition, Climeworks announced in June 2020 that it had by then raised CHF 73 million (USD 75 million), the largest private investment to date for direct air capture (Climeworks, 2020).

Some delays have been announced to hydrogen projects, for instance in Sweden, where a project aiming to develop several commercial-scale demonstrators for methanol based on electrolytic hydrogen has delayed the detailed engineering phase, although only by a matter of months (Liquid Wind, 2020). Other projects may face delays as well: Hydrogen Europe estimates that up to EUR 130 billion of investments in low-carbon hydrogen production projects may be at risk in Europe (Hydrogen Europe, 2020). But there have also been plenty of confirmations of pre-Covid development plans for hydrogen technologies. Several governments, such as Germany and Norway, announced in early June their hydrogen development strategies with firm commitments (EUR 9 billion to support hydrogen technologies in the case of Germany, which is 7% of its national total recovery fund). In addition, the consortium behind the development of iron ore reduction for steelmaking based fully on electrolytic hydrogen confirmed in June 2020 its commitment to proceed with the project as planned. This means that construction of an industrial scale demonstration plant will commence in 2023 with the objective of producing commercial fossil-free steel as early as 2026 (Hybrit, 2020).

New initiatives that promote innovation in hydrogen-related technologies have also emerged over recent months. Australia is committing AUD 300 million funding to support hydrogen-powered projects (Department of Industry, Science, Energy and Resources, Australia, 2020). The Next Generation EU plan could see investments in hydrogen technologies as a tool to support the economic recovery from the Covid-19 crisis (EC, 2020). In the People’s Republic of China (hereafter “China”), the capital city released in June 2020 its municipal “New Infrastructure Action Plan (2020-2022)” to become the demonstration city in China for hydrogen fuel cell vehicles, including establishing national-leading manufacturing centres for hydrogen technologies (Beijing Municipality, 2020). Also in China, State Power Investment Corp disclosed in May 2020 plans to construct an industrial hub in Zhuzhou City (Hunan Province) that integrates hydrogen supply with renewables, storage, refuelling infrastructure and fuel cell manufacturing, with a total investment of JPY 3.6 billion (USD 0.5 billion) (21SPV, 2020). In the private sector, there is a strong focus on sectors that currently have limited commercially available scalable low-carbon options. For instance, six Danish companies from the energy and transport sectors have announced a joint effort to develop hydrogen-based fuels for long-distance transport and heavy industry, with the first projects starting operations in 2023 (Financial Times, 2020). In April 2020, several automakers announced plans to start production of fuel cells for heavy-duty road vehicles, beginning as early as 2020 in some cases (Green Car Congress, 2020; Daimler, 2020), while some equipment manufacturers have announced an agreement to join forces in developing mega-watt scale fuel cell systems suitable for ocean-going vessels (ABB, 2020).

The Faster Innovation Case – just how far could innovation take us?

The Sustainable Development Scenario reaches net-zero emissions from the energy sector within five decades on the back of ambitious technological change and optimised innovation systems comparable to the fastest and most successful clean energy technology innovation success stories in history. In this section we explore just how much more clean energy technology innovation would be needed to bring forward net-zero emissions to 2050, a milestone year of clean energy transitions work that has gained much prominence through the public debate that followed the release of the Intergovernmental Panel on Climate Change’s Special Report on Global Warming of 1.5ºC.

The Faster Innovation Case is a special case of the Sustainable Development Scenario that focuses on stretching underlying innovation drivers. It is not designed to be an ideal pathway to net-zero emissions by 2050; the complexity of this question goes well beyond technology innovation alone, and is likely to require much more fundamental changes to our lifestyles.1 Rather, it is designed to explore how much shorter development cycles would need to be than in the Sustainable Development Scenario, and how much more ambitious technology diffusion rates would need to be in order to deliver net-zero emissions globally by 2050. There are three key changes that distinguish the Faster Innovation Case from the Sustainable Development Scenario:

- In the Sustainable Development Scenario, technologies that are still in the laboratory or early prototype stage today are not considered because of the high level of uncertainty about their performance and possible future commercialisation. To explore their potential contribution to reach net-zero emissions earlier, we include in the Faster Innovation Case those technologies at low technology readiness level (TRL) that are modular and small enough to be mass produced and that have the potential for high spillovers from and to other net-zero emissions technologies. We also include those technologies that have a lot of potential to unlock supply constraints and shift the supply curve towards lower cost resources.

- For technologies currently at prototype stage, we assume a further significant shortening of the period to market introduction, well below what has been achieved in recent success stories of clean energy technology development. We also assume that robust market deployment starts right after the completion of only one single commercial-scale demonstration, which is not common practice.

- For new and emerging clean energy technologies, we further raise adoption rates to a level that risks additional market bottlenecks and resource constraints along the supply chain if co-ordination fails when expanding rapidly.

There is little or no precedent for the required pace of innovation in the Faster Innovation Case and it does not leave any room for any delays or unexpected operational problems during demonstration or at any other stage. These are, of course, bound to happen in practice. Nonetheless, while it can take several decades for a technology to move from the laboratory to mainstream diffusion (as discussed in earlier parts of this report), the 50-year projection horizon of this report is certainly long enough to throw in some surprises. Mission-oriented approaches that support clean energy innovation in technology areas with attributes conducive to fast innovation cycles could speed up the pace of progress, particularly if they are coupled with a once-in-a-generation investment opportunity as a result of recovery plans in response to the Covid-19 crisis. Some technologies currently in the laboratory or at the level of small prototype that are outside the scope of the Sustainable Development Scenario might progress fast enough to be able to contribute to the transition to net-zero emissions in that timeframe. While the true potential and potential ease of scale-up for technologies at such early stages of maturity is highly uncertain, it is reasonable to consider what the impact might be if R&D is successful in bringing some of them to market within that period. This is what the Faster Innovation Case aims to do.

Emissions savings in the Faster Innovation Case

In the Faster Innovation Case, enhanced clean energy technology innovation would need to enable 9 GtCO2 of additional net emissions savings compared to the Sustainable Development Scenario in 2050, which is the equivalent of almost 30% of today’s energy sector emissions. The result is that emissions in end-use sectors would be significantly lower by 2050 in the Faster Innovation Case; by 2050, remaining transport-related emissions would be down to 1.1 Gt (mainly in heavy-duty trucks, aviation and shipping). In industry, they would be down to 0.8 Gt (mainly steel, cement and chemicals production); and in buildings, down to almost 0.3 GtCO2 . To put this into perspective, the additional emissions reductions reached in the Faster Innovation Case through innovative technologies in passenger transport, for instance, would be equivalent to a drop of almost 60% in what the level of passenger activity is otherwise across different modes in the Sustainable Development Scenario in 2050. Similarly, materials production from heavy industrial sectors would need to drop on average to around a quarter of the level reached in the Sustainable Development Scenario in 2050 in the absence of additional technological change to reach an equivalent level of emissions reductions as in the Faster Innovation Case.

