Cite report

IEA (2021), System Integration of Renewables in Moldova: A Roadmap, IEA, Paris https://www.iea.org/reports/system-integration-of-renewables-in-moldova-a-roadmap, Licence: CC BY 4.0

Report options

Mapping a pathway towards system integration of renewables in Moldova

The transition of the Moldovan power system from one that depends on imports and fossil fuels to one that is more self-reliant on domestic, renewable resources requires actions in two main areas. Firstly, an environment must be created that removes barriers for entry, encourages investment and mobilises finances for the deployment of renewable technologies. Secondly, Moldova needs to transition its power system to one that is flexible so that it can integrate the developing shares of variable renewables.

Power system flexibility is defined as “the ability of a power system to reliably and cost-effectively manage the variability and uncertainty of demand and supply across all relevant timescales, from ensuring instantaneous stability of the power system to supporting long-term security of supply” (IEA, 2019a).

Flexibility is already an important characteristic of all power systems, as they have been required to be able to respond to changes in electricity demand or sudden generation or transmission equipment failure. However, with the increasing prominence of VRE in global power systems, there has been a growing need to actively evaluate their inherent flexibility while planning and transforming systems to become more flexible.

There are four main flexibility resources: power plants (both conventional and VRE), electricity networks, storage and distributed energy resources. Appropriate policy, market and regulatory instruments are required to harness their full potential for flexibility. These options can be grouped into several categories of actions at various levels of decision making, as depicted below.

Layers of power system flexibility

Open

Key characteristics and challenges in the different phases of system integration

Open

In order to capture the evolving impacts of VRE on power systems, and the resulting system integration issues, the IEA has developed a phase categorisation for systems under transition. The integration of VRE can be categorised into six different phases, with each phase having its unique set of challenges and potential solutions. This framework can be used to prioritise different measures to support system flexibility, identify relevant challenges and implement appropriate measures to support the system integration of VRE.

While renewable deployment is quite low in Moldova at present, meaning it is only in Phase 1 of the integration of VRE challenges, current policy targets and the potential for switching to a more sustainable and secure energy resource mean that there is great potential for growth in the sector. As a result, it is important to start assessing flexibility requirements to accommodate future growth of VRE, especially as many measures may have a considerable lead-time for actual implementation.

In order to explore the possible pathways that are open to Moldova to support the accelerated deployment of VRE in its power system, this section looks at the transition to renewables across three main themes:

- Removal of regulatory barriers and increasing attractiveness to investors.

- Establishment of flexible electricity markets with enhanced regional co-ordination.

- Enhancement of the technical flexibility of the power system.

Removal of regulatory barriers and increasing attractiveness to investors

The removal of regulatory and fiscal barriers to the development of renewables is vital for stimulating investment in the sector. Despite the adoption of the Law on the Promotion of Renewable Energy, following from the adoption of the primary legislation of the Third Energy Package, there is a lack of consistent policy to follow through on the promises of this law. Clear and transparent guidelines for technical requirements for connection to the grid, long-term off-take agreements, consistent customs or tax breaks with other specialised imports and reasonable policies for rezoning or sharing land and the building of necessary shared infrastructure (e.g. access roads) are all necessary to increase the attractiveness of developing renewables in Moldova.

International best practice in stimulating the RE sector

Ensuring sufficient investment in clean power generation

Investment in new generation capacity requires sufficient long-term visibility of expected revenues. This is true irrespective of the policy, market and regulatory frameworks. In a vertically-integrated, regulated monopoly this certainty is provided by the regulator, which allows the monopoly to recover its cost from consumers. In an environment of competitive wholesale markets, forward markets play a critical role in providing sufficient visibility several years ahead. However, the large-scale uptake of renewable energy and other low-carbon energy sources can challenge both of these approaches.

For example, in the regulated environment, incumbent utilities often face challenges in accessing low-cost capital to shoulder the upfront investment in clean generation options. Both renewable energy plants and associated flexible infrastructure, such as storage and grid infrastructure, have in common the fact that they incur significant upfront costs but low operational costs. Hence, the cost at which financing can be obtained has a critical impact on the overall costs of these projects. Up until now, this situation has been resolved by creating a dedicated off-taker that has sufficient financial credibility, and procuring generation capacity via a competitive auction for long-term power purchase agreements (PPAs) (IEA, 2017a).

As the global VRE industry matures, governments and utilities are moving towards competitive procurement mechanisms to attract competition and drive down costs. This trend is occurring in markets with a diversity of institutional frameworks, including those with wholesale power markets. These competitive procurement mechanisms still offer long-term contracts, but the ultimate price of the contract is discovered through competition. A rapid shift from administratively-set FiTs to competitively set remuneration schemes for renewable plants (both utility-scale plants and large-scale distributed PV projects) has been occurring since 2015. From the forecasts in RE growth for the period 2020-2025, over 60% of developments will be under competitively set remuneration.

Renewable electricity capacity remuneration policy types, 2020-2025

OpenThis trend is clear even in relatively immature markets such as Africa and Latin America, and has had a positive effect on the contract prices for wind and solar, driving down auction prices.

In most cases of a competitive procurement framework, a government or utility issues a call for proposals or tenders for a specified amount of generation capacity or energy. VRE developers then submit bids to supply the capacity or energy, and the government or utility evaluates proposals based on price competitiveness, a host of technical criteria, and in some cases economic development or social impact criteria. When a proposal is accepted, the electricity off-taker enters into a PPA with the VRE project owner. The awarded PPA can be a fixed-price contract, or another pricing mechanism such as a Contract for Difference (CfD) or a market premium (IEA, 2017a).

Properly designed, auctions can help ensure transparency, increase levels of participation, and reduce uncertainties and delays. They can also enable different technologies to compete with one another. Auctions can also be designed to include elements that ensure VRE deployment is done in a relatively system-friendly way, for example by including locational requirements or by aligning results with grid development (IEA, 2017a).

Auctions have been instrumental in lowering the price for wind and solar projects globally, including in other systems close to Moldova which are also navigating the initial barriers to VRE deployment. In 2018, Albania, Armenia and Kazakhstan completed their first auction rounds, with PV prices averaging USD 58 per megawatt hour (/MWh) and onshore wind clearing at USD 53/MWh (IEA, 2019b).

Costs of financing can be driven down through good policy

As an emerging sector in Moldova, RE requires an investment environment that both stimulates and protects the relevant actors in the sector. This should be from the perspective of both public and private financing opportunities. The Covid-19-driven economic downturn in 2020 had a strong negative (-14.9%) impact on investment in Moldova. Public finances are facing additional pressures due to the fall in tax and customs revenues and the sharp increase in public spending to support the healthcare system and social assistance programmes. However, international experience and action plans suggest that government efforts which focus on green recovery policy packages have a potential to stabilise or revitalise the investment downturn of 2020 (OECD, 2020).

