Tracking progress toward the Paris Agreement

Global Energy Transitions Stocktake

The latest IEA analysis tracking the global energy transition, covering technology, investment and people-centred progress toward the Paris Agreement

This year marks the finalisation of the first global stocktake of the Paris Agreement, which assesses the world’s collective progress against its climate goals. In support of that important effort, the IEA is bringing together all of its latest data and analysis on clean energy transitions in one place, making it freely accessible to citizens, governments, and industry.

Reaching net zero emissions requires a complete transformation of how we power our daily lives and the global economy. The IEA's Net Zero by 2050 Scenario lays out a narrow but achievable pathway to net zero emissions in the energy sector by mid-century – a trajectory consistent with limiting global temperature rise to 1.5oC. Following this pathway represents the world’s best chance of avoiding the worst effects of climate change, and requires accelerating the shift to non-emitting sources of energy, such as wind and solar; increasing energy efficiency; electrifying transport, industry and buildings; expanding the use of clean hydrogen and other low-emission fuels; and investing in emissions abating technologies, including negative emission technologies.

The IEA’s Global Energy Transitions Stocktake pulls together the latest data and analysis on the global clean energy transition, including energy sector greenhouse gas emissions, technology developments, energy sector financing, energy access and energy employment. Taken together, these indicators allow us to track global progress of the energy transition and provide an accurate and objective picture of where we are now, and the trajectories we are on.

This page, which will be regularly updated in the lead up to the UN's COP28 climate change conference, includes a calendar of all major report launches throughout the year, making it easy to follow the latest updates and find links to IEA’s publications and in-depth analysis. This series culminates in the release of a new Special Report on Climate which will explore viable pathways in the energy sector to 1.5oC.

Global tracking indicators

Clean energy sectors continues to fuel energy-related job growth worldwide

Total employment by sector, 2019-2023

OpenIn a complex global energy market the emergence of a new clean energy economy provides hope for the way forward

Much additional progress is still required to meet the objectives of the Net Zero Emissions by 2050 (NZE) Scenario which limits global warming to 1.5 °C. Alongside our main scenarios, we explore some key uncertainties that could affect future trends, including structural changes in China’s economy and the pace of global deployment of solar PV.

Annual investment in fossil fuels and clean energy, 2015-2023

OpenCurrent NDCs commit to an 8% decline in CO2 emissions by 2030 in the energy sector

The IEA Climate Pledges Explorer analyses NDCs from more than 190 countries to estimate energy sector CO2 emissions implied by their targets. The database also provides a complete repository of governments’ net zero pledges, including their legal status and target year.

Global CO2 emissions from fuel combustion implied by Nationally Determined Contributions and the Stated Policies Scenario, by 2030

OpenThe path to 1.5 ̊ C has narrowed, but clean energy growth is keeping it open

The case for transforming the global energy system in line with the 1.5 ̊C goal has never been stronger, with global CO2 emissions reaching a record 37 Gt in 2022. Already, solar PV installations and electric car sales are growing fast enough to meet the milestones from our 2021 Net Zero by 2050 report. Plus, innovation is providing new tools and lowering their cost.

But delivering net zero emissions will require larger, smarter and repurposed electricity networks; large quantities of low-emissions fuels; more nuclear power; and scaling up near zero emissions materials production. And, as part of an equitable pathway, almost all countries need to bring forward their targeted net zero dates.

By 2035, emissions need to decline by 80% in advanced economies and 60% in emerging market and developing economies compared with 2022 levels.

Momentum around low-emission hydrogen keeps growing, but progress is still hampered by cost challenges and uncertainty around demand

Greater efforts are particularly needed to stimulate demand for low-emission hydrogen, which still accounts for less than 1% of global hydrogen production and use, and will need to grow more than 100-fold by 2030 to meet the IEA’s Net Zero Emissions by 2050 Scenario.

Low emission hydrogen production by technology route and maturity based on announced projects and in the Net Zero Scenario, 2030

OpenProgress on electricity access has remained slow in 2023, hobbled by financial strains

Recent IEA data and analysis suggest that in 2023 progress on expanding has access has resumed but is still below pre-pandemic levels, with solar home systems playing a major role. This update comes in parallel with an update to all of IEA's latest data on Sustainable Development Goal 7: ensuring affordable, reliable, sustainable and modern energy to all.