Global energy sector CO2 emissions in 2050 by sector

OpenAchieving such transformation of the energy landscape globally in just three decades would require innovation cycles much faster than those achieved in recent success stories of clean energy technology development. Key clean energy technologies at demonstration or large prototype stage today, such as hydrogen-based steel production, electrolytic hydrogen-based ammonia to fuel vessels or carbon capture in cement production, amongst others, are assumed to reach markets in six years from now at the latest. This is about twice as fast as in the Sustainable Development Scenario, which assumes that deployment starts after several demonstrators have been successfully completed, in line with normal innovation practices. Technologies at laboratory or small prototype stage are commercialised in ten years from now on average in the Faster Innovation Case, which is the minimum time required from the first prototype to market introduction observed across all technologies explored for this report: the only case for which there is historical evidence of such rapid progress is that of LEDs, which are small enough to be mass produced and to require a relatively low level of capital expenditure during the prototyping and demonstration phase.

Period from first prototype to market introduction for selected technologies by Scenario and Case, and among the quickest examples in recent history by process size

OpenIn the Faster Innovation Case, the pace of adoption of new technologies following their commercialisation increases by about two-fold on average compared to the Sustainable Development Scenario, and up to almost three-fold for technologies that can be mass produced and that have strong synergies with technology advances elsewhere. In 2050, the share of emissions reductions achieved by deploying technologies that have not reached markets today would be 75% greater in the Faster Innovation Case than in the Sustainable Development Scenario (equivalent to 17 GtCO2 or energy-related emissions from China, the United States and the European Union combined in 2018). Technologies now at prototype stage would enable the largest increase in emissions reductions, partly as a result of assumed actions to stimulate technologies in the laboratory and at small prototype stage that go beyond the scope of the Sustainable Development Scenario. Both the Sustainable Development Scenario and the Faster Innovation Case see a major role for technologies that are not commercially available today; in the Stated Policies Scenario, which takes into account only existing and announced policies which generally focus on technologies that are either mature or are currently at early stage of adoption, such pre-commercial technologies enable just 5% of emissions reductions in 2050, relative to today.

The main decarbonisation strategies in the Faster Innovation Case are not radically different from those in the Sustainable Development Scenario: new and emerging technologies would target the displacement of fossil fuels by electricity or alternative clean energy fuels such as hydrogen, hydrogen-derived fuels and bioenergy, or they would target the capture of CO2 emissions for use and storage (CCUS). What is different is the step change in speed of innovation assumed in the Faster Innovation Case in all sectors.

As in the Sustainable Development Scenario, electrification would be a key strategy in the Faster Innovation Case, which would see the share of electricity in total final energy demand grow by around one-quarter relative to the Sustainable Development Scenario and reach about 45% of total final energy in 2050 compared to nearly 20% today.2 Transport and industry would be responsible for almost 95% of the additional electricity demand in the Faster Innovation Case in 2050 compared to the Sustainable Development Scenario, with the electrification of road transport accounting for more than 40% of the total increase. Faster learning in battery manufacturing and in smart charging infrastructure would be central to the Faster Innovation Case: so would be the development and demonstration of advanced battery chemistries, particularly for heavy-duty vehicles. Without advances in alternative chemistries to Li-ion, the use of batteries for transport will have difficulties to move beyond road vehicles and very short-distance shipping and aviation routes. In the Faster Innovation Case, the gravimetric energy densities (at cell level) would nearly triple from current levels in 2050 compared to a (still very rapid) growth of 70% it the Sustainable Development Scenario. At least two alternative battery chemistries – lithium‑sulphur (Li‑S) and lithium‑air (Li-air) – have the potential to provide such advances: they are at small prototype and concept stage today, respectively. These developments would lead to more rapid uptake of electric vehicles: almost 80% and around 60% of light- and heavy-duty vehicles on the roads in 2050 would be battery-electric in the Faster Innovation Case. In the case of heavy-duty vehicles, nearly 3.5 times more battery-electric vehicles would be deployed than in the Sustainable Development Scenario.

To satisfy demand for electric vehicles in the Faster Innovation Case, about 17 TWh of battery manufacturing capacity would be required by 2050, meaning that around one battery manufacturing plant of the size of the Tesla Gigafactory would need to come online each month from today to 2050. The Faster Innovation Case also would require the rapid deployment of charging infrastructure, and in particular of fast-charging stations capable of charging high battery capacities for electric trucks and buses through conductive or inductive dynamic charging on road and highways: such fast-charging stations are today still at prototype stage. In the Faster Innovation Case, the number of fast chargers for electric heavy-duty vehicles would reach 19 million globally in 2050, more than twice the number in the Sustainable Development Scenario.

While the rapid battery developments envisioned in the Faster Innovation Case would transform road transport, and especially long-distance heavy-duty road operations, their impacts would be more muted in shipping and aviation. Due to the requirements for high energy density fuels in shipping and aviation, battery-electric powertrains only substitute for very short-range operations – the total weight of the battery restricts the range due to mass-compounding effects. Even by 2050, battery-electric powertrains would account for only around 3% of freight movements in shipping and of passenger activity in aviation.

Half of the additional electricity demand in the Faster Innovation Case in 2050 compared to the Sustainable Development Scenario would come from industry. Large-scale electric heating would penetrate far more deeply into the industrial sector in the Faster Innovation Case than in the Sustainable Development Scenario. Rapid advances in the demonstration of large-scale high-temperature electric heating3 for industrial processes that do not involve electricity-conducive materials would be required to enable such sizeable deployment levels in the Faster Innovation Case. Most of these technologies (e.g. electromagnetic) are at the concept validation stage today, but they would reach markets by no later than ten years from now in the Faster Innovation Case.

The commercialisation of direct electrification of energy-intensive industrial processes such as primary steelmaking through iron ore electrolysis (currently at small prototype stage and thus outside the scope of the Sustainable Development Scenario) would also open up new avenues for electrification in the Faster Innovation Case. This is based on the assumption that the time from small prototype to market for iron ore electrolysis is completed in record time (just below ten years), and that average deployment thereafter is maintained at a new 1 Mt installation (equivalent to half the capacity of a conventional integrated steel mill) every two months in the period to 2050. In the buildings sector, around 30 GW thermal capacity from integrated heat pump systems for heating and cooling (including storage systems) are installed every month on average in the period to 2050 in the Faster Innovation Case compared to just over 15 GW per month on average in the Sustainable Development Scenario.

