Cite report

IEA (2022), World Energy Employment, IEA, Paris https://www.iea.org/reports/world-energy-employment, Licence: CC BY 4.0

Report options

Overview

Introduction

Clean energy transitions and efforts to decarbonise energy are the prevailing trend reshaping global energy employment. Countries representing over 70% of global emissions today have committed to net zero emissions targets by mid-century, which will create millions of new clean energy jobs around the world. A paradigm shift in the energy workforce will require strategic foresight to train up the requisite workforce for deploying clean energy at scale as well as just transition policies that provide for employees negatively affected by these changes. The IEA’s seminal report, Net Zero by 2050: A Roadmap for the Global Energy Sector (NZE Scenario), projects that the energy transition will create 14 million new jobs related to clean energy technologies and require the shift of around 5 million workers away from fossil fuel sectors. In addition to these new roles, 16 million workers will require shift to work in clean energy segments, requiring additional skills and training.

However, this report also comes out amidst an energy crisis incurred by Russia’s invasion of Ukraine. This creates urgent imperatives for the energy sector, some of which are accelerating the switch off fossil fuels, and others which are focused on shoring up security of supply. Governments are working with the private sector to localise production and address global supply chain weaknesses, both within fossil fuels and key clean energy segments, including the minerals critical to their manufacture. This builds on the unprecedented USD 710 billion governments made available to clean energy in the wake of the Covid-19 pandemic in the name of sustainable recoveries.

Companies cannot respond to these market and policy signals without the skilled workforce needed to deliver these projects in the regions they are being developed. Shortages of skilled labour across energy supply chains are already translating into project delays and impacting investment decisions in some sectors, such as oil, gas, and offshore wind. While worldwide labour markets remain in flux since the start of the Covid-19 pandemic, energy has been among the fastest evolving industries globally in the last five years.

To navigate the evolutions in the workforce on the horizon, decision makers require better visibility into energy employment today. The World Energy Employment Report aims to deliver the most comprehensive assessment of the global energy labour market to date, and provide a foundational resource for policy makers, industry, jobseekers and students. Our analysis focuses on establishing a 2019 baseline, given the tumultuous last few years within the global labour market, but gives 2021 estimates where possible. It also provides an indication of how these labour demands may evolve in 2022. It covers all parts of the energy value chain, from fossil fuels to clean energy and key end-use sectors, and enumerates employment by subsector, by region, and by economic sector. The industry is facing a period of unparalleled change, but has numerous opportunities to expand economic growth, improve labour conditions, continue to cultivate a highly-skilled, inclusive workforce, and ensure people are at the centre of the clean energy transition.

Energy employs 65 million people worldwide and accounts for 2% of global employment, relatively evenly distributed across fuel supply, power sector, and end uses

Energy employment as a share of global employment and by energy sector, 2019

OpenThe energy sector employed around 41 million workers in 2019, with an additional 24 million working in energy end uses including vehicle manufacturing and efficiency

Over 65 million people were employed in the energy and related sectors in 2019, accounting for almost 2% of formal employment worldwide. Half of the energy workforce is employed in clean energy technologies.

Energy sector employment in 2019 is divided approximately into thirds among fuel supply (coal, oil, gas and bioenergy), the power sector (generation, transmission and distribution), and energy end uses (vehicles manufacturing and energy efficiency for buildings and industry).

In fuel supply, oil has the largest labour force, totalling almost 8 million. This is followed by 6.3 million in coal supply and 3.9 million in gas supply. In the power sector, generation employs around 11.3 million while transmission, distribution and storage combined account for approximately 8.5 million. In end uses, 13.6 million are employed in vehicle manufacturing, while another 10.9 million are employed in energy efficiency.

Roughly 65% of the energy sector workforce is connected to developing new energy infrastructure, while 35% are involved in operating and maintaining existing energy assets. Clean energy employment is rapidly growing alongside efforts to decarbonise energy systems—these sectors account for 50% of the global energy labour force today, and represent the highest employment creation potential.

