IEA (2020), Moldova energy profile, IEA, Paris https://www.iea.org/reports/moldova-energy-profile, Licence: CC BY 4.0

Market design

National market structure

Market information presented in this section does not cover the Transnistria region, as Moldovan state institutions do not monitor its energy sector. Only two electricity market participants from the Transnistria region requested and obtained licences from ANRE: Cuciurgani-Moldavskaya GRES (MGRES) power plant requested a licence for electricity production, and a supply licence was issued to Joint Stock Company (JSC) Energocapital.

Overall market restructuring is ongoing in Moldova, in accordance with provisions of the Third Energy Package and EU directives.

Electricity

The country’s electricity sector relies on limited production sources: domestic supply comes from two combined heat and power (CHP) plants in Chisinau operated by Termoelectrica (http://www.termoelectrica.md/), one CHP plant in Balti (http://cet-nord.md/), an additional eight small CHP plants and the Costesti hydropower plant, all together covering up to 20% of consumption west of the Dniester River. The Cuciurgani-Moldavskaya GRES gas-fired power plant (installed capacity of 2 520 MW), owned by the Russian company Inter-RAO and located in Transnistria, covers the remainder of consumption (http://moldgres.com/). In addition, Ukrainian companies have regained access to the Moldovan market after the lifting of electricity export restrictions imposed by Ukraine in November 2014 due to the unavailability of coal-fired power plants in Eastern Ukraine.

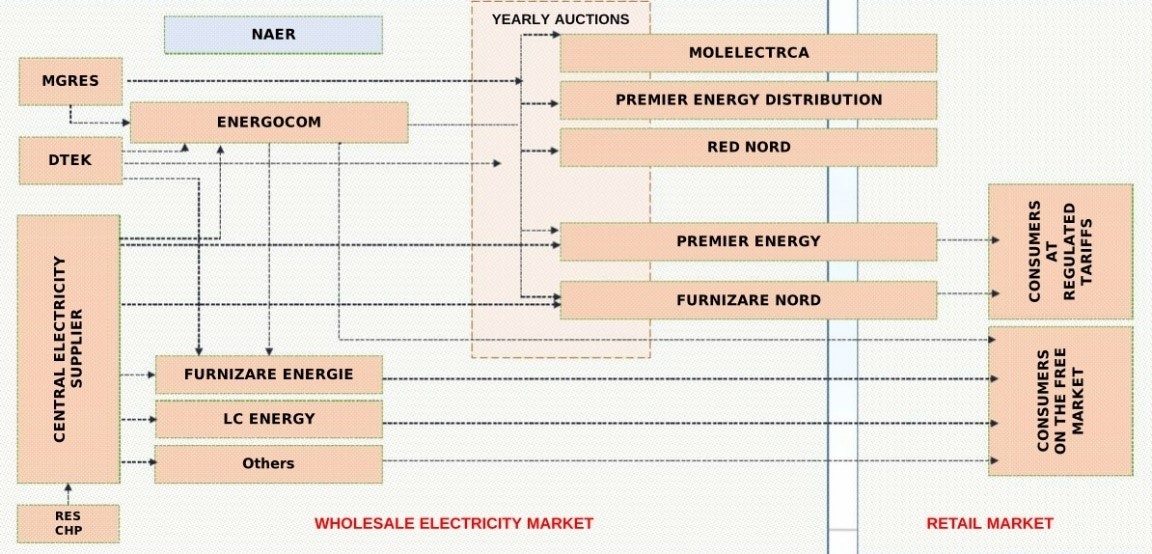

Moldova's electricity market scheme

Open

The TSO and two DSOs have been legally unbundled from generation and supply activities. The Electricity Law provides an ownership unbundling model for the TSO and the conditions for certification as per Moldova’s commitment to the Energy Community Treaty (ECT).

Moldelectrica is the state-owned TSO and central dispatcher for the whole country, including the Transnistria region (http://moldelectrica.md). RED Nord (state-owned; http://rednord.md) and Premier Energy Distribution (privately owned; https://premierenergy.md) are the DSOs. Premier Energy Distribution covers two-thirds of the country, and in 2020 privatisation will also be proposed for RED Nord.