Demand for hydrogen and hydrogen-derived synthetic fuels (including ammonia) would also grow by almost 25% in the Faster Innovation Case in 2050, relative to the Sustainable Development Scenario, with most of the demand coming from the industry and transport sectors. In industry, this increase would translate, for instance, into almost two new 1 Mt steel plants based on full hydrogen reduction being installed every month on average from today to 2050 in the Faster Innovation Case, a pace of adoption that is more than twice as fast as in the Sustainable Development Scenario. Adoption at such a rapid pace necessarily means radical changes to the existing stock of steelmaking capacity; without such changes, around 40% of current global primary steelmaking assets would still be in operation in 2050. In transport, more than 60 ammonia-fuelled large vessels are put into service every month on average until 2050 in the Faster Innovation Case, almost twice the deployment rate in the Sustainable Development Scenario, in the context of a projected monthly market requirement of just over 80 large new vessels a month.

World share of hydrogen and electricity in final energy demand by end-use sector (left) and selected adoption metrics of hydrogen technologies (right)

Open

The share of bioenergy in total final energy demand would increase by around 25% in 2050 in the Faster Innovation Case relative to the Sustainable Development Scenario, mainly driven by industrial and transport-related applications. Such an increase would not present a technical challenge on the demand side, as biofuels are drop-in fuels for most applications, but it would put additional stress on biomass supply chains. Rapid innovation developments in biofuel conversion technologies and agricultural practices would be essential to unlock additional biomass sources and open new conversion routes to ensure the sustainability of supplies. Algae-based biofuels, which are currently only at small prototype stage today for most conversion routes, would be deployed at scale by 2050, but are not deployed in the Sustainable Development Scenario. The Faster Innovation Case would also require the rapid demonstration at scale of advanced biofuels production technologies such as biodiesel and bio-jet through gasification and Fischer-Tropsch, the aggregated production capacity of which would increase at an average rate around 40% faster than in the Sustainable Development Scenario through to 2050.

The overall level of captured CO2 emissions is almost 50% higher in the Faster Innovation Case in 2050 than in the Sustainable Development Scenario (at around 7.5 GtCO2 per year, with the amount of CO2 stored almost 200 times greater than today). Negative emissions technologies, such as direct air capture (DAC) and bioenergy carbon capture and storage, would account for the bulk of this. Both technologies would become even more critical in offsetting residual emissions from long-distance transport and heavy industry than in the Sustainable Development Scenario: emissions captured through these techniques in 2050 would almost triple relative to the Sustainable Development Scenario. Almost 16 DAC facilities of 1 Mt capture capacity would need to be commissioned every year on average from today to 2050 in the Faster Innovation Case compared with around 5 such facilities per year in the Sustainable Development Scenario. The largest DAC plant currently being designed is of 1 Mt capture capacity; only pilot-scale units of 0.4% that size have been operated so far. For bioenergy carbon capture and storage, almost 90 plants of 1 Mt capture capacity would be needed each year, almost three times as much as the capacity projected in the Sustainable Development Scenario.4 Accelerated innovation in CCUS would also enable direct emissions reduction in heavy industry: for example, the Faster Innovation Case would see more than five carbon capture facilities of 1 Mt capacity each month in the cement sector through to 2050, compared to around four in the Sustainable Development Scenario.

Global captured CO2 emissions by source and scenario, 2050

OpenFocus on the key opportunities among technologies at laboratory or small prototype stage today

It is evident from the Faster Innovation Case that some technologies are likely to play a particularly crucial part in achieving net-zero emissions by 2050. For policy makers who are seeking to support technologies currently at laboratory or small prototype stage through stimulus packages, and who are looking to identify those technologies that will have maximum impact, two kinds of technology are likely to be particularly relevant. The first are those technologies that are modular and small enough to be mass produced and have potential for high spillovers from and to other net-zero emissions technologies; the second are those technologies that have a high potential to unlock supply constraints (such as those affecting bioenergy and rare or increasingly demanded materials) and that can shift the supply curve towards lower cost resources. Several such technologies are particularly important in the Faster Innovation Case: advanced battery chemistries and battery recycling technologies; innovative practices to boost biomass resources; and iron ore electrolysis for making steel and advanced cooling.

Advanced battery chemistries and recycling techniques

The increased use of batteries across a broad range of applications plays a critical role in facilitating CO2 emissions reductions. Decarbonising transport relies heavily on electromobility: installed battery capacity for electromobility applications increases 500-fold in the Sustainable Development Scenario by 2070. In grid-scale applications, the capacity of the battery fleet increases 260-fold from today over the same period, providing a range of services from facilitating the integration of variable renewables to facilitating the electrification of end uses. These levels of deployment assume ambitious innovation efforts to maintain cost and performance trajectories: by 2070, the cost of the average battery drops by 68% in the Sustainable Development Scenario, while gravimetric energy densities at cell level increase by 160% compared with current levels.

Despite these improvements, the use of batteries for transport remains largely confined in the Sustainable Development Scenario to road vehicles and to short-distance shipping and aviation routes (the latter with a very marginal impact on total aviation fuel demand). Electric aircraft of the size and range needed for commercial passenger aviation are still not practical on a significant scale in 2070 in the Sustainable Development Scenario, mainly due to the high power density required during take-off. With current battery technology, an Airbus 380 would need batteries with an overall weight 30 times greater than its current fuel intake, making lift-off impossible. Early concepts for ten-seaters and electric taxis, including electrical vertical take-off and landing aircraft, have been developed by Rolls Royce, Uber and a number of start-ups. An all-electric passenger commercial aircraft capable of operating over ranges of 750‑1 100 km would, however, require battery cells with densities of 800 Wh/kg, more than three times the current performance of Li-ion batteries (Schafer et al., 2019).

Accelerated innovation could reduce the gap between the theoretical and current performance of batteries, and enable the use of batteries even in aviation and shipping. It could also strengthen the competitiveness of electric powertrains and make them a more competitive option for road freight. There are at least two alternative battery chemistries that could theoretically reach the necessary density through technological advancements: lithium-sulphur and lithium-air, which are at small prototype and concept stage today, respectively (Thackeray, Wolverton and Isaacs, 2012). And advancements are coming fast: for instance, a recent cathode design for lithium-sulphur chemistry shows a significant improvement in the battery cycle life while retaining energy density advantages compared to Li-ion (Lee et al., 2020). Ultra-high density batteries could in time make electric aircraft possible. They could also make battery-electric trucks the most compelling zero-emission powertrain even for regional and long‑haul operations, thereby accelerating and extending the electrification of heavy-duty road freight. Finally, better performing batteries could provide vessels with the high volumes of energy that must be stored on-board to cover medium-distance ranges without the need for frequent recharging: with such extended range, purely electric ships could cover a larger number of routes.