Number of people without access to electricity by region, 2010-2023

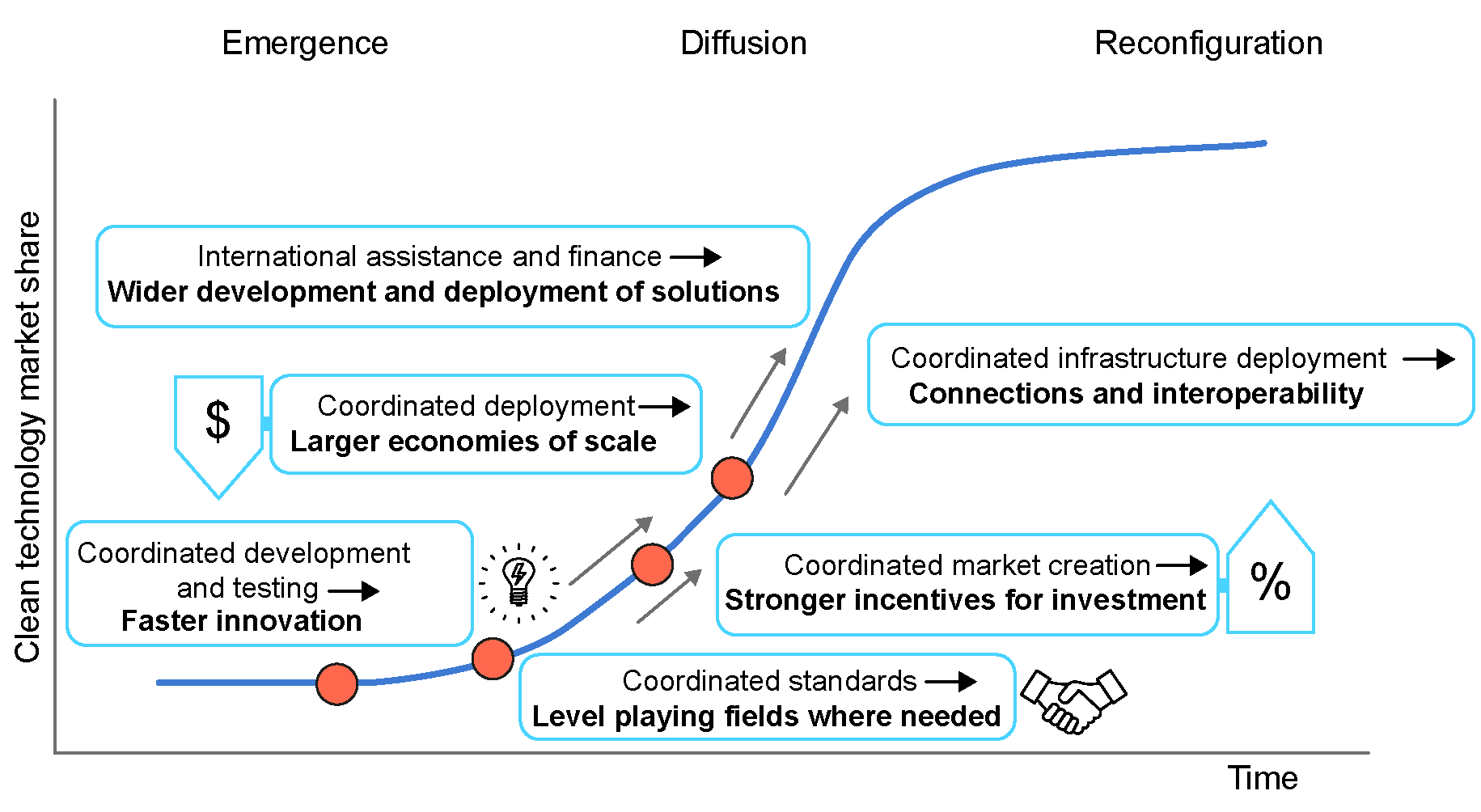

OpenStronger international cooperation in high emissions sectors crucial to get on track for 1.5C climate goal