In terms of private equity, a reduction in financing costs has been vital to scaling up deployment globally. For example, applying a standard real weighted average cost of capital (WACC) of 8% to a solar PV project in the US in 2019 would lead to a levelised cost of energy (LCOE) of around USD 80/MWh, while the same project with access to lower-cost financing (around 4%) was just over USD 50/MWh (IEA, 2020b).

Aspects which pose a risk to potential revenues (and therefore investment) include price, volume and off-taker risk (IEA, 2020c). As the perceived risk of a market increases, so do the financing costs for the project due to a higher required rate of return for any equity capital. Globally, a combination of strong policy support and maturing technology has helped reduce private investors’ and financial institutions’ risk perception for wind and solar PV projects. This has in turn helped to lower the cost of financing for projects provided that they have some type of long-term support mechanism (IEA, 2020c). This can be seen in the WACC trend for solar PV projects (all under support mechanisms of some type) in different regions around the world, although the WACC trended upwards in 2020 due to increased uncertainty in the renewables markets caused by Covid‑19.

Integrated planning and co-ordination can minimise costs and maximise system resilience

In many jurisdictions, increasingly integrated and co‑ordinated planning frameworks have played a key role in the cost-effective and secure transition to a new electricity mix. While this is predominantly the case in vertically-integrated utilities, it can still be useful in unbundled systems to guide project developers, system operators (SO) and authorities. Co‑ordinated and integrated planning practices that are emerging can be broadly categorised into (IEA, 2017a):

- Integrated generation and network planning and investment

- Inter-regional planning across different balancing areas

- Integrated planning across a diversity of supply and demand resources (and other non-wire alternatives)

- Integrated planning between the electricity sector and other sectors

The importance of integrated generation and network planning is magnified as the level of VRE deployment increases because the development of VRE projects can easily outpace the development of network infrastructure. Geographic concentrations of VRE in areas with high resource potential can push up against the limits of the electricity network, which ultimately drives up the cost of delivered electricity.

The renewable‑energy‑zone (REZ) approach has been adopted in several jurisdictions, which brings together network planning and the development of RE projects. REZs are geographical areas that are characterised by high-quality RE resources, potential for grid integration and strong developer interest. The process to establish REZs requires co-ordination from relevant stakeholders in the energy sector, including the regulator, utilities and potential RE developers.

The success of this approach is partly due to the fact that network expansion can be started ahead of constructing generation plants, to allow for its longer development timeline. In addition, developing co‑ordinated network investment for multiple VRE generators increases efficiency relative to planning infrastructure on an individual project basis.

Jurisdictions that have adopted the REZ approach include South Africa and the Electric Reliability Council of Texas (ERCOT). Most recently, the Australian National Electricity Market (NEM) has been developing REZs as part of the Integrated System Plan (ISP) to identify transmission developments to reduce overall costs. Considering the strong need for grid upgrades in Moldova to meet both growing demand and defined strategies for interconnection, there could be an even stronger benefit from a co‑ordinated approach to transmission development which unlocks grid potential for new VRE projects in Moldova, boosts investor confidence for project development and works towards other priorities as per the NES.

Integrated planning between the power sector and other sectors

Integrated planning that spans the power and other sectors is a growing field in energy system integration. Historically, planning across different sectors was thought to be relevant to only the electricity and gas sectors, since gas is one of the main fuels for electricity generation in many countries. However, even power and gas planning have been carried out separately in many countries due to a number of challenges, particularly from institutional and regulatory perspectives.

Efforts have been made in many jurisdictions to link the planning of electricity and gas. In the European Union, the European Commission has encouraged electricity planners to work with gas partners in the ENTSOG (European Network of Transmission System Operators for Gas) to create a common baseline of assumptions. This involves using the same analytical basis for their respective ten-year network development plans. These plans would then be used as the basis for the cost-benefit analysis of different electricity and gas network expansion or reinforcement projects.

In addition, linking the power and transport sectors can also support development and planning of necessary infrastructure for both EVs and the distribution network. For example, to enable a greater uptake of EVs, there will be a growing need to roll out EV charging infrastructure. At the same time, this growth in demand for electric mobility will place additional strain on the distribution network, and may result in local congestion due to the clustering of EV charging. This could occur due to strong uptake of EVs, concentrated charging (e.g. fleet depots or multi-dwelling buildings) or high power charging, such as that required for light-commercial vehicles, trucks or buses (IEA, 2020a).

More recently, continuing innovation in and uptake of demand-side technologies are having an impact on the power system. Demand-side technologies, particularly EVs, have the potential to facilitate a high share of VRE in the power system. Such technology options can be deployed in a way that increases the flexibility of the system. For example, time-of-use tariffs, dynamic electricity pricing or dynamic controlled charging of vehicles (V1G) can provide large benefits to the system for the integration of variable renewables, by incentivising charging during periods of high VRE output (IEA, 2020d).

Key policies for providing a stable environment for investment in RE technologies

Key overarching principles:

- Ensuring the economic attractiveness of renewable projects to investors through the removal of unnecessary administrative burdens and taxation, and through the provision of financial guarantees.

- Developing the capacity of local banks in Moldova to facilitate the financing of clean energy projects.

- Robust implementation of integrated planning in the electricity sector to allow adequate investment in associated infrastructure and proper identification of bottlenecks.

- Implementing well-designed and transparent auctions which allow a fair, competitive and open process with PPAs that are drafted according to best international practice and open to public consultation.

- Developing support mechanisms that allow de-risking of projects for developers while still minimising market distortion and allowing market signals to act as a guidance for development of projects where they are most needed.

Specific policies and actions for consideration

1. Removal of entry barriers

Generally, barriers preventing or making it difficult for project developers and investors to access the electricity market should be eliminated. In particular this may refer to administrative procedures, contractual negotiations, grid access, taxation as well as access to the land. Policymakers should address the issue of cost (rezoning, taxation) and availability of land (competition or shared use) for renewable power plants in order to minimise entry barriers for market players and investors in renewable energy.

Policymakers should aim to reduce investment risk through the inclusion of financial guarantees within long-term PPAs. However, to avoid market distortion and to ensure that developers are still guided by market signals, these guarantees should be in the form of market premiums (either fixed or sliding).

The Government of Moldova should reinforce the public-private dialogue on energy policy matters, and develop a communication strategy for sector stakeholders, as well as the population at large on renewable energy strategies and the challenges, benefits, opportunities and costs of the ongoing reforms. This should include communication about the potential opportunities to become active players in the transition to renewables through private or community participation.

Policymakers should ensure a level playing field in the energy sector by phasing out tax distortions created by reduced VAT on natural gas and zero VAT on electricity and heat for residential consumers.

2. Integrated planning

Policymakers should assign the responsibility of assessing the technical feasibility of grid integration to a technically competent and neutral body such as the

transmission system operator (TSO) and/or the electricity regulator. This should avoid the use of arbitrary caps, or approaches intended for conventional power plants.

