Cite report

IEA (2021), Global EV Outlook 2021, IEA, Paris https://www.iea.org/reports/global-ev-outlook-2021, Licence: CC BY 4.0

Report options

Policies to promote electric vehicle deployment

Are we entering the era of the electric vehicle?

Ten million electric cars were on the world’s roads in 2020. It was a pivotal year for the electrification of mass market transportation. Sales of electric cars were 4.6% of total car sales around the world. The availability of electric vehicle models expanded. New initiatives for critical battery technology were launched. And, this progress advanced in the midst of the Covid-19 pandemic and its related economic downturn and lockdowns.

Over the last decade a variety of support policies for electric vehicles (EVs) were instituted in key markets which helped stimulate a major expansion of electric car models.

But the challenge remains enormous. Reaching a trajectory consistent with the IEA Sustainable Development Scenario will require putting 230 million EVs on the world’s roads by 2030.

For EVs to unleash their full potential to combat climate change, the 2020s will need to be the decade of mass adoption of electric light-duty vehicles. In addition, specific policy support and model expansion for the medium- and heavy-duty vehicle segments will be crucial to mitigate emissions and make progress toward climate goals.

Main policy drivers of EV adoption to date

Significant fiscal incentives spurred the initial uptake of electric light-duty vehicles (LDVs) and underpinned the scale up in EV manufacturing and battery industries. The measures – primarily purchase subsidies, and/or vehicle purchase and registration tax rebates – were designed to reduce the price gap with conventional vehicles. Such measures were implemented as early as the 1990s in Norway,1 in the United States in 2008 and in China in 2014.

Gradual tightening of fuel economy and tailpipe CO2 standards has augmented the role of EVs to meet the standards. Today, over 85% of car sales worldwide are subject to such standards. CO2 emissions standards in the European Union played a significant role in promoting electric car sales, which in 2020 had the largest annual increase to reach 2.1 million. Some jurisdictions are employing mandatory targets for EV sales, for example for decades in California2 and in China since 2017.

Convenient and affordable publicly accessible chargers will be increasingly important as EVs scale up. To help address this, governments have provided support for EV charging infrastructure through measures such as direct investment to install publicly accessible chargers or incentives for EV owners to install charging points at home. In some places building codes may require new construction or substantial remodels to include charging points, for example in apartment blocks and retail establishments.

Efforts by cities to offer enhanced value for EVs has encouraged sales even outside of urban areas. Such measures include strategic deployment of charging infrastructure, and putting in place preferential/prohibited circulation or access schemes such as low- and zero-emission zones or differentiated circulation fees. Such measures have had a major impact on EV sales in Oslo and a number of cities in China.

Broader and more ambitious policy portfolios to accelerate the transition

Making the 2020s the decade of transition to EVs requires more ambition and action among both market leaders and followers. In markets that demonstrated significant progress in the 2010s, a primary direction in 2021 and beyond should be to continue to implement and tighten, as well as to broaden, regulatory instruments. Examples include the European Union CO2 emissions regulation for cars and vans, China’s New Energy Vehicles (NEV) mandate or California’s Zero-Emission Vehicle (ZEV) mandate.

Near-term efforts must focus on continuing to make EVs competitive and gradually phasing out purchase subsidies as sales expand. This can be done via differentiated taxation of vehicles and fuels, based on their environmental performance, and by reinforcing regulatory measures that will enable the clean vehicle industry to thrive.

In the long term, realising the full potential for EVs to contribute to cut vehicle emissions requires integration of EVs in power systems, decarbonisation of electricity generation, deployment of recharging infrastructure and manufacturing of sustainable batteries.

Countries that currently deploy limited numbers of electric cars can profit from the lessons learned and advances already made in automotive and battery technology to support the production and uptake of EVs. Product innovation and the expertise developed in the charging services industry will also be beneficial for emerging economies. But they will also need to significantly tighten fuel economy and emissions standards. Emerging economies with large markets for second-hand imported cars can use policy levers to take advantage of electric car models at attractive prices, though they will need to place particular emphasis on implications for electricity grids.#anchor3## 4