The wholesale electricity market is based on bilateral contracts. Under the new Law on Electricity, former electricity suppliers at regulated tariffs (Premier Energy and Furnizare Nord) are designated to act as universal suppliers for end-consumers and as suppliers of last resort for a period of ten years, 2016‑25 (http://fee-nord.md). Only one customer, a cement factory, has switched suppliers and is now supplied at unregulated prices by state-owned Energocom. Despite the Electricity Law granting switching eligibility to all customers, the competitiveness of retail suppliers is hampered because they only have limited access to wholesale supplies of electricity. As a result, there are very few retail suppliers for consumers to choose from.

Oil

Moldova relies completely on imports of petroleum products (99.9%) to meet domestic oil demand. It consumed 860 kilotonnes (kt) of petroleum products in 2019.

At the end of 2016, Frontera Resources (a US company) and Moldovan authorities signed a 50-year concession agreement for the exploration and development of hydrocarbon resources in southern Moldova. The contract grants Frontera Resources the exclusive right to explore and develop oilfields within an area of 12 000 km2, focused around the Dobrudga Basin. The aim of this concession is to increase and diversify Moldova’s energy sources and reduce the country’s dependence energy imports.

Moldova’s total storage capacity for petroleum products is over 150 000 m3, including state and industry storage but excluding the army’s. In addition, the Giurgiulesti terminal has eight tanks for petroleum product storage with capacity of 63 600 m3 at its disposal.

Gas

Moldova’s gas market is entirely monopolised: the majority of functions – imports, supply management, cross-border and national transmission, distribution and retail – are performed by MoldovaGaz and its subsidiaries (http://www.moldovagaz.md/). MoldovaGaz is owned by Gazprom (50%), the Moldovan government (36.6%) and the Transnistrian administration (13.4%).

MoldovaTransgaz, a MoldovaGaz subsidiary, was the only gas TSO (except Tiraspoltransgaz from the Transnistria region) until January 2015 when VestMoldTransGaz also received a transmission licence (http://www.moldovatransgaz.md/). The Law on Natural Gas introduced three possible unbundling models for gas TSOs and transposed a derogation granted by the Ministerial Council of the ECT allowing unbundling until 1 January 2020.

Source: European Union High Level Advisers’ Mission 2019-2021.

Moldova has achieved progress in restructuring Moldovagaz. Transmission and distribution system operators have all been legally unbundled, and all distribution companies of Moldovagaz have also been unbundled since January 2016 (since 2013 for the DSO Chisinau-gaz), with only the supply function still provided by Moldovagaz. The 12 main gas DSOs in Moldova are subsidiaries of MoldovaGaz, with other smaller DSOs covering less than 2% of gas distribution. The Law on Natural Gas transposed unbundling provisions for distribution operators, including exemptions for those serving less than 100 000 customers.

Moldovagaz acts as an importer, wholesaler and retail supplier. Household customers and small enterprises are entitled to regulated gas supplies by the supplier under public service obligations (PSOs).

The Actual Unbundling Plan, which provides for the ITO model, was sent to the Moldovan Energy Regulatory Authority (ANRE) in December 2019. Regarding MoldovaGaz’s supply activities, a new subsidiary will be created, in order to avoid any conflicts of interest between MoldovaGaz and its daughter ITO. Implementation should happen by 1 September, 2020.

VestMoldTransGaz, which operates Moldova’s section of the new Iasi-Ungheni-Chisinau gas interconnector pipeline, was created in June 2014 and received a TSO licence in January 2015. State-owned Energocom purchases and imports gas from the EU market (from Romania) and uses VestMoldTransGaz’s transmission service.

VestMoldTransgazis is fully unbundled in terms of ownership from any other energy activity in Moldova.

Source: European Union High Level Advisers’ Mission 2019-2021.

There are no gas storage facilities in Moldova and no access to liquefied natural gas (LNG). Domestic gas production meets less than 0.01% of demand, and until the end of 2016 Valiexchimp had been the only company to explore and exploit gas and oil in southern Moldova.

Coal/peat

None.

Nuclear

None.

Large hydro

None.

Energy efficiency

The Energy Efficiency Agency (EEA), an administrative body subordinate to the Ministry of Economy and Infrastructure, is responsible for policy implementation in energy efficiency and renewable energy (http://aee.md). Besides policy implementation, the EEA manages the National Communication Strategy in energy efficiency and renewable energy sources, aimed at promoting rational energy consumption and the use of green energy.

