Cite report

IEA (2020), Clean Energy Innovation, IEA, Paris https://www.iea.org/reports/clean-energy-innovation, Licence: CC BY 4.0

Report options

A once-in-a-generation opportunity to reshape the future

Highlights

- This report makes clear the importance of accelerating clean energy innovation to give the world the best chance of achieving energy and climate goals, including net-zero emissions. Without a strong continuing focus on clean energy innovation, our chances of success are shrinking. The opportunity offered to governments, industry and clean energy investors is enormous. In the Sustainable Development Scenario, annual average investments in technologies that are currently only at prototype or demonstration stages total around USD 350 billion through to 2040, and they reach nearly USD 3 trillion in the 2060s.

- We identify five key principles for compressing the innovation cycle and delivering net-zero emissions. They focus on areas of particular relevance to clean energy technology that often lack attention from energy policy makers or need strengthening. They build on the analytical findings of this report:

- Prioritise, track and adjust. Selecting a portfolio of technologies to support requires processes that are rigorous and flexible and that factor in local needs and advantages.

- Raise public R&D and market-led private innovation. Different technologies have differing needs for further support: from more public R&D funding to market incentives.

- Address all the links in the value chain. In each application, a technology is only as close to market as the weakest link in its value chain, and uneven progress hinders innovation.

- Build enabling infrastructure. Governments can mobilise private finance to address innovation gaps by sharing the risks of network enhancements and demonstrators.

- Work globally for regional success. The technology challenges are urgent and global, making a strong case for co-operation which could draw on existing multilateral forums.

- Covid-19 means that some of these key principles deserve immediate attention from governments looking to boost economic activity. In particular, it is important to maintain R&D funding at planned levels and to consider raising it in strategic areas. Current clean energy demonstration projects should not be allowed to fail. Market-based policies and funding could help scale-up value chains for modular technologies like electrolysers and batteries, significantly advancing their progress. Measures to spur innovation could be taken forward alongside related measures such as infrastructure investments in wider stimulus packages.

- Economic recovery measures also present new opportunities for innovation to reshape the future towards cleaner energy in the longer term. Innovation policies themselves – including technology prioritisation processes and tracking and evaluation systems – could be renewed and aligned with long-term goals. Investments in key demonstration projects in heavy industry and long-distance transport, which have often been neglected, could make low-carbon options available earlier and in time for scheduled investments cycles around 2030, avoiding “locking-in” significant emissions. Co-ordinated investments in R&D and enabling infrastructure for electrification; carbon capture, utilisation and storage; hydrogen; and bioenergy could also significantly boost clean energy transitions.

Introduction

This is an unprecedented moment in energy history. The world may currently be at an inflection point in the development of a clean energy technology portfolio that matches net-zero emission ambitions. The awareness of the importance of innovation and its role in transforming energy systems has never been higher. It has been brought into sharp focus by the ambitious targets for emissions reductions by 2050 which have been set by countries and companies alike. Major industrial sectors – including iron and steel, cement, fuels production, aviation, shipping, gas supply – that don’t yet have commercially available solutions for deep decarbonisation are engaged in project and policy development. Emerging economies, such as Brazil, the People’s Republic of China (hereafter “China”) and India, are strengthening their innovation systems for home-grown technologies appropriate to their contexts.

Government policy will determine whether these positive trends translate into a faster pace of innovation more closely aligned with a clean energy transition to net-zero emissions, and the advent of the Covid-19 pandemic makes the role of governments more important than ever. At the outset of the current crisis, investment in R&D was not sufficient to meet the scale of the challenges, especially in sectors that currently have limited available commercial and scalable low-carbon options. There is an opportunity now to address this, including through measures that form part of economic recovery packages. Maintaining and increasing the rate at which promising new technologies enter the energy system is not only critical for meeting energy policy objectives, but also has the potential to drive future economic growth: this report points to a wide range of investments that make the longer term transition to net-zero emissions more likely, while at the same time spurring near-term economic recovery.

There is, however, also a risk that the economic damage done by Covid-19 may lead to reductions in R&D budgets and investment. That would be deeply damaging to clean energy innovation and to the prospects of achieving net-zero emissions. Innovation is a process that spans decades and, while many of the technology types deployed in the Sustainable Development Scenario are already advancing towards maturity, some key technologies still have a long way to go. Delayed demonstration of the competing options for decarbonising industry in particular would make it harder to meet climate goals, with delays to low-carbon hydrogen demonstration projects alone potentially leading to 1.5 Gt of additional CO2 by 2040 (see Chapter 4). Value chains for new technologies are fragile, and global clean energy innovation systems could take years to recover from cutbacks in spending.

This final chapter draws together the conclusions from the analysis throughout this report into recommendations for policy action. The chapter begins by presenting five key principles for compressing the innovation cycle and delivering net-zero emissions. This focuses on areas of particular relevance to clean energy technology that often lack attention from energy policy makers or that need strengthening in the context of net-zero emissions ambitions. In response to the additional and equally urgent policy context of the Covid-19 pandemic, the subsequent sections of the chapter highlight more specific elements of the policy package that can address both near‑term and long-term goals. They consider immediate actions to keep clean energy innovation on track through to 2025 and beyond, and new opportunities for innovation-related economic recovery measures to reshape a cleaner energy future. They then look at these actions and opportunities in terms of their relevance to key technology families for achieving net-zero emissions, giving concrete examples of what needs to be done.

Five key principles to accelerate clean energy technology innovation for net-zero emissions

This report brings out that innovation policy and energy policy need to be considered together, and that clean energy technology innovation should be seen as a core element in energy policy decision making. There has been a tendency in the past to treat R&D and innovation policy separately from energy policy. Feedback loops between energy strategy and the learnings from technology innovation programmes are sometimes not formalised. In some countries they have been housed in different ministries, while in others the links between the relevant divisions within a single ministry have been weak. Regardless of what organisational arrangements are in place, the two areas of policy need to be considered together, and those working on them need to collaborate closely.

The recommended policy actions in this section are grounded in the findings of the earlier chapters of this report. For example, the recommendation for governments to look more closely for synergies between technology types across sectors is based on the acceleration of innovation progress seen in historical cases such as solar PV and semiconductors and our identification of technology clusters that are central to achieving net-zero emissions, while the recommendation to look at value chains as a whole and identify the weakest links in value chains for a given technology design is based on analysis of areas where progress has been uneven, such as synthetic fuels.

The recommendations are made with national governments and supranational authorities in mind, although many of them are also relevant to action by authorities in cities and other subnational authorities, and to companies too. Different governments will, of course, select portfolios and policy instruments differently according to their individual circumstances. From a global perspective, the adoption of different R&D portfolios by different countries, regions and companies is a strength, as long as all key innovation gaps are addressed in total: it supports competition and diversity in the face of uncertainty.

