Cite report

IEA (2020), Energy Efficiency 2020, IEA, Paris https://www.iea.org/reports/energy-efficiency-2020, Licence: CC BY 4.0

Report options

Long-distance transport

As with urban transport, the Covid-19 pandemic has dramatically curbed long-distance transport, modifying energy intensity via a mix of structural and technical efficiency effects.

Short-term changes include:

- lower load factors in passenger aviation and rail, due to lower demand and the impacts of lockdowns

- low fuel prices, leading to inefficient freight shipping routes

- a reduction in cargo freight capacity in passenger flights, leading to cargo-only flights in less efficient aircraft

- retirements of some of the least efficient planes, trains and ships.

Crisis-induced factors that could affect long-distance transport energy intensity

| Type of effect | Factor | Potential effect on energy intensity improvement |

|---|---|---|

| Activity and structural | Lower load factors in passenger aviation and rail transport, leading to higher energy use per passenger. | |

| Modal shifts in passenger transport, from aviation to cars. | ||

| Modal shifts in passenger transport, from aviation to rail. | ||

| Modal shifts in freight transport from sea to inter-continental rail. | ||

| Technical efficiency | Higher shares of the aviation fleet used for cargo versus passenger flights. | |

| Economic stimulus for airlines and automotive companies is not tied to energy efficiency improvements, leading to rebounds in less efficient transport. | ||

| Continuing low fuel prices encourage the purchase of less efficient vehicles and fuels. | ||

| Government stimulus spending targets more efficient vehicles and modes of inter-city transport. | ||

| Lower demand for long-distance travel, leading to the retirements of some of the least efficient planes, trains and ships. |

Note: A shift from aviation to cars may lead to higher or similar energy intensity, depending on the trip.

In the longer-term, the future of long-distance passenger transport is extremely uncertain. The impact of the crisis on the economic viability of the aviation sector is a key unknown, which could result in modal shifts from aviation to rail or cars for certain domestic and short-haul international journeys.

Freight transport has been less severely affected than passenger transport, as consumers are continuing to purchase goods and services that require transport, even during lockdowns. However, the demand shocks triggered by the pandemic have been felt particularly hard by freight shipping, used for long-distance transport of fuels, raw materials and finished products.

Aviation and rail

Activity and structural impacts

An unprecedented collapse in air and rail travel could trigger long-distance modal shifts

The Covid-19 crisis has led to an unprecedented collapse in commercial flights and air passenger traffic. At the height of travel restrictions in April, there were 65% to 75% fewer commercial flights globally compared with April 2019, and a 98% reduction in international passenger demand. While flights have since gradually resumed, they remained at around 45% of 2019 levels as of September.

As of mid-November, the International Civil Aviation Organization expected air passenger traffic for 2020 to be 60% lower than in 2019. The largest drops are expected in Asia-Pacific, followed by Europe.

World air passenger traffic evolution, 1980-2020

OpenGlobal passenger rail demand for 2020 is expected to decline by up to 30% compared to 2019 according to scenarios developed by the International Union of Railways (as of July 2020). Another projection from September by the consultancy SCI Verkehr estimates a 36% drop from 2019. An estimated USD 45 billion to USD 60 billion in revenue losses are expected in 2020, nearly all from Asia (53%) and Europe (44%) where there are significant passenger rail services.

On average, trains are at least 12 times more energy efficient per passenger than air travel. Therefore, a net shift from aviation to rail, resulting from lower falls in demand for rail than for aviation, would substantially reduce energy use and emissions.

Covid-19 could accelerate the shift from air to rail travel in Europe and China. Higher demand for rail, and lower-than-expected growth in aviation would see an additional 800 high-speed trains in operation in Europe within the next decade, and nearly 200 fewer planes required globally. Earlier IEA analysis had already shown that around 14% of all flights could be competitively shifted to high-speed rail. Several night train routes are emerging (or re-emerging) in Europe, typically on ideal overnight routes of around 10 to 16 hours.

Some countries have also announced policies that may help accelerate a shift from air to rail in the medium to long term. In May, the French government announced that bailouts for Air France would be contingent on the national carrier ceasing to offer short-haul domestic flights when rail presents a viable alternative (trips that take less than two hours and 30 minutes). In China, which has a large potential to shift domestic flights to high-speed rail, rail stimulus announcements in the first half of 2020 are so significant they have already buoyed steel demand there.

In other countries, however, at least some of the domestic aviation trips are likely to be replaced by car travel. According to one US survey in May, around 60% of respondents intended to travel more by car (compared with around 35% by plane), up from 33% in a comparable 2018 survey (60% by plane). A European survey showed similar splits: 50% by car, 30% by plane, and 10% by train.

