IEA (2020), CCUS in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/ccus-in-clean-energy-transitions, Licence: CC BY 4.0

A new era for CCUS

Highlights

- Carbon capture, utilisation and storage (CCUS) so far has not lived up to its promise. Although its relevance for reaching climate goals has long been recognised, deployment has been slow: annual CCUS investment has consistently accounted for less than 0.5% of global investment in clean energy and efficiency technologies.

- Stronger climate targets and investment incentives are injecting new momentum into CCUS. Plans for more than 30 new integrated CCUS facilities have been announced since 2017, mostly in the United States and Europe, although projects are also planned in Australia, China, Korea, the Middle East and New Zealand. Projects at advanced stages of planning represent a total estimated investment of more than USD 27 billion, almost double the investment in projects commissioned since 2010.

- CCUS technologies offer significant strategic value in the transition to net-zero:

- CCUS can be retrofitted to existing power and industrial plants, which could otherwise still emit 8 billion tonnes (Gt) of carbon dioxide (CO2) in 2050.

- CCUS can tackle emissions in sectors where other technology options are limited, such as in the production of cement, iron and steel or chemicals, and to produce synthetic fuels for long-distance transport (notably aviation).

- CCUS is an enabler of least-cost low-carbon hydrogen production.

- CCUS can remove CO2 from the atmosphere by combining it with bioenergy or direct air capture to balance emissions that are unavoidable or technically difficult to abate.

- The Covid-19 crisis represents both a threat and an opportunity for CCUS: the economic downturn will almost certainly impact investment plans and lower oil prices are undermining the attractiveness of using CO2 for enhanced oil recovery. But CCUS is in a stronger position to contribute to economic recoveries than after the global financial crisis. A decade of experience in developing projects and the recent uptick in activity means that there are a number of “shovel-ready” projects with potential to double CCUS deployment by 2025.

Introduction

The story of CCUS has largely been one of unmet expectations: its potential to mitigate climate change has been recognised for decades, but deployment has been slow and so has had only a limited impact on global CO2 emissions. This slow progress is a major concern in view of the urgent need to reduce emissions across all regions and sectors in order to reach global net-zero emissions as quickly as possible. Yet there are clear signs that CCUS may be gaining traction in spite of the economic uncertainty created by the Covid-19 crisis, with more projects coming online, more plans to build new ones and increased policy ambition and action. The coming decade will be critical to scaling up investment in developing and deploying CCUS and realising its significant potential to contribute to the achievement of net-zero emissions.

A radical transformation of the way we produce and consume energy will be needed to bring about a rapid reduction in emissions of greenhouse gases (GHGs) consistent with the Paris Agreement goal of “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels”. The Paris Agreement also seeks to achieve a “balance between anthropogenic emissions by sources and removals by sinks” in the second half of this century: in practice, this translates to net zero emissions. Net zero requires that any CO2 released into the atmosphere from human activity be balanced by an equivalent amount being removed, either through nature-based solutions (including afforestation, reforestation and other changes in land use) or technological solutions that permanently store CO2 captured (directly or indirectly) from the atmosphere. The sooner net zero emissions are achieved, the greater the chances of meeting the most ambitious climate goals.

The International Energy Agency (IEA) Energy Technology Perspectives 2020 report highlights the central role that CCUS must play as one of four key pillars of global energy transitions alongside renewables-based electrification, bioenergy and hydrogen (IEA, 2020a). CCUS can reduce emissions from large stationary sources, essentially power stations and large industrial plants, in a variety of ways, as well as generate negative emissions, by combining it with bioenergy (BECCS) or through direct air capture (DAC). Carbon removal technologies will almost certainly be required due to the practical and technical difficulties in eliminating emissions in certain sectors, including some types of industry (notably steel, chemicals and cement), aviation, road freight and maritime shipping.

Another key attraction of CO2 capture technology is that it can be retrofitted to existing plants, many of which were built recently and could operate for decades to come. CCUS can also provide a least-cost pathway for producing low-carbon hydrogen based on natural gas or coal in countries with low-cost resources. Captured CO2 can be used in a number of ways, including to produce clean aviation fuels.