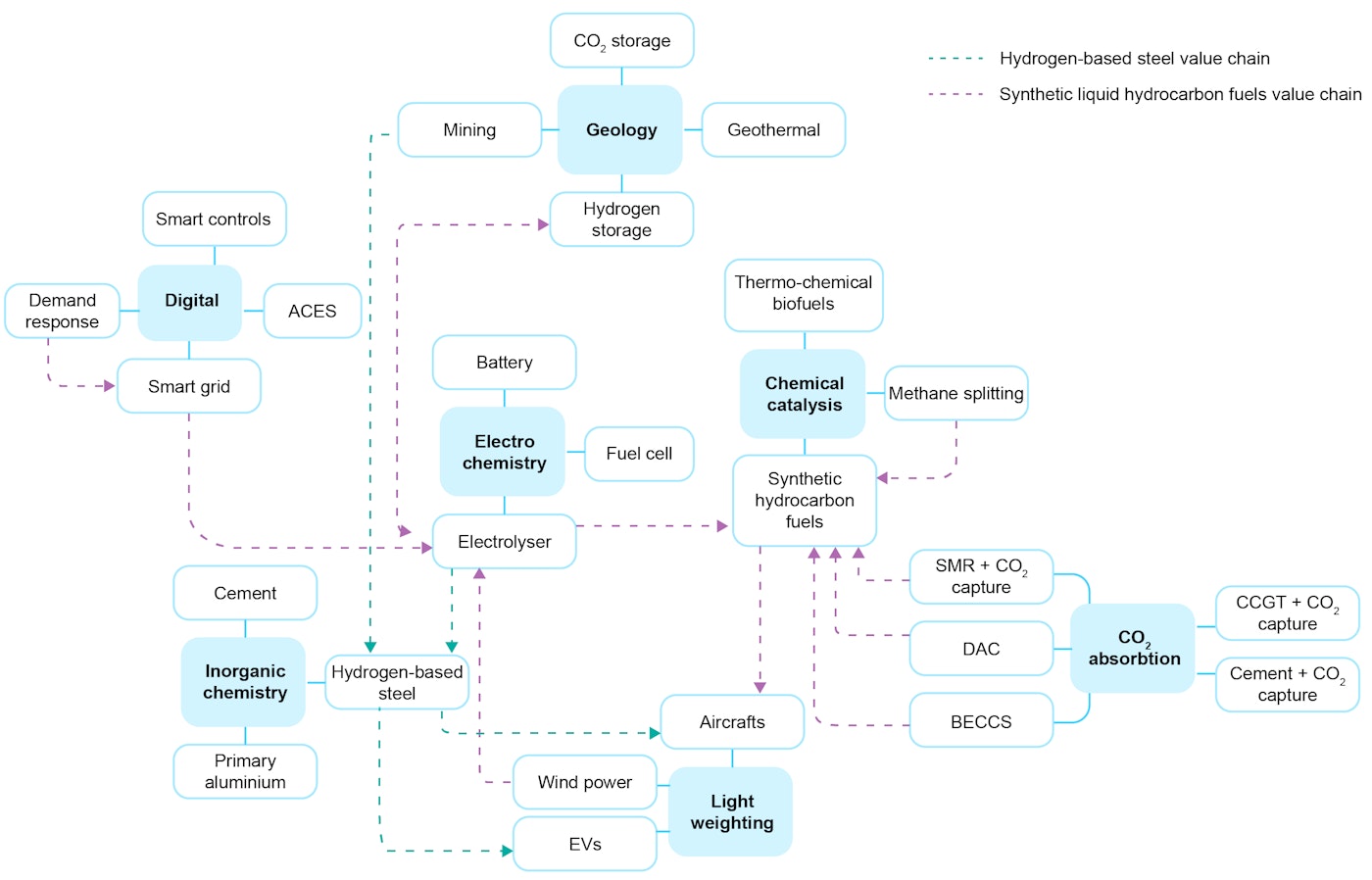

The recommendations do not attempt to provide a single technology portfolio that is suitable for all. Indeed, in general they are not technology specific, focusing instead on good practices that can guide technology choices and be adapted to unanticipated breakthroughs. As highlighted in the findings of Chapters 3 and 4, however, four cross-cutting technology areas underpin most of the long-term emissions reductions in the Sustainable Development Scenario and are therefore key to faster innovation. These are: 1) electrification of end-uses; 2) CCUS; 3) hydrogen and hydrogen-based synthetic fuels; and 4) bioenergy. All four are particularly relevant to sectors where reducing emissions is hardest, and face challenges in co-ordinating innovation across their value chains in a timely manner. For this reason, examples involving these areas of technology are used to illustrate the recommendations wherever possible.

While the focus here is on public policy, the role of private sector entrepreneurs, companies and financers is also critical. Private sector participants in the innovation system greatly outnumber those from the public sector, with public sector employees representing just 5-25% of R&D researchers in most OECD countries (OECD, 2020). Success will depend upon the public and private sectors working closely together to agree the way ahead, identify projects and metrics, and learn together from past successes and failures.

The list of elements set out in this chapter for inclusion in a policy package to accelerate clean energy technology innovation is aimed at maximising the likelihood of a successful transition to net-zero emissions. It is not exhaustive: a successful clean energy innovation system needs various kinds of support, many of which are not energy specific (see Chapter 1). Rather, it focuses on areas of particular relevance to clean energy technology that often lack attention from energy policy makers or need strengthening for meeting net-zero emissions ambitions. These recommendations represent a package of good practices at any time, not just in the context of the repercussions of the Covid-19 pandemic. They are grouped under five core principles.

Key principles to accelerate clean energy technology innovation for net-zero emissions

Open

1. Prioritise, track and adjust

Innovation systems are stronger and have more impact if participants are working towards the same overarching goals. Visions of the future can be formulated and consensus promoted by using roadmapping processes that also identify realistic target markets for local technology development. Given the challenges of decarbonising certain end-use applications, there are strong arguments in favour of developing such visions on a sectoral or application-specific basis – such as supply of low-carbon steel or building heat – and not just at the level of technology type – such as biofuels, wind power or heat pumps. While multi-year priority setting is well established in places including China, the European Union and Japan, there is less experience with complementary processes to ensure flexibility and evaluation of outcomes against policy objectives. The key requirements are to:

Establish and publicise clean energy visions for key sectors in the long term, and at interim milestones, in co-operation with technology experts, civil society and market analysts. Good roadmaps describe the journey and the destination in qualitative as well as quantitative terms: they also look at how the activities of the people and companies involved might change over time, so as to provide a foundation for a conversation about opportunities and trade-offs between all relevant stakeholders.

Identify the technology needs and innovation gaps to get from here to there. Clean energy visions can be mapped onto the existing technology landscape to identify where improvements in cost and performance are needed, and where there are cross-sectoral interactions. Tools such as the ETP Clean Energy Technology Guide can be used to help in this process (see Chapter 3). Technology needs assessments as promoted by the United Nations and as undertaken for the UK Energy Innovation Needs Assessment exercises are examples.

Prioritise a set of R&D topics, taking into account local expertise, local R&D capacity, comparative industrial advantage, and potential for spillovers. Selecting the areas to prioritise is a difficult but essential exercise, and there is significant scope for governments to share good practice in this area. Based on the analysis for the Sustainable Development Scenario, we specifically highlight the importance of considering cross-sectoral spillovers. For example, cross-sectoral technology clusters that support “electrochemistry” or “lightweight materials” might accelerate innovation faster in some countries than clusters for applications such as “energy storage” or “mobility”. Governments of smaller economies have particular incentives to prioritise R&D and select the technology types that they are best placed to contribute. Japan’s Environment Innovation Strategy is an example of a priority-setting document, while Korea’s technology cluster for batteries, solar PV and electronics is an example of clustering.

Track progress towards stated policy goals, embed evaluation ex ante into policy design and establish processes for regular review of priorities. Committing to innovation means taking a long-term view and embracing uncertainty, but that does not diminish the importance of regular assessments of progress and policy orientation. There is considerable potential for better data to help governments assess how their clean energy innovation policies are performing, including by ensuring that the information needed for ex post evaluation is gathered along the way. Canada and Italy are examples of countries that collect data on private sector energy R&D to support policy making, while independent programme evaluations are well established in the United States, one example being the 2017 review of ARPA-E (Advanced Research Projects Agency – Energy) by the National Academies of Sciences, Engineering, and Medicine.