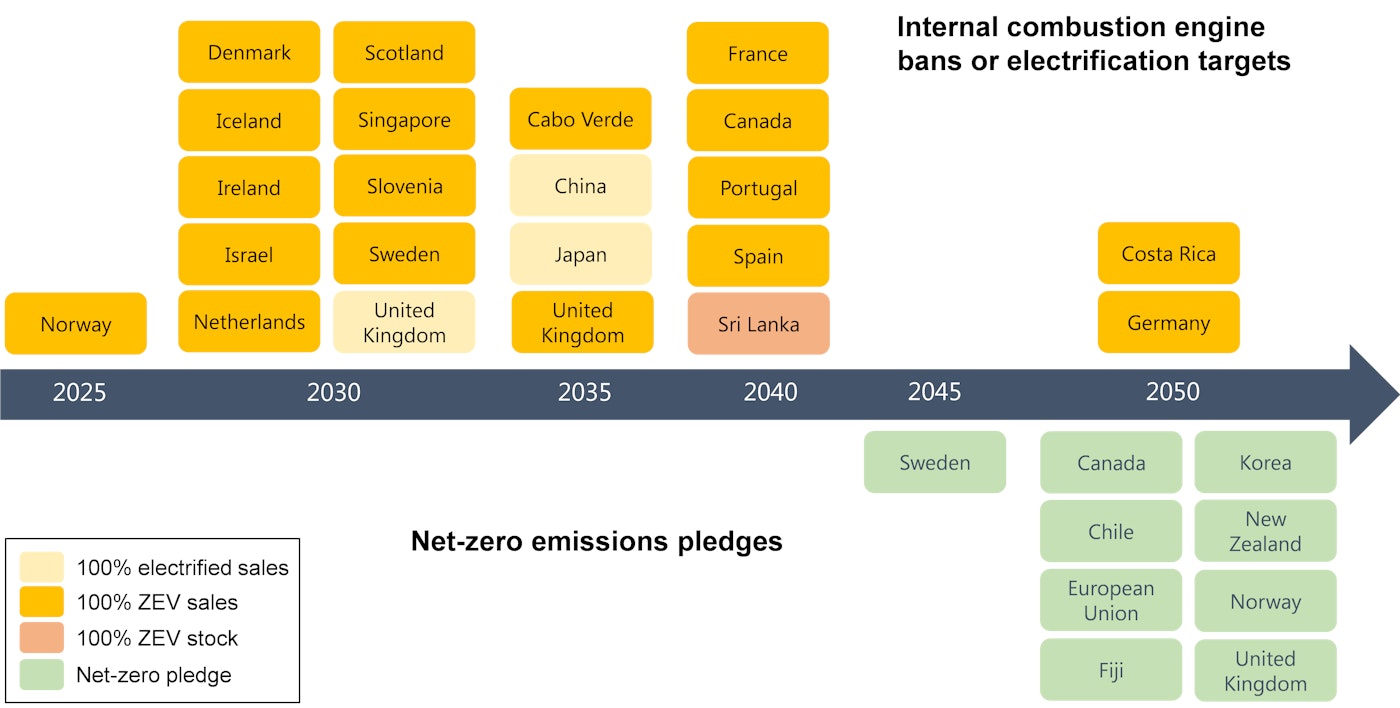

To date, more than 20 countries have announced the full phase-out of internal combustion engine (ICE) car sales over the next 10‑30 years, including emerging economies such as Cabo Verde, Costa Rica and Sri Lanka. Moreover, more than 120 countries (accounting for around 85% of the global road vehicle fleet, excluding two/three-wheelers) have announced economy-wide net-zero emissions pledges that aim to reach net zero in the coming few decades.

Policy attention and actions need to broaden to other transport modes, in particular commercial vehicles – light-commercial vehicles, medium- and heavy-duty trucks, and buses – as they have an increasing and disproportionate impact on energy use, air pollution and CO2 emissions. Medium- and heavy‑duty vehicles represent 5% of all four-wheeled road vehicles in circulation but almost 30% of CO2 emissions. Progress in batteries has led to rapid commercialisation in the past few years of more and more models in ever heavier weight segments and with increasing ranges.

In 2020, California was the first to propose a ZEV sales requirement for heavy-duty trucks. The Advanced Clean Truck Regulation is due to take effect from 2024. The Netherlands and a number of other countries are implementing zero-emission commercial vehicle zones and pioneering deployment efforts. Although this is a “hard-to-abate” sector and there are competing decarbonisation pathways (including hydrogen and biofuels), the electrification of medium- and heavy-duty vehicles is increasingly recognised as a promising pathway to reduce both local pollutant and CO2 emissions. Electrification of HDVs requires policy support and commercial deployment similar to that which passenger cars enjoyed in the 2010s. Electric buses are already making a dent in key cities around the world, supported by national and local policies that target air pollution. Policy measures to promote electric buses are diverse; they may include competitive tenders, green public procurement programmes, purchase subsidies and direct support to charging infrastructure deployment, as well as effective pollutant emissions standards.

Given their enormous number and populartity, electrifying two/three-wheelers in emerging economies is central to decarbonising transport in the near term. China is taking a lead with a ban of ICE versions of two/three-wheelers in a number of cities.

More than 20 countries have electrification targets or ICE bans for cars, and 8 countries plus the European Union have announced net-zero pledges

Open

Policies affecting the electric light-duty vehicle market

Policies buoyed electric car sales in 2020 despite the Covid-19 pandemic

Electric car sales broke all records in 2020. They were up over 40% from 2019. This is particurlary notable as sales of all types of cars contracted 16% in 2020 reflecting pandemic-related conditions.

Existing EV strategies bolstered the electric car market in the first-half of 2020

Electric car sales were underpinned with existing policy support and augmented with Covid-related stimulus measures. Prior to the pandemic, many countries were already developing and strengthening e-mobility strategies with key policy measures such as fiscal incentives and making vehicle CO2 emission standards more strigent. Purchase incentives increased in early 2020, notably in Germany, France and Italy. As a result, electric car sales in Europe were 55% higher during the first-half of 2020 relative to the same period in 2019.

In the rest of the world, electric car sales were hurt by the economic crisis, with sales falling from 2019 levels though not as steeply as conventional cars.

Stimulus measures boosted electric cars sales in the second-half of 2020

Additional Covid-19-related stimulus measures from mid-2020 further boosted electric car sales. Sales between July and December surpassed the 2019 levels in each month in all large markets, despite second waves of the pandemic.5

These stimulus measures differed in important ways from those enacted during the 2008‑09 financial crisis. First, there was a specific focus on boosting the uptake of electric and hybrid vehicles. Second, a number of countries adopted a more integrated approach for the transport sector by supporting charging infrastructure, public transport and non‑motorised mobility. EV stimulus measures primarily took the form of increased purchase incentives (or delaying the phase-out of subsidies) and EV-specific cash-for-clunker approaches. Noteably, Germany did not provide any subsidies to conventional cars in its support package to the automotive sector.

The approaches were more integrated to the broader context of commitments to clean energy transitions and EV deployment than those that were made prior to the Covid-19 crisis. In a number of countries they were confirmed in 2020 via new commitments to achieve net-zero emissions by mid-century.

In addition, ongoing declines in battery costs, wider availability of electric car models, uptake of EVs by fleet operators and enthusiasm of electric car buyers provided fertile ground for the EV market in 2020. These factors, supplemented by local policy measures, likely played an influential role in the uptick in electric car sales shares in the United States despite few incentives at the federal level.

Maintaining momentum in 2021 and beyond is vital

Many of the automotive-related stimulus measures implemented in 2020 were planned to be phased out by the end of the year. In some cases, the maximum quotas were reached in just a few weeks, e.g. France’s enhanced cash-for-clunker scheme. The targeted stimulus measures provided impetus to the EV market, but do not guarantee persistent sales growth over time.

Acknowledging the success of the short-term measures, in the second-half of 2020 some countries extended their EV support packages by several months or even years, although in some cases with stricter access to subsidies, e.g. tightened vehicle price caps, higher income conditions, gradual reduction of subsidies and tax reductions.

Recovery packages that have a continued focus on electric mobility offer an opportunity to accelerate the pace of the transition. At the start of this decade, policy measures should encompass a broad set of considerations including social and environmental lessons learned from the pandemic. These include: equity, such as applying revenue conditions or vehicle retail price-conditions, or providing zero-interest loans; environmental performance standards, such as allocating incentives proportional to each model’s emission reductions; and long-term viability with a view to reaching revenue neutrality, such as differentiated taxation and bonus-malus systems. Regulatory instruments should continue to encourage sustainable and low-emissions technology investment (considering the full lifecycle of a product), while supporting and prioritising industry reskilling to low-carbon economic activities with high employment multipliers, including non-motorised transport infrastructure and battery manufacturing.