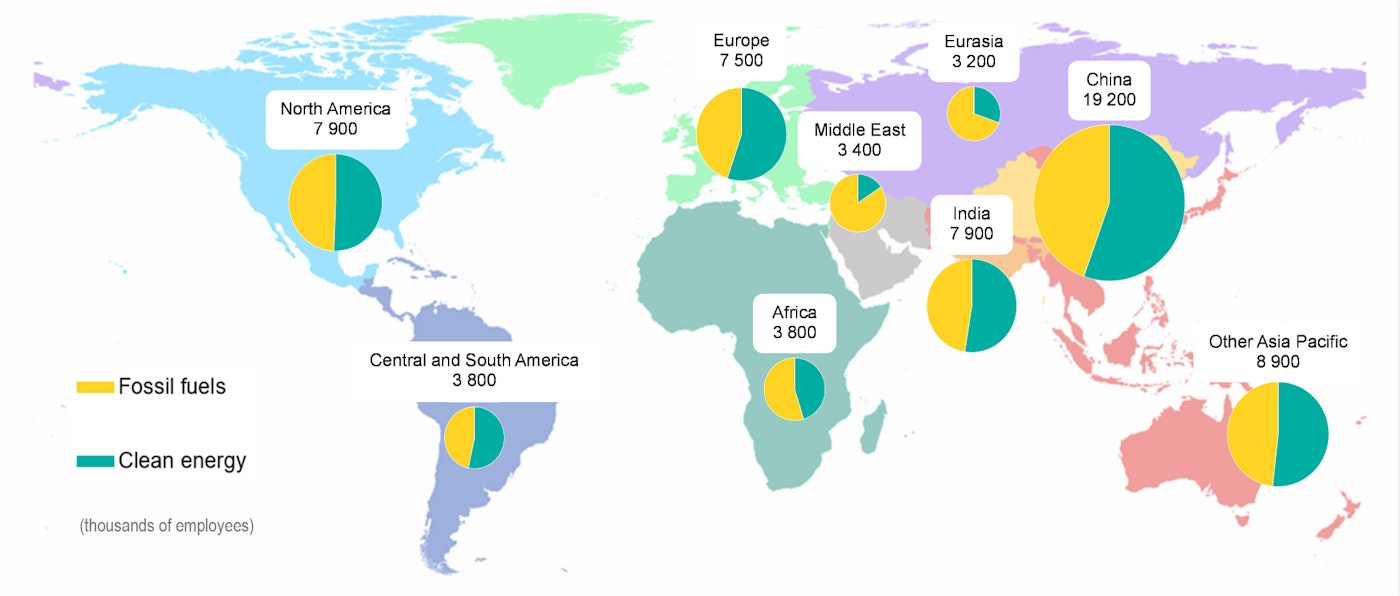

Energy employment is spread globally, with a greater concentration in manufacturing hubs and producer economies. The People’s Republic of China (hereafter ‘China’) has the largest number of energy workers, near 20 million, which represents around 2.5% of the employed in China. In the Middle East and Eurasia, the energy workforce makes up a relatively high share of economy-wide employment, averaging 3.6%. North America has 7.9 million workers in energy, equivalent to 3.4% of total employment; Europe has 7.5 million workers in energy, or 2.4% of total employment.

These jobs span the energy value chain and are captured in different economic activities. Those working in the production of raw materials, which includes mining and extractive sectors for fuels and agriculture for the production of bioenergy, total over 8.5 million. In the mining sector in particular, energy workers make up 15% of global employment. Over 21 million energy sector employees work in manufacturing and approximately 15 million are in construction, making up 5-6% of their respective sectors. An estimated 14 million work in utilities and other professional services. Other types of jobs, such as wholesale traders and energy transport, make up the balance.