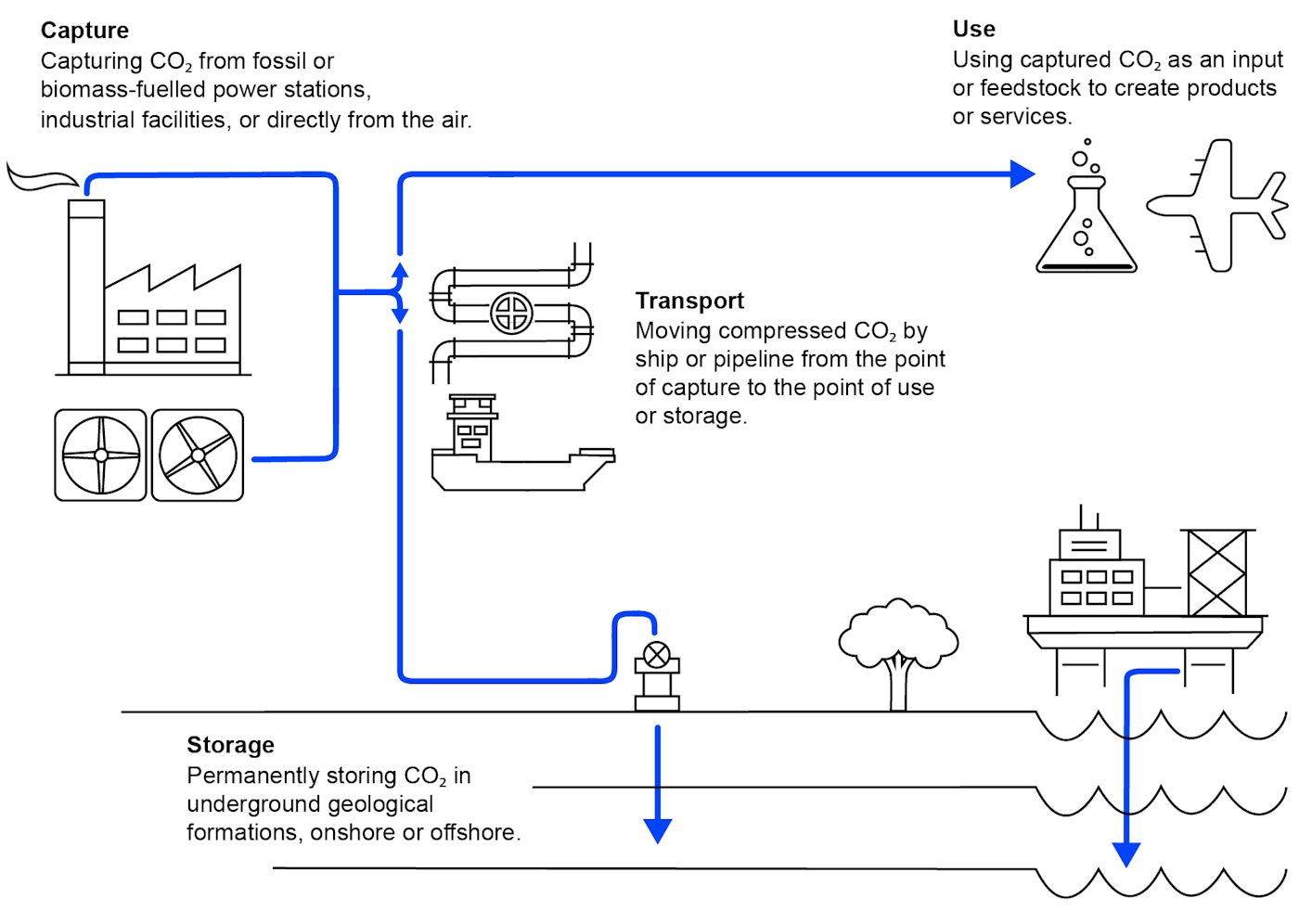

What is CCUS and how does it work?

CCUS refers to a suite of technologies that involves the capture of CO2 from large point sources, including power generation or industrial facilities that use either fossil fuels or biomass for fuel. The CO2 can also be captured directly from the atmosphere. If not being used on-site, the captured CO2 is compressed and transported by pipeline, ship, rail or truck to be used in a range of applications, or injected into deep geological formations (including depleted oil and gas reservoirs or saline formations) which trap the CO2 for permanent storage. The extent to which CO2 emissions are reduced in net terms depends on how much of the CO2 is captured from the point source and whether and how the CO2 is used.

The use of the CO2 for an industrial purpose can provide a potential revenue stream for CCUS facilities. Until now, the vast majority of CCUS projects have relied on revenue from the sale of CO2 to oil companies for enhanced oil recovery (EOR), but there are many other potential uses of the CO2, including as a feedstock for the production of synthetic fuels, chemicals and building materials.

CCUS technologies can provide a means of removing CO2 from the atmosphere, i.e. “negative emissions”, to offset emissions from sectors where reaching zero emissions may not be not economically or technically feasible. Bioenergy with carbon capture and storage (CCS), or BECCS, involves capturing and permanently storing CO2 from processes where biomass (which extracts CO2 from the atmosphere as it grows) is burned to generate energy. A power station fuelled with biomass and equipped with CCUS is a type of BECCS technology. DAC involves the capture of CO2 directly from ambient air (as opposed to a point source). The CO2 can be used, for example as a CO2 feedstock in synthetic fuels, or it can be permanently stored to achieve negative emissions. These technology-based approaches for carbon removal can complement and supplement nature-based solutions, such as afforestation and reforestation.

Schematic of CCUS

Open

CO2 can be captured from a range of sources, including the air, and transported by pipeline or ship for use or permanent storage.

Different terminology is often adopted when discussing CCUS technologies. In this report:

- Carbon capture and storage (CCS): includes applications where the CO2 is captured and permanently stored

- Carbon capture and utilisation (CCU) or CO2 use: includes where the CO2 is used, for example in the production of fuels and chemicals

- Carbon capture, utilisation and storage (CCUS): includes CCS, CCU and also where the CO2 is both used and stored, for example in EOR or in building materials, where the use results in some or all of the CO2 being permanently stored.

Strategic value of CCUS

CCUS carries considerable strategic value as a climate mitigation option. It can be applied in a number of ways and across a range of sectors, offering the potential to contribute – directly or indirectly – to emissions reductions in almost all parts of the global energy system. Consequently, progress in developing and deploying CCUS technologies in one sector could have significant spillover benefits for other sectors or applications, including for technological learning, cost reductions and infrastructure development. The four main ways in which CCUS can contribute to the transition of the global energy system to net-zero emissions – tackling emissions from existing energy assets, providing a platform for low-carbon hydrogen production, a solution for sectors with hard-to-abate emissions, and removing carbon from the atmosphere – are detailed below.

Tackling emissions from existing energy assets

Tackling emissions from today’s power stations and industrial plants will need to be central to the global clean energy transition. Those assets could generate more than 600 GtCO2 – almost two decades’ worth of current annual emissions – if they were to operate as they currently do until the end of their technical lives. Together with the committed emissions from other sectors, this would leave virtually no room for any emissions-generating assets in any sector to meet climate goals – an inconceivable prospect as populations and economies around the world continue to grow.

Coal-fired power generation presents a particular challenge. The global coal fleet accounted for almost one-third of global CO2 emissions in 2019, and 60% of the fleet could still be operating in 2050. Most of the fleet is in the People’s Republic of China (hereafter, “China”), where the average plant age is less than 13 years, and in other emerging Asian economies where the average plant age is less than 20 years. Similarly, 40% of current primary steel-making assets could still be operating in 2050 unless retired early.

CCUS is the only alternative to retiring existing power and industrial plants early or repurposing them to operate at lower rates of capacity utilisation or with alternative fuels. Retrofitting CO2 capture equipment can enable the continued operation of existing plants, as well as associated infrastructure and supply chains, but with significantly reduced emissions. In the power sector, this can contribute to energy security objectives by supporting greater diversity in generation options and the integration of growing shares of variable renewables with flexible dispatchable power. Retrofitting facilities with CCUS can also help to preserve employment and economic prosperity in regions that rely on emissions-intensive industry, while avoiding the economic and social disruption of early retirements. To illustrate the potential significance, Germany’s plans to retire around 40 GW of coal-fired generation capacity before 2038 is accompanied by a EUR 40 billion (USD 45 billion) package to compensate the owners of coal mines and power plants as well as support the communities that will be affected (BMWi, 2020).

A solution for sectors with hard-to-abate emissions

Meeting net-zero goals requires tackling emissions across all energy sectors, including those that are sometimes labelled as “hard to abate”. This includes heavy industry, which accounts for almost 20% of global CO2 emissions,1 as well as long-distance modes of transport, including aviation, road freight and maritime shipping. In these sectors, alternatives to fossil fuels are either prohibitively expensive, such as electricity to generate extreme heat, or impractical, such as electric-powered aircraft or tankers.