Potential trends in long-distance modal shifts are still emerging. However, energy intensity is likely to be significantly reduced by shifts from aviation to rail, little changed by shifts from aviation to cars and increased by shifts from rail to cars.

Travel restrictions and capacity constraints reduce fuel economy of passenger aviation and rail

In the aviation sector, travel restrictions, quarantine requirements upon arrival, high ticket prices, and the need for physical distancing have limited the number of passengers per aircraft, increasing fuel consumption per passenger. In April the average load factor for international flights plunged by two-thirds to just 28%, meaning that only about one in four seats were occupied.

In Australia, caps on international passenger arrivals to manage the virus have resulted in some flights having as few as 30 passengers (a load factor of around 10%), while some US and Asian airlines are keeping middle seats empty. As a result of such restrictions and lower demand, the International Air Transport Association expects the average load factor to fall from 83% in 2019 to 63% in 2020 .

Rail passenger load factors have also fallen, because of lower demand as people chose to travel less via mass transport and safety measures during the height of the Covid-19 crisis. Maximum capacity requirements were temporarily introduced for train travel in France, Italy and elsewhere, which increased energy use per passenger.

Most rail operators no longer impose seating restrictions and have instead introduced measures to maximise the space between passengers where possible, as well as improving ventilation and cleaning procedures. However, while rail capacity is recovering in some countries, such as China, in others load factors have continued to be lower.

Technical efficiency impacts

Higher shares of air freight are affecting the average technical efficiency of aviation

The impacts on air cargo have been less severe than on passenger aviation. Global demand for air cargo fell by 18% in June compared with June 2019, recovering from lows in April when demand fell 28%. This is partly because air freight is continuing to play a vital role in the rapid transport of goods necessary for Covid-19 responses.

Overall, the share of cargo in total air traffic has increased. For example, cargo Boeing 747s accounted for more than 90% of all 747 flights in August compared with around 70% in January. The rising share of cargo flights is having negative impacts for aviation as cargo aircraft tend to be older and less efficient than passenger aircraft.

One of the less reported impacts of the severe drop in passenger aviation is the flow-on effects this is having for freight transport, as many passenger flights also reserve space in cargo holds for freight. As passenger flights were reduced, belly capacity for international air cargo fell by 70% in June compared with the previous year. This has been partially offset by the surge in cargo-only operations of passenger aircraft, which were up 35% in April. However, retrofitted or modified passenger planes offer limited cargo capacities compared with regular cargo aircraft, resulting in low fuel efficiency levels.

Early retirements of inefficient, high-capacity passenger planes: A silver lining for energy efficiency?

Lower demand for long-distance travel has accelerated the retirement of ageing or uneconomical planes, particularly large, four-engine aircraft, which are less energy efficient than smaller long-haul aircraft due to inherent design factors and lower seating densities.

Nearly half of the Airbus A340-600 fleets, almost 30% of the A380 fleets and 70% of the Boeing 747 fleets are to be retired or placed in long-term storage. In July, Boeing announced that B747 production would end by 2022, while Airbus completed initial assembly of the last A380 in September. A range of airlines have announced retirements of older, less efficient aircraft of other sizes. In total, more than 550 aircraft are unlikely to fly again.

Number of retired four-engine aircraft (scrapped or long term storage) by model and airline since March 2020

OpenHowever, some of these retirements have been pulled forward by merely one year. At the same time, airlines are delaying and cancelling orders for new, more efficient planes as fuel prices continue to be low and demand will take years to rebound. Meanwhile, aircraft manufacturers are reversing their initial plans to increase production in 2020 and beyond.

Global aviation fuel consumption, 2013-2021

OpenIn sum, the International Air Transport Association forecasts that fuel consumption improvements will slow down in 2020 and levels initially expected to be reached this year will only be achieved in 2021. Although early retirements of planes have made only a minor impact, fuel consumption improvements would be even lower without them.

The crisis is also drawing attention to the fuel cost savings made possible via more efficient aircraft, as airlines find themselves in deep financial stress. For example, more efficient Boeing 787s and Airbus A350s accounted for almost half of long-haul traffic during the second quarter of 2020, compared with only a quarter in 2019. Order books suggest that despite cancellations, more efficient aircraft types will continue to play a role in airlines’ future plans.

How will recent retirements of very large aircraft affect air travel if it returns to pre-crisis levels?

Early retirements of some of the world’s largest aircraft have improved the average fuel efficiency of the aircraft fleet in 2020, which will reduce energy use and emissions when flights start to increase again. However, the impact is minor.

If flights return to 2019 levels, replacements of very large aircraft (Airbus A380s and Boeing 747s) by smaller, more efficient aircraft that were triggered by Covid-19 would improve average fuel efficiency of the global aircraft fleets by just 0.2%. Although the impact is slightly larger when only looking at long-haul fleets, it stresses the need to accelerate fleet renewals in addition to replacing very large aircraft with smaller models. Typically, new models are 15% to 25% more fuel efficient than their predecessors with similar sizes and ranges. In 2020, this process has slowed, as airlines are avoiding major investments and aircraft manufacturers are reducing production capacities.

