Cite report

IEA (2022), Global EV Outlook 2022, IEA, Paris https://www.iea.org/reports/global-ev-outlook-2022, Licence: CC BY 4.0

Report options

Trends in electric light-duty vehicles

Over 16.5 million electric cars were on the road in 2021, a tripling in just three years

Global electric car stock, 2010-2021

OpenElectric car sales more than doubled in China, continued to increase in Europe and picked up in the United States in 2021

Electric car registrations and sales share in China, United States, Europe and other regions, 2016-2021

OpenElectric car sales are accelerating, with China and Europe setting new records

Sales of electric cars reached another record high in 2021 despite the Covid-19 pandemic and supply chain challenges, including semiconductor chip shortages. Looking back, about 120 000 electric cars were sold worldwide in 2012. In 2021, that many were sold in a week.

After increasing in 2020 despite a depressed car market, sales of electric cars – battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) – nearly doubled year-on-year to 6.6 million in 2021.1 This brought the total number of electric cars on roads to over 16.5 million. As in previous years, BEVs accounted for most of the increase (about 70%).

EV markets are expanding quickly. Electric car sales accounted for 9% of the global car market in 2021 – four-times their market share in 2019. All the net growth in global car sales in 2021 came from electric cars. Sales were highest in the People’s Republic of China ("China" hereafter), where they tripled relative to 2020 to 3.3 million after several years of relative stagnation, and in Europe, where they increased by two-thirds year-on-year to 2.3 million. Together, China and Europe accounted for more than 85% of global electric car sales in 2021, followed by the United States (10%), where they more than doubled from 2020 to reach 630 000.

China accelerates EV vehicle deployment as a new five-year plan sets more ambitious objectives

More electric cars were sold in China in 2021 (3.3 million) than in the entire world in 2020 (3.0 million). China’s fleet of electric cars remained the world’s largest at 7.8 million in 2021, which is more than double the stock of 2019 before the Covid-19 pandemic. Over 2.7 million BEVs were sold in China in 2021, accounting for 82% of new electric car sales. Electric cars accounted for 16% of domestic car sales in 2021, up from 5% in 2020, and reached a monthly share of 20% in December, reflecting a much quicker recovery of EV markets relative to conventional cars.

This impressive growth comes alongside government efforts to accelerate decarbonisation in the new 14th Five-Year Plan (FYP) (2021-2025), continuing the trend of progressively strengthening policy support for EV markets in the past few FYP periods. The current FYP includes medium-term objectives in transport such as reaching an annual average of 20% market share for electric car sales in 2025. Notably, China had extended subsidies for electric cars for two years in the wake of the pandemic, with a planned scale-back of 20% in 2021 and 30% in 2022 – but by the end of 2022 they will be phased out. There are also a number of subnational regulations that give preferential treatment to EVs, such as local subsidies or tax breaks, financial incentives and exemptions from purchase limitations.

Growth in 2021 in spite of declining subsidies indicates the maturing of China’s EV markets. Consumer anticipation of declining subsidies may also have supported record high sales, although the pace at which subsidies effectively decline warrants further examination. China’s electric car market can be expected to further expand in 2022 and beyond, as investments from previous years ramp up production capacity and bear fruit.

Europe sustains strong growth after its 2020 boom, reaching the world’s highest electric car penetration rates

In Europe, electric car sales continued to increase in 2021 by more than 65% year-on-year to 2.3 million, after the boom of 2020. EV sales remained strong even though the overall automotive market has not yet fully recovered from the pandemic: total car sales in 2021 were 25% lower than in 2019. Over the 2016-2021 period, EV sales in Europe increased by a compound annual growth rate (CAGR) of 61%, the world’s highest, above China (58%) and the United States (32%).

Overall, electric cars accounted for 17% of Europe’s auto sales in 2021. Monthly sales were highest in the last quarter, when electric car reached a 27% sales share and surpassed diesel vehicles for the first time. However, the distribution is uneven across countries. The largest market in terms of number of EVs sold remains Germany, where electric cars accounted for 25% of new cars sold overall, which increased to one-in-three in November and December. Germany offers some of the highest subsidies in Europe.