In practice, some sectors will simply not be able to achieve net-zero emissions without CCUS. Cement production is a prime example: it generates significant process emissions, as it involves heating limestone (calcium carbonate) to break it down into calcium oxide and CO2. These process emissions – which are not associated with fossil fuel use – account for around two-thirds of the 2.4 Gt of emissions from global cement production and more than 4% of all energy sector emissions. With no demonstrated alternative way of producing cement, capturing and permanently storing these CO2 emissions is effectively the only option.

In other sectors, CCUS is one of few available technologies that can yield significant emissions reductions. In the iron and steel sector, production routes based on CCUS are currently the most advanced and least-cost low-carbon options for the production of virgin steel2 which accounts for around 70% of global steel production. In chemicals, CCUS is often the cheapest option for reducing emissions from the production of fertiliser (ammonia) and methanol.

CCUS is also the only solution to address CO2 emissions from natural gas processing, which is important given the continued use of natural gas across the energy system over the next decades (IEA, 2020a). Natural gas deposits can contain large amounts of CO2 – even up to 90% – which, for technical reasons, must be removed before the gas is sold or processed for liquefied natural gas (LNG) production. This CO2 is typically vented to the atmosphere but can instead be reinjected into geological formations or used for EOR.

CCUS is also among a limited number of options that can decarbonise long-distance transport, including aviation. A supply of CO2 is needed to produce synthetic hydrocarbon fuels, which alongside biofuels are the only practical alternative to fossil fuels for long-haul flights due to energy density requirements. Limitations on the availability of sustainable biomass mean that these synthetic fuels will be needed for net-zero emissions; the CO2 would need to come from bioenergy production or the air to be carbon-neutral.

A platform for low-carbon hydrogen production

Hydrogen is a versatile energy carrier that can support the decarbonisation of a range of sectors, including transport, industry, power and buildings (IEA, 2019a). CCUS can facilitate the production of clean hydrogen from natural gas or coal, which are the sources of practically all hydrogen production today, and provide an opportunity to bring low-carbon hydrogen into new markets in the near term at least cost.

Today, the cost of CCUS-equipped hydrogen production can be around half that of producing hydrogen through electrolysis powered by renewables-based electricity (which splits water into hydrogen and oxygen). The costs of electrolytic hydrogen will certainly decline over time, with cheaper electrolysers and renewable electricity, but CCUS-equipped hydrogen will most likely remain a competitive option in regions with low-cost fossil fuels and CO2 storage resources. CCUS also offers an opportunity to address emissions from existing hydrogen production that almost exclusively relies on natural gas and coal and is associated with more than 800 MtCO2 each year.

Removing carbon from the atmosphere

Meeting international climate goals, including net-zero emissions, will almost certainly require some form of carbon removal. There are multiple approaches to removing carbon from the atmosphere, including nature-based solutions such as afforestation and reforestation or enhanced natural processes such as the addition of biochar (charcoal produced from biomass) to soils. Technology-based carbon removal solutions are underpinned by CCUS, namely BECCS and DACS.

The role for carbon removal in meeting ambitious climate goals was emphasised by the Intergovernmental Panel on Climate Change (IPCC) in its Special Report on 1.5°C. Out of 90 scenarios considered by the IPCC, 88 assumed some level of net-negative emissions to limit future temperature increases to 1.5°C (IEA, 2019b). Carbon removal can neutralise or offset emissions where direct mitigation is currently technically challenging or prohibitively expensive, such as some industrial processes and long-distance transport. Carbon removal is also a hedge – although not a substitute – against the risk of slower-than-expected innovation or commercialisation of other technologies. BECCS and DACS are an energy sector contribution to carbon removal and, if successfully deployed, can also mitigate slower progress in emissions reductions outside the energy sector. Unlike BECCS, DACS is not limited by the availability of sustainable biomass but rather the availability of low-cost energy.

CCUS deployment today

Today, there are 21 CCUS facilities around the world with capacity to capture up to 40 MtCO2 each year.3 Some of these facilities have been operating since the 1970s and 1980s, when natural gas processing plants in the Val Verde area of Texas began capturing CO2 and supplying it to local oil producers for EOR operations.4

Since these early projects, CCUS deployment has expanded to more regions and more applications. The first large-scale CO2 capture and injection project with dedicated CO2 storage and monitoring was commissioned at the Sleipner offshore gas field in Norway in 1996, which has now stored more than 20 MtCO2 in a deep saline aquifer. For technical and commercial reasons, the CO2 needs to be removed from the gas before it can be sold; a CO2 tax on offshore oil and gas activities introduced by the Norwegian government in 1991 made the project commercially viable (IEA, 2016).