Communicate the vision to the public and nurture and build socio-political support. Energy innovation takes time and there is little room for manoeuvre if net-zero ambitions are to be realised. Compressing the timetables for scale-up and continual improvement requires mobilising all stakeholders. In practice, this demands transparency about the process and the identification of possible areas of public concern (and enthusiasm) in advance. The European Commission, for example, conducts regular Eurobarometer surveys of public opinion on energy.

2. Raise public R&D and market-led private innovation

Aligning innovation with the opportunities for a clean energy transition to net-zero emissions requires more resources than are currently devoted to clean energy R&D and innovation by both the public and private sectors. While it is not possible to specify the precise amount that should be spent, or who is best placed to spend it in each country, the innovation system needs sufficient funding to generate a steady pipeline of new ideas that align with sectoral net-zero emissions visions, and the proponents of these ideas need to be able to access funding to reach prototype scale, demonstration and scale-up into successive market niches, if their potential is proven at each stage. The key requirements are to:

- Mix public funds and market mechanisms to maximise the contribution from private capital. Depending on the technology areas prioritised, different mixes of instruments will be appropriate – including research grants, standards, deployment incentives, loans, prizes and project grants. For each concept or project, the level of maturity, unit size, modularity, value chain complexity and value for customers should influence programme and policy design. The history of the development of solar PV shows how research grants were followed by public procurement and then market-pull policies combined with manufacturing support, with the latter stimulating private sector innovation to drive down costs. Several governments have been adapting their energy innovation policy instruments to raise the efficiency of public funding, including through ARPA-E in the United States, InnovFin in the EU and National Major S&T Projects in China. Canada and India are among the countries seeking to enhance incentives for venture capital finance to encourage a vibrant start-up community with longer time horizons.

- For each priority, support an evolving portfolio of competing designs at different stages of maturity, and favour options with rapid innovation potential. Diversity and competition help to spur progress and leave some space for unexpected developments, while small, modular, mass-manufactured technology designs with high spillover potential offer rapid innovation dynamics. These types of technologies can be found among the proposed solutions for many of the current energy challenges and there is an emerging body of work that supports their inclusion in technology portfolios. While solar PV and lithium-ion (Li-ion) are exemplars of how this kind of approach accelerated progress in the past, electrolysers, fuel cells, heat pumps and smart-home technologies could all benefit in the future.

- Ensure that knowledge arising from publicly funded R&D is rapidly and openly shared with the research community and taxpayer value is maximised. This is good practice for knowledge-sharing purposes – open access publishing is a condition of receiving EU R&D grants, for example – and can also raise public support.

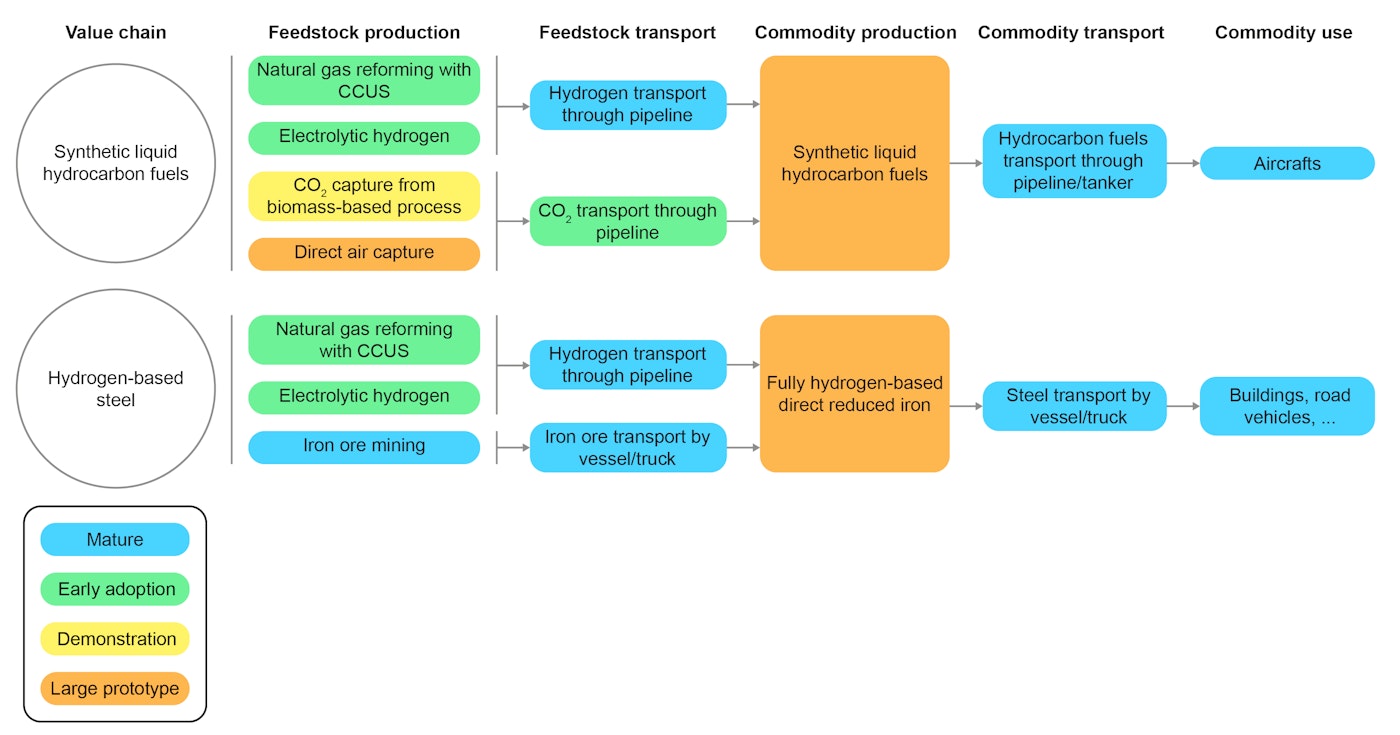

3. Address all the links in the value chain

Delivering energy services to a specific end-use involves different technologies for supply, distribution, storage and use, and value chains spanning the process are only as strong as their weakest link. Individual countries and companies need not contribute technology improvements to all steps in a given value chain (indeed most countries don’t have the capacity to do so) but, by considering the full value chain, they can more easily identify areas where faster progress is needed for deployment. In keeping with the findings about the importance of key end-use sectors in the Sustainable Development Scenario, an approach focused on value chains starts from the needs of each application rather than focusing on supply. The key requirements are to:

- For each technology area, identify the position(s) in the value chain that present(s) the greatest opportunity for local innovators. Energy-related equipment is a global industry, with countless specialised components and intermediates traded internationally. As part of the consideration of comparative advantage during technology prioritisation, governments should consider where their comparative advantages might lie in future trade networks, alongside strategic considerations about energy security, technology clusters and integration. For example, a small highly-skilled economy might prioritise hydrogen for industrial use, but recognise that its relative strengths relate more to project integration and gas handling than electrolyser manufacturing.

