Cite report

IEA (2021), Driving Down Methane Leaks from the Oil and Gas Industry, IEA, Paris https://www.iea.org/reports/driving-down-methane-leaks-from-the-oil-and-gas-industry, Licence: CC BY 4.0

Report options

Regulatory Toolkit

By making your way through the Roadmap, you have conducted a landscape review of your regulatory setting and context (Steps 1-3). You have also assessed your regulatory capacity and stakeholder engagement and developed a plan for outreach (Steps 4-5). You should have also established a baseline and set appropriate goals and objective for your regulation (Step 6). In brief, you are ready to set a strategy, work on policy design and implement your regulation. Your outlined strategy will likely include a number of elements and include several governmental bodies. This Toolkit presents the different mechanisms that are already in use in various jurisdictions along with information about how you can use them.

We start by considering the different regulatory structures that will aid you in selecting an appropriate policy design (Step 7). We proceed to further explore the four main approaches to methane regulation, describing their typical requirements, benefits and drawbacks. For each approach, we present concrete examples from our Policies Database that will provide models for you as you draft your policy (Step 8). Finally, this Toolkit discusses essential elements of regulation. This includes mechanisms for enabling compliance and enforcement (Step 9) through the use of monitoring, reporting and verification provisions, approaches to co‑ordinating complementary policies, and strategies to ensure your policy can be adapted through periodic review and refinement (Step 10).

Outline of regulatory toolkit

|

Topic |

Subtopic |

Key questions |

|---|---|---|

|

Regulatory structure |

|

What is the overarching structure of your regulatory regime? |

|

Regulatory approach |

|

What types of tools are best suited for each strategy and setting? |

|

Regulatory elements |

|

What are the key aspects of successful regulatory regimes for methane? |

Regulatory structure

What is the overarching regulatory structure: a case-by-case approach or generally applicable requirements?

Governments usually either apply requirements on a case-by-case basis through individualised permits or contractual provisions, or establish broad, generally applicable standards. These two options can also be used in combination, providing different degrees of regulatory discretion and flexibility.

Case-by-case requirements, whether they are applied through permits, bidding rounds, contracting arrangements or a licensing scheme, typically provide more space for adaptation – but individually tailored provisions may require additional resources on the part of the regulator. On the other hand, generally applicable regulations – focused on addressing climate change, air pollution, worker safety or resource efficiency – may be more rigid in application but potentially demand less institutional commitment.

Depending on the regulatory structure of your jurisdiction, you may already have regulations of one or both types. Many countries use a licence or concession process to grant rights to exploit oil and natural gas but at the same time, impose generic regulations to control air pollution. A key starting point may be to determine whether enabling legislation already exists, and in what form. If so, you may be able to incorporate provisions on methane within an existing regime by updating applicable guidelines or norms that orient procedures already in place.

Case-by-case approach

Methane requirements can be introduced within authorisation or contracting procedures, from bidding of exploratory areas to service procurement, including project appraisal, direct development through NOCs or shared production agreements.

For example, auctions could include a criterion rewarding bidders that commit to low emission levels. Alternatively, contracts might specify what measures must be taken to avoid leaks or establish performance standards regarding emissions. Permits may limit flaring and venting or require periodic monitoring of abandoned wells to ensure no methane leaks are active.

Requirements can be introduced in permits or licences that cover a range of ongoing activities. These requirements may be individually developed for each permit, or they may be based on provisions found in overarching codes, model clauses or guidelines, such as Northern Territory of Australia’s code for onshore oil activities in its northern region. This regulation applies to all interest holders and requires baseline assessments, routine air monitoring, venting and flaring restrictions, and the need for businesses to present methane reduction plans before the start of production, with reduction targets set “as low as reasonably practicable”. Thus, it sets minimum standards that will be assessed for each permit on a case-by-case process, without limiting the ability of the regulatory authority to adjust or tailor these requirements for a specific permit or to establish more stringent measures if deemed necessary.

Certain activities may also be subject to a specific authorisation or consent procedure. Nigeria’s standards for the petroleum industry, for example, state that if flaring must occur, operators must secure a waiver and permit for each instance of flaring, and must pay the necessary fines for every standard cubic metre flared, ensure complete combustion and prevent venting.