The clean energy economy is gaining ground, but greater efforts are needed

Clean energy investment in emerging markets and developing countries needs to grow steeply to reach SDGs and climate goals

Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies

Clean energy investment in emerging and developing countries (excluding China) in the Net Zero Scenario, 2019-2035

OpenGovernments have allocated USD 1.34 trillion to clean energy since the pandemic

In addition, policymakers have spent a further USD 900 billion in efforts to protect households and businesses from rising energy bills since autumn 2021. Only about 25% of these short-term affordability measures were targeted toward households most in need of support or businesses most exposed to the effects of high energy prices. Without better targeting, new affordability measures will further contribute to rising levels of government debt.

Government spending for clean energy investment support and crisis-related short-term consumer energy affordability measures, Q2 2023

OpenClean energy investment reaches record high in 2022

Global energy investment in clean energy and in fossil fuels, 2015-2023

OpenRenewable capacity additions grew by 13% in 2022

Global additions of hydropower grew, owing to several large projects in Asia, while bioenergy production for power generation also declined due to the phaseout of subsidies in China, the world’s largest market. For geothermal and CSP technologies, global annual market growth remained small but stable.

Renewable electricity net annual capacity additions, 2017-2022

OpenPublic investment in energy-based research and development grew in 2022

Global public energy RD&D budget, 2015-2022

OpenClean energy supply chains expand substantially in 2022

Read the report: The State of Clean Technology Manufacturing

Announced project throughput and deployment for key clean energy technologies in the Net Zero Scenario, 2030

OpenEVs now close to 15% of global car market

A growing number of EV policies, such as the Inflation Reduction Act and new EU CO2 standards for cars and vans are driving the outlook for EV sales up, EV costs down, and and are leading to substantially less oil demand by the end of this decade. Around 500 models of electric cars were available to consumers in 2022, and supply chains continue to grow, especially for EV battery production, which is now responsible for 60% of global lithium demand, 30% of cobalt and 10% of nickel.

Global electric car stock, 2010-2022

OpenGlobal heat pump sales continue double-digit growth

Annual growth in sales of heat pumps in buildings worldwide and in selected markets, 2021 and 2022

OpenCO2 Emissions in 2022: Growth in emissions lower than feared

In a year marked by energy price shocks, rising inflation, and disruptions to traditional fuel trade flows, global growth in emissions was lower than feared, despite gas-to-coal switching in many countries. Increased deployment of clean energy technologies such as renewables, electric vehicles, and heat pumps helped prevent an additional 550 Mt in CO2 emissions.

Global CO2 emissions from energy combustion and industrial processes, 1900-2022

OpenMethane emissions remained stubbornly high in 2022

Global methane emissions from the energy sector, 2000-2022

OpenCCUS set to expand rapidly if all planned projects come online

Operational and planned carbon capture capacity by status, 2022-2030

OpenHalf the emission reductions needed to reach net zero come from technologies not yet on the market

Global CO2 emissions changes by technology maturity category in the Net Zero Scenario, 2050 compared to 2030

OpenCountry-level tracking indicators

Moving to sustainable energy systems is a global challenge that involves a multitude of decisions taken at national and local levels. Not every country starts from the same position, and not every country can or will seek the same solutions. That will depend on the structure of its economy, its legacy energy mix, and factors such as climate and geography.

Related analysis

-

The Role of Carbon Credits in Scaling Up Innovative Clean Energy Technologies

How high-quality carbon credits could accelerate the adoption of low-emissions hydrogen, sustainable aviation fuels and direct air capture

-

Renewables 2023

Analysis and forecasts to 2028

-

Navigating Indonesia’s Power System Decarbonisation with the Indonesia Just Energy Transition Partnership

-

A Policy Toolkit for Implementing LiFE

Lessons from G20 experiences

-

World Energy Outlook 2023

-

Tracking climate pledges: can the Global Stocktake be a landmark moment for energy sector ambition?

-

Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach

2023 Update

-

Global Hydrogen Review 2023