- Ensure adequate support for all elements of the value chain. Four of the key technology areas for net-zero emissions energy systems – direct electrification, CCUS, hydrogen and bioenergy – all have value chains that are advancing unevenly (see Chapter 3). For some, the issues relate to upstream supplies, for example in biomass production, while for others the issues are downstream, for example in CO2 storage availability or smart grids. While uneven progress is inevitable to a large extent, all elements must reach sufficient maturity by the time the full value chain needs to be deployed. In the meantime, innovation in the more mature elements can be taken to the next level by using market-pull policies to support niche markets. Early niche markets are often those requiring the shortest new value chains and therefore have the lowest risks: examples include the sale of captured CO2 for enhanced oil recovery and the use of geothermal CO2 for synthetic fuels production. Importantly, the best niche markets may not be in the same sectors as the future markets with the highest potential: for example, blending low-carbon hydrogen into gas grids or its use in refineries could be an invaluable springboard for its use in transport.

- Co-operate regionally and internationally with developers of other elements of the value chains. Multilateral and bilateral co-operation can help ensure timely and targeted investment in individual elements of value chains. International projects can help channel funds to where they are needed most.

Maturity level of technologies along selected low-carbon value chains

Open

4. Build enabling infrastructure

Several key areas that need to see rapid technical progress for reaching net-zero emissions require new infrastructure or upgrades to existing networks. Such infrastructure includes major demonstration facilities for industrial processes. Among the network needs are smart electricity grids, hydrogen-ready gas grids, low-temperature district heat networks, CO2 storage infrastructure, and communications networks for connected appliances and vehicles. These types of investments have strong public good elements by virtue of being natural monopolies and having large returns to adoption, meaning that later adopters often face lower costs and obtain higher benefits. Once infrastructure is in place, it can be a platform for innovation, encouraging new ideas for how to make best use of it, especially if third-party access is guaranteed. On the other hand, it can be a major barrier to adoption if project promoters have to bear the risks of new infrastructure at the same time as they are bearing the risks of developing other elements of the value chain. There is therefore a strong rationale for governments to ensure that enabling infrastructure is put in place in line with demand for the new technology. The key requirements are to:

- Incentivise network owners and operators to test and deploy enabling infrastructure for new technologies to integrate into existing grids, pipelines and communication systems. Regulated network operators and utilities are usually obliged to minimise risk, which reduces their capacity to incorporate new enabling technologies into network infrastructure. New regulatory models are emerging to provide more scope for experimentation. For example, the RIIO 2 (Revenue = Incentives + Innovation + Outputs) price controls in the United Kingdom include provisions for network operators to access innovation funds and trial technologies with appropriate regulatory exemptions.

- Take the initial investment risk in large-scale demonstrators that present a high-cost barrier to scale-up. Technologies like CCUS for industrial facilities, fossil fuel-free iron and steel processes, new nuclear designs, and floating offshore wind all face high capital costs for the first commercial projects. These projects have the highest costs and risks, with subsequent entrants benefiting from the learnings. This provides a rationale for direct government investment in this phase of development, in tandem with action to create more market value for products such as low-carbon steel. Public funding for such projects could be conditional on the learnings from the projects being widely shared. For example, CCUS projects that received public support in Alberta (Canada), the European Union and the United Kingdom had their findings published for the benefit of the technical community. In some cases, the facilities can be made “open access” for testing of different designs, as has been done for CO2 capture at the Technology Centre Mongstad in Norway and the US National Carbon Capture Test Center.

5. Work globally for regional success

The innovation gaps to be filled for a net-zero emissions future are global, reflecting the global nature of the climate challenge, and innovation will be most efficient if countries are able to share some of the burden internationally. Multilateral platforms for co-operation between governments already exist and can be strengthened as necessary to ensure that global innovation systems work as efficiently as possible. Appropriate intellectual property regimes also have an important role to play in maximising the innovation benefits of trade. The key requirements are to:

- Work across borders to ensure that no essential technology areas remain underfunded because of high development risks that cannot be borne by one country. Learnings and experiences in each country are global public goods because they advance the innovation frontier for all regions. In most cases, this contribution, coupled with the first-mover advantages for local innovators, justifies public financial support for R&D, demonstration and early adoption in a given economy. However, the risks can sometimes be too high for a single country to fund if the market players are multinational, the outlook uncertain and the project particularly costly – as is the case for CCUS, including for low-carbon hydrogen, and low-carbon industrial processes. Countries with smaller R&D budgets and companies with weaker balance sheets are likely to find collaboration especially attractive if it keeps local innovators from moving overseas. Pooling of innovation resources in this way is rare, but not without precedent, as the size of the budgets for EU energy R&D and cross-border nuclear fusion campaigns attest. As a recent example, the French and German governments announced co‑financing of a floating offshore wind project in early 2020.

- Exchange experiences with other clean energy innovation policy makers about good innovation policy practice. Several of the recommendations in this list are for actions that would have positive impacts but for which there is not yet consensus on the best approach. R&D prioritisation, funding instrument design and evaluation fall within this category and could benefit from an exchange of experiences between governments.

- Support networks for the rapid exchange of knowledge between researchers in overlapping fields and cross-fertilisation between sectors. The benefits and speed of knowledge and application spillovers can be maximised by exploiting synergies internationally. International networks for knowledge exchange can also help avoid duplication of effort and identify innovation gaps not yet addressed. Existing multilateral platforms for co-operation provide a sound basis for deepening collaboration. They include the IEA technology collaboration programmes, which facilitate co-operation across 38 technology areas, Mission Innovation and the Clean Energy Ministerial, among others.

Covid-19: The case for rapid implementation of innovation policies to maintain momentum and accelerate the transition

Covid-19 does not change the elements of the net-zero emissions innovation policy package, but some of the elements deserve immediate attention as governments prepare policies to repair, stimulate and recover economic activity. The central role of government in supporting energy innovation is well established, especially in relation to the public good nature of R&D, and tackling the greenhouse gas externality is widely agreed to need strong government action over the coming decades. Energy innovation offers an opportunity to boost economic activity damaged by the Covid-19 pandemic and at the same time to help with the transition to net-zero emissions. It supports a sizeable workforce, including around 750 000 R&D personnel, and is a driver of economic growth: it is also essential to addressing climate change and other long-term energy and sustainability challenges. By the same token, reduced investments in energy innovation because of Covid-19 would have short-run economic costs as well as long-run costs for energy transitions, and would increase the difficulty of meeting mid-century climate goals.

When designing stimulus packages, it is critically important to consider overarching energy policy objectives such as improving energy sector resilience and addressing climate change, as set out in the IEA World Energy Outlook Special Report on Sustainable Recovery. The recommendations in that report identify the areas of energy investment where short-term and long-term interests converge.

Policy actions for a sustainable recovery plan for the energy sector beyond clean energy innovation

|

Buildings |

|

|

Transport |

|

|

Industry |

|

|

Electricity |

|

|

Fuels |

|

The following sections of this report follow the same logic, identifying elements of the net-zero emission innovation policy package that could be included in recovery measures for their potential to meet two crucial objectives in the current context, one short-term and one medium-term:

- keep the whole innovation system on track

- invest strategically and ambitiously to reshape the economy towards net-zero emissions in the period to 2030.

Analysis throughout this report indicates that there are significant benefits to renewing support for clean energy technology innovation out to both these time horizons and indeed beyond. There are two main reasons for this. The first is that the world cannot afford to drift further off-track in its capacity to tackle emissions in certain end-use sectors. The second is that the investment opportunity presented by stimulus funding and new market realities is unique: it could potentially carry some key technologies across the “valley of death” much faster than anticipated.

Keep the whole innovation system on track

In the short term, governments are looking to boost economic activities that are labour intensive, can be rapidly deployed and have large economic multipliers. Maintaining spending across the economy on innovation meets these criteria. Research, including public sector R&D, is a labour-intensive activity that underpins future productivity and growth. Manufacturing plants for new technologies and demonstration projects that are already at an advanced stage of planning are likely to be ready for rapid deployment, i.e. they are “shovel ready”. R&D projects that had already started or were ready to start but now face funding uncertainty can be begun or ramped up quickly.