One key benefit of these approaches is that they can be adapted based on the specific circumstances. Requirements are individualised depending on the characteristics of the particular project, and this can provide a more tailored approach that can ensure the most cost-effective measures are applied.

Case-by-case systems offer multiple avenues for regulators and companies to address methane emissions. Regulators can establish reduction requirements across the board or introduce them more gradually through pilot projects with interested operators. If an initiative is successful, it can be rolled out to the whole industry.

Permits

Permits are a means of granting authorisation for specific operations or procedures that would otherwise be legally prohibited (e.g. pollution permits, drilling permits, flaring permits). Permits also include conditions that limit their validity, which may be temporal, technological or spatial. Non‑compliance with permit provisions may result in the suspension or withdrawal of the permit, interrupting or leading to the termination of related undertakings.

Oman requires projects with significant greenhouse gas emissions to apply for and obtain a climate affairs permit, which authorises the emission of greenhouse gases. A permit is required of oil and natural gas developments that emit 2 000 tonnes of CO2 equivalent per year or more, or that product and consume 30 TJ or more of energy per year. The request for a licence requires an initial approval of the project by the competent authority and an initial report on the expected amount of greenhouse gas emissions. As part of the permitting process, projects are required to monitor and report their greenhouse gas emissions annually; use energy-efficient and low-emission technologies; submit a plan to increase green space; and undertake adaptation measures to protect their business from the impacts of climate change.

Permits can often enable methane reduction through targeted provisions. In Norway, operators must apply for production permits every year, presenting flaring/cold venting volumes among other matters for approval.

Contracts

Petroleum contracts refers to systems where the government grants contractual licences to companies to exploit oil and gas, including through concessions, production sharing contracts, joint ventures, technical service contracts and unitisation agreements. These instruments typically grant the licensee a right to explore, develop and exploit public resources under certain conditions. These conditions may include restrictions related to methane emissions. Due to the contractual nature of these restrictions, it may be difficult to alter provisions in existing contracts without specific statutory authority to do so.

The United Kingdom has published model clauses that are included in petroleum licences for both onshore and offshore production. These clauses include a requirement that the licensee may not flare or vent gas without obtaining the prior consent of the Oil and Gas Authority. In addition, every petroleum licence includes a provision requiring the licensee to take all practicable steps to prevent the escape or waste of oil or gas from its operations. In previous updates to the United Kingdom’s statutory petroleum authorities, the legislature has made changes to model clauses automatically applicable to all existing contracts.

The Oil and Gas Authority has recently published a report on venting and flaring from regulated activities, including a commitment to take a stronger stance on flaring and venting through its consents, field development process and project stewardship activities.

Generally applicable regulations

Methane requirements may also be addressed through generally applicable regulations. The key difference between this and the case-by-case approach is that these requirements apply to all regulated activities without individualised tailoring of requirements. However, standards may still differ based on predetermined categories, such as industry segment, age and type of facility, or kind of technology employed.

Some countries have developed regulations narrowly targeted at reducing oil and gas methane. Mexico, for example, has developed a regulation for the prevention and comprehensive control of methane emissions from the hydrocarbons sector. Under this regulation, facilities must develop and implement a Program for Prevention and Integrated Control of Methane Emissions. They must identify all sources of methane, calculate an emissions baseline, set an emissions reduction goal and establish an implementation schedule for mitigation measures, demonstrating annual progress towards their goal.

In other cases, policies may apply more broadly to other sectors and other pollutants besides methane. For example, methane provisions may be included in instruments that set policy for the entire oil and gas sector, either focusing on a specific segment, such as the upstream or downstream industry, or addressing the entire oil and gas value chain. Nigeria’s national gas policy encourages the use of flare gas capture technologies, including those related to power generation, prohibiting flaring at greenfield projects and promoting gas utilisation initiatives.

Even broader still, methane may be covered by broad environmental regulations that apply to many sectors and many air pollutants. For example, methane may be covered by a directive setting overall greenhouse gas targets. This could include a set of complementary requirements, such as greenhouse gas reporting, emissions intensity limits and a carbon market, including accredited voluntary methane reductions as a way of generating offsets.

Notably, in some countries broad enabling legislation already exists that may authorise regulations on methane abatement at different scales. Often environmental laws or energy legislation have provisions on the need to develop economic activities in line with sustainable development, resource efficiency or industry best practice, and these provisions could be further developed through regulations.