Reaching the performance goal of 800 Wh/kg (cell level) by 2050 as assumed in the Faster Innovation Case (a level 60% higher than in the Sustainable Development Scenario) would boost the share of electricity in heavy-duty road freight from 15% in the Sustainable Development Scenario to almost 70% by that year, with battery-electric trucks dominating the vehicle fleet. In aviation, commercial electric aircraft would begin to penetrate the market in the early 2040s, displacing about 3% of fuel use in that sector by 2050. In shipping, the higher energy density would make possible longer journeys of up to 1 000 km. This increased level of electrification across all transport modes in turn would ease constraints on alternative clean high energy density fuels, delivering more than one additional gigatonne of total CO2 emissions savings in 2050 compared to the Sustainable Development Scenario: this is equivalent to 15% of the annual emissions from all modes of transport in 2019.

Global share of vehicle activity electrified in the Faster Innovation Case compared with the Sustainable Development Scenario by mode, 2050

OpenThe demand-pull from the large-scale deployment of lithium-based batteries in the Sustainable Development Scenario brings with it important implications upstream. In 2011, less than 1% of lithium supply was related to mobility or grid storage applications whereas by 2019 that share increased to around 20%. In 2070, lithium production in the Sustainable Development Scenario is roughly thirty-fold larger than levels today, with batteries taking 90% of total supply. In the Faster Innovation Case, the same level would be reached by 2040. Demand for lithium is currently small relative to other metals, totalling around 75 kt per year – two orders of magnitude smaller than that of copper.

All stages of the lithium supply chain from exploration and mineral extraction to metal processing have to expand quickly and evolve in order to ensure the reliable provision of a critical commodity. Demand for lithium is projected to continue to grow beyond 2030 since most battery chemistries currently at prototype stage use it. Measures such as recycling that can prevent potential supply chain bottlenecks for lithium are important in this context. Battery recycling technologies today are mainly focused on high-value metals like cobalt and nickel: lithium is rarely recycled, not least because of limited demand for it. This changes in the Sustainable Development Scenario: lithium recycling reaches almost 780 kt by 2070, meeting 35% of all lithium demand in that year, based on recycling technologies either available now or already at the demonstration phase. Technologies now at early stages of development could enhance the efficiency of recycling, and thus reduce the energy consumption of the lithium supply chain.

There are a number of technologies at low technology readiness level along the battery recycling value chain that could provide a step change in current performance. Collaborative human-robot sorting and disassembling of batteries could greatly reduce costs, for example, while ultrasonic assisted separation offers a novel way to accelerate the separation of the layered components of a battery, and could greatly increase efficiency in combination with conventional agitation. Bioleaching applies microorganisms to help in the recovery of metals: it is already used in the mining industry, but is at an early stage of development for battery recycling. Research so far shows that it could offer a more efficient way of recovering metals than other methods. The ability to handle different battery chemistries will be key to innovative recycling technologies becoming competitive: by the time such technologies are commercially available, the batteries they process are likely to be based on current chemistries, but battery chemistries already entering markets are rapidly evolving, and it is just a matter of time before they reach recycling markets too.

The Faster Innovation Case assumes that innovative battery recycling would be commercialised over the next decade, reducing demand for primary lithium below the level it would otherwise have reached, and accelerating the electrification of the transport sector by lowering costs. The main markets for repurposed batteries are in light-duty vehicles, urban mobility and utility-scale power storage, as these uses are less affected than others by the lower performance and reduced capacities of repurposed batteries, which inevitably lag behind best available technologies at any given moment. Secondary lithium production would be almost 80% higher in 2050 in the Faster Innovation Case than in the Sustainable Development Scenario, and this would push down the CO2 footprint of lithium production. This downward effect on emissions is offset, however, by the increase in lithium demand in the Faster Innovation Case as a result of faster electrification: the Faster Innovation Case would require more lithium than the Sustainable Development Scenario from primary as well as from secondary routes.

Global production of lithium by route, 2019 and 2050

OpenInnovative techniques to expand sustainable biomass supply

Primary demand for bioenergy worldwide grows from 1 470 Mtoe (62 EJ/year) in 2019 to 2 870 Mtoe (120 EJ/year) in 2070 in the Sustainable Development Scenario. As a result, its share of total primary energy demand increases more than 80% to almost one-fifth, making it the second largest energy source. It plays an important role in the transition to net-zero emissions in the Sustainable Development Scenario: it is used in sectors that are difficult to electrify, and it provides feedstock for the production of transport biofuels. In shipping and aviation combined, the share of biofuels grows from a negligible level today to about 30% by 2070. This scaling-up of the consumption of biomass resources needs to be undertaken sustainably to deliver real lifecycle emissions reductions and wider environmental and social benefits.

Scientific studies have yielded a wide range of estimates of the availability of sustainable biomass for energy purposes, but there appears to be a broad consensus that up to 2 400 Mtoe (100 EJ/year) could be produced sustainably without serious difficulties, while the long-term potential could be as high as 5 000 Mtoe (200 EJ/year). In the Faster Innovation Case, 3 220 Mtoe (135 EJ/year) of primary bioenergy is supplied sustainably by 2050, which is 12% more than in the Sustainable Development Scenario by 2070. This expansion and acceleration of bioenergy consumption in the Faster Innovation Case is made sustainable by a set of innovative technologies and practices:

- Using crops with higher yields, which allows the production of additional energy without a requirement for more land. An example is “energy cane”, a variety of cane that creates more bagasse residues without compromising sugar content. Some trials in Brazil for this crop have shown increases of up to threefold in production yields compared with standard cane varieties (IEA, 2017). The additional bagasse can be used as fuel for co-generation of electricity and heat or for cellulosic ethanol production.

- Developing new biomass resources such as algae and aquatic biomass for the production of liquid biofuels, biogas or high-value chemicals. These technologies are today at the early prototype stage of development, and face high production and harvesting costs, but there are promising near-term opportunities to co-produce fuels and chemicals in biorefineries (IEA, 2017).

- Maximising the potential of agricultural land by applying "double-cropping" on a more widespread basis. Where soil and climatic conditions make it appropriate, a secondary energy crop could be harvested on the same land after the principal food crop, providing additional biomass resource and diversifying the incomes of farmers. For example, brassica carinata is an oil-yielding crop that can be cultivated in winter and used as a feedstock for biofuel production, complementing conventional food crops grown in other seasons (Todo el Campo, 2018).

- Developing advanced waste management systems on a much larger scale, enabling a step increase in collection and segregation together with the rapid development of supply chains and the implementation of advanced waste-to-energy systems. With the commercialisation of thermochemical biomass technologies, the waste produced could be utilised as a feedstock for transport biofuel production.