The highest market share for new electric car sales in 2021 in Europe are Norway (86%), Iceland (72%), Sweden (43%) and the Netherlands (30%), followed by France (19%), Italy (9%) and Spain (8%). For the first time in 2021, the bigger market of the United Kingdom was not included in European Union-wide regulations, although it has put in place national law that mirrors EU regulations. The key driver underpinning EV growth in Europe is the tightening CO2 emissions standards that occurred in 2020 and 2021. The expansion of purchase subsidies and tax benefits in major markets also contributed to the acceleration of sales.

In 2021, there were about 5.5 million electric cars on European roads – more than three-times the stock of 2019 before the Covid-19 outbreak. As in previous years, new sales were evenly split between BEVs and PHEVs, in contrast to China where BEVs typically score a clear lead. In 2021, Europe’s stock of electric cars was about 55% BEVs, a share that has remained steady since 2015 and is lower than other regions such as China (80%) and the United States (65%). This may reflect a corporate strategy among European automakers and original equipment manufacturers (OEMs) of offering PHEV versions of many large and high-end car models to capitalise on their experience in developing conventional drivetrains (a necessary part of PHEVs), whereas their experience in electric powertrains is more recent. In addition, the CO2 regulation structure in Europe makes PHEVs very attractive for OEMs in terms of compliance.

A new wave of electric car uptake in the United States

After two years of consecutive decline of 10%, electric car sales increased in the United States in 2021. About 630 000 electric cars were sold – more than in 2019 and 2020 combined – bringing the total stock of electric cars to over 2 million. About 75% of new EV sales were BEVs, up from 55% just five years ago, resulting in a higher share of BEVs relative to PHEVs today over the total EV stock (65%) than in 2015-2016 (about 50%). Relative to other regions, the overall car market recovered faster from the pandemic in the United States, but electric cars still doubled their share to 4.5% in 2021. Tesla accounts for over half of all units sold, and there are generally fewer models available in the United States than in other major markets. Some of the main drivers underpinning growth in the United States in 2021 were the increased production of Tesla models and the availability of new generation electric models by incumbent automakers.

Available electric car models may reached 450 in 2021, with particular expansion of SUVs

Automakers accelerate efforts to offer new electric options and EV driving range continues to expand

Five times more models in 2021 than in 2015

Globally, there were over 450 electric car models available in 2021, an increase of more than 15% relative to 2020 offerings and more than twice the number of models available in 2018. Over the 2015-2021 period, the CAGR for new models was 34%. The increase in the number of available EV car models is associated with a notable increase in sale volumes in all markets. This reflects the interests of automakers to capture EV market share by producing new options quickly to appeal to an broadening pool of consumers.

As in previous years, China offers the broadest portfolio, with nearly 300 models available, compared with 184 in Europe and nearly 65 in the United States. Thanks to consistently high electric car sales, Chinese automakers have been able to diversify offerings and market a larger number of products over the years. Availability increased in all major markets relative to 2020, but increased more in Europe (26%) and the United States (24%) than in China (13%) as these markets catch up.

Automakers and consumers continue to prefer SUVs

In 2021, global sales of conventional sport utility vehicles (SUVs) marked another record, setting back efforts to reduce emissions. This development is also seen in EV markets. SUVs and luxury models typically generate much larger profit margins, which is one reason why automakers promote them and boost supply. About half of the electric car models available in major markets in 2021 were SUVs, far ahead of small (10%) or medium-size models (23%).

Small models found most success in China (13% of available models), with the example of the best-selling Wuling Hongguang Mini EV, and least in the United States (2%). In China, there were more than ten new offerings for small and medium cars relative to 2020 (up 13%), versus 22 new models offered for larger models and SUVs (up 13% as well). Meanwhile, there were many more new offerings for large models and SUVs in Europe and the United States – about 50 in total – than for small and medium EVs, hence the number of models available in these segments increased disproportionately.

While smaller electric car models are BEVs for the most part, the share of PHEVs in larger models and SUVs is higher, especially in Europe and the United States. This may result from automakers discontinuing some high power, luxury conventional vehicle models to offer these as PHEVs instead. In 2022 and beyond, expectations are for even more electric SUVs to reach markets as automakers and OEMs accelerate efforts to electrify this fast growing segment to simultaneously seek profits from larger models and comply with policy and market regulations. This is expected to result in even higher demand for large battery designs and the raw materials to produce them.