Once you have settled on a general strategy, additional tools and elements can be incorporated to effectuate your regulation and achieve your policy goals. The following sections of this Toolkit describe key regulatory typologies and essential regulatory elements.

Methane Strategy

Regional or national strategies provide roadmaps for curbing overall or sector-wide methane emissions. They are often non‑binding and provide information about future regulatory actions to the public.

The EU Methane Strategy sets forth cross-sectoral measures for key emitting sectors (energy, agriculture and waste management). For the energy sector, it points to legislative proposals in 2021 on compulsory measurement, reporting and verification for all energy-related methane emissions, building on the Oil and Gas Methane Partnership methodology. It also cites requirements for LDAR programmes for both the upstream and downstream segments, as well as the goal to eliminate routine venting and flaring. Furthermore, the strategy puts forth international actions, including promoting global co‑ordination on methane reduction efforts. Thus, it refers to a methane supply index to empower buyers to make informed choices when purchasing fuels as well as to the establishment of an independent international methane observatory tasked with the detection and monitoring of super-emitters through the use and integration of satellite imagery.

Other examples include Nigeria’s National Action Plan to reduce short-lived climate pollutants and Saskatchewan’s Methane Action Plan.

Methane regulation

Some jurisdictions have established regulations for methane pursuant to general legislation such as a petroleum law or an environmental code. These often direct the means and procedures required for emissions control.

British Columbia (Canada) has issued regulations for oil and gas methane in its Drilling and Production Regulation. This rule requires operators to check each well for surface casing vents, at key moments in well development and as part of routine maintenance. If vents are discovered, operators must notify the regulator and eliminate the hazard. If gas migration is discovered, the operator must notify the regulator and submit a risk assessment. The regulation also forbids venting unless the gas heating value, volume or flow rate is insufficient to support stable combustion and a series of conditions are met, including the minimisation of the volume vented. It has further restrictions on flaring and requires a fugitive emissions management programme. This, in turn, is the subject of the Fugitive Emissions Management Guideline.

Note that the federal government of Canada has also issued methane regulations. Pursuant to the 2020 equivalency agreement between British Columbia and the federal government, only the subnational regulations apply within the province, though federal requirements still apply to interprovincial pipelines and other federal works.

Approaches to regulation

What types of tools are best suited for your strategy and setting?

We have outlined four main regulatory approaches in our Typology of regulatory approaches. Here, we explore examples of these different approaches and consider some of the benefits and drawbacks of each approach, as summarised in Table below.

Regulatory approaches drawbacks and benefits

|

Regulatory approach |

Transaction costs |

Rigidity |

Preconditions |

Consider when… |

Examples |

|---|---|---|---|---|---|

|

Prescriptive |

Low |

High |

Moderate |

You have identified key abatement opportunities |

Prohibition |

|

Performance- or outcome-based |

Moderate |

Low |

High |

You have a reasonable understanding of emissions and monitoring capabilities |

Facility limits |

|

Economic |

High |

Low |

Moderate |

A monitoring system is in place and you want to mobilise different solutions |

Royalties (Brazil) |

|

Information-based |

High |

Moderate |

Low |

You need a better understanding of methane emissions and abatement opportunities |

Measure and report |

|

Often different approaches are combined, e.g. Viet Nam has put in place a regulation with restrictions on flaring (prescriptive), entitling the government to grant the right to use, free of charge, gas that would be flared (economic) and requiring gas loss reporting (information-based). |

|||||

It bears emphasis that the choice for regulators is to select the right approach for a given regulatory goal and institutional context. Often, a methane regulation is part of a broader effort with multiple policies co‑ordinated towards reaching a larger goal. It can also be designed to align with efforts from other jurisdictions, allowing for fair competition among areas that share common markets. Ultimately, an effective policy effort will likely involve the co‑operation of different stakeholders and a mix of different regulatory approaches and tools – all working together to tackle methane emissions in a complementary manner.

Thus, different regulatory approaches can build on and complement each other. An information regulation might help to identify key sources that are then tackled by prescriptive or performance-based instruments. Over time, as a regulator improves their understanding of the industry and abatement options, it may be possible to adopt market-based or other economic instruments to facilitate companies’ complying and going above and beyond existing regulations. That said, lack of information or institutional resources need not delay methane regulation, but instead may suggest certain policy design options to compensate for – and perhaps overcome – those deficiencies.