Accelerated retirements of less efficient diesel trains for passenger rail

Covid-19 could further accelerate the reduction in the diesel locomotive fleet, particularly in passenger rail. The market for diesel locomotives is expected to shrink by 24% between 2020 and 2024 compared with pre-pandemic projections. However, in freight rail – especially in markets with very few electrified networks, like the United States and the Russian Federation (“Russia”) – investments in diesel locomotives are expected to continue.

Shipping

Activity and structural impacts

Shifts from ships to rail along Asia to Europe routes may increase freight energy intensity

Freight shipping activity has fallen as a result of record drops in cargo and oil demand. Global container trade volumes declined 8% through the first half of 2020, after bottoming out in April when it fell 17% compared with April 2019. Data from EU ports show that ship arrivals declined by 16.5% through the first half of 2020 compared with the first half of 2019.

Global freight rail volumes are also projected to decline by up to 10%. The largest revenue losses are expected in Europe, accounting for about a third of the global losses projected in 2020. Freight rail traffic in continental Europe is projected to drop by 20%. In India, rail freight demand fell by 28% during April and May compared with April and May 2019, with lower coal loads contributing to 60% of the reduction.

In China, however, which has the largest share of global freight activity, freight rail has been resilient, with volumes up 3.6% year-on-year through the first half of 2020. This increase is the result of a shift from marine to rail on selected routes.

Ocean freight has been affected by capacity constraints as ships have been withdrawn and strong European demand for personal protective equipment from China has filled up the available air freight space. As a result, traders in Europe and Asia have increasingly shifted to using rail corridors linking the two continents. Rail is likely to have mainly replaced ocean freight (which is slower but cheaper) more than air freight (which is much faster but more expensive). This may slightly increase energy intensity, as rail is more energy intensive than ocean freight but less energy intensive than air freight.

Freight turnover on Eurasian routes was 30% higher in March compared with 2019, and 90% higher in August.

Eurasian rail freight turnover, Jan-Sept 2019 and 2020

OpenEast to west rail routes have become so popular that capacity constraints are now being reached. Congestion is starting to increase rail shipping times, which are normally about one week faster than ocean shipping.

Technical efficiency impacts

Economic downturn pushes down marine fuel prices, with mixed implications for energy intensity

As of 1 January 2020, the International Maritime Organisation lowered the maximum sulphur content of shipping fuel oil from 3.5% to 0.5%. To comply with the new regulations, freight ship operators can either use very low sulphur fuel oil or continue to use high sulphur fuel oil in combination with scrubbers, devices that reduce sulphur dioxide emissions but use more energy.

Very low sulphur fuel oil prices (linked to Brent crude oil prices) were high before the pandemic, making high sulphur fuel oil and scrubbers the more economical choice for compliance for large ships. However, the economic crisis has narrowed the price difference between the fuel oil types – from around USD 160 per million tonnes in the first quarter of the year to around USD 50 in the third quarter. As a result, the payback period for using high sulphur fuel oil and scrubbers is now six to seven years on a scrubber worth USD 3.5 million.

Low oil prices change oil tanker delivery routes

Low marine fuel prices, combined with a shortage of fuel storage facilities at the height of lockdowns, resulted in some unusual itineraries for fuel tankers, many of which were essentially repurposed as floating oil storage facilities.

As oil prices hit historic lows in March and April, satellite tracking revealed that some supertankers were taking longer delivery routes in the hope that by the time they reached their destination, oil prices would have risen, more than offsetting the cost of burning extra fuel by taking the longer route.