Policymakers and regulators should encourage the integration of generation and network investment planning during long-term planning exercises. While transmission and distribution investments are already considered during most system planning exercises, they are often considered separately from generation investment exercises. However, network investment decisions have strong implications for system flexibility requirements. Policymakers and regulators can help ensure that transmission and distribution planning processes are better integrated with generation planning, particularly as the latter begins to include a more holistic consideration of system flexibility.

Current electricity market prices are high enough to support the development of local, renewable resources in Moldova. In the long run, the aim of the government could be to transform Moldova from a net electricity importing country to a net exporting country driven by renewable production.

Policymakers should request the use of state-of-the-art decision support tools in all aspects of power sector planning by all relevant stakeholders (e.g. the TSO, market operator and regulator). This would allow for a better understanding of flexibility requirements and prioritise efforts in the short-, medium and long-term. This may include timely development in key shared infrastructure (e.g. transmission network development and EV charging infrastructure), and market design that ensures appropriate investment in generation and flexibility assets that allow the achievement of national climate and energy goals in the most cost-optimal manner.

3. Procurement of renewables and flexibility

The regulator should assess options for cost allocation, including cost sharing among developers, and contributions from the public purse, which may be recovered subsequently from developers, consumers or taxpayers.

The SO should refer to state-of-the-art industry standards and international experiences when identifying the technical requirements for connecting VRE plants, modifying international standards to suit the local context.

The SO should start with requirements appropriate to a low VRE share while preparing for higher shares of VRE based on international experience. These include ranges of operation, power quality, visibility and control of large generators, in such a way that they do not discourage initial investment and allow growth of the market. These will need to be adjusted regularly as deployment grows

Establishment of flexible electricity markets with enhanced regional co-ordination

Policy, market and regulatory frameworks have a strong bearing on the way in which decisions relating to power system operations are made. In recent years, there has been growing global interest in the establishment or strengthening of wholesale electricity markets worldwide to improve the operational efficiency of the power system and better incorporate higher shares of VRE. The drivers behind this include the potential for savings through making better use of existing assets, in particular across larger geographical regions and allowing market operations closer to real-time.

Recent improvements to the design of short-term markets have focused primarily on: enabling trading closer to real time, improving pricing during periods of scarcity, reforming markets for the procurement of system services, allowing for trade over larger geographical regions, and better incorporating VRE and distributed resources into the system dispatch. The latter is especially enabled through advanced weather forecasting (as discussed later in this section).

International best practice in increasing power system flexibility

Moving operational decisions closer to real time can unlock flexibility

Technical constraints of the power system call for a certain degree of forward planning and scheduling with regard to system operation. In practice, however, many power systems tend to lock in operational decisions far more in advance than technically required, sometimes weeks or even months ahead. Such a situation is undesirable for least-cost system operation, in particular at high shares of VRE penetration where the error in forecasts in wind and solar production becomes smaller as one approaches real-time. These forecast errors are then needed to be balanced by reserves. Considering that Moldova does not currently have any domestic reserves, this is an aspect which is particularly relevant for increased deployment of variable renewables.

In regions where the share of VRE is on the rise, steps have been taken to improve the trading arrangements for electricity closer to real time. Scheduling and dispatch that are as close to real time as possible allow for more accurate representation of variations in net load. This results in a more efficient use of reserves, because a larger proportion of VRE variability is absorbed by schedules and hence does not need to be balanced by reserves.

The shortest dispatch interval in major electricity markets today is five minutes, which is implemented by most independent system operators (ISOs) in the United States and in the Australian NEM. In most systems in the US (and indeed also the NEM), market operators procure balancing reserves centrally, co-optimised with energy in these shorter intervals. However, in Europe, most market operators procure reserves in day-ahead markets. The trade-off of procurement at the longer timescale is an increased certainty that the volumes of reserves are available, but at the cost of reducing the pool of available resources for energy in the intraday or real-time markets. Meanwhile, a shorter dispatch interval reduces the amount of reserves for deviations in the forecasts. This is demonstrated in the figure below, where the increased trading of 15-minute products in the German intraday electricity market has led to a decline in the real-time deviations which have to be met by balancing reserves.

Effect of quarter-hourly trading on the need for reserves in Germany, 2012-2017

OpenRegional integration of markets can provide system flexibility

As a country makes the transition to short-term electricity markets, there are risks of issues with market liquidity and price stability. However regional co-ordination of markets can help to mitigate these issues. Regional integration of markets is one option, although this may rely on a diverse set of trading partners. Moldova is currently largely reliant on imports from either Ukraine or Moldova GRES in Transnistria, which accounted for 81% of supply to the Moldovan system. While there are transmission lines connecting Moldova’s electricity system to Romania, it cannot operate synchronously with Romania’s electricity system (which is part of the Continental Europe Synchronous Area) as Moldova’s electricity system is part of the Russian UPS. This is currently a large obstacle to wider regional integration of its markets. However, prior to the synchronous interconnection with Continental Europe, Moldova aims to connect asynchronously with Romania via HVDC back-to-back converters at several locations. This was a similar starting point for Lithuania which, as part of the BRELL (Belarus, Russia, Estonia, Latvia and Lithuania) group, is synchronously interconnected with the Russian UPS. Additionally, since the closure of the Ignalina nuclear plant in 2009, it has also become a net importer of electricity, with the majority of its demand met by imports (IEA, 2021c).

However, there may be key lessons to be learnt from the Lithuanian experience over the last 15 years, as it has progressively increased its diversity of trading partners for electricity through asynchronous interconnection with the Nordic Synchronous Area (via Sweden) and later with Continental Europe (via Poland). This then allowed for the coupling of its electricity market with the European market, in which it has since had its own price zone, and in which it has access to a suite of regional markets. This has resulted in a general decline of electricity prices in Lithuania due to the diversity of trade partners. It also increased the flexible portfolio to which Lithuania has access, allowing it to increase its portfolio of variable renewables and decrease its reliance on natural gas, for which it is completely reliant on Russian imports (IEA, 2021c).

As deployment of variable renewables accelerates, and markets have higher shares of wind and solar in their generation mix, the impact of the variability and uncertainty of VRE can be reduced by even further adaption of the short-term markets (intraday, balancing and ancillary services) by further expansion of balancing areas through inter-regional interconnectors, and allowing the use of imbalance netting and the exchange and sharing of reserves. An example of this has been implemented in the European electricity market, where the Single Intraday Coupling (SIDC) system has been deployed over multiple phases to allow for increased trading between participating countries following the closing of the day-ahead market. SIDC currently couples the intraday markets of 22 countries including the expansion of the products for cross-border trading to include 30- and 15-minute products across several borders (ENTSO-E, 2020). Amongst these 22 countries are neighbouring Romania and the nearby Baltic states (Estonia, Latvia and Lithuania).

The Geographical Scope And Implementation Phases Of The Single Intraday Coupling (SIDC) In Continental Europe

All NEMO Committee (2021), Single Intraday Coupling.