Enhancing the availability of sustainable biomass resources enables bioenergy to play an even bigger role in the Faster Innovation Case than in the Sustainable Development Scenario, particularly after 2040: by 2050, the share of bioenergy in final energy demand in the Faster Innovation Case would be 25% higher than in the Sustainable Development Scenario. In industry, larger amounts of bioenergy would be directed in the Faster Innovation Case towards medium- and high-temperature heating applications that do not require significant equipment retrofits for its use. Cement kilns are good examples of this. The result of increasing bioenergy shares in the fuel mix of cement kilns that are equipped with CCUS is that more than four times as much negative emissions would be achieved in 2050 in cement production than in the Sustainable Development Scenario: this helps to bring forward the achievement of net-zero emissions across the entire energy system.

In transport, heavy-duty trucks, shipping and aviation all benefit from a greater availability of biomass resources. Biomass alternatives to energy-dense fossil liquids are particularly critical in shipping and aviation, where electrification is technically challenging. The total biofuel consumption of shipping and aviation combined would increase about 18% in the Faster Innovation Case relative to the Sustainable Development Scenario in 2050.

Advanced aircraft designs

Since commercial passenger aviation began in the early 20th century, there has been little change in the basic tubular design of aircraft. Radically improved aerodynamic designs could bring about considerable energy efficiency savings in the future, and by so doing reduce the aviation sector’s demand for high energy density alternative fuels. Take-off requirements, however, might still be limiting in some circumstances.

Research programmes at Airbus (MAVERIC) and Boeing (Boeing X-48) have tested small-scale prototypes of passenger aircraft with blended-wing-body designs with the potential to improve fuel efficiency by up to 20% compared with current single aisle airframes. Despite such designs having been already commercialised for military aircrafts, they have only reached small-scale prototypes for passenger aircraft. This is mainly due to the challenge of passengers accepting an aircraft without windows and the complexity of incorporating emergency exits in the theatre-like seating layout. The high wingspan-to-height ratio of blended-wing-body aircraft design makes it suitable only for large aircrafts, meaning that development costs cannot be split over a model family with different sizes.

The development of hybrid-electric aircraft is less constrained by the need for manifold improvements in battery power and energy densities than is the case with all-electric aircraft, but a hybrid could nevertheless deliver fuel-burn improvements of as much as 50% over today’s best‑performing aircraft. NASA is developing the STARC-ABL, a single aisle turboelectric aircraft design concept that uses boundary layer ingestion. Wright Electric has meanwhile developed a 186‑seat electric aircraft for short-haul range and aims to introduce it to market in 2030.

The Faster Innovation Case assumes that such novel designs would reach passenger aviation fleets before 2050. As a result, total final energy demand in aviation in 2050 is reduced by 8%, and total final demand for liquid jet fuel in that year declines by more than 50 Mtoe, or about 15% of 2019 consumption, compared with the Sustainable Development Scenario.

Direct electrification of primary steelmaking

There are no economical and scalable technologies available today to make primary steel using non-fossil energy. The most advanced option, based on low-carbon hydrogen as a reducing agent, is expected to reach the pilot-project stage in 2021 and commercial-scale demonstration from 2025 (Hybrit, 2020). One promising low-carbon technology – direct electrification of primary steelmaking (known as iron ore electrolysis) – is technically feasible, but the two most advanced processes have so far only been tested at small scales. One of these is low-temperature alkaline electrolysis, which has recently moved to a 100 kg pilot (ArcelorMittal, 2020). The other is high-temperature molten oxide electrolysis, which was validated in the laboratory in 2013: a prototype cell was commissioned in 2014 and there are plans to test full-scale cells by 2024.

In iron ore electrolysis, electrolytic cells can be stacked to provide the capacity needed, allowing the possibility of expanding capacity by increments thereafter: the capital at risk in the first stages of investment in a given plant is therefore relatively small. Iron ore electrolysis is similar to chlorine and alkaline water electrolysis in this respect, while high-temperature molten iron oxide electrolysis and alumina electrolysis for aluminium production share many features in terms of their layout. Knowledge spillovers in design, operation and materials may therefore flow from aluminium, chlorine and water to iron ore electrolysis, and these may include knowledge about how to modulate plant operation as necessary so as to align it with the incentives for balancing a grid dominated by variable renewable electricity.

In the Faster Innovation Case, four factors would combine to make it possible to speed the deployment of iron ore electrolysis compared with other low-carbon processes for making primary steel in the Sustainable Development Scenario: relatively low risk in scale-up; spillovers from other electrolysis technologies; standardised and repetitive manufacturing; and compatibility with electricity grid needs. About 10% of global primary liquid steel production would be produced from iron ore electrolysis in the Faster Innovation Case in 2050, increasing electricity demand for steelmaking by 60% relative to the Sustainable Development Scenario.

Advanced refrigerant-free cooling

The number of air conditioner units in use around the world is projected to nearly triple to more than 5.5 billion by 2050 in the Sustainable Development Scenario. Much of this dramatic growth in demand is driven by population and economic growth, in particular in emerging economies with hot weather: it is estimated that the global population living in hot areas will grow from 2.8 billion today to more than 4 billion in 2050. Accelerated innovation could curb the climate impact of the rise in demand through a combination of additional incremental early-stage efficiency gains, alternative cooling technologies, the integration of cold storage and changes in the use of refrigerants. In turn, spillovers from the faster growing demand for advanced cooling technologies could benefit technology development for heating services, tapping into additional mitigation potential. In the Faster Innovation Case, a combination of these measures and improved building performance would save 260 MtCO2 emissions in 2050 compared with the Sustainable Development Scenario.

Many refrigerants currently in use in vapour-compression cycles – the standard technology for air conditioners – are powerful greenhouse gases. Hydrofluorocarbons are the most common refrigerant compounds. Under the Kigali Amendment of the Montreal Protocol, more than 195 countries have committed to reducing the use of hydrofluorocarbon refrigerants by more than 80% in the next three decades. In the Faster Innovation Case, refrigerant-free cooling technologies, which are currently in the prototype phase, would be progressively adopted ten years from now. Amongst these are advanced evaporative cooling, advanced desiccants and solid-state cooling technologies:

- Membrane-based evaporative cooling and desiccants would open up the possibility of controlling both humidity and temperature by decoupling latent (vapourisation) and sensible (temperature variations without phase change) heat loads. These technologies avoid the energy-consuming components of a vapour-compression cycle: they also avoid the need to use a refrigerant. In tests, membrane-based systems have shown promising coefficients of performance ranging from 5 up to 15.5 in advanced evaporative cooling systems.

- Solid-state cooling technologies represent a new approach to refrigeration, air conditioning and heat pump technologies. These technologies rely on caloric effects to provide cooling: at present, barocaloric (producing heat under pressure variation) and electrocaloric (producing heat under an electric field) materials seem to be the most suitable for thermal applications. These technologies are at the prototype phase, but research in test conditions shows that barocaloric refrigeration, in particular, performs better than vapour-compression coolers in domestic applications, with improvements ranging from 5% to 150% depending on ambient, material and flow rate conditions.