Energy employment spans many economic sectors, with manufacturing and construction of new projects dominating today’s energy workforce

Fuel supply, power and end use sectors are key sources of employment across every region

Energy sector employment by region, 2019

|

Energy sector |

North America |

Central and South America |

Europe |

Africa |

China |

India |

Other Asia Pacific |

Rest of world |

Global |

|---|---|---|---|---|---|---|---|---|---|

|

Supply: coal |

100 |

<50 |

100 |

200 |

3 400 |

1 400 |

800 |

300 |

6 300 |

|

Supply: oil and gas |

1 900 |

1 100 |

600 |

1 600 |

1 100 |

700 |

1 100 |

3 800 |

11 800 |

|

Supply: bioenergy |

100 |

800 |

300 |

600 |

300 |

500 |

600 |

<50 |

3 300 |

|

Power: generation |

1 000 |

600 |

1 400 |

400 |

3 800 |

1 200 |

1 800 |

1 000 |

11 300 |

|

Power: grids |

900 |

400 |

1 200 |

500 |

2 300 |

1 500 |

1 200 |

600 |

8 500 |

|

End uses: vehicle |

1 800 |

600 |

2 700 |

200 |

4 500 |

1 200 |

2 100 |

600 |

13 600 |

|

End uses: efficiency |

2 000 |

300 |

1 100 |

400 |

3 800 |

1 500 |

1 400 |

400 |

10 900 |

|

All energy |

7 900 |

3 800 |

7 500 |

3 800 |

19 200 |

7 900 |

8 900 |

6 600 |

65 700 |

Notes: Grids includes transmission, distribution, and storage. Vehicles includes the manufacturing of all road vehicles (two- and three-wheelers, passenger vehicles, light-duty commercial vehicles, buses, and trucks) and batteries for electric vehicles. Efficiency refers to energy efficiency in buildings (covering retrofits, heating, ventilation and air conditioning equipment, as well as appliances); and in industry. Values may not sum due to rounding.

Understanding the scope and drivers of global energy employment

The energy sector is a capital-intensive industry, geared to meet, as efficiently as possible, the world’s expanding energy needs. Given this, a large portion of its workforce is focused on new and expanding projects—building energy efficient power plants, expanding and upgrading grids, and tapping into additional deposits of fossil fuels. Accordingly, developing an estimate of global energy employment needs depends heavily on planned energy investments in the coming years, as well as current and new capacity and production. Our employment estimates are developed using the IEA’s comprehensive data on global investments, energy production and demand. Our assessments are also calibrated to data from national labour statistics, corporate filings, company interviews, international organisations’ databases and academic literature.

Numbers in this report are shown for 2019, the latest year of comprehensive historic data, to establish a pre-pandemic baseline, accompanied by high-level estimates for 2021 and 2022. In this report’s accounting, energy employment encompasses all jobs directly related to the operation of energy facilities and their construction, as well as indirect jobs in manufacturing of direct inputs specific to the energy industry. Indirect jobs associated with production of general goods such as cement are not counted, nor are induced jobs. Jobs are normalised to full-time equivalent (FTE) employment for consistent accounting. Numbers include informal workers in order to better reflect the impacts of energy policy on the labour force. The Annex shows further detail on the methodology.

The regional distribution of energy jobs depends on multiple factors. First, jobs are concentrated where energy facilities are being built more than where they currently exist. Given the labour intensity of building new facilities, fast-growing markets tend to dominate the workforce. Second, today’s global supply chains for some upstream components are concentrated in certain countries. Notably, manufacturing of solar PV is centred in China. The production of fossil fuels spans the globe among resource-rich economies, but know-how on areas such as exploration, development, production and services are concentrated in regions like Houston, Texas in the United States, with companies based there providing expertise for projects worldwide. Third, worker compensation differs widely across countries, by a factor of up to 20. Differences in labour costs beyond earnings, such as benefits and pensions, add a secondary layer of country variations. Where compensation is low, like in India, the construction of the same project may employ many-fold the workers as they do in advanced economies. Finally, the prevalence of part-time, temporary, and informal work creates wide disparities in how many people work in a sector, even when normalising to FTEs, as we do in this report. Short-term projects, such as the installation of rooftop solar PV, often rely on part-time workers. In emerging markets and developing economies (EMDEs), informal work is common. Deployment or decommissioning of a project can create jobs only for a few weeks but wages earned can represent an important share of workers’ annual income, even if they work in farming or other jobs for most of the year.