Meanwhile, the Western Energy Imbalance Market (WEIM) in the western United States (hereafter “US”) and Canada is one of the more innovative approaches to regional collaboration on real-time dispatch (IEA, 2019c). As a starting point, it is worth noting that it is the only regional market in the Western Interconnection in the US. Among the US states that make up the Western Electricity Coordinating Council (WECC), only California has introduced an independent system operator (ISO) – CAISO – meaning that the WEIM is the only wholesale market environment in the region, and even there the utilities remain vertically integrated.

The development of the WEIM, therefore, stands out from similar efforts elsewhere. In Europe, for example, efforts to develop regional balancing markets have followed the development of regional wholesale markets (e.g. Nord Pool) and wholesale market harmonisation more generally. The WEIM, in contrast, starts from the balancing side first, where it operates 15-minute and 5-minute real-time dispatch markets. Between its inception in 2014 and the end of 2019, it is estimated that the WEIM led to gross economic benefits of more than USD 860 million for participating due to more efficient dispatch, while also reducing 4.3 Mt CO2 in emissions from the reduction in curtailment of renewables (IEA, 2021b).

Market design can evolve to better value flexibility

As VRE shares grow in systems around the world, the necessity for flexibility from a number of different resources, including power plants, storage, demand-side response and the grid, will increase. Power plants will be required to transition towards more flexible modes of operation and, at times, reduced operating hours. While existing power plants may offer increasingly important flexibility services to the power system, reductions in energy sales are leading to concerns about their financial viability, calling for the need to re-evaluate how they are compensated in many markets. This is equally important for storage and demand-side response, which can offer a range of flexibility services with the appropriate markets and incentives in place that value this flexibility. Storage, for example, in many wholesale markets is limited to energy arbitrage. However, with appropriate markets in place that value flexibility, storage can provide multiple services (e.g. balancing, ancillary services, congestion management, etc.) while combining these revenues (i.e. revenue stacking) can allow these projects to become profitable for developers. However, in their absence, a market may lack the appropriate incentives to ensure investment in flexible resources in a timely manner and also be unable to prevent early retirement of non-profitable power plants as the shares of VRE increase.

Reliable operation of the power system critically depends on a number of system services which contribute to maintaining system frequency and voltage levels. Special capabilities may also be required when restarting the system after a large-scale blackout (so-called black-start capabilities). Different systems may obtain the same service in different ways. For example, some will mandate it in the grid code, while others use a procurement or market mechanism.

As the penetration of VRE increases to very high shares, the need and economic value for such services are bound to change. One reason behind this is that conventional generators have traditionally provided many of these services as a simple by-product of power generation. For example, a conventional generator contributes to voltage and frequency stability with its voltage regulator and governor, including the inertia stored in the rotating mass of its turbine and generator.

While VRE plants are often seen as a driver for flexibility requirements and system services, they can also provide a range of system services, though this requires adequate technical requirements (e.g. grid connection codes) and, in some cases, economic incentives (e.g. markets) to explicitly procure services, such as fast frequency response and upward reserves, that enable the full range of their technical capabilities.

Islanded systems that are advanced in their own energy transitions have become good test beds for reforms in market design and system operation that mitigate system integration challenges as they have very little or no synchronous interconnection with other systems. For example, the all-island system of Ireland and Northern Ireland, the DS3 programme was introduced which has expanded the system services market to allow for the more instantaneous amounts of non-synchronous generation. The programme started a consultation process on a range of new system service products to address and mitigate potential system issues, which had been identified by comprehensive technical studies. New products have been proposed to address the challenges associated with frequency control and voltage control in a power system with high levels of variable, non-synchronous generation (EirGrid/SONI, 2021). The new services identified under the DS3 programme include synchronous inertial response, fast frequency response, fast post-fault active power recovery and a ramping margin.

Integrating forecasting into power system operations provides visibility of VRE production

The ability of the aforementioned short-term electricity markets (including closer to real-time dispatch) to provide flexibility hinges on the ability of system and market operators to properly represent wind and solar generation in their operation decisions. This is enabled through advanced forecasting which can accurately predict wind speed and solar irradiance, and subsequently forecast outputs from VRE plants on a sub-hourly basis.

Centralised system-level forecasting of VRE generation can greatly improve system operation by enabling the SO to account for overall variability of VRE outputs across the whole system and accurately predict the amount of VRE generation available. Forecasting is a useful tool to assist real-time dispatch, scheduling and operational planning.

In self-dispatching markets, forecasting of VRE generation helps generators to establish reliable schedules and limit schedule deviations. A good plant-level forecast will allow for a more cost-effective and reliable schedule of generation. A good system-wide forecast is critical in verifying that generation schedules are feasible and that sufficient operating reserves are held. Forecasts are regularly updated and are more accurate closer to real time. As the share of VRE increases, forecasting becomes an even more integral element of power system planning and operation.

One way to ensure that SOs have the ability to both control and monitor VRE production is through the establishment of renewable control centres. In 2006, Red Eléctrica de España (REE) in Spain was a pioneer when it established a Control Centre of Renewable Energies (CECRE), an initiative which allowed the SO to monitor and control renewable generation with real-time information. This also extended beyond just active power as it included reactive power as well as the voltage at the point of connection.

This same structure has since been emulated by numerous systems around the world. For example, in support of its growing share of VRE generation and its ambitious target of 175 GW by 2022, India inaugurated 11 Renewable Energy Management Centres (REMCs) in March 2020 which are co-located in the state dispatch centres in seven renewable-rich states (Gujarat, Rajasthan, Madhya Pradesh, Maharashtra, Karnataka, Andhra Pradesh and Tamil Nadu), in addition to being co-located in three of the five regional dispatch centres (north, west and south) and the national dispatch centre. The purpose the REMCs is to facilitate VRE integration along the Green Energy Corridors, a project started in 2013 to establish grid infrastructure to connect renewable-rich states and enable intra- and inter-state transmission (IEA, 2020e).

With the right policy, market and regulatory conditions in place, VRE can provide valuable system flexibility services

As VRE shares have grown, market operators have begun to take advantage of advanced forecasting to actively manage VRE in the dispatch. If VRE plants can automatically adjust their generation set point in response to control signals, the opportunity to provide frequency regulation services is opened. So, while VRE is often perceived as the key driver of new flexibility requirements, these plants can also provide flexibility services to address a range of operational issues related to power systems.

However, in order to enable this, system operators need to first define technical requirements for these services, in addition to appropriate economic incentives in many cases. For example, grid connection codes can explicitly stipulate certain services to be provided or to increase the visibility and controllability of VRE resources to system operators (IEA, 2019d). In addition, the provision of certain flexibility services may also require VRE generators to decrease their energy production, and hence their primary basis for remuneration. This may therefore require amendments to existing market frameworks or PPAs to allow for the fair remuneration of VRE resources for these services (IEA, 2019d).