Large-scale commercial CCUS projects in operation in 2020

|

Country |

Project |

Operation date |

Source of CO2 |

CO2 capture capacity (Mt/year) |

Primary storage type |

|---|---|---|---|---|---|

|

United States (US) |

Terrell natural gas plants (formerly Val Verde) |

1972 |

Natural gas processing |

0.5 |

EOR |

|

US |

Enid fertiliser |

1982 |

Fertiliser production |

0.7 |

EOR |

|

US |

Shute Creek gas processing facility |

1986 |

Natural gas processing |

7.0 |

EOR |

|

Norway |

Sleipner CO2 storage project |

1996 |

Natural gas processing |

1.0 |

Dedicated |

|

US/Canada |

Great Plains Synfuels (Weyburn/Midale) |

2000 |

Synthetic natural gas |

3.0 |

EOR |

|

Norway |

Snohvit CO2 storage project |

2008 |

Natural gas processing |

0.7 |

Dedicated |

|

US |

Century plant |

2010 |

Natural gas processing |

8.4 |

EOR |

|

US |

Air Products steam methane reformer |

2013 |

Hydrogen production |

1.0 |

EOR |

|

US |

Lost Cabin Gas Plant |

2013 |

Natural gas processing |

0.9 |

EOR |

|

US |

Coffeyville Gasification |

2013 |

Fertiliser production |

1.0 |

EOR |

|

Brazil |

Petrobras Santos Basin pre-salt oilfield CCS |

2013 |

Natural gas processing |

3.0 |

EOR |

|

Canada |

Boundary Dam CCS |

2014 |

Power generation (coal) |

1.0 |

EOR |

|

Saudi Arabia |

Uthmaniyah CO2-EOR demonstration |

2015 |

Natural gas processing |

0.8 |

EOR |

|

Canada |

Quest |

2015 |

Hydrogen production |

1.0 |

Dedicated |

|

United Arab Emirates |

Abu Dhabi CCS |

2016 |

Iron and steel production |

0.8 |

EOR |

|

US |

Petra Nova |

2017 |

Power generation (coal) |

1.4 |

EOR |

|

US |

Illinois Industrial |

2017 |

Ethanol production |

1.0 |

Dedicated |

|

China |

Jilin oilfield CO2-EOR |

2018 |

Natural gas processing |

0.6 |

EOR |

|

Australia |

Gorgon Carbon Dioxide Injection |

2019 |

Natural gas processing |

3.4-4.0 |

Dedicated |

|

Canada |

Alberta Carbon Trunk Line (ACTL) with Agrium CO2 stream |

2020 |

Fertiliser production |

0.3-0.6 |

EOR |

|

Canada |

ACTL with North West Sturgeon Refinery CO2 stream |

2020 |

Hydrogen production |

1.2-1.4 |

EOR |

Note: Large-scale is defined as involving the capture of at least 0.8 Mt/year of CO2 for a coal-based power plant and 0.4 Mt/year for other emissions-intensive industrial facilities (including natural gas-based power generation). Source: GCCSI (2019), The Global Status of CCS 2019: Targeting Climate Change.

The deployment of carbon capture to date has been concentrated in the United States, which is home to almost half of all operating facilities. This is due in large part to the availability of an extensive CO2 pipeline network and demand for CO2 for EOR, as well as public funding programmes, including those introduced after the global financial crisis of 2008‑09. In the last decade, CCUS facilities have been commissioned in Australia, Brazil, Canada, China, Saudi Arabia and the United Arab Emirates.

Many of the early CCUS projects focused on industrial applications where CO2 can be captured at relatively low additional cost, from around USD 15/tCO2. For example, in natural gas processing, any CO2 contained in the gas usually needs to be separated out to meet market requirements or prior to liquefaction for LNG production to avoid the CO2 freezing and damaging the production facilities. In other applications, such as bioethanol production (the Illinois Industrial project in the United States) or steam methane reformers to produce hydrogen (such as Quest in Canada), the CO2 stream is relatively concentrated, which reduces the cost and the amount of energy required in the capture process. Until the 2000s, virtually all the CO2 captured globally at large-scale facilities came from gas processing plants, but other sources now make up about one-third of the total5.

CCUS facilities in operation by application, 1980-2021

OpenCCUS deployment tripled over the last decade, albeit from a low base – but it has fallen well short of expectations. In 2009, the IEA roadmap for CCUS set a target of developing 100 large-scale CCUS projects between 2010 and 2020 to meet global climate goals, storing around 300 MtCO2 per year (IEA, 2009). Actual capacity is only around 40 Mt – just 13% of the target.

Investment in CCUS has also fallen well behind that of other clean energy technologies. Annual investment in CCUS has consistently accounted for less than 0.5% of global investment in clean energy and efficiency technologies (IEA, 2020b). Since 2010, around USD 15 billion in capital has been invested in the 15 large-scale CCUS projects that have been commissioned as well as the Kemper County CCUS facility, which was abandoned in 2017 (IEA, 2017). The investment in these facilities was supported by around USD 2.8 billion in public grant funding6.

There are several reasons CCUS has not advanced as fast as needed; many planned projects have not progressed due to commercial considerations and a lack of consistent policy support. In the absence of an incentive or emissions penalty, CCUS may simply not make any commercial sense, especially where the CO2 has no significant value as an industrial input. The high cost of installing the infrastructure and difficulties in integrating the different elements of the CO2 supply chain, technical risks associated with installing or scaling up CCUS facilities in some applications, difficulties in allocating commercial risk among project partners, and problems securing financing have also impeded investment. Public resistance to storage, particularly onshore storage, has also played a role in some cases, notably in Europe. CCUS is also often viewed as a fossil fuel technology that competes with renewable energy for public and private investment, although in practice it has substantial synergies with renewables.

Growing CCUS momentum

CCUS may not be a new technology or concept, but it has been the subject of renewed global interest and attention in recent years, holding out the promise of a rapid scaling-up of investment, wider deployment and accelerated innovation. The pipeline of new CCUS projects has been growing, underpinned by strengthened national climate targets and new policy incentives. CCUS costs have been declining, new business models that can improve the financial viability of CCUS have emerged, and technologies associated with CO2 use and carbon removal are advancing and attracting interest from policy makers and investors.

After years of a declining investment pipeline, plans for more than 30 new integrated CCUS facilities have been announced since 2017. The vast majority are in the United States and Europe, but projects are also planned in Australia, China, Korea, the Middle East and New Zealand. If all these projects were to proceed, the amount of global CO2 capture capacity would more than triple, to around 130 Mt/year. The 16 projects at advanced stages of planning, including several facing a final investment decision (FID) within the next 12 months, represent a total estimated investment of more than USD 27 billion. This is almost double the investment in projects commissioned since 2010 and around 2.5 times the planned investment in projects at a similar stage of development in 2017.

World large-scale CCUS facilities operating and in development, 2010-2020

OpenAlthough some projects might fall by the wayside, the new investment plans for CCUS, if realised, will push the technology further along the learning curve, contribute to infrastructure development and further reduce unit costs. Importantly, several of the planned projects go beyond the “low-hanging fruit” opportunities associated with natural gas processing to include less developed applications, including coal- and gas-fired power generation and cement production. There is also less reliance on EOR, which has been a major driver of CCUS investment to date (16 of the 21 capture facilities in operation sell or use the CO2 for EOR). Less than half of the planned facilities are linked to EOR, with a shift towards dedicated CO2 storage options. Almost one-third of planned projects involve the development of industrial CCUS hubs with shared CO2 transport and storage infrastructure.

Large-scale CCUS projects in development worldwide by application and storage type

OpenThe large-scale deployment of CCUS provides an important indicator of the state of technology development, but does not convey the entire CCUS story. In addition to major commercial projects, there are a large number of pilot and demonstration-scale CCUS facilities operating around the world, as well as numerous CCUS technology test centres (GCCSI, 2020). There are also a growing number of facilities making use of CO2.

What is driving renewed momentum?

Strengthened climate commitments

The more stringent climate targets triggered by the greater ambition of the 2015 Paris Agreement and the 2018 IPCC Special Report on 1.5°C have spurred greater interest in mitigation options that go beyond renewables or power generation, including CCUS. There is also increased focus on technology opportunities to reduce emissions where they are hard to abate, given the need to fully decarbonise the entire energy sector to reach net zero.

An increasing number of countries and organisations have adopted net-zero emissions targets, drawing attention to the need for CCUS. By August 2020, 14 countries and the European Union (EU) – representing around 10% of energy-related global CO2 emissions – had adopted formal net-zero emissions targets in national law or proposed legislation to that effect, with a target date of 2045, 2050 or beyond (IEA, 2020a). Similar targets are under discussion in about 100 other countries.