Subsidies have been instrumental in boosting EV sales during the pandemic

National subsidies for EV purchase before and after economic stimulus measures, 2020

OpenCurrent zero-emission light-duty vehicle policies and incentives in selected countries

|

|

|

Canada |

China |

European Union |

India |

Japan |

United States |

|---|---|---|---|---|---|---|---|

|

Regulations vehicles |

ZEV mandate |

British Columbia: 10% ZEV sales by 2025, 30% by 2030 and 100% by 2040. Québec: 9.5% EV credits in 2020, 22% in 2025. |

New Energy Vehicle dual credit system: 10-12% EV credits in 2019-2020 and 14-18% in 2021-2023. |

|

|

|

California: 22% EV credits by 2025. Other states: Varied between ten states. |

|

Fuel economy standards (most recent for cars) |

114 g CO2/km or 5.4 L/100 km*** (2021, CAFE) |

117 g CO2/km or 5.0 L/100 km (2020, NEDC) |

95 g CO2/km or 4.1 L/100 km (2021, petrol, NEDC) |

134 g CO2/km or 5.2 L/100 km (2022, NEDC) |

132 g CO2/km or 5.7 L/100 km (2020, WLTP Japan) |

114 g CO2/km or 5.4 L/100 km*** (2021, CAFE) |

|

|

Incentives vehicles |

Fiscal incentives |

✓

|

✓ | ✓ | ✓ | ✓ | ✓ |

|

Regulations chargers** |

Hardware standards. |

✓

|

✓ |

✓

|

✓ |

✓

|

✓

|

|

Building regulations. |

✓* |

✓* |

✓ |

✓ |

|

✓* |

|

|

Incentives chargers |

Fiscal incentives |

✓ |

✓

|

✓

|

✓

|

✓ |

✓ *

|

* Indicates that it is only implemented at state/provincial/local level. ** All countries/regions in the table have developed basic standards for electric vehicle supply equipment (EVSE). China, European Union and India mandate specific minimum standards, while Canada, Japan and United States do not. *** Historically, Canada and the United States have aligned emission standards for on-road light-duty vehicles. In April 2020 the United States adopted a final rule to reduce the annual stringency conditions for the 2021-2026 model years. Soon after, Canada finalised its mid-term evaluation of the Passenger Automobile and Light Truck GHG Emissions regulation, indicating a potential separation from the US ruling, pending further consultation. ✓ Indicates that the policy is set at national level. Notes: g CO2 /km = grammes of carbon dioxide per kilometre; L/100 km = litres per 100 kilometres; CAFE= Corporate Average Fuel Economy test cycle used in the United States and Canada fuel economy and GHG emissions tests; NEDC = New European Driving Cycle; WLTP= Worldwide Harmonized Light Vehicle Test Procedure; WLTP Japan = WLTP adjusted for slower driving conditions in Japan. Building regulations imply an obligation to install chargers in new construction and renovations. Charger incentives include direct investment and purchase incentives for public and private charging.

Strong policies underpin major electric car markets

The Covid-19 pandemic spurred governments to enact stimulus measures, many of which singled out EV development both as a way to create jobs and to push for a cleaner tomorrow.

China

In order not to further hinder the car market in the depressed context of the pandemic, the planned end-2020 elimination of the New Electric Vehicle (NEV) subsidy programme was postponed to 2022 albeit with gradual reductions in subsidies over that period. The programme, which drove EV technology improvements over time, favoured models with longer driving ranges, better fuel economy and high density batteries. In 2020, a vehicle price cap and a NEV sales limit of 2 million per year were added to the subsidy programme. Plus in early 2021, fuel consumption limits for passenger light-duty vehicles (PLDVs) were set at 4.0 L/100 km (NEDC) by 2025.

The NEV credit mandate, introduced in 2017, has been a powerful driver of EV sales. It sets annual ZEV credit targets for manufacturers as a percentage of their annual vehicle sales. In 2020, the programme and its targets were extended to 2023, by which the target will be 18% (16% in 2022, 14% in 2021). Each EV can receive between 1 and 3.4 credits depending on its characteristics. Each OEM can achieve the target in several ways, mainly by selling BEVs, PHEVs and FCEVs in various proportions, and by trading credits with other manufacturers. In addition, since June 2020, “fuel-efficient passenger vehicle” bonuses can count towards the calculation of corporate NEV credits; conventional vehicles with fuel consumption below defined thresholds account for only a fraction of a conventional vehicle sold by the OEM. This provides an additional compliance pathway towards annual NEV credit targets.6

Other ZEV policies and programmes that deal with charging infrastructure, battery reuse and recycling and FCEV deployment were rolled out in 2020. To cushion the impacts of the pandemic on the automotive sector, some cities in China eased access restrictions in the second-quarter of 2020 to encourage all types of car sales. But many local governments included measures specifically aimed at supporting ZEV sales such as offering time-limited purchase subsidies, charging rebates to new ZEV adopters and expanding traffic restriction waivers for ZEVs.

China does not have specific ZEV policies in place beyond 2023, when the NEV credit expires, but has announced clear commitments. The New Energy Automobile Industry Plan (2021-2035) targets 20% of vehicle sales to be ZEVs by 2025,7 to achieve international competitiveness for China’s ZEV industry. The China Society of Automotive Engineers set a goal of over 50% EV sales by 2035. These goals fit in the context of China’s announcing economy-wide carbon neutrality ambitions before 2060.