For example, modern VRE resources which are controllable by the SO can provide downward reserves when operating at full output. However, if it were to run at a reduced output, it could also provide upward reserves by utilising the headroom between its reduced and full output. This mode of operation has been explored in a number of jurisdictions such as California, Chile and Puerto Rico (IEA, 2019d). Following these, the 141 MW Luz del Norte photovoltaic (PV) power plant from First Solar in Copiapó (Chile) became the world’s first solar PV plant to be licensed to provide ancillary services, including frequency control, to the system operator in August 2020 (First Solar, 2020).

Key policies for ensuring that electricity markets promote flexible operation

Key overarching principles:

- New market design and market rules should be developed with a view to foster closer co-ordination and coupling with neighbouring markets in Ukraine and Romania to provide better liquidity and stability.

- Increased regional interconnection and diversity of trade partners would increase the potential for deployment of wind and solar.

- Further revision to market design should be in place to extend the short-term market to include real-time balancing and ancillary services on a regional basis to appropriately value and incentivise electricity generation and flexibility from all technologies at different times and locations.

- As shares of VRE increase, system operation protocols should be updated to shorten dispatch intervals in order to reduce balancing requirements.

- The SO should have the capability to control and monitor VRE through advanced forecasting tools.

- Regional co-ordination of forecasting could help better highlight opportunities for trade of VRE amongst neighbouring systems in Romania and Ukraine.

- Network codes should require technical flexibility from VRE and conventional plants.

Specific policies and actions for consideration

1. Public-private stakeholder engagement

The Government of Moldova should develop a communication strategy and initiate dialogue between the public and private sectors for the development of fair, optimal and mutually agreed electricity markets and enabling environments.

2. System operation should enable flexibility

The SO should incorporate advanced forecasting tools and monitoring of renewable plants into system operations in order to allow for an accurate account of availability of plant outputs in both system and market operations.

The SO should look to minimise balancing requirements through the establishment of shorter dispatch intervals which, in combination with advanced forecasting of wind and solar generation, can reduce the balancing needs of the system.

Policymakers and the SO should explore the possibility of enhanced regional co-ordination with the neighbouring systems of Romania and Ukraine by sharing information from centralised forecasting and monitoring systems for VRE to allow for more optimal co-ordination of system and market operations in response to renewables over a large geographical area, accessing potential benefits in terms of smoothening variability and reducing imbalances.

3. Regional markets are needed that incentivise flexibility

The Government of Moldova should take the necessary steps to enhance cross-border trade with Romania and Ukraine. By diversifying the routes of electricity supply, Moldova can enhance electricity security and improve its negotiation position for the supply of power from Moldova GRES. This includes the development of regional infrastructure, harmonisation of cross-border trading rules and regulations, and the development of market rules with an aim towards the coupling of electricity markets in the region. Successful implementation and operation of the wholesale market will require liquidity, through the maximum participation of domestic and cross-border resources. Thus, there should be an aim to reduce the volumes traded by means of bilateral contracts.

The Government of Moldova should develop a short-to-medium- and long-term strategy towards synchronisation with the Continental Europe Synchronous Area. In the short- to medium-term, this should include taking the necessary steps to couple its electricity market with the European market via an asynchronous interconnection with Romania. However, in the longer term, considering the importance of Ukraine to the Moldovan system, this should include enhanced dialogue with Ukraine to develop a detailed roadmap towards the synchronisation of their interconnected systems with the Continental Europe Synchronous Area.

Policymakers and regulators should ensure that price signals indicate the value of electricity generation and flexibility in different locations and at different times, thereby ensuring that the market is able to provide clear investment signals for new generation or flexibility requirements (either domestic or cross-border) and the opportunity for participation from all technologies, including generation, storage and distributed energy resources. The latter includes distributed generation, demand-side participation and distributed storage.

Policymakers should promulgate rules that allow VRE resources to provide flexibility services, including reserves. VRE resources are technically capable of contributing to the reserves of a power system, but infrequently do so due to a lack of regulatory requirements or economic incentives. Allowing VRE to contribute to reserves can help unlock these resources as important contributors to system flexibility, but may require the introduction of a compensation scheme or regulatory requirement for VRE.

Enhancing technical flexibility of power systems

There are four key categories of infrastructure assets that provide system flexibility: (a) power plants (both conventional and VRE); (b) electricity networks; (c) energy storage; and (d) demand-side response (DSR).

Historically, conventional power plants, pumped storage hydro (PSH) and electricity networks have been the primary providers of flexibility (IEA, 2019d). However, due to declining costs and improving capabilities of newer technologies, such as battery energy storage systems (BESS) and the advent of distributed energy resources (DERs)##anchor1##, as well as the improvement of operational protocols, a wider range of flexibility options are now available.

As power systems moved towards higher shares of VRE, these different technologies can work together to enhance the flexibility of the power system in a cost-effective manner. However, achieving this goal typically requires changes to policy, market and regulatory frameworks (IEA, 2019d). The following section brings together a few key examples which could be considered to make the Moldovan electricity system more flexible for higher shares of VRE, and for the potential transformation of the Moldovan electricity sector to one that is cleaner, more sustainable and more secure.

International best practices in increasing power system flexibility

Conventional power plants play a critical role in enhancing system flexibility

Conventional power plants are still currently the predominant source of system flexibility being used to accommodate the variability and uncertainty in supply and demand in modern power systems (IEA, 2019a). Flexible power plants can provide flexibility in a number ways, such as being able to rapidly change its output, starting up or stopping quickly and for short periods, and being able to reduce output without requiring a shutdown. There are a number of strategies to increase the flexibility that power plants provide to the system, ranging from modification of operational protocols to access inherent flexibility, to retrofits which improve technical parameters of these plants.

By modifying the operational practices of power plants, increased flexibility can be accessed without the need for new capital investments. However, this may need to be enabled by a better understanding of the operational limits of individual power plants through increased data collection and real-time monitoring (IEA, 2019a).

Meanwhile, the flexibility of power plants can be improved through targeted retrofits to achieve more flexible operation or pairing with other technologies such as BESS. For instance, the strategic coupling of BESS with existing plants is increasingly becoming a viable means of boosting flexibility, in both technical and economic terms. An example of the latter is Southern California Edison’s Center Peaker plant in Norwalk, California, where an existing gas peaking plant was coupled with a short-duration (< 1 hour) BESS. This has allowed the plant to provide spinning reserves without burning any fuel, while also offering valuable frequency response services. This is achieved as the BESS component of the hybridised power plant covers the spinning reserve requirements during the first few minutes as the gas plant would be required to start-up, after which the plant can ramp up to full capacity while the battery output decreases (IEA, 2019a).