CCUS also features in the mid‑century climate strategies that parties to the Paris Agreement are invited to submit this year. Of the 16 country strategies submitted by August 2020, nine referenced a role for CCUS: Canada, France, Germany, Japan, Mexico, Portugal, Singapore, the United Kingdom (UK) and the United States (UNFCCC, 2020). Together, these countries account for 96% of the total energy-related CO2 emissions of those countries that have submitted mid‑century strategies.

A growing number of corporations across a range of industry sectors, including oil and gas, power generation, manufacturing, transport, and technology services, are also adopting net-zero emissions targets (IEA, 2020a). The level of detail and approach to meeting these commitments varies, including in the coverage of emissions across the value chain.7 More than 20% of global oil and gas production is covered by 2050 net-zero commitments, with CCUS expected to play a role in every case. Companies such as Dalmia Cement and Heidelberg Cement in the cement sector and ArcelorMittal in steel are actively pursuing CCUS to meet their goals.

Carbon removal approaches are to the fore in meeting commitments in other sectors, notably aviation. To date, all airline companies that have adopted net-zero goals have identified the need for offsets from other sectors, primarily relying on nature-based solutions such as reforestation (IEA, 2020a). Microsoft announced in January 2020 that it aims to become carbon negative by 2030, and by 2050 it plans to have removed from the atmosphere all the carbon that it has emitted since it was founded in 1975 (Microsoft, 2020). This would be achieved through a portfolio of solutions, potentially including afforestation and reforestation, soil carbon sequestration, BECCS, and DACS. Microsoft is establishing a USD 1 billion climate innovation fund to accelerate the global development of carbon reduction, capture and removal technologies.

Share of activity covered by corporate carbon-neutral targets in select sectors, with an identified role for CCUS

OpenImproved investment environment

The growing pipeline of CCUS facilities also reflects a considerably improved investment environment, underpinned by new policy incentives.8 In the United States, the expansion of the 45Q tax credit alongside complementary policies – such as the California Low Carbon Fuel Standard (LCFS) – has spurred a large number of new investment plans. The expanded tax credit, introduced in 2018, provides a credit of USD 50/t for CO2 that is permanently stored and USD 35/t for CO2 used in EOR or other beneficial uses, for 12 years from the commencement of operation of the project.

In Europe, the EU Innovation Fund for demonstrating innovative low-carbon technologies and funded by revenues from the Emissions Trading System (ETS) – valued at EUR 10 billion at current CO2 prices – will be able to support CCUS projects among other clean energy technologies from 2020 (European Commission, 2020). Norway is also funding the development of a full-chain CCUS project – Longship – , involving CO2 capture at a cement factory and a waste-to-energy plant and its storage in a large facility in the North Sea – Northern Lights – being developed by a consortium of oil and gas companies. The Netherlands is expanding its SDE+ support scheme to a wider set of clean energy technologies, including CCUS and low-carbon hydrogen (SDE++). The UK government has also announced significant public funding for new CCUS projects.

Deployment strategies that shift the focus from large, stand-alone CCUS facilities to the development of industrial “hubs” with shared CO2 transport and storage infrastructure are also opening up new investment opportunities. This approach can improve the economics of CCUS by reducing unit costs through economies of scale as well as reducing commercial risk and financing costs by separating out the capture, transport and storage components of the CCUS chain. The development of shared infrastructure can also be a major trigger for new investments. For example, the development of the Northern Lights CO2 storage project – the central component of Norway’s Longship project – is linked to the potential development of at least nine capture facilities across Europe, including four cement factories and a steel plant (Northern Lights PCI, 2020). Plans to equip these facilities with CO2 capture would probably not have materialised in the absence of a potential CO2 storage solution.

The role of hubs in accelerating deployment of CCUS

The development of CCUS hubs – industrial centres with shared CO2 transport and storage infrastructure – could play a critical role in accelerating the deployment of CCUS. Efforts to develop CCUS hubs have commenced in at least 12 locations around the world. These hubs have an initial CO2 capture capacity of around 25 Mt/year, but could be expanded to more than 50 Mt/year. A major legal barrier to the development of CCUS was resolved in 2019 when Norway and the Netherlands secured an amendment to the London Protocol to permit cross-border transportation of CO2.

The principal benefit of a “hub” approach to CCUS deployment is the possibility of sharing CO2 transport and storage infrastructure. This can support economies of scale and reduce unit costs, including through greater efficiencies and reduced duplication in the infrastructure planning and development phases. The initial oversizing of infrastructure increases the capital cost of the project and so can make it harder to raise financing, but it can reduce unit transport and storage costs substantially in the longer term. For example, the Zero Emissions Platform estimates that the cost of transporting CO2 through a 180 km onshore pipeline in Europe would equate to around EUR 5.4/t with a capacity of 2.5 Mt/year of CO2 – 70% higher than the cost of EUR 1.5/t for the same length pipeline but with a capacity of 20 Mt/year (ZEP, 2011). For an average cement plant capturing around 0.5 Mt/year of CO2, this would represent an annual cost saving of almost EUR 2 million.

Developing CCUS hubs with shared infrastructure can also make it feasible to capture CO2 at smaller industrial facilities, for which dedicated CO2 transport and storage infrastructure may be both impractical and uneconomic. It can allow continued operation of existing infrastructure and supply chains in industrial regions, maintaining employment and making it easier to attract new investment, including in energy-intensive industries or low-carbon hydrogen production, while respecting emissions reduction targets.

Government leadership and co‑ordination are vitally important to the early development of CCUS hubs in most regions, notably in supporting or underwriting investment in new CO2 transport and storage infrastructure. This can help to overcome the initial “chicken and egg” problem with CCUS – there is no point in capturing the CO2 if there is nowhere to store it and there is no point in developing storage if there is no CO2. In Canada, the Alberta Carbon Trunk Line (ACTL), which came online in June 2020, is an example of strong government support for CO2 transport infrastructure to enable the future expansion of CCUS. The 240 km pipeline has been oversized with almost 90% of its capacity available to accommodate future CO2 sources (ACTL, 2020).