Asia is home to energy’s largest and fastest-growing workforce, driven by rapidly expanding energy infrastructure and a significant share of global clean energy manufacturing capacity

Energy employment in fossil fuel and clean energy sectors by region, 2019

Open

Employment in new sectors already rivals levels in conventional energy sectors

Employment in selected energy subsectors, 2019

OpenNew energy projects are the major driver of employment, with around 65% of energy workers employed to build and deploy new solar plants, wellheads, heat pumps, cars, and more

Energy employment by economic sector operating existing assets vs. building new projects, 2019

OpenEnergy employment rebounded in 2021 and is set to rise further in 2022, but tight labour markets remain a cross-cutting barrier

All drivers of energy employment are set to rise in 2022, but the turbulence afoot in global markets is reshaping which regions are seeing investment and how much of the increased economic activity flows to workers. Energy investment is set to pick up by 8% in 2022, reaching USD 2.4 trillion, but almost half of the increase in capital spending is linked to higher costs. Total energy demand also climbed higher than pre-pandemic levels in 2021, with increased production driving a greater need for workers.

Higher levels of capital spending and energy demand are not necessarily correlating to increases in labour. Multiple supply chain pressures and higher energy prices are driving up the costs of construction inputs like steel and cement, meaning more project costs are going to materials. Key components for energy projects are also seeing cost inflation for services and operations, notably in oil and gas, transmission and distribution, wind and solar. Tight markets for specialised and highly skilled labour have led to increased worker turnover in response to more competition and escalating wages, hindering hiring.

We estimate that total energy employment in 2021 was up around 1.3 million from 2019, and could increase by another 6 percentage points by 2022. Clean energy accounts for virtually all of the growth in energy employment. Major new manufacturing facilities have come online since 2019, most notably for solar and EVs. These facilities are larger and increasingly automated, improving labour efficiency, especially in EMDEs. Advanced economies provided the largest increases in investment in 2021 and, along with China, are set to drive nearly 60% of the growth in 2022. Employment constructing new projects has grown strongly in these regions, whereas EMDEs have struggled to find the investment resources needed. In particular, energy efficiency programmes have been allocated an extra USD 165 billion in the wake of the pandemic. New programmes, notably the European Union’s REPowerEU, put increasing emphasis on energy efficiency targets, driving up demand for workers to retrofit buildings and to administer these projects.

Employment in fuel production has recovered somewhat amidst the scramble to secure energy supply, but remains below pre-pandemic levels. Employment growth is concentrated in natural gas, with the build out of new LNG facilities and expanding production. The coal mining workforce – which had been decreasing rapidly with increased mechanisation – saw this trend let up with coal mining on the rise in China after shortages in 2021, and could climb in India with mounting concerns for energy security in 2022.

However, several risks could derail this momentum in expanding energy employment. Concerns about cost inflation are acting as a brake on the willingness of companies to increase spending, despite the strong price signals. Ongoing labour shortages and increased worker turnover are creating challenges for hiring and recruitment.

In recent years, the share of energy employment related to clean energy technologies has grown steadily and has proven more resilient through the Covid-19 pandemic

Energy employment in fossil fuel and clean energy sectors, 2019-2022

OpenThe energy sector has a large share of high-skilled labour and offers higher than average wages

The energy sector demands more high-skilled workers than other industries, with 45% of the workforce requiring some degree of tertiary education, from university degrees to vocational certifications. Less than 10% of energy employment is in low-skilled labour, and is concentrated in EMDEs, although may be missing many informal workers in those regions.

Variations are larger between geographies than across sectors, with EMDEs employing more low-skilled or informal workers in manual tasks, whereas in advanced economies, many labour-intensive parts of the energy business have been mechanised or automated.

This high degree of skilling fetches higher wages on average. Energy sector wages typically see a premium over economy-wide average wages, though this premium ranges substantially from 10% to 50% across advanced economies alone. These premiums remain true across all regions, but the differences between wages in advanced economies and EMDEs remain pronounced, with the range of wages between geographies being larger than the range of jobs within the energy sector within the same region.