Each measure should be considered within the context of a systematic approach to maintaining momentum in the face of serious risks. Disruption to any of the key functions of the clean energy innovation system could choke the pipeline of new technologies, and it might take years for it to be replenished. This is a further argument in favour of a value chains approach, as highlighted in the recommendations below, and in favour of integrating support for clean energy innovation with other elements of stimulus funding, including infrastructure investments and corporate support.

The recommendations below are all elements of the five key principles introduced above. They have been selected for the contribution they make to counteracting short-term risks. They also incorporate lessons learned from the stimulus measures implemented in 2009 after the 2007-08 financial crisis.

Raise public R&D and market-led private innovation

- Maintain public clean energy R&D programmes already planned for 2020-21.

- In major economies, give early signals that budgets in 2021-25 will be raised counter‑cyclically, consistent with the increases seen in 2009-11 (these were 100% or USD 4.7 billion in the United States, and 60% or USD 1.8 billion in other major economies).1

- Take low-cost measures to raise R&D productivity by enhancing professional networks, ensuring that results are published with open access and by enforcing existing regulations, for example in relation to intellectual property.

- Explore international finance options to avoid further widening the gap between emerging markets and global leaders in R&D and innovation.

- Make support for distressed companies conditional on commitments from them on clean energy innovation. Conditions in bail-out agreements for companies in energy supply or heavy industry and long-distance transport sectors where reducing emissions is hardest, could require purchases of new technologies, investments in enabling infrastructure or temporary reinvestment of profits in R&D. Conditional loans or tax incentives for corporations could require them to increase spending on clean energy technology R&D to counteract R&D spending cuts, following the example set by the European Investment Bank when it provided funding to car companies for electric vehicle (EV) R&D in the 2010s. Capital – such as short-term grants and loans or loan guarantees – can be provided to viable and innovative start-ups and SMEs, especially if it is administratively possible to target those in strategic areas.

Address all the links in the value chain

- Act across value chains for mass-manufactured technologies on the cusp of rapid scale‑up by co-ordinating support for market demand, factory completions, field trials and R&D. This action applies particularly to new Li-ion battery designs, electrolysers, fuel cells, heat pumps and highly efficient air conditioners.

- Build on existing instruments to create niche markets and avoid the need for complex new regulations. Market-based support is likely to attract more private capital and have a long-lasting effect on developing new businesses. In 2009, US American Recovery and Reinvestment Act (the “Recovery Act”) incentives leveraged the tax system, while the possible use of the EU Emissions Trading System to issue “carbon contracts-for-difference” that guarantee revenue to low-carbon hydrogen consumers in industry has been proposed in Europe.

- Give preferential treatment to innovative low-carbon solutions in major public procurement programmes within stimulus packages. Examples include low-carbon building materials, smart controls for energy management and novel approaches to manufacturing energy efficiency retrofits, such as off-site prefabrication and standardisation.

Build enabling infrastructure

- Ensure that major technology demonstrations and large-scale field trials proceed to completion if they are at an advanced stage of planning and if follow-on commercial investments are still expected. Projects with simple value chains and infrastructure requirements are most attractive for rapid spending and job creation. In the area of CCUS, several of the 15 projects seeking support from the so-called 45Q tax credit in the United States are well advanced in their planning and have reasonable certainty about their CO2 storage contracts; the Northern Lights project in Norway is also close to a final investment decision. In the area of smart grids, demonstrations of different implementation contexts for demand-response, load aggregation and electricity storage would build regulator confidence in faster/wider adoption.

- Network infrastructure is likely to be a target for investment by governments due to its economic multiplier effects, providing an opportunity to make it more compatible with a net-zero emissions future. In some cases, relaxation of certain regulatory provisions may be needed to allow regulated entities to make widespread investments in key enabling technologies. Examples include smart grid upgrades, EV charging, district heat modernisation and hydrogen-ready gas pipelines.

Experience from previous energy innovation stimulus measures

Governments around the world, faced with the predicted severe negative impacts of the global financial crisis of 2007-08, passed wide-ranging economic stimulus packages by 2009. Among these, several major governments with sufficient economic resources chose to channel money to clean energy innovation. The rationale was generally to pair short-term stimulus measures with longer term investments in increased productivity and technologies that could reduce CO2 emissions once the economy recovered.

The largest and most wide-ranging example of this approach was the 2009 US American Recovery and Reinvestment Act, which provided more than USD 90 billion in support of clean energy activities. Within this envelope, USD 7.5 billion was allocated to energy R&D and major demonstration projects, and other funds were directed to scaling-up value chains for early-stage technologies. By the end of 2010, an estimated 32 200 job-years through 2012 for innovation and job training had been created by the Recovery Act (CEA, 2010). In the three years from 2009 to 2011, federal R&D on energy efficiency was raised by over USD 1 billion per year compared to 2006-08, or 160%. Funding for carbon capture, utilisation and storage R&D and demonstration also rose by over USD 1 billion, a nearly 600% increase. Although smaller in absolute terms, the near trebling of funding for electricity grids and storage was also striking and came at an opportune moment for batteries development.

US federal funding for applied energy technology R&D and demonstration, 2000-2019

OpenThe Recovery Act made a notable contribution to the development of Li-ion battery technology. The funding it provided for US battery R&D funding represented a significant increase in global R&D at a time when EVs were primed for market entry but needed better batteries, and when the United States produced less than 2% of the world’s batteries for hybrid vehicles (Walsh, Bivens and Pollack, 2011). With new battery designs, the cost of EV batteries fell by 70% and the number of electric cars sold in the United States rose from 1 500 to 114 000 between 2008 and 2015 (US DoE, 2015; IEA, 2016). Not all of this can be attributed to the Recovery Act, but there is no doubt that the sector benefited from the timely allocation of resources to different parts of the value chain, not just R&D. The Act allocated USD 140 million to 12 grid‑level demonstration projects; USD 400 million to 8 demonstration projects for EVs and chargers, plus workforce training and R&D; USD 160 million to 60 novel battery development projects under ARPA-E by 2015; USD 2 billion to 30 manufacturing facilities for batteries, battery components and EV drivetrain components; USD 33 million in tax credits to battery factories; USD 2 billion in loans to EV and battery manufacturing; and USD 2.2 billion to tax credits for EV purchases (US DoE, 2020a, 2020b, 2020c; Walsh et al., 2011). Twenty-six of the 30 manufacturing projects receiving grants were in construction by 2011; 2 of the battery factories were already in production.

Although the sums spent on clean energy innovation outside the United States were generally much lower than for the Recovery Act, Germany also allocated around EUR 0.5 billion to R&D for mobility (Deutscher Bundestag, 2009; Schmidt et al., 2009), and annual clean energy R&D budgets were increased around 60% in 2009-11 in other large economies that used stimulus in this way. In these countries, the increases in funding were often lasting, whereas many of the areas funded by the Recovery Act are today at near pre-2009 levels of funding, having fallen back after 2011.

Public energy R&D and demonstration funding in selected countries that used stimulus money for this purpose, 2000-2019

OpenA common feature of several of the largest economic recovery packages was investment in large-scale technology demonstration in complex engineering projects. The large sums of money unlocked by stimulus funding packages offered a welcome opportunity to get these financially risky, capital-intensive projects built. All projects generated valuable experience in relation to project permitting, regulatory challenges, financing and business models – which was sometimes shared publicly as a legal condition for receiving funding – but their success was mixed.