Technological advances

Experience with building and operating CCUS facilities has contributed to progressive improvements in CCUS technologies as well as significant cost reductions. At around USD 65/t of CO2, the cost of capture at the Petra Nova coal-fired power plant in Houston (commissioned in 2017) is more than 30% lower than the Boundary Dam facility in Canada – the only other commercial coal plant with capture facilities – which started operations in 2014. Detailed engineering studies show that retrofitting a coal-fired power plant today could cost around USD 45/t (International CCS Knowledge Centre, 2018). There are now plans to retrofit as many as ten coal power plants with capture equipment (in China, Korea and the United States). With further research, development and demonstration (RD&D) and growing practical experience, there is considerable potential to further reduce energy needs and cost .

New technologies and ways for using or recycling CO2 other than EOR, such as to produce synthetic fuels or building materials, are emerging, potentially boosting demand for CO2. The growing interest in these technologies is reflected in increasing support from governments, industry and investors, with global private funding for CO2 use start-ups reaching nearly USD 1 billion over the last decade (IEA, 2019c). Several governments and agencies have been supporting innovation related to CO2 conversion technologies. For example, in June 2019, Japan released a Carbon Recycling Roadmap highlighting opportunities to commercialise CO2 use technologies over the next decade (METI, 2019). Additionally, several prize initiatives have been held with the aim of promoting the development of CO2 conversion technologies, awarding a prize to the most innovative CO2 use applications. A notable example is the NRG COSIA Carbon XPrize (NRG COSIA XPRIZE, 2019).

DAC technologies are also making significant progress and attracting investment from a range of stakeholders. Since 2019, around USD 180 million in private investment has been raised by leading developers alongside more than USD 170 million in public funding for research and development. A number of small-scale DAC facilities are operating commercially today, and a planned large-scale facility in the United States, with capacity to capture 1 MtCO2 per year, could be operational by the mid-2020s.

Will the Covid-19 crisis derail momentum?

The response to the Covid-19 crisis has driven the world into a deep recession, which will almost certainly affect investment plans for CCUS. The slump in economic activity is likely to curb interest in new CCUS projects, at least in the near term, but this could be partially or wholly offset by fresh government incentives for CCUS and other clean energy technologies as part of economic recovery programmes currently under development.

With the global economy set to shrink by several percentage points in 2020 and gross domestic product (GDP) expected to contract in nearly every country, investment in clean energy technologies could plunge by as much as 20% (IEA, 2020b). This has prompted governments around the world to draw up plans to invest massively to stimulate economic recovery. The IEA has called for governments to put clean energy at the heart of stimulus packages and, in July 2020, released the Sustainable Recovery Plan – a set of actions that can be taken over the next three years to promote economic growth through investment in clean energy. The IEA estimates that implementing this plan could boost global economic growth by 1.1% per year and save or create 9 million jobs while avoiding a rebound in emissions (IEA, 2020c).