BEV and PHEV driving range is increasing, albeit slowly

Over the 2015-2019 period, the sales-weighted average range of new BEVs increased steadily at a 12% annual growth rate on average, but then stagnated in 2019-2020, and only moderately increased in 2021 (up 3.5%), to reach 350 kilometres (km). The CAGR over the 2015-2021 period remained high at 9%, reflecting sustained efforts to improve vehicle efficiency and increase battery size. The sales-weighted average driving range of new PHEVs increased by 8.5% in 2021 and exceeded 60 km for the first time, after several years of relative slow growth, resulting in a 2.7% CAGR over the 2015-2021 period. This increase in part is due to the availability of new PHEV models equipped with larger batteries and thus lower rated CO2 emissions.

Driving range remains an important consideration for consumers. Automakers typically aim for longer ranges to boost sales. On the other hand, increasing driving range typically implies larger batteries, increased resource needs and higher prices. In the long run, driving range is likely to plateau, as a market optimal vehicle range is reached and fast charging becomes more widely available.

Evolution of average range of electric vehicles by powertrain, 2010-2021

OpenEV model availability and sales share have increased significantly

Number of available EV models relative to EV sales share in selected countries, 2016 and 2021

OpenElectric car sales spiked in emerging markets in 2021

Electric car models available in selected emerging markets by segment, 2016-2021

OpenSales and models available by region, 2016-2021

OpenEV sales and model availability remain limited in emerging markets, despite positive signals

Sales of electric cars picked up in 2021

Electric cars have not met similar success in all regions in the last decade. China, Europe and the United States account for nearly two-thirds of the overall electric car market and their aggregated sales represented 95% of total electric car sales in 2021. In large economies such as Brazil, India and Indonesia, EVs account for less than 0.5% of total sales, with some growth over the last years, albeit from low sales levels.

There were positive developments in 2021, however, possibly signalling stronger prospects. Electric car sales in emerging markets spiked to unprecedented levels in 2021: more than doubling in Asia to 33 000; in Eastern Europe, Central and West Asia to 32 000; and in Latin America and the Caribbean to 18 000. In Eastern Europe, Central and West Asia, this growth was led by BEVs, which accounted for about 65% of new electric car sales. In Latin America and the Caribbean, sales were more evenly split with PHEVs. Although electric car sales remained low across Africa, they increased by 90%, of which BEVs accounted for 85%.

Model availability remains limited and prices high

Few EV models are available in emerging markets. In 2021, there were only 90 distinct models available across members of the Global Environment Facility’s Global E-Mobility Programme, which counts more than 50 countries. Less than 20 models were available throughout Africa, and less than 40 in emerging Asian markets. In Latin America and the Caribbean 75 models were available, which are slightly above the number of models in the United States, but far behind Europe and China.

Available models tend to be the larger or more expensive ones in emerging markets. Across the countries in the GEF programme, two-thirds of the available models were large cars and SUVs in 2021, which is similar to Europe and the United States despite stark disparities in purchasing power. In India, Tata’s Nexon BEV SUV was the best-selling model – accounting for two-thirds of EV sales – and most other offerings were SUVs as well. In South Africa, three-quarters of the available options for electric cars are from high-end brands. Similar observations can be made across the developing and emering economies.

For many years, major EV markets such as the China, Europe and United States also have been dominated by high-end models, before car manufacturers could offer less expensive, mass-market options. Even though some small electric vehicle models are now available, prices remain too high for mass-market consumers in emerging market countries. As a result, mostly consumers from high income groups are able to purchase EVs, thereby limiting mass-market adoption. The lack of widely accessible charging infrastructure and weaker regulatory push also contribute to slower market uptake in emerging markets and developing economies.