Flexible and cleaner cogeneration

Cogeneration plants can be a highly restrictive constraint on the short-term flexibility of electricity systems, such as that in Moldova. In systems where cogeneration plants are used for combined heat and power, the generation of the plant is determined by the heat requirements. Hence, the plant will be designated as must-run. Decoupling heat and electricity provision via the introduction of heat storage or electric boilers can be used to overcome this. In some cases, for example the supply of district heating, the heat capacity of the network and connected buildings may be sufficient to ensure some heat and electricity decoupling.

Several projects have been undertaken in Europe to make cogeneration plants more flexible as the share of VRE has increased. In 2015 Stadtwerke Kiel in Germany set out to replace a 50-year-old 323 MW coal-fired cogeneration plant. The original plant, with 323 MW of electrical output, was also able to provide 295 MJ/s of thermal energy to the city’s district heating network (IEA, 2018). Meanwhile, the new installation, which was commissioned in January 2020, was deployed in two phases. The first phase consisted of a 30 000 cubic metre hot water storage facility, with 1 500 MWh capacity, a 35 MW electrode and a pump house to be connected to Kiel’s district network.

During the second phase, twenty 9.5 MW gas engines were installed with a total capacity of 190 MW. The main requirement of the design was to be a secure power supply option in a system with a high VRE share. Deploying a large number of multiple units of gas-fired engines in cogeneration mode allows for units to always run at full load and maximum efficiency, with the number of units that run depending on heat demand. Meanwhile, the electric boiler commissioned in the first phase allows 35 MW of flexible heat storage and production, which can utilise cheap wind and solar power when available while maintaining a portion of the heat demand.

Smaller CHP plants in Denmark have also decoupled electricity generation from heat output through electric boilers, allowing more flexible operation in the provision of peaking heat capacity while also providing ancillary services such as operational reserves. Short-term heat storage is a common feature of Denmark’s district heating network which can provide short-term storage of approximately 12 hours of heat production at full load. This can allow the larger, baseload CHP plants to reduce power output during times of high VRE generation and increase output during other periods (Danish Energy Agency, 2017). Heat is typically stored in large insulated steel containers in which hot water rises to the top and cold water drops towards the bottom. It is this separation of hot and cold water which enables the efficient loading and unloading of hot water from the storage (IEA, 2017b).

CHP plants in Denmark have also moved towards using biofuels and municipal waste as an alternative to fossil fuels. They have provided the additional benefit of advancing their clean energy transition and diversifying resources away from imported fossil fuels, though Denmark has now become a large importer of wooden pellets (IEA, 2017b). This, however, is not the only way of accessing clean and flexible district heating solutions. Denmark has also implemented a number of solar heating installations and solar district heating (SDH) networks, which may also be equipped with seasonal pit heat storage that allows solar power in the summer to be stored and used for heating in the winter (Epp, 2019). Large seasonal storages are implemented as underground storages in dams, aquifers, boreholes or caverns. This includes the re-purposing of old and abandoned infrastructure, e.g. old oil storage caverns (IEA, 2017b). In Denmark, over 1 GW of capacity for solar heating was connected to their network in 2019. It provides heat to 113 villages, towns and cities. A typical solar heating installation is depicted in 7.

Example Of A Typical Solar District Heating Network With Short Term Storage

Open

Battery energy storage systems are becoming a cost-competitive flexibility provider

While PSH is still the most widely deployed utility-scale storage option with over 90% of global energy storage capacity (with 160 GW of capacity in 2019), a rapid decline in technology costs is creating an important opportunity for BESS to play a larger role in providing power system flexibility. A BESS offers notably fast and accurate response times to dispatch signals from system operators, and its modularity enables a wide range of installation sizes and potential locations for deployment. This differs from the more traditional storage options such as PSH which have been constrained by geographical limitations for suitable pumped storage sites.

Though battery costs have declined considerably,##anchor2## in most contexts BESS are not yet a fully cost-competitive flexibility resource. While further reducing costs and improving the technology’s performance characteristics remain important, it is equally important to ensure that policy, market and regulatory frameworks allow BESS to participate fairly within the power sector, and offer the full range of services they are technically capable of providing.

Battery storage systems are well-suited to short-duration storage that involves charging and discharging over a span of hours or days. This makes them a good partner for variable renewables, and there is a growing trend for battery storage to be paired with solar PV and wind. From an RE developer’s point of view, BESS may be co-located with renewable projects in order to shift generation from periods of high supply (and low market value) to peak periods when generation is more valuable. Similarly, they may also be deployed as standalone projects, to provide energy arbitrage and offer an alternative to other peaking capacity such as gas turbines. Both of these applications would require a BESS with sufficient storage volume to provide capacity over the peak period, which would usually mean a storage duration of approximately four hours. An example of this is a recently completed tender for 1 200 MW of renewable projects with storage in India, which will lead to the installation of 600 MW of battery storage with five hours storage duration to provide firm supply to the Indian system (The Economic Times, 2020).

Furthermore, BESS can also provide vital system services. This however requires that they be able to bid into ancillary service markets to make them suitably attractive for developers. In most jurisdictions, to be cost‑effective a BESS currently would need to combine multiple revenue streams, driven by the broad range of services it can provide. This would challenge existing policy, market and regulatory frameworks. However, if owned and operated by a TSO, several benefits could be realised without markets with revenue streams, and therefore provide a vision of how a BESS could be operated with the appropriate markets and incentives in place. An example of this in South Australia, where the 30 MW ECRIS-SA BESS is owned by ElectraNet, the DSO, but is leased to AGL, a large generation company. As a result, the BESS is able to provide regulated services such as reduced unserved energy and fast frequency response (for which no market currently exists in Australia), while AGL is able earn revenue through energy arbitrage and providing ancillary services through competitive markets (ElectraNet, 2020).

As VRE deployment accelerates, new flexibility requirements emerge and novel system services are created, the precision and speed of response from a BESS not only make it well-suited to providing these services, but it can also be the most cost-competitive when doing so. A prominent example is the recent auction for a new type of system service in Italy, an ultra-fast frequency regulation service or “Fast Reserve”, which aims to address stability challenges as the share of inverter-based generation increases in the system (Terna, 2020). Providers for this service were procured via a technology-neutral auction mechanism in a highly competitive auction, where 250 MW of BESS (comprising the entire auction) were awarded contracts to provide the service (Renewables Now, 2020). This follows the trend from a similar auction result in the UK a comparable service (Enhanced Frequency Response), for which the National Grid procured 201 MW of BESS in a competitive auction (KPMG, 2016).

Electrification of new flexible loads at scale has the potential to enhance power system flexibility

“Sector coupling” has been identified as a key strategy to promote economy-wide decarbonisation and broader macro-economic efficiency. It is defined as the intelligent linkage between the power sector and other energy-consuming sectors (e.g. industry, mobility and buildings), often through advanced sensing, communication and control technologies, that flexibly utilise demand to integrate VRE and reduce power system operational costs (IEA, 2019a). Sector coupling offers a significantly increased potential to reduce primary energy demand (through efficiencies and fuel switching) and increase flexibility of the demand-side of the power system, while also supporting power sector revenue sufficiency through electrification efforts which increase demand.