China’s major cities have implemented a broad array of EV promotion policies

|

City |

Car plate restrictions and ZEV direct access |

Traffic restrictions and ZEV waivers |

Lower cost or free parking |

Subsidies for the use of charging infrastructure |

Direct ZEV purchase subsidies |

Public bus fleet electrification |

|---|---|---|---|---|---|---|

|

Shanghai |

✓

|

✓

|

|

✓ 2020

|

|

✓ 2025

|

|

Beijing |

✓

|

✓

|

|

|

|

✓ 2020*

|

|

Chengdu |

|

✓

|

First two hours |

|

|

✓ **

|

|

Guangzhou |

✓

|

|

First hour |

|

✓ 2020/21

|

✓ 2020

|

|

Zhengzhou |

|

|

50% off |

|

✓ 2020

|

|

|

Chongqing |

|

✓

|

100% off |

✓

|

✓ 2020

|

|

|

Shenzhen |

✓

|

|

First two hours |

|

✓ 2020/21

|

|

|

Suzhou |

|

|

First hour |

|

|

✓ 2020*

|

|

Hangzhou |

✓

|

✓

|

|

|

|

✓ 2022

|

|

Dongguan |

|

|

|

|

|

✓ 2020

|

|

Xi’an |

|

✓

|

First two hours |

|

|

✓ 2019

|

|

Wuhan |

|

✓

|

First hour and then 50% off |

|

|

|

|

Tianjin |

✓

|

✓

|

|

✓ 2020

|

|

✓ 2020* |

|

Changsha |

|

|

|

|

|

✓ 2020

|

|

Foshan |

|

|

|

|

|

✓ 2019

|

|

Ningbo |

|

|

|

|

|

✓ 2022

|

|

Nanjing |

|

|

First hour |

|

|

✓ 2021

|

|

Kunming |

|

|

First two hours |

|

|

✓ **

|

|

Jinan |

|

✓

|

First two hours and then 50% off (BEV) |

✓ 2020/21

|

|

✓**

|

|

Shijiazhuang |

|

✓

|

|

|

✓ Dec 2020 |

✓ 2020* |

* Indicates the full fleet electrification target applies to the city’s urban area. ** Indicates that the electrification requirement applies only to new or replacement vehicles Notes: ZEV = zero-emissions vehicle. All restrictions refer to privately owned LDVs. Various other restrictions apply to commercial vehicles. The cities are ranked by size of the car fleet in 2019. For the categories subsidies for the use of charging infrastructure and direct ZEV purchase subsidies the numbers indicate the years for which the policy is active. For the category public bus fleet electrification, the numbers specify the year by which the total stock is expected to be electrified. Sources: See list of sources in the Annexes chapter.

European Union

As part of its pandemic-related response, the European Union accelerated the roll-out of electric mobility through its commitment to decarbonisation in the EU Green Deal8 and the subsequent Next Generation EU and Recovery Plan. In December 2020, the EU Sustainable and Smart Mobility Strategy and Action Plan bolstered these plans for the transport sector with ambitious ZEV deployment goals.

A number of EU directives and regulations are under review to adapt them to achieve stated ambitions. These include: CO2 emissions performance standards for cars and vans; Alternative Fuels Infrastructure Directive; European Energy Performance of Buildings Directive (which supports the deployment of charging infrastructure); Batteries Directive of 2006 which is being complemented by a proposed Batteries Regulation announced in December 2020 and the EURO pollutants emissions standard.

Corporate fleet average tailpipe emissions are targeted to go below 95 grammes of carbon dioxide per kilometre (g CO2/km)9 in 2021 under the CO2 emissions standards. EVs are increasingly important to meet the targets and a driving factor explaining why EV sales rose in 2020 despite Covid-19 and the automotive sector’s overall downturn. The next targets push emissions to fall 15% in 2025 and 37.5% by 2030 from 2021 levels.These targets are being revised with a view to better support the EU Green Deal ambitions. Revisions are likely to include lower emissions targets, modifications in the role of zero and low emission vehicles (ZLEVs) (emissions under 50 g CO2) and possibly a well-to-wheel approach rather than the current tailpipe (tank-to-wheel) approach.

In early 2021, nine EU countries urged the European Commission to accelerate an EU-wide phase out of petrol and diesel cars. This could create legislation allowing member states to enforce national ICE bans.

In addition to EU policies and directives, many countries in Europe are continuing EV subsidy and incentive measures. In some, pandemic relief stimulus measures have favoured alternative powertrains with supplemental purchase subsidies and cash-for-clunker schemes.

United States

At the federal level, the United States took a less supportive approach to EVs than China and Europe in 2020. The Corporate Average Fuel Economy (CAFE) standard was revised and rebranded as the Safer, Affordable Fuel-Efficient (SAFE) vehicle standard with significantly weaker energy efficiency targets for model years 2021-2026 than those established under the CAFE standards.10 In 2020, a federal tax credit of up to USD 7 500 for the purchase of an electric car was still available, with the exception of General Motors and Tesla which had reached the 200 000 sales limit per automaker in 2018, but this credit was not renewed.

It was at the state level where policies pushed for stronger EV deployment. The number of states following the California Low Emissions Vehicles pollutant and GHG emissions regulations now represent about a third of US car sales. The governor of California issued an Executive Order requiring that by 2035 all new car and passenger light truck sales be zero-emission vehicles. New York, New Jersey, and Massachusetts are considering similar bans on internal combustion engines.

Other state level policies such as the Low Carbon Fuel Standard are supporting EV adoption, especially in the heavy-duty vehicle sector. In addition, the majority of US states have specific policies in place to offer tax credits or purchase incentives for EVs as well as financial and technical assistance for installing charging infrastructure.

Total car sales dropped 23% in the United States in 2020, but sales shares of electric cars held up. This may be reflective of state intiatives partly compensating for diluted federal incentives as well as the expanding menu of available EV models including very popular SUV models. Only 30% of electric cars sold in the United States in 2020 benefitted from federal tax credits. In early 2021, the new US administration announced intentions to encourage ZEVs. So changes to the SAFE and federal tax credit programmes may be forthcoming and may be likely to to be structured to benefit domestic manufacturers and middle-class consumers.

India

India’s efforts to control pollutant emissions from vehicles moved into high gear in April 2020 when it imposed Bharat Stage VI (BS-VI) standards, (which are largely aligned with Euro 6 standards), on new sales of motorcycles, light-duty and heavy-duty vehicles. The jump directly from BS-IV to BS-VI forces manufacturers to make significant changes to vehicle designs in a short period. Investment by some Indian OEMs focus on ICE models meeting BS-VI standards, thereby delaying investment in BEV deployment. These OEMs have indicated that they are facing losses due to slumps in auto sales from reduced demand during the pandemic.

Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme is India’s key national policy relevant for EVs. It allocates USD 1.4 billion over three years from 2019 for 1.6 million hybrid and electric vehicles (including two/three-wheelers, buses and cars)11 and includes measures to promote domestic manufacturing of EVs and their parts. However, more than halfway to the April 2022 end-date only 3% of the allocated funds have been used for a total of just 30 000 vehicles. Significant acceleration will be required to reach both the programme targets and national targets of 30% EV sales by 2030. Some critics blame the lack of supply-side policy instruments such as ZEV sales requirements or ICE phase-out targets to hasten EV adoption, while others have indicated the limited availability of EV models for average consumers.