Global total spending on electric cars nears USD 280 billion in 2021 and the share of government support in total spending continues to decline

Consumers and governments spend more and more on electric cars

Consumer and government spending on electric cars doubled in 2021, led by considerable increases in China and Europe

Worldwide consumer and government spending on electric cars continued to increase in 2021. Consumer spending doubled to reach nearly USD 250 billion, about eight times what was spent five years ago. Government spending, such as through purchase subsidies and tax waivers, also doubled to nearly USD 30 billion. The resulting government share of total spending for electric cars remained at 10%, down from about 20% only five years ago.

In China, consumer spending nearly tripled to about USD 90 billion in 2021. Government spending also increased, doubling relative to 2020 levels to reach USD 12 billion. However, government spending on a per electric car basis decreased from about USD 5 000 to USD 3 750, in a declining trend since 2016 highs. The drop in 2021 reflects declining per unit subsidies and spiking sales.

Europe massively increased public spending on electric cars in the last two years. In 2019, public support for electric cars accounted for about USD 3.0 billion and levels have been rising steadily since 2016. In 2020, it more than doubled to USD 8 billion, and in 2021 it increased to USD 12.5 billion. Consumer spending similarly increased to USD 112 billion in 2021, resulting in a constant share of government in total spending since 2019 at about 10%. While government spending to support electric car uptake increased as a whole, the per unit support level remained flat in the range of USD 5 000 - 6 000 over the 2019-2021 period. This reflects two mechanisms that balance each other: increasing per unit subsidies in Covid-related stimulus packages; and tightening eligibility requirements for subsidies with a vehicle price cap (for equity considerations).

In the United States, consumer and government spending increased in 2021, although they lag behind levels in China and Europe. Consumer spending doubled to USD 30 billion relative to 2020 levels and government spending tripled to USD 2 billion. Public spending on a per unit basis ranks lower than in other regions, at about USD 3 200, which is above the support level of USD 2 300 provided in 2020, but below the 2019 level of USD 4 500.

Electric cars remain cheaper in China

The global sales-weighted average price of BEVs in 2021 was just over USD 36 000, down 7% relative to 2020, and stable at USD 51 000 for a PHEV. However, these average prices are significantly skewed downwards by the market in China, which accounts for the highest sales and lowest prices. This is notably due to a stronger market position for small and medium models there, lower production costs and more integrated domestic battery value chains. Excluding China, the average BEV price was just under USD 50 000 in 2021, up 3% relative to 2020, and over USD 57 000 for the average PHEV, up 4%.

Price distribution of electric cars compared to overall car market in the United States, 2021-2022

OpenIn China, the sales-weighted average BEV cost about USD 27 000 in 2021, down 6% from the previous year, and USD 40 000 for a PHEV, down 2%. In Europe, the average BEV cost about USD 48 000 in 2021, more expensive than Chinese models but less expensive than US BEVs, and over USD 58 000 for a PHEV, the world’s highest PHEV average price. Both BEV and PHEV average prices were up 4% relative to 2020 average European prices. In the United States, BEVs are more expensive on average although they were cheaper than in 2020 by nearly 4% at over USD 51 000, driven by the dominate Tesla models. Meanwhile, the average PHEV cost about USD 50 000 in 2021, up 3.6% from 2020.

There are regional variations in terms of price differential between electric and conventional cars. In China, where electric models are smaller and less expensive on average, the price gap is narrower than in other major markets. We estimate that the sales-weighted median price for BEVs in China was only 9% higher than the overall car market, and that the average BEV was 20% more expensive than the average conventional vehicle, compared to about 45 - 50% in Europe and the United States for both metrics.

Globally, decreasing EV prices and increasing driving ranges in 2021 relative to 2020 have resulted in a 10% decrease in the sales-weighted average price-per-range ratio for BEVs and 14% for PHEVs. Excluding China, the drop was 7% for BEVs and an increase of 2% for PHEVs because average prices increased faster than the average range. The highest drop for BEVs was recorded in the United States (-8%), where the price dropped by 4% while the range increased by 5% on average. In Europe, while BEV driving range increased by 11% on average, prices also increased, resulting in a slower price-per-range decrease (-6%).