In 2009, USD 12 billion was made available for CCUS, concentrating solar power, offshore wind, smart grid and energy storage projects in Canada, the European Union and the United States. In Canada, this represented 1.2% of the total stimulus package and 59% of the energy-related budget, alongside funding for smart grids and renewables R&D. The EU and US levels were lower, at 0.7% and 33% for the European Union and 1.2% and 9.3% for the Recovery Act. Of the 58 projects that received funding, 40 were commissioned and have generated operational experience. Many of these were smaller smart grid and electricity storage projects in the United States. CCUS projects had a lower success rate, with 5 out of 19 commissioned to date, including one that started operations in 2020.

Demonstration project funding from economic stimulus budgets approved by governments in 2009

|

Programme |

|

CCUS |

CSP |

Electricity storage |

Offshore wind |

Smart grids |

|---|---|---|---|---|---|---|

|

Canada: Economic Action Plan Clean Energy Fund |

Budget |

0.41 |

- |

- |

- |

- |

|

Projects |

3 |

- |

- |

- |

- |

|

|

Commissioning of first project |

2015 |

- |

- |

- |

- |

|

|

Projects operating by 2020 |

2 |

- |

- |

- |

- |

|

|

European Union: European Economic Programme for Recovery |

Budget |

1.46 |

- |

- |

0.35 |

- |

|

Projects |

6 |

- |

- |

6 |

- |

|

|

Commissioning of first project |

- |

- |

- |

2011 |

- |

|

|

Projects operating by 2020 |

0 |

- |

- |

5 |

- |

|

|

United States: American Reinvestment and Recovery Act |

Budget |

3.37 |

5.8* |

0.14 |

- |

0.42 |

|

Projects |

10 |

5 |

12 |

- |

16 |

|

|

Commissioning of first project |

2013 |

2013 |

2011 |

- |

2010 |

|

|

Projects operating by 2020 |

3 |

5 |

11 |

- |

16 |

* Loan guarantees. Note: CCUS = carbon capture, utilisation and storage; CSP = concentrating solar power. Sources: US DoE (2020a; 2020d); Herzog (2016); EC (2018); Government of Canada (2014).

Certain combinations of scale and complexity presented significant risks to projects aiming to spend capital quickly and mobilise employment in the value chain. Challenges included:

- Spending the money quickly enough. CO2 storage facilities can take several years to develop from scratch, leaving no room for delays in order to meet the legal timeline for spending capital quickly. But competitive mechanisms take time to implement, respond to and evaluate, and the US Department of Energy needed to hire new people after its civilian energy budget tripled in a year. Delays also arose from permitting processes and social concerns that had not previously been tested, as well as from technical issues.

- Attracting co-financing alongside government funds at a time of economic difficulty, especially where the new technology was not a core business activity for the lead sponsors.

- Adapting to an uncertain market environment, including falling CO2 prices and stalled regulation, within inflexible grant funding rules. Project sponsors sought certainty that new assets worth hundreds of millions of dollars would run for many years, not just the short time horizons of grants.

- Co-ordinating entirely new value chains involving firms from sectors with different appetites for risk.

Project failures can cause setbacks for a whole technology field if they lead to that field becoming associated with ineffectiveness, high costs or immaturity, or for other reasons. In much of Europe, for example, efforts to quickly deploy large CCUS projects became linked to concerns about the sustainability of fossil fuels.

Learning from prior experiences suggests that factors that favour success include:

- Plugging into existing infrastructure, such as electricity networks, fuel supply or CO2 pipelines.

- Being the simplest and cheapest configurations to address technical or regulatory knowledge gaps.

- Being at or beyond the front-end engineering design stage at the time of award.

- Having dependable sales of output under existing market or bilateral offtake contract conditions.

- Having funding flexibility that can manage limited cost or time overruns.

Today, governments appear to be better equipped to implement a green stimulus package as a result of increased public awareness and improved national and international frameworks for climate policy (Kröger et al., 2020). In addition, some of the lessons set out above have already been learned, including in the design of the forthcoming EU Innovation Fund, while others, such as the relative effectiveness of grants and tax credits compared with loans, have been documented by the relevant agencies (Aldy, 2013).

Invest strategically and ambitiously to reshape the economy towards net-zero emissions in the period to 2030

The sheer scale of the stimulus packages under discussion is striking. The US measures passed so far amount to USD 2 trillion, which in real terms is almost exactly the total sum authorised for the 2008 US Emergency Economic Stabilization Act and the Recovery Act in the midst of the 2007-08 financial crisis. Measures totalling around USD 850 billion have meanwhile been proposed for the European Union, but not yet approved. These two packages alone represent more than double annual capital spending on all energy assets worldwide each year. So far, governments have announced measures worth about USD 9 trillion (IEA, 2020b). By comparison, the total amounts of money that could underpin a leap forward in clean energy innovation outcomes are relatively modest. Large demonstration projects cost in the order of USD 0.5 billion to USD 2 billion each. Furthermore, not all costs need be borne by taxpayers: with anticipated declines in capital costs, co-investment by the private sector could represent a significant share of total clean energy innovation spending if public spending is combined with loans, loan guarantees and measures that provide more revenue certainty.

Investing in a strategic portfolio of R&D, demonstration and infrastructure projects today could put the world on a pathway for net-zero emissions. It could also secure new areas of industrial leadership for first‑mover economies and prevent a recovery that locks in high-carbon growth. In particular, there is a once-in-a-generation opportunity to unlock emissions for long-lived assets by avoiding a new investment cycle in high-emissions infrastructure occurring just at the wrong time. Making cost-competitive low-carbon technologies available earlier substantially reduces the future costs of early retirements and disruptive refurbishments in order to meet the net-zero emissions goal. It also saves CO2: the Reduced Innovation Case showed that there could be an additional 1.5 Gt of CO2 emissions by 2040 if hydrogen demonstration projects are delayed by the Covid-19 pandemic (see Chapter 4). It is vital, however, that such a portfolio prioritises promising solutions for sectors where technologies for deep decarbonisation are lagging behind and capital for major demonstration projects is especially hard to raise. Clean energy innovation spending would also create jobs in science and engineering as well as construction supply chains.

Prioritise, track and adjust

- Review R&D funding and other energy innovation measures in the light of long-term goals. Many determinants of the effectiveness of public innovation policies are embedded in their frameworks and institutional processes, and relate to factors such as eligibility criteria, performance evaluation, progress tracking, dissemination of results, flexibility of funding instruments, intellectual property rights enforcement and competition law. New funding from stimulus funds could represent an opportunity to implement reforms, taking account of goals for the future and lessons from the past.

- Update clean energy technology prioritisation processes to take account of new developments, including the possibility of long-term structural and behavioural changes triggered by Covid-19.

Raise public R&D and market-led private innovation

- Where budgets allow, increase innovation funding for priority clean energy value chains that have been identified as having particular long-term strategic importance. While near-term actions to repair damaged innovation systems might concentrate on ensuring that the demonstration and early adoption stages continue to function, these longer term policies should be more focused on boosting the pipeline of new ideas reaching prototype stage. Technology areas that deserve more R&D attention than they currently receive include advanced battery chemistries, direct air capture (DAC) designs, algae‑based biofuels, electrification of heavy industrial processes such as iron ore electrolysis, electric aircraft designs and connected appliances for buildings energy control.