The Faster Innovation Case assumes that successful demonstration of these technologies at scale would lead to them being increasingly used in the 2030s, starting in niche markets: membrane-assisted evaporative cooling and desiccants would be initially adopted in markets that need cooling with humidity controls, while solid-state technologies provide a range of building energy services, including water heating, thermal comfort and domestic refrigeration. The Faster Innovation Case also sees the initial deployment of advanced vapour-compression technologies using both low- or zero-global warming potential refrigerant, and next-generation components including more compact heat exchangers, refrigerant flow controls and electrochemical compressors.

Given the size of the market, more rapid innovation in alternative cooling technologies could bring spillover benefits in the Faster Innovation Case for vapour compression-based technologies equipped with next-generation components and low global warming potential refrigerants: these benefits lead to higher efficiencies and faster adoption of reversible heating and cooling systems, displacing gas heating earlier in the projection horizon. In the Faster Innovation Case, advanced space cooling technologies would account for more than 30% of global cooling capacity in 2050, allowing the average energy efficiency rating of the building stock to more than double to 9 by 2050, up from around 4 in 2019.

Taken together, the earlier adoption in the Faster Innovation Case of refrigerant-free cooling technologies and the knock-on effects of advanced cooling on other areas would speed up the decarbonisation trajectory of the buildings sector. Coupled with other measures to make buildings more energy efficient, they would lead to an additional 3 000 Mtoe of energy savings in the sector from 2030 to 2050 relative to the Sustainable Development Scenario, with two-thirds of these savings concentrated in the residential sector. These additional savings would be equivalent to more than the current final energy consumption of the buildings sector today. Innovative systems for heating and cooling would contribute up to 60% of total annual emissions reductions in buildings.

Potential negative impacts of Covid-19 on critical clean energy technologies – the Reduced Innovation Case

Clean energy innovation has the potential to play a major part in reshaping the future energy sector. However, threats to it in the form of reduced R&D spending and a potential loss of policy attention to long-term climate goals should not be underestimated, especially given the speed of technology development which is needed.

In this section we explore the impact that a slowdown in the pace of innovation resulting from the Covid‑19 crisis could have on direct electrification, CCUS and hydrogen and hydrogen-derived fuels, which together account for about 40% of the cumulative emissions reductions in the Sustainable Development Scenario until 2070 compared to the Stated Policies Scenario. Each of these areas of technology depends on continued and rapid evolution in a wide range of technologies at different levels of maturity along the different steps of their value chains. This means that their ability to contribute to decarbonisation to the fullest extent depends on all the technologies along the entire value chain getting to the market and then scaling-up.

Starting from the assumptions of the Sustainable Development Scenario, this section assesses the implications of a possible delay in technology innovation on the basis of two key assumptions:

- For demonstration projects that are either underway or announced, we assume a five-year delay in their completion.

- For technologies at the early adoption phase, we assume a slowdown in the pace of deployment by 50% through to 2025, 30% to 2030 and 15% to 2040.

Direct electrification

Electric end-use technologies have generally seen increasing momentum in recent years, helped by a supportive policy environment. Over the last five years, the number of households purchasing heat pumps used as heating systems has increased at an average rate of more than 5% per year, and the rate of increase rose significantly in 2019 in many countries (heat pump purchases were up by 14% in Europe last year [EHPA, 2020], and by 6% in the United States). Growth has been consistent across most regions with cold and mild climates, including China, the European Union and the United States, thanks to dedicated incentives. But the increases started from a low base, and less than 5% of heating needs globally were met by heat pumping technologies in 2019. Heat pump sales are moreover mostly driven by installations in new buildings, while retrofits lag behind. That needs to change if heat pumping technologies are going to achieve their full potential: with a typical 80- to 200-year building lifetime in most developed economies, as much as three-quarters of today’s buildings will still be in use in 2040.

Innovative design would help to make the most of the potential of heat pump technology. Such designs need to be compact, able to use existing piping, and able to deliver heat securely in poor-performance buildings, to integrate a storage unit (e.g. a heat battery, often directly connected to on-site solar PV panels) or to displace electricity use off peak. Some equipment providers are rising to this challenge by demonstrating new designs tailored to specific local conditions and able to deliver up to a two-fold increase in efficiency (e.g. super-efficient ground-source or air-source heat pumps with pre-heating in passive houses); others are demonstrating next-generation components such as electrochemical compressors (US DoE, 2019) and electrocaloric cycles (Fraunhofer ISE, 2019).

Global electric car sales grew by more than 60% every year over the past decade until 2019, when growth slowed to 6% as the regulatory environment changed in China and passenger car sales contracted in major markets. Global capacity to make Li-ion battery cells has expanded rapidly in recent years: manufacturers today globally can produce around 320 GWh of batteries per year for use in electric road vehicles, which is comfortably more than the approximately 100 GWh of batteries required for the 2.1 million electric cars that were sold in 2019. Some start-ups already provide commercial battery cells with advanced chemistries that are critical in the Faster Innovation Case. For instance, commercial Li-S cells are available for applications with low cycle life, such as unmanned aerial vehicles (Service, 2018). At the same time, developments to electrify long-distance transport are also advancing: while the demonstration of a fully electric and autonomous container ship design started in February 2020 (Skredderberget, 2018). Various start‑ups, together with established aerospace and automotive companies, have meanwhile demonstrated autonomous electric passenger aircraft capable of carrying one to four passengers over the past few years (Marr, 2018; Hawkins, 2019; Hyundai, 2020). While such aircraft applications are bound to remain marginal over the coming decades, they could help to accelerate innovation in battery technologies and vehicle automation.

Pilot trials and feasibility studies are underway to test fully electrified processes in heavy industry. These involve, among others, the two most advanced processes to electrify primary steelmaking directly: there is now a 100 kg pilot for low-temperature alkaline electrolysis (ArcelorMittal, 2020), and a prototype cell for high-temperature molten oxide electrolysis, with plans to test full-scale cells by 2024. A consortium of six large petrochemical companies was also created in 2019 to investigate jointly how naphtha or gas steam crackers for high-value chemicals production could be operated using renewable electricity instead of fossil fuels: the consortium has agreed dedicated R&D budget commitments (Borealis, 2019). In addition, feasibility studies have been undertaken over the last two years in both Norway and Sweden to explore the scope for electrifying the heating process of cement kilns (Cementa, 2019; Gautestad, 2018).

It is uncertain what effect the Covid-19 crisis will have on adoption rates and development plans for electric technologies. Given the higher levels of risks associated with the development plans of technologies at small prototype or below, we focus our analysis of the impact of delayed progress on those technologies at early adoption stage, and in particular on heat pumps and electric road vehicles.