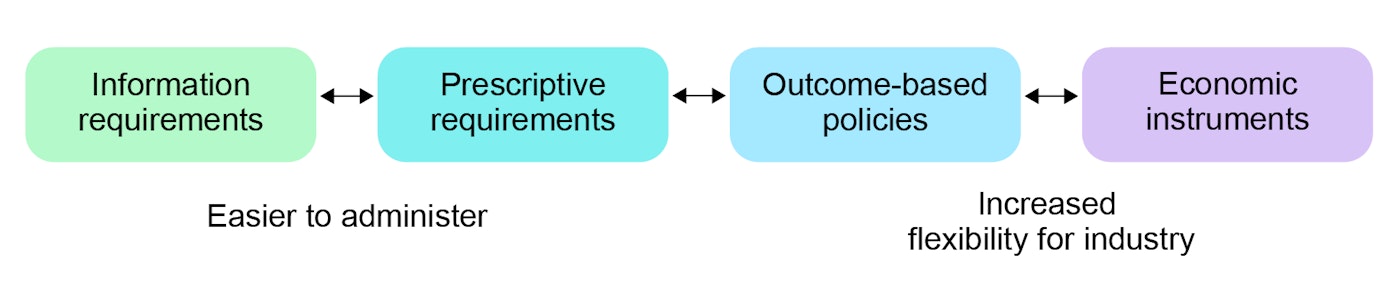

Regulatory approaches continuum

Open

This continuum reflects the different considerations at play in selecting regulatory approaches. At one end of the spectrum, your information is limited, so you might want to focus on building information to understand sources and abatement opportunities. Moving a step further, you have identified some clear and worthwhile abatement opportunities, which you can implement in a command-and-control fashion. Once you have established an institutional environment where you have reasonable estimates and are capable of monitoring emissions, you can use economic instruments or outcome-based standards to ensure greater flexibility and enable creative solutions.

Prescriptive approach

Prescriptive requirements (or command-and-control requirements) achieve emissions reductions by directing regulated entities to undertake or not to undertake specific actions or procedures. Prescriptive requirements may set procedural, equipment or technological requirements such as the installation or replacement of specific devices.

Some regulations direct companies to follow specific procedures or processes with respect to their operations. For example, many jurisdictions have required companies to establish leak detection and repair programmes. As another example, the US EPA’s 2012 standards for volatile organic compounds (as amended to September 2020) set procedural requirements for well completions including requirements to route flowback into well completion or storage vessels.

Prescriptive regulations may also direct companies to adopt specific equipment practices or to replace certain high-emitting equipment or components. Maryland’s regulation requires operators to convert continuous-bleed natural gas-powered pneumatic devices to compressed air or electric systems or to install a vapour collection system.

Prescriptive regulation may also include an outright prohibition on certain activities. Many countries prohibit routine flaring and venting. Algeria’s hydrocarbon law prohibits flaring and venting absent a compelling safety reason without express permission from the regulator.

A key advantage of prescriptive requirements is that they have the potential for a significant impact on overall emissions without the need for an emissions baseline or a continuous monitoring programme. Another advantage of prescriptive standards is that they are relatively simple to administer for both the regulator and the firms, as it is clear what must be done to comply and it is relatively easy for regulators to determine if the standard has been met.

However, there are drawbacks to this type of regulation. It may not be the most cost-effective approach to reducing emissions because companies may not have an incentive to seek out more efficient strategies that are allowed by the regulation. That said, it may be possible to incorporate mechanisms that provide flexibility for companies to select among several available options to reduce emissions.

In any case, for countries in the early stages of regulating methane, prescriptive standards may be an important first step, especially when clear abatement opportunities have been identified. Over time, it may be possible to incorporate performance standards or economic instruments to enable companies to seek cost-effective solutions.

Leak detection and repair

LDAR programmes are designed to locate and repair fugitive leaks. Policies may address the type of equipment used, frequency of inspection, the leak threshold that triggers repair requirements and the length of time allowed to conduct the repairs. The most typical requirement is for quarterly LDAR campaigns, although there are a number of exceptions. These campaigns may be carried out with drones, vehicles or properly equipped personnel.