- Look for the areas to focus on that are most appropriate for the post-crisis economy. If the global economy becomes more averse to putting large sums of capital at risk, this will strengthen the case for supporting smaller unit size, modular technologies. The appropriate support mechanism and potential contribution from private sector finance will depend on maturity, potential to scale-up quickly and ability to benefit from cross‑sectoral synergies with other technologies.

Build enabling infrastructure

- Allocate capital resources to bring forward the planning and operation of important large-scale first-of-a-kind demonstration projects and field trials with end-users, while ensuring that the market will support investment in a follow-on wave of projects if these projects are successful. Examples of technologies that are critical to net-zero emissions targets but face challenges scaling-up include hydrogen-based synthetic fuels, CCUS for hydrogen production, cement kilns, or steelmaking, and hydrogen-based steel production.

Work globally for regional success

- Deepen international dialogue on common missions and funds, especially for high-cost, high-reward technology programmes that may be hard to finance at a national level in the current economic climate. New low-carbon processes in heavy industry, DAC, BECCS (bioenergy with carbon capture and storage), international low-emissions shipping, and aviation and offshore CO2 storage all have strong global public good qualities. Many of them are “footloose”, i.e. they can easily relocate, or are expected to be situated in jurisdictions outside the regulatory regimes of their customers.

- Participate in international dialogue on the timing of creation of additional, larger niche markets. This could help avoid gaps between programmes and corresponding disruption in global supply chains.

The once-in-a-generation investment opportunity

For some sectors, 2050 is just one investment cycle away. In others, the next new capital assets might reasonably be expected to still be operating in 2070, the date of net-zero emissions in the Sustainable Development Scenario. This means that the timing of investments and the availability of clean energy solutions at the right time is of critical importance. If innovation timelines can be aligned with net-zero emissions objectives, then this will unlock multi-billion dollar markets for new energy technologies and avoid the risk of billions of tonnes of “locked in” emissions.

In the Sustainable Development Scenario, new low-carbon technologies are adopted rapidly once they are mature enough for early adoption. They enter the market as new capacity is needed or existing equipment either reaches the end of its lifetime or is retired earlier if needed. This leaves little room for manoeuvre, especially in heavy industry. In the cement, chemicals, and iron and steel sectors, today’s lack of commercial low-carbon options means that technologies currently at the prototype or demonstration stage are starting to be deployed widely before 2030. This is because, despite most steel and cement plants being young and not reaching the end of their 40-year design lifetimes until 2045-55, they will face major refurbishment decisions in the next 10-18 years, which could lock in another 25 years of similar emissions if the same technologies are renewed. By changing the production technology to one compatible for deep decarbonisation after 25 years rather than 40 years, their owners reduce the cumulative projected emissions from the steel, cement and chemicals sectors by nearly 60 GtCO2 , or 38%, by 2070. Due to the size of the fleets and ages of the plants, these reductions would mostly occur in China and other Asian countries.

Intervening at the end of the next 25-year investment cycle could avoid "lock in" of nearly 60 GtCO2 , or 38% of projected emissions from existing equipment in the steel, cement and chemicals industries.

2028-35 is the earliest that most technologies for net-zero emissions in these sectors could reach the early adoption stage. For example, demonstration trials of hydrogen-based direct reduced iron for steelmaking are scheduled to run from 2025 until 2035 (Hybrit, 2020). Not keeping to this timetable for this and other pilot and demonstration projects would mean many plants in the cement, chemicals, and iron and steel sectors would lose the opportunity to switch to low-carbon technologies at the refurbishment point in their investment cycles: this would entail higher emissions, and higher costs later on from a combination of early retirements and more disruptive refurbishments or replacements part way through the lifetimes of operating plants.

Recovery packages present a major opportunity to invest in the near term in projects that help ensure that these technologies will be available in line with the Sustainable Development Scenario – an opportunity that may not recur. Recovery packages could support the series of commercial-scale demonstration projects (each with a declining level of public support) that are generally needed to give the market confidence in a new technology. Funds could also make capital available for adapting equipment that reaches its 25-year investment decision before 2028 so that it is compatible with retrofit of the new technology, a strategy that is mostly relevant to European and North American plants. In the specific case of hydrogen-based direct reduced iron, conversion of blast furnaces to direct reduced iron processes that can handle hydrogen could be undertaken as a preparatory step. Early conversion plans to adapt an existing blast furnace to this process in parallel to the trials in the first demonstration plant have already been announced (SSAB, 2020).

This opportunity is most evident in heavy industry – a higher share of investment in heavy industry goes to the deployment of technologies that are not commercially available today than to transport, buildings or power generation – but is not limited to it. We estimate that operating existing energy infrastructure until the end of its lifetime would lead to nearly 800 Gt of CO2 emissions between now and 2070. While 150 Gt of this is from heavy industry, more is from the power sector, where 33% of the installed coal-fired capacity is under 10 years old. Technologies for retrofitting power plants with CCUS, and decarbonising long-distance transport need to be readily available to avoid a new investment cycle occurring just at the wrong time.

If these low-carbon technologies are successfully commercialised and supported by early markets, then they could open the way to enormous new commercial opportunities. Annual investments in technologies that are at prototype or demonstration stages today reach around USD 350 billion per year on average between 2020 and 2040 in the Sustainable Development Scenario. They increase to USD 3 trillion across all sectors by the 2060s, by when the market size for technologies of this maturity in heavy industry reaches almost USD 100 billion per year.

Average annual investment in technologies that are today at pre-commercial or early adoption stages by maturity level in the Sustainable Development Scenario, 2020-2070

OpenInvestments in technologies that are today at demonstration or large prototype stage become important investment opportunities in the Sustainable Development Scenario, particularly in sectors with less readily-scalable low-carbon options today, such as heavy industry and long-distance transport.

Tailoring the package to the needs of technology families

It is critically important for a transition to net-zero emissions that all energy end-users have affordable clean energy solutions available to them in line with the timetables set out in the Sustainable Development Scenario, or sooner if possible. At a global level, the portfolio of technologies to be refined and developed is a broad one, and represents a much more diverse set of technology types than the energy system has previously had to manage. It includes a growing number of smaller scale, decentralised devices on the supply side of the equation together with more flexible technologies on the demand side to integrate new fuels. These can be grouped in technology families spanning different low-carbon value chains. It also includes technologies that sit outside traditional energy networks, such as BECCS and DAC, that will have an important future role because of their ability to offset CO2 emissions. Different technologies will be suited to different roles in economic recovery measures related to clean energy innovation.

This section regroups the policy measures in the previous section by families of key technologies based on similar technology attributes. Within each of these families, knowledge and application spillovers hold significant potential to accelerate innovation if linkages are exploited: against this background, the section provides some concrete suggestions for action for each family of technologies to help policy makers to integrate tailored approaches for priority technology areas into overall strategies.

Technology families:

- Electrochemistry: modular cells for converting between electricity and chemicals.

- CO2 capture: processes to separate CO2 from industrial and power sector emissions or the air.

- Heating and cooling: efficient and flexible designs for electrification.

- Catalysis: more efficient industrial processes for converting biomass and CO2 to products.

- Lightweighting: lighter materials and their integration in wind energy and vehicles.

- Digital: integration of data and communication to make energy systems flexible and efficient.

The list above is not intended to be exhaustive, but covers the types of solutions that hold the most promise for advancing value chains involving electrification, hydrogen and hydrogen-based fuels, CCUS and bioenergy. Among the other technologies that all have important roles to play in achieving net-zero emissions are large, scientifically complex technologies such as nuclear, including small modular nuclear reactors, and small-scale, consumer-led technologies such as flexible or buildings-integrated solar PV or high-efficiency motors. In between these extremes lie geological technologies to enhance geothermal energy, hydrogen storage or CO2 storage, as well as such high-potential areas as ocean energy, prefabricated net-zero energy building envelopes, and thermal and mechanical energy storage.