Electric light commercial vehicles sales pick up after a slow start

Electric light commercial vehicle (LCV) sales worldwide increased by over 70% in 2021. At a global level, the electric LCV market share is 2%, about four times less than for passenger cars. Even in advanced EV markets, the LCV share barely exceeds 12%. The economic case for electrifying LCVs is stronger than for cars in cases such as urban delivery since LCV fleets are driven intensively, often operate on predictable routes and can be charged at commercial depots. The fact that the uptake of electric LCVs has been slower than cars in most markets to date may be attributable to a mix of factors, including less stringent fuel economy and ZEV regulations, fewer model options, and a diversity of use profiles (including lower annual mileage).

China accounted for the largest number of LCVs sales in 2021, at 86 000, showing rapid growth consecutively for 2020 and 2021. Europe was the second-largest market with more than 60 000 electric LCV sales in 2021 and where sales have been quickly increasing partially in response to CO2 performance standards.

Korea has seen a very rapid increase in sales of electric LCVs, reaching 28 000 in 2021 (a 12% market share of overall LCVs), up from just 1 500 just two years prior. This increase is attributable to an innovative policy in Korea that incentivises the adoption of EVs for commercial use.

The vast majority of electric LCVs are BEVs, only a few PHEVs are sold in Europe. This may reflect that most electric LCVs are acquired for specific uses within fixed delivery areas and may not need an extended driving range. The average battery size of LCVs is 18% smaller than for passenger cars; this may be due predictable and shorter routes, or because total ownership and operation costs are key factors in fleet owner decisions to buy electric LCVs.

Electric LCV registrations by type and market, 2015-2021

OpenElectric two/three-wheelers have high market shares, especially in Asia

Sales of electric two/three-wheelers in China continued to increase rapidly in 2021. The very small battery sizes needed to deliver adequate range for a daily commute and the simplicity of their manufacturing make them cheaper to buy than their internal combustion engine (ICE) counterparts in many regions. This is not the case in Europe and the United States where electric models still tend to be more expensive, but where the total costs of ownership and operation are lower than ICE analogues (assuming they are used relatively frequently for transport rather than for recreational purposes).

China dominates the market, reaching nearly 9.5 million electric two/three-wheeler new registrations in 2021 out of a global total of just over 10 million.##1## Electric two/three-wheeler sales in China increased on average by nearly 25% per year from 2015 to 2021 and now account for more than half the global market. Other high volume markets are Viet Nam where 230 000 electric two/three-wheelers were sold in 2021 and India with nearly 300 000. Electric two/three-wheelers can displace the use of oil and cut emissions in these markets where they account for around half of gasoline consumption for all road transport. In Europe, the electric two/three-wheeler market share reached 5% in 2021 with 87 000 sales.

Several companies that entered the two/three-wheeler market focussing only on electric models are now large companies that sell their vehicles worldwide, such as Niu and Gogoro. This market continues to attract new investment. A notable example is one of the world’s largest electric two/three-wheeler factory being built in India.

Electric two/three-wheeler sales share by region, 2015-2021

OpenUpdate on private sector commitments in the EV100 Initiative

The Climate Group’s EV100 is a 122-member worldwide initiative that brings together forward-looking companies committed to accelerating the transition to electromobility by purchasing EVs and installing charging points.

The initiative welcomed 31 new members in 2021, including the first members headquartered in Brazil and Korea. Over the past year, EV100 members have increased their global ambition, with 5.5 million vehicles now committed across 98 markets worldwide, a 13% increase over previous commitments. Members are acting on these commitments and have collectively deployed over 200 000 EVs and 20 000 charging points at 3 100 locations worldwide.

New members that joined in 2021 include Donlen, a US based leasing company, which has committed to more than 150 000 EVs. Zomato, a food delivery service in India, has committed to more than 160 000 EVs. EV100’s first members in Korea, LG Energy Solutions Ltd. and SK Networks, together have committed to transition 200 000 corporate vehicles to electric. Unidas – the first Brazilian EV100 member – is one of the largest car rental companies in the country and aims to electrify 85 000 vehicles by 2027, while also working to install more than 1 000 charging points for staff and customers.