Alberta (Canada) has different requirements for different types of facilities (e.g. gas plants and compressor stations should conduct surveys three times a year). The regulation defines accepted methods to conduct surveys (e.g. a gas-imaging camera that can detect a stream of pure methane gas emitted at a rate of 1.0 gramme per hour or less operated within 6 metres of the equipment being surveyed), yet also allows for the use of equally capable equipment (subject to demonstration requests). It further provides guidelines for the type of equipment that must be surveyed, personnel training requirements, and reporting and repair directives (e.g. must address detected sources of fugitive emissions within 24 hours of identification if fugitive emissions are the result of a failed pilot or ignitor on a flare stack).

LDAR protocols may be a part of a fugitive emissions management plan. Alberta’s manual on How to Develop a Fugitive Emissions Management Program and Queensland’s (Australia) code of practice for leak management, detection and reporting for petroleum operating plants provide further detail.

Best available technologies requirements

Best available technologies typically refers to a benchmark technology or procedure for reducing emissions that has been determined to be reasonably available. This is often linked to what is considered reasonably practicable and evolves according to technological development. Often regulations mention regular updates to reflect advancing standards and environmental concerns.

Colorado (United States) sets standards according to facility type. Thus, installations that store, process or handle oil or natural gas liquids must minimise the leakage of VOCs and hydrocarbons “to the extent reasonably practicable,” through vapour recovery systems or flares. The regulation specifies that best available technologies are required at equipment level (e.g. flares must have auto-igniters, and open lines must have caps, plugs or valves that seal except when in use) and what types of devices must be replaced with better alternatives (e.g. operators must replace continuous-bleed pneumatic controllers at upstream sites with low-bleed controllers).

For another example, see California (United States), which requires the implementation of a best practices management plan to limit methane emissions.

Performance- or outcome-based approach

A performance- or outcome-based requirement establishes a mandatory performance standard for regulated entities, but does not dictate how the target must be achieved. Such regulations are most often applied at the level of a facility or individual piece of equipment, but they could be applied at wider scale as well.

Performance-based regulations often set a standard of performance for specific types of equipment. The Colorado (United States) regulation includes examples of equipment-level performance standards. For example, large storage tanks must meet a 95% VOC reduction target, and flares must be designed for 98% efficiency.

At a somewhat wider scale, a regulation could mandate that all firms achieve a specific methane reduction goal. This is the approach that Saskatchewan (Canada) has taken in setting requirements at company level for yearly methane reductions. The regulator sets a methane limit each year for all upstream companies that emit at least 50 000 tonnes of CO2 equivalent per year. At the same time, businesses must submit and develop a related methane emissions reduction plan.

Although not mandatory, some jurisdictions have also adopted sector-wide or national-level strategic performance targets for methane emissions (or methane intensity). For example, Nigeria has set targets of achieving a 50% reduction in fugitive emissions from production and processing and from transmission and distribution by 2030.

These examples illustrate the main advantage of performance standards compared with prescriptive standards. Namely, the regulated entity has more leeway to decide on how it will comply with the regulation, which frees the company to seek the most cost-effective solution. Furthermore, because companies that develop cheaper technologies are able to reduce their compliance cost, this kind of policy design can encourage technological development while also encouraging cost-effective improvements in emissions.

On the other hand, these examples also illustrate the key drawbacks of performance standards. In order for this type of regulation to be effective, both the company and regulator must have accurate baseline data and reliable mechanisms to track progress, which may require significant monitoring efforts and/or sophisticated methods for estimating emissions. Considering these requirements, performance standards are an especially useful tool if you already have thorough methane estimates or measurement requirements and a developed reporting scheme.

Emissions standards

Emissions standards set limits on pollutant emissions from specific sources. They are set in terms of a specific metric related to atmospheric emissions, such as quantity (e.g. volume), characteristics (e.g. temperature) or means (e.g. height of discharge). Although they are set in terms of performance, they can be incorporated within regulatory regimes that are primarily prescriptive in nature.

Canada’s federal regulation on the release of methane and certain VOCs places performance standards at facility and equipment level. Conditional requirements apply to covered upstream oil and gas facilities handling significant volumes (at least 60 000 m3/year of gas). For example, as of 1 January 2023, production facilities must limit annual vented volumes of methane to 15 000 m3. This requirement does not apply to vented gas from temporary activities, such as emergencies or equipment start-ups, nor to certain processing equipment. Pneumatic devices are also regulated: operators of natural gas-powered pneumatic controllers must ensure that ongoing emissions remain below 0.17 m³ per hour, and pneumatic pumps are prohibited from emitting methane where the volume of liquid being pumped exceeds 20 litres per day.