A lower uptake of heat pump designs that are already commercial combined with a five-year delay in the demonstration of innovative designs would result in in the Reduced Innovation Case in around 3 GtCO2 of additional direct emissions from fossil fuel boilers in buildings cumulatively by 2040 (roughly equivalent to all building-related direct emissions in 2019) compared to the Sustainable Development Scenario. The installed output thermal capacity of innovative heat pumps would be 60% lower in 2030 in the Reduced Innovation Case than in the Sustainable Development Scenario. The products mostly affected by delaying testing and demonstration would be those integrating storage solutions or next-generation components (i.e. advanced vapour-compression cycles) and non-vapour-compression systems (e.g. evaporative cooling): these jointly account for around 60% of the decrease in thermal capacity in 2030 relative to the Sustainable Development Scenario. The lower uptake of heat pumping technologies would also reduce the opportunities available to learn from experience, preventing these technologies from achieving a reduction of 10% of their average cost in 2030. Higher technology costs would, in turn, make it more difficult for heat pumps to compete with incumbent fossil-based heating options, particularly in a context of limited household purchasing power.

Heat pumping technology deployment by market segment in the Sustainable Development Scenario in 2030 and portion not deployed if innovation is delayed

OpenThe Reduced Innovation Case would result in a slowdown in the uptake of electric road vehicles; this in turn would lead to around 2.5 GtCO2 of additional emissions cumulatively by 2040 compared to the Sustainable Development Scenario. This slowdown would translate into a 20% decrease in cumulative battery production by 2040 compared to the Sustainable Development Scenario. The annual reduction in battery manufacturing capacity in 2040 would be equivalent to 34 Gigafactories.5 Such a reduction in battery manufacturing capacity and operations would imply a slowdown in learning-by-doing and other innovation drivers, which in turn would translate into an increase of 8% in average battery costs by 2025 relative to the Sustainable Development Scenario. Most of the battery demand loss would reflect a slowdown in the uptake of light-duty battery-electric vehicles, which drives the vast majority of battery demand up to 2040 in the Sustainable Development Scenario. The slowdown in the adoption of electric vehicles in the Reduced Innovation Case also has knock-on effects on the electrification of heavy-duty transport: it would delay improvements in battery performance and costs at a critical juncture when electric powertrains are just beginning to enter the heavy-duty vehicle market at commercial scale.

Decrease in automotive battery annual demand between the Sustainable Development Scenario and the Reduced Case by segment, 2030-2040

OpenCCUS

The CO2 value chain has gained considerable momentum in recent years. Two Alberta Carbon Trunk Line projects in Canada became operational in 2020: they capture CO2 from fertiliser production and oil refining, and have a combined capacity of 1.5-2 MtCO2/year. The Gorgon CO2 injection project came into operation in 2019: it captures CO2 from natural gas processing. The world’s first large-scale CCUS project related to biomass-sourced emissions started operation in the United States in 2017, and the world’s first large-scale iron and steel facility with CCUS was brought online in Abu Dhabi in 2016. Plans to scale-up DAC deployment include a 1‑MtCO2/year facility being developed in the United States; it is scheduled to be operational by the mid-2020s. At least two pilot plants also started operations in 2019 to test the application of different CO2 capture technologies to power generation in tandem with other decarbonisation strategies such as hydrogen and bioenergy. In Japan, for example, CO2 capture tests started at the end of 2019 at an oxygen-blown integrated gasification combined-cycle power plant (160 MW): the project also plans to demonstrate the use of hydrogen in the combined-cycle power plant and in a solid oxide fuel cell system – integrated gasification fuel cell (Osaki CoolGen, 2019).

An improved investment environment has contributed to the development of a growing number of CCUS projects that target industrial hubs and low-carbon hydrogen production. In Norway, there are plans to develop a fully integrated industrial CCS system by 2024: feasibility studies are under way for CO2 capture from a cement facility and from a waste-to-energy recovery plant, and a consortium of oil and gas companies is developing offshore CO2 storage in the North Sea (Northern Lights, 2020a). Further full CO2 value chain projects under development in Europe include the Porthos project in the Netherlands, which is scheduled to enter in operation by 2021 (Rotterdam CCUS, 2020); the Zero Carbon Humber and Net Zero Teesside projects in the United Kingdom, which are scheduled to come online by the mid-2020s (Net Zero Teeside, 2020a); and the Ervia Cork project in Ireland, which is scheduled to come online by 2028 (Ervia, 2020). These European projects will jointly bring up to 10 MtCO2/year additional capture and storage capacity online over the next ten years. In the United States, at least 20 large-scale facilities are being developed, prompted by an expanded 45Q tax credit6 and complementary policies such as the California Low Carbon Fuel Standard. These facilities cover a range of applications at different stages of maturity, including natural gas processing; biofuels and cement production; DAC; and gas- and coal-fired power generation.

Planned investments could be affected by the economic fallout from the Covid-19 pandemic. In the Reduced Innovation Case, a delay in demonstration projects for pre-commercial CCUS technologies together with a slowdown in the deployment of CCUS technologies at early adoption stage would bring about a 50% and 35% reduction in CO2 emissions captured in 2030 and 2040 respectively, compared to the Sustainable Development Scenario. As a result, CO2 capture and storage deployment by 2040 would be reduced by around 8 GtCO2 cumulatively, which is equivalent to the entire direct emissions of the transport sector in 2019. CO2 captured from cement production and power generation would be the areas most affected in the Reduced Innovation Case over the next two decades, accounting between them for almost 80% of the reduction in CCUS deployment in that period compared to the Sustainable Development Scenario. Plans are already underway to demonstrate CO2 capture in cement making as part of fully integrated CO2 hubs, and deployment expands from the mid-2020s in the Sustainable Development Scenario. Two CCUS-equipped power plants are already in operation, and here too deployment expands in the Sustainable Development Scenario. Low-carbon cement production in particular is highly dependent on the demonstration of such technologies, because other technical options able to yield a comparable level of emissions reductions at scale (e.g. certain alternative binding materials) are significantly less developed today.

The reduced level of CCUS deployment in the Reduced Innovation Case would mostly affect chemical absorption within the different capture technologies. As there is already considerable experience accumulated today in operating this technology, however, the cost of CO2 capture by chemical absorption would be about 5% higher by 2030 in the Reduced Innovation Case compared to the Sustainable Development Scenario as a result of the reduced learning-by-doing. There would be a more significant impact on the costs of other less advanced CO2 separation techniques that are at demonstration or prototype stage, such as physical adsorption and oxy‑fuelling.