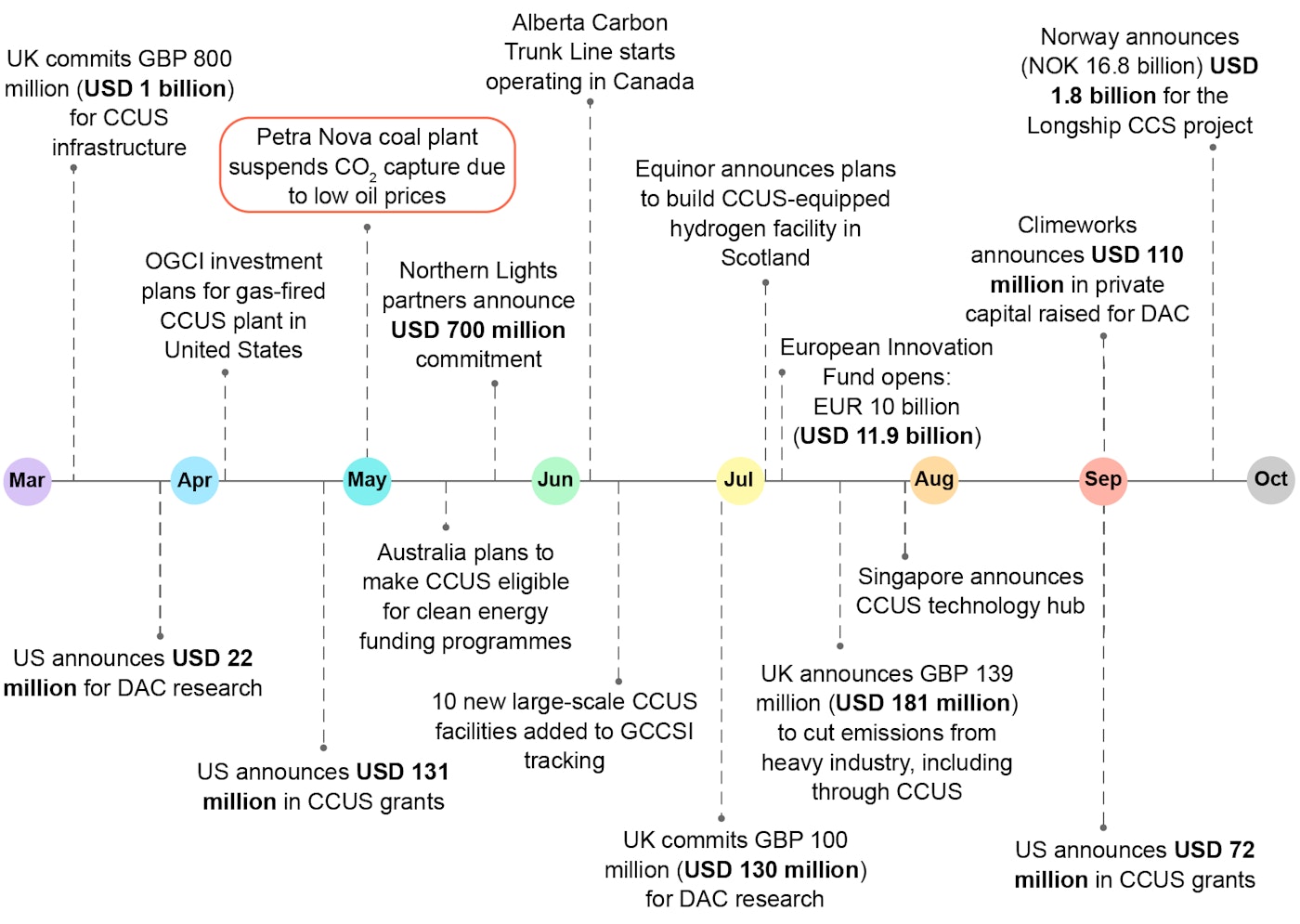

CCUS developments in 2020

Despite the economic and investment uncertainty created by the Covid-19 crisis, the prospects for CCUS have been boosted by a number of new funding announcements and project developments since the beginning of 2020. In March, the UK government confirmed its pledge to invest GBP 800 million (USD 995 million) in CCUS infrastructure, involving establishing CCUS in at least two industrial locations and equipping a gas-fired power plant with CCUS. In July, it announced additional investment of GBP 139 million (USD 178 million) to cut emissions from heavy industry, including through CCUS. In April, the US government awarded USD 85 million in grants and announced a further USD 46 million in new grants for CCUS development and deployment, followed by an additional USD 72 million in funding in September (DOE, 2020a, 2020b). In May, the Australian government announced plans to make CCUS eligible for existing funding programmes for clean technologies, including via the Clean Energy Finance Corporation’s AUD 10 billion (USD 7.1 million) investment fund (Australian Government, 2020). In September 2020, the Norwegian government announced it would provide NOK 16.8 billion (USD 1.8 billion) in funding for the Longship CCS project (formerly called the “Full-Scale CCS Project), including ten years of operating support. The total cost of the Longship project is estimated at NOK 25.1 billion (USD 2.7 billion).

Timeline of CCUS developments, March-September 2020

Open

The private sector has also announced several new CCUS investments. In April 2020, the Oil and Gas Climate Initiative (OGCI) – a group of 13 international oil and gas companies – announced it would invest in equipping a natural gas power plant in the United States with CCUS (OGCI, 2020). A month later, Equinor, Shell and Total announced plans to invest more than USD 700 million in the Northern Lights offshore CO2 storage project, subject to government support (Equinor, 2020a). In July, Equinor announced it would lead a project – H2H Saltend – to produce hydrogen from natural gas with CCUS in the Humber region of the United Kingdom (Equinor, 2020b).

Spending on DAC research has also expanded since the start of 2020. In March, the US Department of Energy announced USD 22 million in funding for DAC. In June, the UK government allocated GBP 100 million (USD 128 million) to the technology. In addition, Climeworks – one of the leading DAC technology developers – announced in September 2020 that it had raised 100 million Swiss francs (USD 110 million), the largest private investment for DAC (Climeworks, 2020).

The impact of the economic downturn and lower oil prices

Notwithstanding these positive developments in 2020, CCUS investments will almost certainly be vulnerable to delays and cancellations due to the global economic downturn. In particular, oil and gas companies, which are involved in more than half of planned CCUS projects, have announced significant capital spending cuts for 2020.

In the United States, the attractiveness of the 45Q tax credit – a major driver of new investments – is likely to diminish as profits slump and corporate tax liabilities fall. Any delays to projects would also have a significant impact on their eligibility for credits, as facilities must be in construction before 1 January 2024 to qualify under current arrangements. Projects unable to meet this deadline are far less likely to proceed.

Another important consideration is the impact of low oil prices on the demand and price for CO2 used in EOR. Two-thirds of operating CCUS facilities rely on revenue from sales of CO2 for EOR, and more than one-third of planned projects are linked to EOR (GCCSI, 2020). The price paid for CO2 for EOR is typically indexed to the oil price in commercial contracts, so the recent slump in oil demand and prices will have substantially reduced revenues for CCUS facilities.

Low oil prices led NRG, the operator of the Petra Nova coal-fired power plant in Texas, to suspend CO2 capture operations at the plant in May 2020. The plant has a CO2 capture capacity of 1.4 Mt/year, with the CO2 transported by a 132 km pipeline to the West Ranch oilfield southwest of Houston for EOR. According to NRG, crude oil prices in excess of USD 60/bbl to USD 65/bbl are required to cover the operating costs of the capture facilities, while the price of West Texas Intermediate has averaged less than USD 40/barrel between January and August 2020 and USD 17/barrel in April (NRG, 2020a). Petra Nova is the only CCUS facility in the United States capturing CO2 from a relatively dilute source, which is associated with higher capture costs.9 This highlights the risks of business models linked to EOR revenue – especially for these higher-cost CCUS applications. NRG has stated that it will bring the facility back online “when economic conditions improve” (NRG, 2020b).

An extended period of low oil prices and demand would undoubtedly undermine planned investment in CCUS projects linked to EOR. The risk of project delays or cancellations is generally higher for CCUS projects at early stages of development, or in regions where the use of CO2 for EOR is still relatively limited and where expansions require significant new injections of capital for EOR infrastructure.

In the United States, demand for CO2 for EOR may be more resilient. Around 80 MtCO2 is used for EOR today, with around 70% of this extracted from declining natural CO2 deposits. An increase in the availability of CO2 captured from power or industrial CCUS facilities could displace the use of this naturally occurring CO2, without requiring an expansion in demand or significant new EOR infrastructure. Further, the availability of the 45Q tax credits could act as a commercial buffer during periods of low CO2 prices. However, capture projects may opt for dedicated geological storage, which attracts a higher tax credit, as a more financially attractive and stable alternative, especially if oil prices remain low for a long time.

CCUS in economic recovery plans

The inclusion of CCUS in economic recovery plans and programmes could help ensure that the Covid-related economic downturn does not derail recent progress in deploying the technology. A collective push by all stakeholders is needed to exploit recent progress and drive a major leap forward in deployment. Governments have a key role to play in incentivising investment, as well as co‑ordinating and underwriting new transport and storage infrastructure. The development of economic stimulus packages presents a critical window of opportunity for governments to support investment in a technology that will be needed to meet their climate goals. The IEA Sustainable Recovery Plan identified boosting innovation in CCUS and other crucial technologies, including hydrogen, batteries and small modular nuclear reactors, as one of six key objectives for economic stimulus packages.

CCUS is in a stronger position to contribute to sustainable economic recovery plans than after the global financial crisis in 2008‑09. A decade of experience in developing projects and the recent uptick in activity means that there are a number of advanced “shovel-ready” projects with potential to double CCUS deployment and create thousands of jobs worldwide by 2025. As discussed above, the pipeline of at least 16 advanced projects could represent a potential investment of more than USD 27 billion and an additional 50 Mt/year of CO2 capture capacity. For several of these projects, a FID is imminent, and construction could begin as early as 2021. These projects are well aligned with government goals of boosting economic activity in the near term while providing the foundation to meet long-term energy and climate goals. However, almost all will rely on some form of government support to overcome the commercial barriers associated with early deployment.

