Cite report

IEA (2022), How to Avoid Gas Shortages in the European Union in 2023, IEA, Paris https://www.iea.org/reports/how-to-avoid-gas-shortages-in-the-european-union-in-2023, Licence: CC BY 4.0

Report options

Executive summary

European and global natural gas markets are not yet out of the danger created by Russia’s cuts to pipeline deliveries of gas. Conditions have been turbulent, prices have been extremely volatile, many households and gas-intensive sectors have suffered – as have many gas-importing countries worldwide. Overall gas demand in the European Union (EU) is set to fall by around 10% in 2022, a drop of around 50 billion cubic metres (bcm). Some 10 bcm of this drop is due to curtailed production rather than efficiency gains or fuel switching. But the situation could be worse: European Union and national policies, markets, consumer actions, non-Russian suppliers and mild weather have all played a part in compensating for the missing Russian deliveries. As of early December, Europe’s gas storage levels remain above their five-year average.

Several key factors could make 2023 an even sterner test:

- Russian supplies may have further to fall. Although far below the levels seen prior to Russia’s invasion of Ukraine, total gas volumes delivered by pipeline from Russia to the European Union over the course of 2022 are set to be around 60 bcm. Russian pipeline deliveries are likely to be considerably lower in 2023 and could drop to zero, leaving an even larger hole in European and global gas supply.

- Supplies of liquified natural gas (LNG) will be tight. The European Union as a whole is set to add an estimated 40 bcm of LNG import capacity by the end of 2023. However, only around 20 bcm of additional LNG supply is expected to come onto the market over the course of the year. Meanwhile, Chinese import demand could well recover from the unusually low levels seen in 2022, intensifying competition for LNG cargoes. Europe’s ability to secure higher LNG imports in 2022 was enabled in large part by lower import demand from China.

- The unseasonably mild temperatures seen at the beginning of winter may not last. In our estimation, the mild weather in Europe in autumn 2022 has cut gas demand by more than 10 bcm. There is no guarantee that temperatures will be as forgiving for the remainder of the winter, or for 2023 as a whole.

If pipeline imports to the European Union from Russia drop to zero in 2023 and Chinese LNG demand rebounds to 2021 levels, then the European Union faces a serious supply-demand gap opening up in 2023. In this analysis, we provide a stress test for the EU gas balance in 2023 and find continued risks of renewed price volatility and turbulence in gas markets.

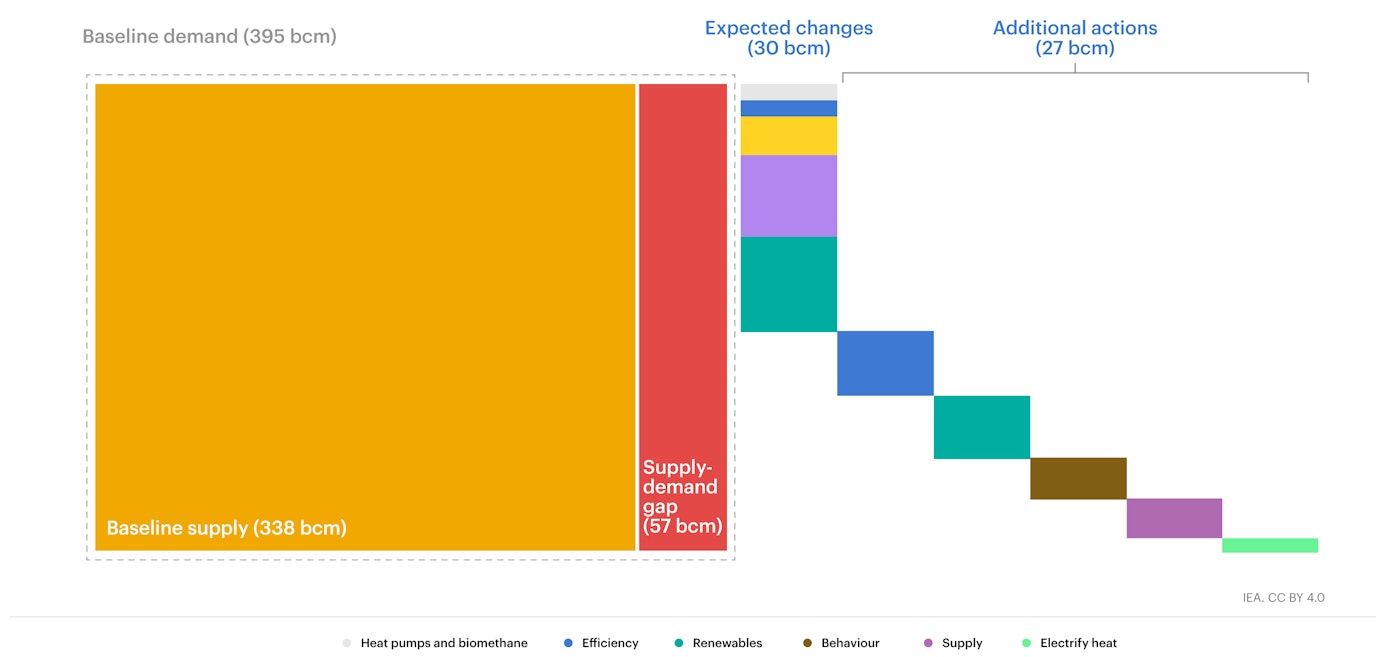

Of the overall supply-demand gap of 57 bcm that could arise in 2023, around 30 bcm is covered by actions that are already visibly in motion. A series of measures have been adopted by the European Union and by individual European countries to increase security of supply. These will help lead to new improvements in energy efficiency, installations of renewable capacity, installations of heat pumps and so on. A recovery in nuclear and hydropower output from the decade-low levels in 2022 should also help narrow the gap.

Closing the remaining deficit of 27 bcm requires a suite of additional near-term policy actions. This report identifies the practical actions that can be taken by governments and others to fill the potential supply-demand gap in 2023 and avoid excessive strains for European consumers and for international markets. The analysis includes real-world examples of measures that could be implemented and quantifies their impacts.

The key policy actions to reduce demand are:

- incentivise faster improvements in energy efficiency

- allow for more rapid deployment of renewables

- accelerate the electrification of heat

- encourage behaviour changes among consumers.

With the short-term horizon of 2023, there is little scope to bring additional supplies to market, but reducing the waste of gas via flaring and leaks to the atmosphere offers some upside, as does boosting production of low-emissions gases.

The actions set out in this report offer a pathway to a more secure and balanced EU gas market in 2023, in ways that are consistent with the EU’s climate goals. As ever, solidarity among EU member states and a close international dialogue on energy markets and security will be crucial. If these additional structural measures are implemented, this will minimise the call on less desirable ways of balancing the market, such as price spikes, industrial demand destruction, increased generation from coal-fired plants, or fierce international competition for LNG cargoes.

The additional investment required to implement the actions described in this report is around EUR 100 billion. This is less than one-third of the EUR 330 billion that has been mobilised by EU member states over the last year in emergency packages to shield consumers from high prices. The additional EUR 100 billion in upfront spending, with public support helping to underpin investment by companies and households, leads to lasting reductions in gas demand; a similar amount would be saved in around two years by lower gas import bills. The risks to European and international gas markets are real, but so too are the solutions.

Expected changes and additional actions to close the supply-demand gap in the European Union in 2023

Open