The majority of new vans are registered by businesses, which make vehicle purchase decisions based on the total cost of ownership. Recent research shows that in major European markets, electric vans are the cheapest option for all user groups when purchase subsidies are included. This reflects a global trend towards rapidly improving the business case for electric vans. The shift in cost is reflected in demand. Charging infrastructure, electric van driving range and availability of suitable vehicle types all remain barriers to uptake. However, the main challenge is ensuring that supply meets established demand.

Number of vehicles and chargers committed by EV100 members, 2017-2021

OpenMajor automakers accelerate electrification plans and aim for a fully electric future

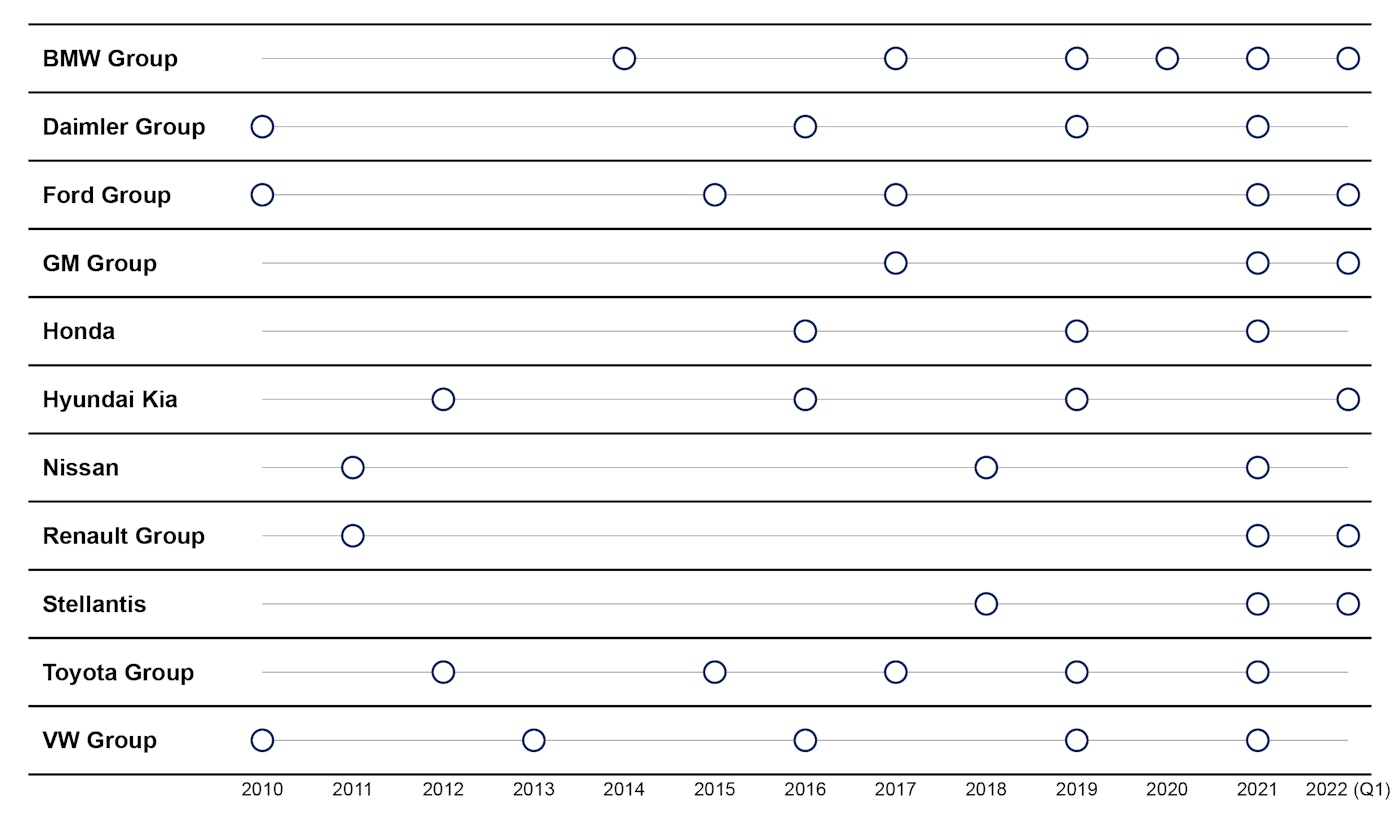

EV sales target announcements, 2010- Q1-2022

Open

In recent years, automakers have been progressively fleshing out business strategies that consider electrification not only as a way to comply with policy regulations or respond to government incentives, but also as an opportunity to capture market share and maintain a competitive edge. Looking forward, one can expect increasingly aggressive pricing and the development of a wider range of models. In some market, the combined ambitions of OEMs are more ambitious than government announcements.