Economic stimulus funding for CCUS after the global financial crisis of 2008-2009

Government efforts to boost the deployment of CCUS after the global financial crisis were met with relatively limited success. Initially, more than USD 8.5 billion was made available to support as many as 27 integrated projects around the world. This included funding through the American Recovery and Reinvestment Act 2009 and the European Energy Programme for Recovery, as well as measures in Australia, Canada and the United Kingdom. Ultimately, however, less than 30% of this funding was spent, and only five projects are today operating as a direct result of these stimulus measures, all of them in North America.##anchor10##

A number of factors explain this lack of success, including the relatively limited experience in CCUS deployment at the time as well as the way the programmes were designed:

- Many projects were not sufficiently advanced to be able to meet near-term stimulus spending milestones. It can take several years to plan and build CCUS facilities, particularly for newer applications (such as power generation or in heavy industry). For example, the US government aimed to spend USD 1 billion in grants on the FutureGen project in less than five years under the American Recovery and Reinvestment Act, but it took almost four years to obtain the approvals for what was the country’s very first CO2 injection permit for dedicated storage (Congressional Research Service, 2016).

- The focus of policy makers in many regions, including Europe, was on coal-fired power, which is an important but also a more expensive and complex application for CCUS. Where industrial facilities with high-concentration CO2 streams (and therefore lower-cost capture) were targeted, stimulus measures met with greater success.

- Support was generally limited to capital grants for one-off projects rather than establishing a framework for broader investment. In some cases, the absence of measures to address the higher operating costs for CCUS facilities, for example through feed-in tariffs or tax credits, was cited as a reason for cancelling projects.

Despite these difficulties, the five stimulus projects that did go ahead have made an important contribution to CCUS technology development and cost reductions. Collectively, they have captured more than 15 MtCO2 to August 2020. The developers of Petra Nova (coal-fired power) and Quest (hydrogen) claim that capital costs would be around 30% lower if they were to rebuild these facilities today.

A number of planned projects could benefit quickly from economic stimulus packages, bringing major economic, social and environmental benefits. In Europe, the Norway Longship CCS project (including Northern Lights) is expected to generate as many as 4 000 jobs during the investment and construction phase, and 170 permanent jobs (Northern Lights PCI, 2020). In July, the European Free Trade Association (EFTA) Surveillance Authority cleared the way for the Norwegian government’s support for the project under EU market rules, recognising it as “a ground-breaking step towards tackling climate change” (ESA, 2020).

A number of advanced CCUS projects are based on the development of industrial hubs, benefiting from economies of scale and reducing integration risk through shared CO2 transport and storage infrastructure. This includes the Port of Rotterdam (Porthos) project in the Netherlands, the Net Zero Teesside project in the United Kingdom, the Carbon Storage Assurance Facility Enterprise (CarbonSAFE) Integrated Midcontinent Stacked Carbon Storage Hub in the United States, and CarbonNet in Australia. Several of these CCUS hubs involve the production of low-carbon hydrogen.

The employment benefits of encouraging these projects – a major objective of stimulus packages – could be significant. At least 1 200 direct construction jobs could be created at each new large-scale capture facility, rising to 4 000 or more depending on location, application and size. CCUS investments would also secure existing jobs and minimise social and economic disruption by enabling the continued operation of power and industrial facilities under tighter emissions constraints. For example, the developers of the Net Zero Teesside industrial hub claim that CCUS infrastructure could safeguard between 35% and 70% of existing manufacturing jobs in the region (Net Zero Teesside, 2020).

Many of the job opportunities that will arise in the CCUS sector will also be able to make use of the subsurface skills and experience of personnel in the oil and gas sector, which has seen thousands of job losses already in 2020. These opportunities include the near-term employment needs associated with CO2 storage exploration, as well as the more intensive phase of characterisation and development of new storage facilities.

References

Including industrial process emissions. Heavy industry encompasses cement, steel and chemicals production.

Steel that is not made from recycled material.

One facility, the Petra Nova coal-fired power generation plant in the United States, has temporarily suspended CO2 capture operations in response to low oil prices.

CO2-EOR is a proven technology for rejuvenating the production of oil at mature oilfields but can also provide a means of storing CO2 permanently, as much of the gas injected is ultimately retained in the reservoir over the life of the project. For a CO2-EOR/CCUS project to be considered a genuine climate mitigation measure, the CO2 has to come from an anthropogenic source, such as a power station or natural gas processing plant. In practice, about 70% of the CO2 used in United States EOR projects today comes from naturally occurring underground reservoirs (not included here as CCUS). Several additional activities would also need to be undertaken before, during and following CO2 injection, including additional measurement, reporting and verification of stored volumes.

This includes CO2 capture at integrated CCUS facilities where the CO2 is capture and used in EOR or permanently stored. It does not include CO2 generated in ammonia production and used on-site to manufacture urea (as this use of CO2 is not associated with a climate benefit).

An estimated USD 6.2 billion was invested in developing a new integrated gas combined cycle technology at the Kemper County CCUS facility, which was abandoned in 2017 after significant cost overruns.

For example, some companies include the use of the commodity or product being sold while others include only the company’s operations.

See " Accelerating deployment" for a discussion of existing and potential policy measures for CCUS.

The other nine large-scale CCUS facilities in the United States capture CO2 from more concentrated sources; see "CCUS technology innovation" for discussion on the impact of this on costs.

Including industrial process emissions. Heavy industry encompasses cement, steel and chemicals production.

Steel that is not made from recycled material.

One facility, the Petra Nova coal-fired power generation plant in the United States, has temporarily suspended CO2 capture operations in response to low oil prices.

CO2-EOR is a proven technology for rejuvenating the production of oil at mature oilfields but can also provide a means of storing CO2 permanently, as much of the gas injected is ultimately retained in the reservoir over the life of the project. For a CO2-EOR/CCUS project to be considered a genuine climate mitigation measure, the CO2 has to come from an anthropogenic source, such as a power station or natural gas processing plant. In practice, about 70% of the CO2 used in United States EOR projects today comes from naturally occurring underground reservoirs (not included here as CCUS). Several additional activities would also need to be undertaken before, during and following CO2 injection, including additional measurement, reporting and verification of stored volumes.

This includes CO2 capture at integrated CCUS facilities where the CO2 is capture and used in EOR or permanently stored. It does not include CO2 generated in ammonia production and used on-site to manufacture urea (as this use of CO2 is not associated with a climate benefit).

An estimated USD 6.2 billion was invested in developing a new integrated gas combined cycle technology at the Kemper County CCUS facility, which was abandoned in 2017 after significant cost overruns.

For example, some companies include the use of the commodity or product being sold while others include only the company’s operations.

See " Accelerating deployment" for a discussion of existing and potential policy measures for CCUS.

The other nine large-scale CCUS facilities in the United States capture CO2 from more concentrated sources; see "CCUS technology innovation" for discussion on the impact of this on costs.