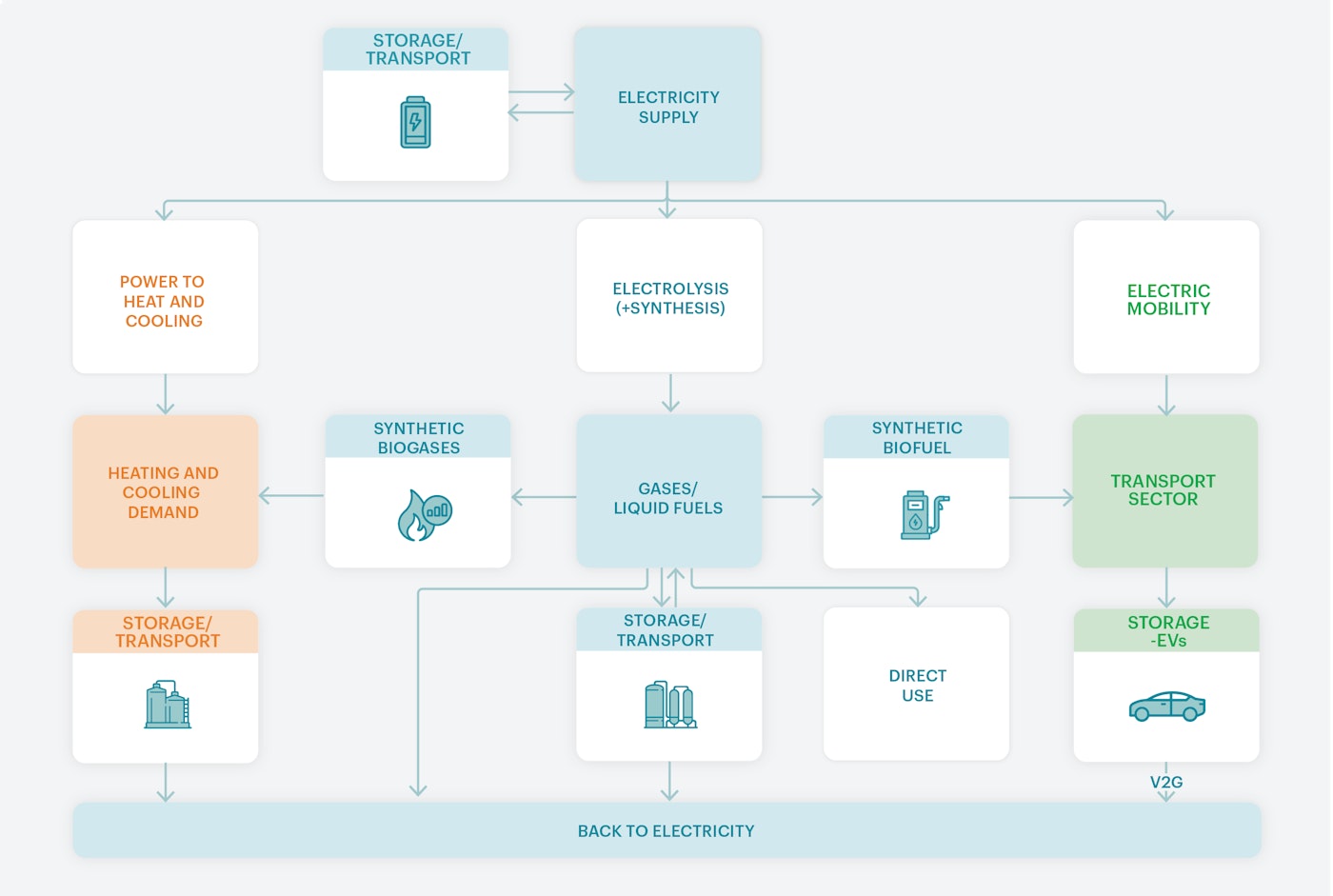

Conceptual diagram of sector coupling

Open

EVs provide a very good example of a newly electrified load. Europe is seeing a rise in personal cars and electric buses being deployed. As of 2020, there were 3.2 million BEVs in Europe, a rise from less than ten thousand in 2010. Globally, the stock of electric vehicles grew by 43% compared to 2019, with the number of vehicles exceeding 10 million vehicles by the end of 2020, and with BEVs representing two thirds of that total (IEA, 2021d). While the number of EVs is currently low in in Moldova, the Energy Community has started to consider the implementation of a revised Renewable Energy Directive (RED II) that, if fully transposed into Moldovan law, would set a target of 9% of renewable sources in the transport sector in Moldova by 2030.

Global electric car stock by region and mode, 2010-2020

OpenUnder a normal charging pattern, EVs may be expected to add to the peak demand requirements of electricity systems as charging patterns would follow the commuting patterns of drivers, with considerable charging expected when people return home from work, contributing to evening peaks. However, the potential for smart charging of EVs could add considerable demand-side flexibility into modern and future power systems alike. This can be in the form of either time-of-use rates or smart/controlled charging (V1G), with both currently being explored for applications in cities around the world. Looking even further into the future, deploying vehicle-to-grid (V2G) technologies could then allow EVs to both consume electricity and act as a generator, like a battery, and therefore contribute to peak demand (IEA, 2020d).

An example of smart charging has been demonstrated in the Netherlands, where 1 000 EV charging sessions were pooled by an aggregator, Jedlix, and allowed to shift in response to price signals (IEA, 2019a). The resulting charging pattern showed a significant shift in charging (relative to 1 000 charging sessions which were not influenced by price) in order to take advantage of lower prices during off-peak hours. The charging pattern also shifted to periods of low household demand, demonstrating its potential benefit for alleviating local congestion on distribution networks. Based on existing usage patterns in the Netherlands, there is also significant potential for the use of smart charging. At the time of the study, the majority of charging in the Netherlands (30-50% nationally) occurred during the evening peak period, while cars were parked four-times longer than the required charging time (IEA, 2019a).

Regular and smart EV charging patterns from 1 000 simultaneous sessions compared with average hourly household demand in the Netherlands

OpenAlternatives to new lines can help alleviate network congestion in the short term

Increased VRE penetration, particularly at locations where the grid is not strong, can exacerbate congestion in the network. Although congestion can have economic impacts, such as in the form of possible curtailment, it can also pose risks to the reliability of the system. Multiple options exist that may solve the issue, including grid reinforcement, demand management, targeted generation or storage, but these may not be economically attractive.

Cost-effective options are available to strengthen weak spots and better utilise transmission capacity without large-scale grid reinforcement. Typical measures are dynamic line rating (DLR), flexible alternating current transmission system (FACTS) devices and phase shifters.