Until July 2018, financing of energy efficiency measures and renewable energy projects was undertaken by the Energy Efficiency Fund (EEF), which was an independent body governed by its Administrative Board (http://fee.md/index.php?l=ro). Since its creation in 2012, the EEF has been financing projects mainly in the public sector, highlighting the exemplary role of public buildings in energy efficiency. The calls for proposals under development by the EEF relied on market-driven financial instruments, moving away from high grant-component financing (up to 75%) towards energy performance contracts and preferential loans.

According to the recently adopted (July 2018) new Energy Efficiency Law, the institutional framework for the implementation of energy efficiency policies was reviewed with a view to strengthening the capacity of the competent authority. In particular, the Energy Efficiency Agency was reorganized through a merger (acquisition) with the Energy Efficiency Fund (the absorbed organization).

Other central public authority dealing with renewables and energy efficiency are the Ministry of Agriculture, Regional Development and Environment (MoARDEnv). The MoARDEnv promotes energy efficiency and renewable energy, and finances related sectoral activities through the National Ecological Fund, recognising the considerable impact of these projects on reducing greenhouse gas (GHG) emissions.

Renewable energy

The renewable energy market – overseeing electricity and biofuels, and the heating and cooling sub-sector – is regulated by ANRE, an independent authority established in 1997 to introduce market mechanisms in the energy field while protecting consumer and investor interests. It issues licences, regulates fuel and power prices, and establishes energy pricing principles and methodologies for calculating tariffs, including for renewables’ support mechanisms through secondary legislation.

In the renewable electricity market, the key stakeholders are the grid operators: the TSO Moldelectrica, and two DSOs – RED Nord (state-owned enterprise) and Premier Energy Distribution (private company) - and the Central Electricity Supplier – SA Energocom (state-owned enterprise), appointed by the government.

The main companies involved in gas supply, in the case that biogas producers eventually feed purified energy resources into the national network, are Moldovagaz and its affiliates.

The centralised district heating and cooling sector, which exists in the cities of Chisinau and Balti, is managed by JSC Termoelectrica and JSC CET Nord.

Local public authorities are also influential in the energy efficiency and renewable energy sector: they develop their own plans and programmes in both energy efficiency and renewable energy, and raise funds to implement projects in priority sectors. These public authorities are also responsible for issuing permits and certificates, such as urban planning permits for deep refurbishment of buildings (when an urban planning permit is required), and can make decisions on land destination for renewable projects when necessary.

Regulatory framework

To promote development of the energy sector, Moldova’s legal framework was designed to correspond with the European framework and the relevant acquis of the Energy Community. Primary legislation includes the Law on Energy (2017), the Law on Natural Gas (2016), the Law on Electricity (2016), the Law on Petroleum Products (2001), the Law on Heat and Cogeneration Promotion (2014), the Law on Promotion of Energy from Renewable Sources (2016) and the Energy Efficiency Law (2018).

With adoption of the Laws on Natural Gas and Electricity (May 2016) and the Law on Energy (September 2017), Moldova fully transposed its Third Energy Package requirements.). The new laws:

• Define the respective competences of government authorities, and the objectives, duties, powers and rights of ANRE.

• Define the tasks, rights and responsibilities of producers, TSOs, DSOs and suppliers.

• Define the concept of public service obligations and the basic rules for imposing them, which may relate to security of supply, regularity, quality and price of supplies, and environmental protection, including energy efficiency, energy from renewable sources and climate protection.

• Provide directives for unbundling, designation, certification and independence of TSOs and DSOs.

• Address network development and the authority to make investment decisions.

• Define the concepts of vulnerable customers and customer protection, which may be applied to energy poverty.

• Define market organisation, market liberalisation and third-party access to transmission and distribution systems.

The new Law on Energy transposed provisions for independence of the energy regulator and its enhanced powers.

The Law on Heat and Cogeneration Promotion was approved by the Parliament in May 2014 in accordance with international standards and EU directives; it is expected to define the responsibilities of dwelling-owners’ associations, consumers and suppliers.

Renewables and energy efficiency developments in Moldova are governed by the new Law on Energy Efficiency (2018), aligned with EU directives on energy efficiency, the Law on Energy Labelling (2014), the Law on Energy Performance in Buildings (2014) and the Law on Eco-design (2014). A new Law on Promotion of Energy from Renewable Sources was adopted in February 2016, but its entry into force was delayed until 25 March 2018 to allow the competent authorities to adopt the necessary secondary legislation.