In 2021, several major automakers have announced plans to accelerate the transition to a fully electric future by developing new product lines as well as converting existing manufacturing capacity. Key examples include:

Toyota, the world’s largest car manufacturer, announced the roll-out of 30 BEV models and a goal of reaching 3.5 million annual sales of electric cars by 2030. Lexus aims to achieve 100% BEV sales globally in 2035.

Volkswagen announced that all-electric vehicles would exceed 70% of European and 50% of Chinese and US sales by 2030, and that by 2040, nearly 100% should be zero emissions vehicles.

Ford expects one-thid of its sales to be fully electric by 2026 and 50% by 2030, building on the success of its F-150 electric model, and to move to all-electric in Europe by 2030.

Volvo committed to becoming a fully electric car company by 2030.

Geely targets around 30% of electric cars in sales by 2025.

BMW aims for 50% of its vehicles sold to be fully electric by 2030 or earlier.

Mercedes announced that from 2025, all newly launched vehicles will be fully electric.

General Motors aims for 30 EV models and for installed BEV production capacity of 1 million units in North America by 2025 and for carbon neutrality in 2040.

Stellantis targets 100% of sales in Europe and 50% of sales in the United States to be BEVs by 2030.

Hyundai targets sales of 1.9 million BEVs annually by 2030 to secure a 7% global market share, and to end sales of ICE vehicles in Europe in 2035.

Kia aims to increase sales of BEVs to 1.2 million in 2030.

In China, some automakers are adjusting to reflect the goal of carbon peaking by 2030. Dongfeng plans to electrify 100% of its new models of main passenger car brands by 2024. BYD announced that it would only produce BEVs and PHEVs from April 2022 onwards.

Korea maintains lead in deploying fuel cell electric vehicles

Fuel cell electric vehicles (FCEVs) are zero emissions vehicles that convert hydrogen stored on-board using a fuel cell to power an electric motor. Although FCEV cars have been commercially available for about a decade, registrations remain more than two orders of magnitude lower than EVs. This is in part because hydrogen refuelling stations (HRS) are not widely available and unlike EVs, FCEVs cannot be charged at home. In addition, few commercial FCEV models are available, and high fuel costs and purchase prices result in a higher total cost of ownership than EVs.

Governments have funded, either fully or partially, the construction of HRSs to enable the deployment of FCEVs, including public buses and municipal trucks as well as cars. Today there are about 730 HRSs globally providing fuel for about 51 600 FCEVs. This represents an increase of almost 50% in the global stock of FCEVs and a 35% increase in the number of HRSs from 2020. Over 80% of the FCEVs on the road at the end of 2021 were LDVs with the majority being passenger cars. Buses and trucks each constitute almost 10% of global FCEV stock.

In 2021, Korea maintained the lead in FCEV deployment, with over 19 000 vehicles (almost double the stock at the end of 2020). The United States has the second-largest stock of FCEVs, increasing from about 9 200 at the end of 2020 to 12 400 at the end of 2021.

Together, Korea and the United States represent over 60% of global FCEV stock, though only a quarter of refuelling stations with 114 stations in Korea and 67 in the United States.

China has the largest fleet of both fuel cell buses and trucks, with a combined stock of more than 8 400 vehicles. China accounts for almost 90% of fuel cell buses worldwide and over 95% of fuel cell trucks.

References

This report focuses on BEVs and PHEVs, i.e. EVs that are powered with electricity from the grid. All figures and discussion exclude fuel cell electric vehicles unless otherwise specified.

Reference 1

This report focuses on BEVs and PHEVs, i.e. EVs that are powered with electricity from the grid. All figures and discussion exclude fuel cell electric vehicles unless otherwise specified.