As an example, DLR has been used to great effect in a number of systems worldwide (e.g. Australia, Belgium, France, Spain, Ireland, the United Kingdom and United States) to increase the limits of power transmission on their network and reduce congestion. Typically, a transmission line is rated at a certain capacity to carry power. While the limits of a line may be due to other considerations on the network (e.g. contingency, stability limits), the capacity is usually constrained by line sag, which happens due to current-related temperature increase. The conventional approach for determining the capacity of transmission lines is based on the worst-case assumptions (low wind speed, high ambient temperature and high solar radiation) (IRENA, 2020). However, the DLR calculates the capacity of transmission lines close to real time by taking into account actual operating and ambient conditions instead of assuming a fixed or seasonal capacity, therefore unlocking extra capacity on the transmission network. This can also have a good correlation with VRE, especially wind, as high wind output would occur during favourable conditions for increased capacity due to the DLR.

Grid requirements for the integration of VRE can also be considered as part of the infrastructure that is already being planned for other reasons. For example, Moldova is currently considering back-to-back converter stations with Romania at several locations to allow for asynchronous interconnection and electricity trade with its neighbour. However, with the appropriate technology, converter stations can also act as a grid support devices, especially in weak parts of the grid where the development of VRE may be considered in the future. While a number of technologies exist for these converter stations, HVDC technology that use Voltage Source Converters (VSC) can offer several benefits to the grid for integration of VRE, including frequency and voltage support, increasing grid stability as well as being able to contribute to black starts (Korompili et al., 2016).

Key policies for improving the technical flexibility of the Moldovan electricity system

Key overarching principles:

With appropriate changes to market, regulatory and operational frameworks, additional flexibility can be accessed from existing infrastructure (e.g. power plants, grids, interconnectors).

New technologies can provide system flexibility but require the appropriate market framework and incentives to enable their use.

More flexible and clean district heating networks, with the decoupling of electricity and heat generation and the replacement of fossil fuels with biomass, can aid the integration of variable renewables and advance the climate goals of Moldova.

Appropriate changes are needed to markets and regulations that enable the participation of distributed energy resources, including distributed generators, storage and demand-side response.

Procurement of new firm capacity and system services, including domestic reserve capacity, should be competitive (either market or auction-based) and allow the participation of all technologies on an equal basis, including more innovative solutions such as variable renewables plus storage.

Specific policies and actions for consideration

1. Encourage public-private dialogue and sharing of best practice

The relevant organisations should disseminate assessment results widely to ensure that power system stakeholders understand near- and long-term flexibility needs. Dissemination of accurate and high-quality data facilitates investment decisions and enables sound analysis by a broader community, including potential investors, academia, research organisations and other advisers to government decision makers.

Power system stakeholders should facilitate domestic capacity building through international learning and exchange. Many global best practices are emerging in the form of policy solutions, planning practices and decision support tools. Supporting international engagement for ministry, regulatory and utility staff can enhance human capacity and ensure that domestic stakeholders are working efficiently towards a common goal.

Policymakers should promote domestic analysis by facilitating data sharing and issuing public grants for clean energy research on system flexibility. They should also issue calls for proposals to allow the research and analysis community to directly answer their questions about promoting system flexibility. Analysis activities will not only serve to strengthen human, technical and institutional capacity, but also help inform policy priorities and the next steps for policymaking.

Power system planners should convene and participate in domestic and international workshops to share information on and discuss power system flexibility issues and opportunities. Workshops can help raise awareness of system flexibility issues, review analysis and assessment results, advance dialogue around the evolution of market structures, build local capacity and help enhance investment environments.

Policymakers should engage directly with power plant operators and original equipment manufacturers (OEMs) to discuss the future flexibility requirements of the power system. Such dialogue can help communicate policy objectives and power system transformation goals to the plant owners, highlight power plant flexibility as a potential avenue for performance and revenue improvement, help policymakers understand the requirements of plant operators, and inspire power plant flexibility retrofit concepts from the OEMs.

2. Incentivise a range of flexibility solutions

Policy makers and regulators need to ensure that flexible operation of power plants is appropriately incentivised, with appropriate price signals for investment in flexibility that take into account new operating assumptions.

Flexibility remuneration solutions must be adapted to the specific circumstances of each power system and its broader goals. In the case of Moldova, policymakers should ensure that there are appropriate incentives to make domestic CHP more flexible through the decoupling of electricity and heat.

Policymakers should assess whether, in the absence of appropriate market signals, it may be appropriate to offer direct financial incentives to encourage the investment in retrofits or new plants with highly flexible components. Paying an incremental incentive upfront may reduce the need for more expensive flexibility investments in the future.

Policymakers and regulators should ensure the removal of entry barriers for distributed resources as flexibility providers, such as the high transaction costs associated with “qualifying” these small-scale resources for market participation. They must ensure that the necessary qualification requirements allow participation from the full range of flexible resources, taking into account the limitations of each technology.

As part of new market rules, new legal or administrative frameworks should ensure that new actors such as aggregators can fully participate in the new energy and/or ancillary services markets.

Parties responsible for grid planning and investment should adopt advanced strategies to increase available grid capacity, boost system flexibility and reduce operational constraints placed on power plants. This can include targeted investment in new, multi-use technologies that allow for grid support including high-voltage transmission lines, distribution networks, digital control systems and certain network infrastructure components (e.g. VSC-HVDC converters).

The regulator and market operator must ensure that appropriate changes are implemented to various market rules to ensure that storage can act as both a wholesale buyer and seller of electricity, while avoiding any inappropriate charges for this double role (e.g. consumer tariffs).

Regulators and market operators should implement market rules and regulatory changes that enable benefit-stacking in battery storage deployment so that batteries can be used to their full potential. Measures may include removing exclusivity clauses in ancillary services contracts, changing the specifications of flexibility services to allow for participation in multiple services, or redefining the role of storage owners to allow their participation in additional markets.

3. Consistently re-evaluate system flexibility needs

Policymakers and regulators should mandate regularly planned system adequacy assessments to include technical flexibility assessments. Creating a regulatory requirement to ensure these exercises also includes a technical flexibility assessment which would help to ensure that system flexibility insights can be used to inform long-term planning exercises.

Policymakers should facilitate the creation and maintenance of a comprehensive system-wide flexibility inventory. Assembling a clear picture of options aimed at increasing system flexibility will help to ensure that planning exercises are informed by the best possible data on options for the future.

A three-step vision for the system integration of renewables in Moldova

This section provides a vision of a modern, clean and secure electricity system in three steps, outlining the economic, environmental and social benefits it could deliver. The roadmap to this vision is split into three different timeframes: short- (1-5 year), medium- (5-15 years) and long-term (>15 years). While each timeframe has its own individual targets that detail the key actions needed to deliver this vision, they all stop short of offering a concrete timeline.

Delivering the vision of sustainable and secure electricity for Moldova

In order to provide the necessary conditions to deliver this vision a key set of policies, programmes and initiatives need to be rolled out over the three different timeframe periods: short term (ST), medium term (MT), long term (LT).