State and urban governments have also started efforts to fast track road vehicle electrification. In February 2021, the chief minister of New Delhi announced the Switch Delhi awareness campaign to highlight its ambitious EV policy introduced in August 2020. The policy targets 25% electrification of vehicle sales in 2024 and 50% of all new buses to be battery electric. Other cities such as Kolkata, Pune, Nagpur and Bangalore continue to transform their fleets.

Japan

Japan declared an intention to be cabon neutral by 2050 in a statement from the prime minister in October 2020. In December the Ministry of Economy, Trade and Industry (METI) released the Green Growth Strategy with action plans for 14 sectors to achieve that goal. For transport, it will focus on increased electrification and fuel cell use, as well as next generation batteries, by using a mix of grants (for research, development and demonstration projects), regulatory reforms related to hydrogen refuelling and EV charging infrastructure and tax incentives for capital investment and R&D.

METI announced that by the mid-2030s Japan aims to have all new passenger cars electrified.12 To reach this goal, it proposed to revisit fuel efficiency regulations, public procurement of EVs, expansion of charging infrastructure and large-scale investment in EV supply chains. A decision on options is to be made in mid-2021. Speculation is that the fuel efficiency standards for LDVs may be strengthened to meet the more ambitious mid-2030 and carbon neutrality targets.

In 2020, Japan was one of the few markets where EV sales dropped more than overall car sales. Sales are expected to recover after Japan doubled its subsidies for passenger ZEVs registered from the end of 2020. Other measures such as tax exemptions on BEVs, PHEVs and FCEVs have been extended for two years. In January 2021, electric cars sales increased around 35% relative to January 2020.

Canada

Canada continued to support key infrastructure and ZEV incentives in 2020 in light of its recently increased climate ambitions to reach net-zero emissions by 2050. Canada has ZEV targets of 10% of LDV sales by 2025, 30% by 2030 and 100% by 2040. Québec supports even faster adoption and has aligned with mandates in California and 14 other US states. British Columbia also has a ZEV mandate and together with Québec is leading the country in ZEV uptake.

A federal invesment of CDN 1.5 billion (USD 1.2 billion) in the low carbon and zero emissions fuels fund was announced in 2020 to increase production and use of low-carbon fuels, while major infrastructure and ZEV deployment programmes and federal purchase incentives received additional funding.

Chile

Chile’s energy roadmap 2018-2022 targets a ten-fold increase in the number of electric cars in 2022 compared with 2017. The National Electromobility Strategy aims for a 40% penetration rate of electric cars in the private stock by 2050 (and 100% of public transport by 2040).

A new energy efficiency law aims to reduce energy intensity by at least 10% by 2030 (from 2019). It will establish energy efficiency standards for imported vehicles (with BEVs and PHEVs given supercredits) for LDVs and heavy-duty trucks. The government offers subsidies for electric taxis and home charging points.

New Zealand

New Zealand has a target of net‑zero emissions by 2050, which is an important accelerator for policy developments in a variety of sectors. In 2020, the government and the private sector co-financed 45 new low-emissions transport projects, including charging infrastructure and BEV trucks. Legislation is expected to be adopted in 2021 for a clean car import standard which would progressively phase in more stringent targets, setting limits of up to 105 g CO2/km average emissions in 2025. A February 2021 draft advice package from New Zealand’s Climate Change Commission recommended a number of policies to accelerate the uptake of electric LDVs, including banning the import, manufacturing or assembling of light-duty ICE vehicles from 2030. The government's response to the Climate Change Commission's advice is due by the end of 2021.

Governments roll-out plans for interconnected charging infrastructure networks

The rapid evolution of EVSE infrastructure continued in 2020 and early 2021. Efforts are underway in some countries to strategically plan and install large-scale interconnected EV charging stations along main transport routes. Key considerations in the planning include digitalisation, interoperability and roadmaps for developing charging networks. Stimulus packages are augmenting the funding for EV infrastructure in some cases.

In the Europe Union, the Alternative Fuel Infrastructure Directive (AFID) is the main measure guiding the roll-out of publicly accessible EV charging stations. EU members are required to set deployment targets for publicly accessible EV chargers for the decade to 2030, with an indicative ratio of 1 charger per 10 electric cars. The EU Green Deal raised the bar with a target of 1 million publicly accessible chargers installed by 2025 and set out a roadmap of key actions to achieve it. This includes revisions to the AFID in 2021. Some proponents call for it to be converted to an enforced regulation which would allow the establishment of binding targets for member states, to revise the 1 charger per 10 electric cars ratio, to give EU citizens the right to request the installation of charging points (“right to plug”) regardless of location and to include provisions for HDVs.

The AFID also sets targets for the deployment of chargers along the Trans-European Transport Network (TEN-T) core network, which will be reviewed in 2021. To inform the review three large industry associations signed a joint letter that proposes to formalise charging point targets to 2029 and an ultra-fast charging network along the TEN-T. Others have stated the importance of these revisions to ramp up charging infrastructure to meet increasingly ambitious OEM targets and the variety of availible EV models.

EU member states are implementing the revised European Energy Performance of Buildings Directive (EPBD III), which sets requirements for residential and non-residential buildings to improve access to charging points. The Recovery and Resilience Facility, a EUR 672.5 billion fund, includes support for charging stations.

An interconnected European EV charging network also depends on the ambitions of individual countries. Leading countries such as Germany, France, Netherlands, Sweden and Italy have national policies and targets to encourage development that range from grants and fiscal incentives for installation of public and private chargers to free public charging in urban areas.

Similar to large-scale investments in Europe, China announced a USD 1.4 trillion digital infrastructure public spending programme that includes funding for EV charging stations. This has trickled down to the local level, with more than ten cities announcing targets to install about 1.2 million chargers by 2025.13 The province of Henan modified its approach from subsidising capital expenses for public charging stations to a tariff subsidy mechanism for fast charging stations. It also provides financial rewards to local governments that meet targets for new household chargers.

In the United States an infrastructure plan proposed in early 2021 would establish grant and incentive programmes to install 500 000 chargers, adding to about 100 000 existing charging points. Leading states such as California and New York offer subsidies and tax incentives, and collaborate with electric utilities to promote EV deployment.