The relatively modest projected deployment of large-scale DAC in the Sustainable Development Scenario over the next two decades means that the delay in the demonstration of large-scale DAC in the Reduced Innovation Case would not significantly reduce the overall CCUS capacity expansion projected in the Sustainable Development Scenario over that period. Such delay, however, would increase by around 35% the cost at which large-scale DAC plants could be available in 2030 by severely limiting the scope for decreases in costs arising from learning-by-doing over the next decade.

Reduction in captured and stored CO2 emissions in the Reduced Innovation Case compared to the Sustainable Development Scenario, by sector, 2030-2040

OpenCCUS demonstration projects are capital-intensive, but they are associated with substantial job creation, particularly during the construction phase. Such jobs would be at risk in the Reduced Innovation Case. For instance, the Norwegian demonstration of a full-chain industrial CCS system could create almost 4 000 jobs during the investment phase (Northern Lights, 2020b). Other fully integrated industrial CCUS systems (with multiple capture facilities) have reported the potential to create several thousand jobs during construction: for example, Net Zero Teesside is expected to create 5 500 direct jobs in the United Kingdom during the construction phase (Net Zero Teeside, 2020b). Based on existing CCUS facilities, a stand-alone CCUS plant (e.g. with a single-capture source) is likely to have a job creation potential of between 400 and 1 200 jobs for an average three-year construction phase and between 20 and 60 jobs during several decades of expected operations (Northern Lights PCI, 2020; Government of Alberta, 2019; Lake Charles Methanol, 2020).

Hydrogen

Hydrogen technologies gained momentum in 2019. Hydrogen-producing capacity based on water electrolysis reached more than 25 MW last year, which is a record. The Fukushima Hydrogen Energy Research Field in Japan now has 10 MW of installed capacity, which is twenty times the average size of all projects since the early 2010s (Asahi Kasei Corporation, 2020). Large electrolysis-based hydrogen-producing capacities with hundreds of megawatts of capacity have been announced and are expected to be operational in the early 2020s: the hydrogen they produce will be used for fuels transformation, chemical production and hydrogen blending into natural gas grids. The fuel cell electric vehicle (FCEV) stock almost doubled in 2019 relative to 2018, mainly driven by a surge in demand in the Asian market, including demand for buses and light-duty trucks. Hydrogen refuelling infrastructure is expanding globally hand-in-hand with growth in the use of FCEVs: it saw more than 20% annual growth in 2019. Demonstration and pilot tests for up to 20% and 10%7 hydrogen blending into gas distribution and transmission grids respectively have recently been carried out in France and Italy, while a large pilot plant to validate iron ore reduction for steelmaking based fully on electrolytic hydrogen is about to start operations in Sweden.

Whether this momentum will continue after the Covid-19 outbreak is to be seen. In the Reduced Innovation Case, a delay in demonstration projects for pre-commercial hydrogen technologies, together with a slowdown in the deployment of hydrogen technologies at early stage of adoption, would result in a reduction of 9% and 12% in annual hydrogen demand in 2030 and 2040 respectively, relative to the Sustainable Development Scenario. This reduction would result in more than 1.5 Gt of additional CO2 emissions cumulatively by 2040 compared to the Sustainable Development Scenario, or almost twice the annual emissions related to hydrogen production today. Transport would see the largest hydrogen demand reduction: demand would fall by almost 12 Mt of hydrogen in 2040, or around half of the total hydrogen demand reduction in that year compared to the Sustainable Development Scenario. This fall would mostly reflect a delay in the uptake of heavy-duty FCEVs and of ammonia in shipping. Two‑thirds of the fall in hydrogen demand in 2040 would be translated into reduced electrolytic production, which would also suffer a slowdown in deployment compared to the pace projected in the Sustainable Development Scenario because of a more uncertain build-up of hydrogen demand increasing investment risks.

A drop of almost 8 Mt/year global cumulative production capacity of electrolytic hydrogen by 2030 would result in an increase of almost 10% in the average capital expenditure of water electrolysers in 2030 relative to the Sustainable Development Scenario as a result of slower technology learning. This increase is barely noticeable in the levelised cost of producing electrolytic hydrogen, which would increase only marginally (up to 3.1 USD/kg)8, but it would put additional stress on upfront investment financing for projects that are already highly capital-intensive, with potential implications for jobs: a cancellation of projects in the pipeline for 2020 and 2021 aiming to scale-up plant capacity of electrolytic hydrogen would put at risk between 3 300 and 4 400 direct and indirect jobs.9

References

See the World Energy Outlook 2019 for a discussion of changes required for a 1.5°C pathway (IEA, 2019)

Electricity demand reported here refers to direct use of electricity only, and exclude indirect uses such as for the production of electrolytic hydrogen.

High-temperature heating refers to heat delivered at 450°C or above, with some of the specific applications targeted requiring a temperature above 1 000°C.

1 Mt capture capacity is equivalent to the largest biofuel plant with CO2 capture in operation today, which was commissioned in 2017 in the United States to produce bioethanol.

Battery Gigafactory capacity considered at 35 GWh/yr.

Section 45Q is a tax credit that was expanded in 2018 and provides a credit of up to USD 50 per tonne of CO2 for permanent geological storage, or up USD 35 per tonne for enhanced oil recovery (US Government, 2018).

Blending shares on volumetric basis.

Hydrogen levelised cost is based on 69% (conversion efficiency), USD 50 per MWh (electricity price), 5 000 full-load hours and a weighted average cost of capital of 8%.

Based on between six to eight jobs created by USD 1 million investment including engineering, manufacturing, construction and operation (IEA, 2020).

Reference 1

See the World Energy Outlook 2019 for a discussion of changes required for a 1.5°C pathway (IEA, 2019)

Reference 2

Electricity demand reported here refers to direct use of electricity only, and exclude indirect uses such as for the production of electrolytic hydrogen.

Reference 3

High-temperature heating refers to heat delivered at 450°C or above, with some of the specific applications targeted requiring a temperature above 1 000°C.

Reference 4

1 Mt capture capacity is equivalent to the largest biofuel plant with CO2 capture in operation today, which was commissioned in 2017 in the United States to produce bioethanol.

Reference 5

Battery Gigafactory capacity considered at 35 GWh/yr.

Reference 6

Section 45Q is a tax credit that was expanded in 2018 and provides a credit of up to USD 50 per tonne of CO2 for permanent geological storage, or up USD 35 per tonne for enhanced oil recovery (US Government, 2018).

Reference 7

Blending shares on volumetric basis.

Reference 8

Hydrogen levelised cost is based on 69% (conversion efficiency), USD 50 per MWh (electricity price), 5 000 full-load hours and a weighted average cost of capital of 8%.

Reference 9

Based on between six to eight jobs created by USD 1 million investment including engineering, manufacturing, construction and operation (IEA, 2020).