Selected technology families and their footprint in low-carbon value chains

Open

1. Electrochemistry: Modular cells for converting between electricity and chemicals

Example technology types

- Batteries, electrolysers, fuel cells, electrochemical iron reduction.

Relevant types of value chains for this family

- Electrification, hydrogen and hydrogen-based synthetic fuels.

Relevant sectors where reducing emissions is hardest

- Iron and steel, chemicals, long-distance transport.

Summary

- Action is needed to maintain the significant recent investor momentum in these areas and invest in a cleaner economic recovery by accelerating the scale-up of manufacturing and innovation for new markets.

Key attributes

| Unit size##32## | Modularity | Value chain complexity | Value chain maturity | Consumer value added |

|---|---|---|---|---|

| 50 kW to 20 MW | Very high | Low |

|

|

Policy recommendations specific to this group

|

|

Keep innovation on track |

Invest to reshape the future |

|---|---|---|

|

Prioritise, track and adjust |

|

|

|

Raise public R&D and market-led private innovation |

|

|

|

Address all the links in the value chain |

|

|

|

Build enabling infrastructure |

|

|

|

Work globally for regional success |

|

|

2. CO2 capture: Processes to separate CO2 from industrial and power sector emissions or the air

Example technology types

- Natural gas reforming with CO2 capture, chemical absorption from fossil fuel flue gas, direct air capture, chemical absorption from cement emissions, process reconfigurations to raise CO2 concentrations, novel capture approaches.

Relevant types of value chains for this family

- CCUS, hydrogen, electrification and bioenergy via CCUS-equipped plants.

Relevant sectors where reducing emissions is the hardest

- Cement, iron and steel, chemicals, long-distance transport via hydrogen or offsets.

Summary

- Act to keep projects on track wherever local conditions give them a high chance of success and raise industrial and investor expectations about future regulation of emissions.

Key attributes

|

Unit size |

Modularity |

Value chain complexity |

Value chain maturity |

Consumer added value |

|---|---|---|---|---|

|

|

|

|

Low |

Policy recommendations specific to this family

|

|

Keep innovation on track |

Invest to reshape the future |

|---|---|---|

|

Prioritise, track and adjust |

|

|

|

Raise public R&D and market-led private innovation |

|

|

|

Address all the links in the value chain |

|

|

|

Build enabling infrastructure |

|

|

|

Work globally for regional success |

|

|

3. Catalysis: More efficient industrial processes for converting biomass and CO2 to products

Example technology types

- Methanation, methane splitting, liquid fuel synthesis, polysaccharide hydrolysis, algae processing, chemical hydrogen storage, bio-based and CO2-based bulk chemicals, ammonia cracking, artificial photosynthesis.

Relevant types of value chains for this family

- Bioenergy, chemicals, hydrogen-based synthetic fuels.

Relevant sectors where reducing emissions is hardest

- Long-distance transport; high-temperature industrial processes.

Summary

- Intensify efforts to find breakthroughs and direct the tremendous R&D capacities of the chemical and biotech sectors towards net-zero emissions challenges.

Key attributes

|

Unit size |

Modularity |

Value chain complexity |

Value chain maturity |

Consumer added value |

|---|---|---|---|---|

|

50 MW to 100 MW |

Medium |

High (dependence on uncertain developments both upstream and downstream) |

|

Low to Medium |

Policy recommendations specific to this family

|

|

Keep innovation on track |

Invest to reshape the future |

|---|---|---|

|

Prioritise, track and adjust |

|

|

|

Raise public R&D and market-led private innovation |

|

|

|

Address all the links in the value chain |

|

|

|

Build enabling infrastructure |

|

|

|

Work globally for regional success |

|

|

4. Heating and cooling: Efficient and flexible designs for electrification

Example technology types

- Heat pumps, high-efficiency air conditioning, advanced refrigerant-cooling, district heating and cooling, thermal energy storage.

Relevant types of value chains for this family

- Electrification, digital.

Relevant sectors where reducing emissions is the hardest

- Buildings, industry.

Summary

- Stimulate R&D and spillovers to deliver more efficient and flexible designs that are adaptable to a wider range of applications, services (including flexibility) and climate conditions.

Key attributes

|

Unit size |

Modularity |

Value chain complexity |

Value chain maturity |

Consumer added value |

|---|---|---|---|---|

|

1 kW to 5 MW |

High (except district energy) |

Low |

High |

Medium to High |

Policy recommendations specific to this family

|

|

Keep innovation on track

|

Invest to reshape the future |

|---|---|---|

|

Prioritise, track and adjust |

|

|

|

Raise public R&D funding and market-led private innovation |

|

|

|

Address all the links in the value chain |

|

|

|

Build enabling infrastructure |

|

|

|

Work globally for regional success |

|

|

5. Lightweighting: Composite materials and their integration in wind energy and vehicles

Example technology types and materials

- Carbon fibre reinforced polymer, 3D printing.

Relevant types of value chains for this family

- Electrification, hydrogen and hydrogen-based fuels, and bioenergy (via more manageable costs of reduced fuel loads).

Relevant sectors where reducing emissions is the hardest

- Long-distance transport, energy-intensive sectors (via lower cost wind energy).

Summary

- Act to support R&D and foster spillovers across multiple applications to reduce costs and improve competitiveness along different value chains.

Key attributes

|

Unit size |

Modularity |

Value chain complexity |

Value chain maturity |

Consumer added value |

|---|---|---|---|---|

|

Any |

Not applicable |

Low |

High |

Medium |

Policy recommendations specific to this family

|

|

Keep innovation on track |

Invest to reshape the future |

|---|---|---|

|

Prioritise, track and adjust |

|

|

|

Raise public R&D funding and market-led private innovation |

|

|

|

Address all the links in the value chain |

|

|

|

Build enabling infrastructure |

|

|

|

Work globally for regional success |

|

|

6. Digital: Integration of data and communications to make energy systems flexible and efficient

Example technology types

- Sensors for energy efficiency monitoring, baselining and billing; smart home systems; emissions auditing; big data, machine learning and artificial intelligence for: processing for mobility and logistics management, smart charging, smart management of district heat systems, etc.; distributed ledgers and blockchain; smart contracts; distributed grid management.

Relevant types of value chains for this family

- Electrification.

Relevant sectors where reducing emissions is the hardest

- Buildings, industry, long-distance transport.

Summary

- Steer the exponential growth in digital capabilities and creativity towards energy system challenges that can engage energy users and seamlessly connect them with markets.

Key attributes

|

Unit size |

Modularity |

Value chain complexity |

Value chain maturity |

Consumer added value |

|---|---|---|---|---|

|

1 mW to 10 kW |

High |

Medium |

Low to Medium |

High |

Policy recommendations specific to this family

|

|

Keep innovation on track |

Invest to reshape the future |

|---|---|---|

|

Prioritise, track and adjust |

|

|

|

Raise public R&D and market-led private innovation |

|

|

|

Address all the links in the value chain |

|

|

|

Build enabling infrastructure |

|

|

|

Work regional for local success |

|

|

References

Canada, France, Germany, the Netherlands, Norway, Spain, Sweden and the United Kingdom.

Reference 1

Canada, France, Germany, the Netherlands, Norway, Spain, Sweden and the United Kingdom.