In Canada, the Zero Emission Vehicle Infrastructure programme (iZEV) received additional funding of CAD 150 million) (USD 112 million). Its focus is on level 2 chargers at multi-unit residential buildings and workplaces, and fleet and high power charging infrastructure. The Electric Vehicle and Alternative Fuel Infrastructure Deployment Initiative (EVAFIDI) supports the installation of a national network of fast chargers.

In Chile, the new Energy Efficiency Law aims to ensure the interoperability of the EV charging system to facilitate the access and connection of EV users to the charging network.

Under India’s FAME II programme, USD 133 million is budgeted for charging infrastructure, though so far the funds have been under utilised. In October 2020, the Ministry of Heavy Industries released an expression of interest welcoming investors to benefit from the scheme and install a minimum of 1 charging station every 25 km along key highways and every 100 km to accommodate HDVs. Critics compare it to a similar initiative in 2019 in which there were many applicants but grants were only awarded to public companies.

Markets for EV battery supply heat up

The rapid deployment of electric mobility and the automotive industry adoption of batteries to power EVs are drastically changing the battery industry. The scale of lithium-ion (Li-ion) battery material sourcing and manufacturing is set to grow substantially. Recent years have witnessed consolidation of small producers and rapid growth in installed and planned factory size.

Much of the existing legislation regulating batteries and their waste was not designed for automotive Li-ion batteries. Public authorities are only at the start of providing policy frameworks for the large-scale transformation of the automotive battery industry in terms of material sourcing, design, product quality requirements and traceability from inception to disposal. Effective policy frameworks are increasingly important for issues related to industrial competitiveness, know-how, employment and the environment.

In 2020, policy developments related to EV batteries focused on increasing competitiveness to strategically position countries to take a larger market share throughout the entire EV supply chain and to reduce reliance on imports of EV components.

In China, subsidies and regulations for battery suppliers favour large production facilities (at least 8 gigawatt-hours [GWh]) of Li-ion batteries and encourage consolidation and cost competitiveness. Though not official, China appears to be setting minimum production capacities for battery manufacturers (aiming for 3‑5 GWh/year) in an attempt to consolidate small players and reduce battery costs. China established key measures in 2018 to push battery producers to establish collection and recycling activities. Guidelines encourage the standardisation of battery design, production and verification, as well as repairing and repackaging for second life utilisation.

To promote expansion of the ZEV industry, in 2018 the goverment banned investment in new enterprises for ICE car manufacturing that did not meet energy performance‑related requirements. Also in 2018, new requirements were set for ZEV investments and limitations on foreign investment were eased to attract large foreign manufacturers.

In response to increased pressure from China, Japan continues to focus on competitiveness and high performance batteries. Its recently released Green Growth Strategy targets reducing the cost of batteries (cutting costs to USD 100 per kWh by 2030) and aims to achieve net-zero emissions of a vehicle through its entire lifecycle by 2050. Next generation batteries, such as solid state, are viewed as a key strategic pillar for the evolution of Japan’s automotive industry and to achieve the aims of the Green Growth Strategy. The government and automotive sector are collaborating on the collection and testing of used batteries to maximise the value of the embedded materials and to avoid waste.

The European Union aims to build a competitive EU-based automotive battery industry and to establish global standards for environmentally and socially responsible batteries. The EU 2006 Battery Directive is being revised with a new Batteries Regulation proposed in December 2020 for mandatory collection and recycling of automotive EV batteries.14 It calls for a carbon footprint declaration for batteries sold in Europe starting in 2024. It proposes enhanced transparency and traceability along the full lifecycle via labelling and a digital “battery passport”.

The European Battery Alliance serves to promote local competitive and innovative manufacturing. In early 2021 the European Commission approved a EUR 2.9 billion support package for a pan-European research and innovation project along the entire battery value chain – in particular related to raw and advanced materials, battery cells and systems, recycling and sustainability. Named European Battery Innovation, the project will provide support to 12 countries through 2028. Poland is positioning itself as a central EV manufacturing hub for Europe: in early 2020 the European Investment Bank supported the construction of a LG Chem Li-ion battery cells-to-packs manufacturing gigafactory in Poland.

In the United States, California eastablished the Lithium-ion Car Battery Recycling Advisory Group and tasked it with proposing policies for the end-of-life reuse and recycle of batteries. Their recommendations are due for release in 2022.

In Canada, the federal government and the province of Ontario each provided CAD 295 million (USD 220 million) to the Ford Motor Company Canada to support production of EVs, making it the largest Ford EV factory in North America. The federal and Québec governments are providing CAD 100 million (USD 75 million) to Lion Electric to support a battery pack assembly plant project.

In India, the Performance Linked Incentives scheme was extended in November 2020 to include INR 18 billion (USD 243 million) over five years for the advanced chemistry cell battery sector along with USD 7.8 billion for the automotive sector. Serving the “make in India” goal it provides incentives for the domestic production of EVs and to reduce reliance on imported components.

Policies affecting the electric heavy-duty vehicle market

Current zero-emission heavy-duty vehicle policies and incentives in selected countries

|

Policy Category |

Policy |

Canada |

China |

European Union |

India |

Japan |

United States |

|---|---|---|---|---|---|---|---|

|

Regulations vehicles |

ZEV sales requirements |

|

|

Voluntary to earn credits economy standards under fuel. Municipal vehicle purchase requirements. |

|

|

California: new bus sales 100% ZEV by 2029. |

|

Fuel economy standards |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

Weight exemptions |

|

|

2 tonnes over class. |

|

|

California: 2 000 pounds over class. |

|

|

Incentives vehicles |

Direct incentives |

✓* |

✓* |

✓* |

✓ |

✓ |

✓* |

|

Incentives fuels |

Low-carbon fuel standards |

✓* |

|

|

|

|

✓* |

|

Incentives EVSE |

Direct investment |

✓ |

|

|

✓ |

✓ |

✓* |

|

Utility investment |

|

|

|

|

|

✓* |

* Indicates implementation only at state/local level. Notes: ZEV = zero-emission vehicle, which includes BEV, PHEV and FCEV; EVSE = electric vehicle supply equipment. Weight exemptions support freight operators by allowing ZEV trucks to exceed strict weight restrictions by a set amount. Because batteries weigh more than diesel fuel combustion technologies, ZEV truck operators may need to reduce their cargo to meet weight restrictions, resulting in lower profits and inefficient freight delivery. Utility investment: electric utilities tend to be large companies with business interests in EV charging, but they may be unwilling or unable to invest in charging infrastructure. Leading provinces and states have enabled or directed utilities to develop plans and deploy HDV charging infrastructure. Sources: See list of sources.