Established industries such as nuclear, oil and gas typically offer the highest wages. Industries with a high share of workers in construction, such as installing solar panels or carrying out energy efficiency retrofits, typically have lower wage premiums. Newer energy sector sectors, such as solar, also have less union representation than established fossil fuel industries, especially in EMDEs. Labour representation has led to higher wages in parts of the energy sector. For example, coal jobs in India receive compensation around three to four times the national average.

In all IEA scenarios, energy employment is set to grow, creating a growing demand for workers with energy-sector specific skill sets. Meeting a growing need for skills is a concern raised in interviews we conducted with companies,1well as in dialogues held in IEA’s Clean Energy Labour Council between governments and labour leaders.

Many of the skills needed exist in adjacent industries. For instance, project managers in residential construction have some of the same skills needed to manage the construction of solar farms. Companies also indicate an intention to transition existing employees from carbon-intensive activities to other parts of their portfolio, instead of exclusively pursuing new hires or dismissing any workers. This is particularly true in the electricity and other clean energy sectors, where all firms interviewed saw either rising employment or were reallocating their workforce internally rather than dismissing any workers. To support this, companies have created internal upskilling and reskilling programmes in partnership with universities.

Many firms interviewed said they faced a very competitive environment for hiring candidates with the requisite skill sets. This was particularly true for positions in fields for science, technology, engineering, and mathematics (STEM), followed by project managers and other technical roles. Companies also expressed concern about the high turnover of workers with the most in-demand competences, which has increased throughout the Covid-19 pandemic.

Strong links between employers and universities or vocational training programmes can fill talent pipelines, as can research grants for PhDs, internships and apprenticeships. New graduate rotation programmes were cited as ways to cultivate, attract and retain key talent. Companies highlighted a growing need to revamp teaching curricula of degrees with the highest demand, namely engineering, followed by economics and information technology. Surveyed companies also welcome opportunities to work with universities to shape new curricula.

The IEA intends to deepen our analysis on growing skilling needs in energy, as well as the transferability of skills from energy sectors in decline and from adjacent industries.

Average annual earnings per employee by energy sector, 2019

OpenFemale representation in energy is far below economy-wide averages

Women are strongly under-represented in the energy sector. Despite making up 39% of global employment, women account for only 16% of traditional energy sectors captured in dedicated labour classifications. As in economy-wide employment, women make up a very small share of senior management in energy, just under 14% on average. However, there is substantial variation among energy sectors, with the percentage shares in nuclear and coal the lowest at 8% and 9%, respectively, whereas electric utilities are among the highest with nearly 20%. This compares with 16% of women in senior management economy-wide. While ratios are better in regions with policy frameworks and strong private sector efforts to improve gender balance, all geographies show the energy sector lags behind the economy-wide average when it comes women’s participation in senior management roles in the sector.

There are no major differences in the share of female employment between fossil fuels and clean energy globally. However, clean energy start-ups show signs of change, with a greater share of women founders and inventors in clean energy, even if still far short of parity. This marks an opportunity for these growing segments to help increase female representation. However, further steps must be taken in all energy sectors if women’s roles in energy companies is to improve. In the IEA’s NZE Scenario, as many as 14 million new jobs in clean energy are created by 2030. Introducing new public sector policy frameworks supporting diverse hiring practices, as well as private sector initiatives, could make the energy employment growth this decade an opportunity to achieve a better gender balance, with special focus needed particularly in management. Numerous studies show that improved diversity enhances firm performance, long-term competitiveness and greater innovation, all of which contribute to the energy sector advances needed to meet global change goals.

The IEA’s Gender Diversity Initiative has been developing further indicators on the topic of gender and energy, including energy employment, recently published in a dedicated data explorer.

Employment by gender, 2019

OpenReferences

Companies interviewed are included in the acknowledgements of the report.

Reference 1

Companies interviewed are included in the acknowledgements of the report.