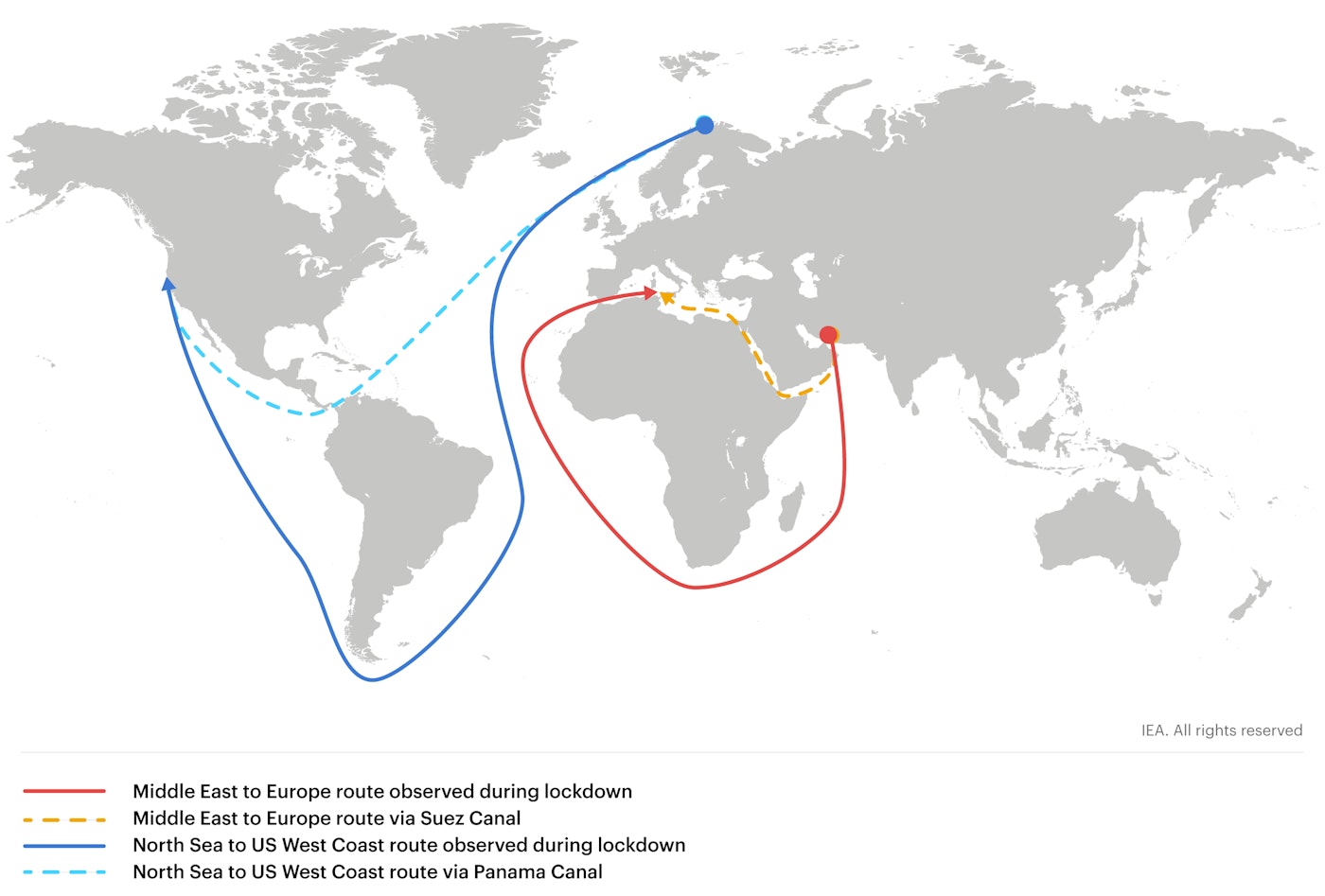

Illustrative crude oil tanker delivery routes: Frequently taken oil tanker routes compared with some routes taken during March-April 2020

Open

Reports show that at least three supertankers travelled a far more energy-intensive route around the Cape of Good Hope instead of taking the Suez Canal, while European tankers delivering fuel to the West Coast of the United States were observed sailing around Cape Horn at the tip of South America instead of taking the Panama Canal.

Should low oil prices prevail, more shipping operators might shift to very low sulphur fuel oil, a less energy-intensive option. Without any regulation, however, sustained low oil prices could delay or discourage the adoption of low-carbon alternative fuels, such as LNG in the near term, and biofuels, hydrogen and ammonia in the longer term. They could also reduce the imperative to adopt technical and operational measures to reduce fuel consumption.

Cruises pause but fleet efficiency rises as inefficient ships are retired or retrofitted

Passenger cruise ship operations were projected to serve 32 million passengers in 2020, but have been largely suspended since mid-March. Operations in the United States have been suspended until the end of October, while similar suspensions have been announced in Australia, Canada and New Zealand.

As with the aviation industry, retirements of older ships have been taking place in the cruise liner industry. Carnival, the world’s largest operator, announced plans to sell 13 ships for scrap, representing 9% of its capacity. These are likely to be ageing ships that are less energy efficient. Royal Caribbean, another major cruise operator, is also scrapping or selling older parts of its fleet.

As in aviation, financial stress could delay cruise companies’ purchases of new ships, meaning the net effect for fleet technical efficiency may not be as large as expected. However, the unexpected downtime during the pandemic is also affording cruise operators the chance to conduct large-scale energy efficiency-related retrofits of the remaining fleet to reduce future operating costs.1

References

IEA conversations with energy efficiency consultants to the cruise ship industry.

Reference 1

IEA conversations with energy efficiency consultants to the cruise ship industry.