Public policies prepare for expected surge in electric heavy-duty vehicles

Electric heavy-duty vehicles (HDVs) have faced slower adoption compared with LDVs due to high energy demands, large battery capacity requirements and limited availability of vehicle models. Now, the landscape is changing with advances in battery technology, bigger variety of models available and policies to support ZEV uptake in the HDV segment. Demand is expected to surge in this decade..

Asia

China is the leader in deploying zero-emission HDVs drawing from early and continuing actions over the last decade. The government bolstered the zero-emission HDV market with generous direct subsidies, initially for public buses and municipally owned vocational trucks, to offset higher vehicle costs (compared to ICE vehicles). Fuel economy standards further supported the development of electrified components.

Government subsidies for electric HDVs that were due to be phased out in 2019 were extended in 2020 through the Notice on improving the promotion and application of financial subsidy policies for New Energy Vehicles.

Current subsidies are calculated as a purchase price reduction valued per kilowatt-hour (kWh of battery capacity and modified for bus length and truck weight, with a cap set at about CNY 200 000 [USD 30 000]). Local governments often augment the subsidy with a cap set at 50% of new vehicle costs.

Japan’s HDV decarbonisation strategy takes a different direction by focusing on hydrogen. Its 2017 Basic Hydrogen Strategy aims to rapidly expand hydrogen production and make the fuel more abundant and affordable. Its hydrogen strategy sets targets for FCEV deployment, including 1 200 transit buses by 2030. Japan plans to showcase the FCEV bus technology during the 2021 Tokyo Summer Olympics.

In India, through the FAME-II programme, the government is targeting electrification of buses. About 86% of the programme’s budget is earmarked for direct vehicle subsidies, which is expected to generate demand for 7 000 BEV buses. Under the programme, the national government recently approved the addition of 5 595 new electric buses in various states.

Europe

The European Union has supported commercial ZEV adoption with a variety of regulations and incentives. Its 2019 HDV CO2 standards reward participating ZEV manufacturers for up to twice the credit allocation of a diesel-fuelled truck through 2024. This “super-credit” system will be replaced in 2025 with a benchmarking system that reduces the calculation of the manufacturer’s average specific CO2 emissions once their ZEV sales share exceeds 2%. ZEV adoption is also supported by the Clean Vehicles Directive, which aggregates municipal vehicle purchases to national levels and establishes ZEV procurement targets for each member state in 2025 and 2030. The European Union also allows electric heavy trucks to exceed class limits by 2 tonnes.

EU member states are using policy measures to promote deployment of electric HDVs. Germany, Spain, Italy and France have provided incentives for commercial ZEV purchases with amounts ranging from EUR 9 000 to EUR 50 000 in some case since 2017. The Netherlands will implement zero-emission zones in 2025 for up to 40 of its largest cities, which will likely encourage the use of electric commercial vehicles in urban areas. The Netherlands and Norway have announced targets to electrify buses and trucks.

Switzerland has encouraged FCEV truck growth through its road tax on diesel truck operations, making alternative fuels more attractive for large Swiss retail associations.

United States

At the federal level, the United States lacks meaningful policy to support electric HDVs. Fuel economy standards allow ZEVs as eligible technologies but no other incentives are in place. At the subnational level, however, innovative policies have been adopted.

For example,15 states and the District of Columbia have targeted 2050 for all new commercial HDVs to be ZEVs, with an interim target of 30% by 2030.

California leads state efforts:

- Launched by the California Air Resources Board in 2009, the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) makes clean vehicles more affordable for fleets through point-of-purchase price reductions. It is a first-come first-served incentive that reduces the incremental cost of commercial vehicles. Incentives may be up to USD 150 000 for eligible ZEV technologies. HVIP has disbursed more than USD 120 million for the uptake of ZEV buses and trucks. The programme was replicated in New York and is planned for adoption in Massachusetts and New Jersey.

- Developed in 2009, the Low Carbon Fuel Standard rewards clean fuel generators and ZEV owners with credits that can be sold to non-compliant fuel providers. The programme is expected to particularly encourage zero-emission HDVs as the fleets are more likely to accrue large-scale savings for using low-carbon fuels and to secure those savings. The standard was replicated in Oregon.

- Adopted the Innovative Clean Transit Rule in 2018, which requires all bus sales to be ZEVs by 2029, and the Advanced Clean Truck Rule in 2020, which uses the LDV ZEV programme design to require zero-emission truck sales as a percentage of total vehicle sales for each truck manufacturer. New Jersey has become the first of several states to adopt the rule; 13 other states plus the District of Columbia have announced their interest in following suit.

- Adopted legislation that compels large investor-owned utilities to submit proposals for electrified transportation, including programmes specific to HDVs. Southern California Edison has proposed to spend more than USD 300 million to install truck and bus charging stations in its service territory in the next five years. Pacific Gas & Electric has developed a plan that replaces costly charges for commercial ZEVs with a subscription service.

- Allows a 1 metric tonne exemption for alternative fuel freight vehicles to exceed weight class limits.

Canada

In October 2020, the government announced the Infrastructure Growth Plan and pledged CAD 1.5 billion (USD 1.1 billion) to procure 5 000 zero-emission public buses, with an additional CAD 2.75 billion (USD 2 billion) over the next five years to electrify transit and school buses across the country.

Canadian provinces also have programmes to advance zero-emission HDV adoption. Québec has subsidised electric trucks since 2017 and offers commercial freight vehicle operators 50% off the incremental price of a new electric truck up to CAD 75 000 (USD 56 000). British Columbia recently increased incentives in two Clean BC programmes that enable commercial ZEV purchase price reductions up to 33% with a cap of CAD 100 000 (USD 75 000). British Columbia also manages a low-carbon fuel standard that was implemented in 2010 and was updated in 2020 to require fuel suppliers to reduce carbon intensity annually to reach a total reduction of 20% relative to 2010. At the national level, the Clean Fuel Standard adopts design features of British Columbia’s low-carbon fuel standard, putting in place a policy to reduce the carbon intensity starting in 2022 by 13% by 2030, relative to a 2016 baseline.