Apart from primary legislation, a number of secondary normative acts have been approved by ANRE, particularly on issues such as licensing, market rules, investments, tariffs, consumer protection, access and connection to electricity networks, contracting, supplying and billing of energy, and guarantees of origin.

The Regulatory Programme, prepared and approved by ANRE, lists normative acts and actions, with strict deadlines for approval and implementation, to be implemented by ANRE to make the energy market functional and competitive. More than 30 secondary acts were amended and adopted by 2019 for implementation of the electricity acquis alone. This includes certifying the TSO and updating the rules for the electricity market, such as those pertaining to balancing and imbalance settlement.

Tariffs

ANRE regulates and approves electricity, gas and heat tariffs in Moldova. Tariff regulation is mainly well-defined and based on global good practices (http://documents.worldbank.org/curated/en/101211468060253519/pdf/Moldova-Tariff-and-Afordability-Study-2015-10-26-FINAL.pdf):

- Effective total revenue yields, providing a fair return with a socially desirable level of service and safety. (In Moldova, total revenue has been determined effectively, with a rate of return based on the weighted average cost of capital [WACC], and a desirable level of service has been determined.)

- Stable and predictable revenue for utility companies. (Methodologies are determined for five to seven years in Moldova.)

- Stable and predictable consumer rates. (In Moldova, changes in operating costs may lead to sudden changes in consumer tariffs, but capital costs are included gradually.)

- Discouraging wasteful use of services. (Energy is billed based on consumption in Moldova, and in principle the total cost of production is covered.)

- Fairness of rates in the apportionment of total costs of service among different consumers. (Distribution tariffs in Moldova aim to account for differences in cost of service at different voltage/pressure levels.)

- Avoidance of discrimination in rates. (There is no cross-subsidisation in Moldova: consumers with similar connections pay the same tariff.)

Tariffs and methodologies are transparent and are published on ANRE’s website, and ANRE also organises public hearings before tariff approvals to ensure transparency of the approval process.

Regional markets and interconnections

Electricity

Moldova’s electricity system operates synchronously with Ukraine’s, and the neighbouring systems are interconnected by 11 lines of 110 kV and 7 lines of 330 kV.

Although Moldova is interconnected with Romania, the two systems do not operate in parallel but can function together in island mode (four islands can be created). Romania’s power system is part of ENTSO-E, and Moldova is currently working towards full synchronisation. The feasibility study for Moldova and Ukraine to interconnect with ENTSO-E outlines the next steps and measures to be taken.

The major challenge is to establish, in a short time, the proper and stable infrastructure connections with the European Union. In the interim, asynchronous interconnection is considered a transitory step towards final synchronisation. Priority projects are:

- Back-to-back (BtB) station Vulcanesti and 400‑kV overhead line (OHL) Vulcanesti-Chisinau

- BtB station and 400‑kV OHL Balti-Suceava

- BtB station and 400‑kV OHL Romania-Ungheni-Straseni (optional).

Natural gas

Moldova is connected to the Ukrainian gas transportation system that transits all gas imports to Moldova from Russia on a bilateral contract. Moldova also transits gas to the border with Romania, to be sold on European markets in Turkey and the Balkans. The total length of Moldova’s three transit pipelines is 247 km with a total capacity of 34.6 bcm/y. Another pipeline interconnection with Ukraine in northern Moldova connects two parts of the Ukrainian network; this pipeline, with a capacity of 9.1 bcm/y, is important to Moldova’s supply security, as it connects to the storage facilities of Bogorodchany in Ukraine. In practice, the capacity utilisation rate of all cross-border pipelines is only about 45% to 55%, i.e. approximately 19 bcm/y of natural gas is transited through the southern route (in 2019 it deceased to 10 bcm/y) and 1 bcm/y through the northern one.

The Iasi-Ungheni interconnector gas pipeline to Romania became operational in 2015 but can be used only at very low capacity due to technical constraints limiting the amount of natural gas that can be injected into Moldova’s transmission system, and to the low availability of gas in the Romanian gas network supplying Iasi. The government plans to extend the pipeline to Chisinau by 2020, maximising its 1.5‑bcm/y capacity to meet all of Moldova’s gas consumption, but not that of the Transnistrian region.