Other regions

In early 2021, the New Zealand government established a requirement that only zero-emission public transit may be purchased from 2025, with the target of decarbonising the public transport bus fleet by 2035. Government support to regional councils for this objective is a NZD 50 million (USD 35 million) fund over four years.

In South America, Chile and Colombia each established national targets in 2019 to electrify their bus fleets by 2040 and 2035 respectively.

Government investment in charging infrastructure for HDVs is slowly picking up

Leading governments around the world are developing programmes and strategies to roll-out high power fast charging networks. Several large-scale national or regional investments have also expanded commercial charging that has indirectly supported HDVs.

China has prioritised public fast charging infrastructure, which today supports its expanding commerical electric vehicle fleet, including HDVs. While subsidies from the central government have not been particularly large, additional subsidies from local sources have supported installation of large-scale charging infrastrucure by China’s largest electric utilities.

In India, the FAME II programme supports investment in EVSE for electric buses with funding up to USD 135 million. This is expected to cover the costs of one low power charger per bus and one fast charger for every ten buses.

In Japan, the government supports the ZEV deployment plan with infrastructure targets and financial support. Through its Basic Hydrogen Strategy, plans are to install 320 hydrogen stations by 2025.

The European Union Alternative Fuels Infrastructure Directive requires each member state to establish a plan that defines charging needs. It does not explicitly set guidelines or targets for the charging infrastructure to support electric HDVs.

The Netherlands released a roadmap for logistics charging infrastructure, including HDVs and inland shipping in 2021.

The United Kingdom government will provide GBP 500 million (USD 640 million) to support public charging installations to 2025, including funding for the Rapid Charge network that will place high power chargers (150-350 kW) along strategic transport corridors. It aims to install 2 500 high power charging stations by 2030 and 6 000 by 2035.

California and some other US states are supporting infrastructure developments for electric HDVs through direct investment. The California Energy Commission (CEC) has funded the largest hydrogen refuelling network in North America with more than USD 125 million since 2009 for 62 public stations as part of the state goal to install 200 stations by 2025. Until 2020, investments have focused on LDV refuelling infrastructure. In December 2020, a plan was approved to provide up to an additional USD 115 million for hydrogen refuelling infrastructure, including fuelling for medium and heavy-duty vehicles.

The Canada Infrastructure Bank will invest CAD 1.5 billion (USD 1.1 billion) in electric buses and associated charging infrastructure.

References

In Norway, battery-electric cars have been exempt from registration tax since 1990 and from value added tax since 2001. Such taxes in Norway can be up to half or as much as the full initial (pre-tax) vehicle purchase price.

A number of other US states follow the California ZEV mandate (Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Vermont and Washington). Canadian provinces Québec and British Columbia adopted the mandate in 2020.

For example, Sri Lanka applies significantly differentiated import taxes for conventional versus electric and hybrid second-hand vehicles. As a result, it is recognised for its high number of hybrid and electric vehicles. Mauritius is taking a similar approach.

In Africa, 60% of LDVs in circulation are imported second-hand vehicles, primarily from EU countries, Japan and United States.

Including China, European Union, India, Korea, United Kingdom and United States.

In 2021, a fuel-efficient passenger vehicle counts for only half of a conventional vehicle sold, easing compliance to meet the NEV credit target for the OEM. This 0.5 factor tightens in 2022 and 2023.

This target was confirmed in October 2020 and updates the previous target of 15-20%, though a proposal for an update to 25% by 2025 did not make it to the final version.

Which includes a commitment for climate neutrality by 2050.

Applicable to 95% of registered new cars in 2020 and 100% in 2021.

SAFE weakens the annual improvement in fuel-economy standards from 4.7% under CAFE to 1.5% for model years 2021-2026.

The largest share of the incentives is dedicated to buses (41%), followed by three-wheelers (29%) and two-wheelers (23%).

Electrified vehicles include HEVs, BEVs, PHEVs and FCEVs.

Includes cities/provinces of Beijing, Tianjin, Shanghai, Sichuan, Henan,Guangdong, Shandong, Jiangxi, Hunan and Hainan.

The 2006 EU Battery Directive targets a 50% recycling efficiency of batteries by weight. The new Battery Regulation proposal envisions a 70% recycling efficiency for Li-ion batteries by 2030, plus specific recovery rates of 95% for cobalt, nickel and copper and 70% for lithium.

Reference 1

In Norway, battery-electric cars have been exempt from registration tax since 1990 and from value added tax since 2001. Such taxes in Norway can be up to half or as much as the full initial (pre-tax) vehicle purchase price.

Reference 2

A number of other US states follow the California ZEV mandate (Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Vermont and Washington). Canadian provinces Québec and British Columbia adopted the mandate in 2020.

Reference 3

For example, Sri Lanka applies significantly differentiated import taxes for conventional versus electric and hybrid second-hand vehicles. As a result, it is recognised for its high number of hybrid and electric vehicles. Mauritius is taking a similar approach.

Reference 4

In Africa, 60% of LDVs in circulation are imported second-hand vehicles, primarily from EU countries, Japan and United States.

Reference 5

Including China, European Union, India, Korea, United Kingdom and United States.

Reference 6

In 2021, a fuel-efficient passenger vehicle counts for only half of a conventional vehicle sold, easing compliance to meet the NEV credit target for the OEM. This 0.5 factor tightens in 2022 and 2023.

Reference 7

This target was confirmed in October 2020 and updates the previous target of 15-20%, though a proposal for an update to 25% by 2025 did not make it to the final version.

Reference 8

Which includes a commitment for climate neutrality by 2050.

Reference 9

Applicable to 95% of registered new cars in 2020 and 100% in 2021.

Reference 10

SAFE weakens the annual improvement in fuel-economy standards from 4.7% under CAFE to 1.5% for model years 2021-2026.

Reference 11

The largest share of the incentives is dedicated to buses (41%), followed by three-wheelers (29%) and two-wheelers (23%).

Reference 12

Electrified vehicles include HEVs, BEVs, PHEVs and FCEVs.

Reference 14

The 2006 EU Battery Directive targets a 50% recycling efficiency of batteries by weight. The new Battery Regulation proposal envisions a 70% recycling efficiency for Li-ion batteries by 2030, plus specific recovery rates of 95% for cobalt, nickel and copper and 70% for lithium.