Methane intensity

The methane intensity concept represents the total methane emissions from oil and gas production as a percentage of the associated volume of gas marketed. It is intended to serve as a performance standard and to allow the comparison of methane emission levels from different actors and segments of the petroleum industry.

Although not a regulatory action, the Oil and Gas Climate Initiative 2025 methane intensity target is an example of how an intensity target functions. The target covers all sources from operated assets within the upstream sector, including fugitives, venting and incomplete combustion. The overall objective is to be consistent with the Paris goals and approach near-zero methane emissions (0.25-0.2%) by 2025. It applies to initiative member companies (BP, Chevron, CNPC, Eni, Equinor, ExxonMobil, Occidental, Petrobras, Repsol, Saudi Aramco, Shell and Total). The initiative outlines a series of methane reduction measures, including a commitment to zero routine flaring by 2030.

Targets such as these could theoretically be incorporated into regulatory or policy requirements. Ten companies suggested as much in their policy recommendations for Europe’s Green Deal, proposing a methane intensity-based performance standard to be applied to the upstream segment of the supply chains. The Global Methane Alliance also advocates for methane intensity targets, recommending that countries pursue a 0.2% intensity goal.

Economic approach

Economic provisions induce action by applying financial penalties or incentives. This may include taxes, subsidies or market-based instruments such as tradeable emissions permits or credits that allow firms to choose between different strategies to address emissions. In this context, regulations would provide the industry with a choice between reducing emissions and paying for the methane released, effectively changing the cost curve of abatement. In response, an operator might prefer to reduce venting rather than pay a methane tax.

Economic instruments often influence behaviour by making undesirable behaviour more expensive. An emissions tax, such as Norway’s carbon tax, described in Box 9, is perhaps the simplest example of such an instrument. Other versions may provide different compliance options, such as Alberta’s (Canada) Technology Innovation and Emissions Reduction system, where regulated facilities must undertake one of several options: reduce their emissions, redeem credits from facilities that have exceeded their reduction targets, purchase offsets from non‑regulated entities, or pay into a compliance fund.

Economic instruments can also operate by promoting desirable behaviour. Governments may offer economic incentives to nudge a firm to take action. Russia enables offsets of its pollution impact fee when an operator can document that the money was used to invest in the capture and use of associated gas. Similarly, Nigeria allows companies to deduct capital expenditures on gas equipment from profits for taxation means, as well as royalties assessed on gas that is sold and delivered downstream. Canada and the province of Alberta are providing more direct economic incentives through loans and grants to companies for methane abatement projects at existing and orphaned wells.

Economic instruments share some of the benefits and drawbacks of outcome- and performance-based instruments. The primary benefit is that companies are free to seek out the most cost-effective method of reducing their emissions, which can encourage innovation. This may further mobilise other stakeholders, including service providers and different segments of the value chain, in the search for all solutions that are cost-effective taking into account the economic incentives.

At the same time, economic instruments generally require a structured information base and a robust monitoring, reporting and verification system. Robust data are necessary in order to allow regulators and markets to get prices right and follow through with necessary measurements and reporting.

Emissions taxes

In the context of methane, the term carbon tax is generally used to refer to a carbon dioxide equivalent tax. It corresponds to a fee on greenhouse gas emissions coming from an economic sector or entity. It follows the “polluter pays” principle and aims to reduce emissions by making companies and consumers internalise pollution costs. A challenge of this approach is setting an appropriate cost for externalities associated with greenhouse gas emissions.

Norway imposes an emissions tax that is due for the burning of petroleum and the discharge of natural gas from offshore oil production (the tax includes methane and CO2 emissions resulting from the production or transportation of petroleum). It also sets up systems for the calculation and payment of the tax, including metering and reporting requirements to determine the volume of emissions. The offshore industry is subject to a rate of 500 kroner per tonne (about USD 58).

Some countries already have some form of a carbon tax in place for some sectors, although it may not apply to methane emissions, e.g. Canada for fuel consumption and industrial emissions and South Africa for large emitters.

Venting and flaring tax

Levying a tax on vented and flared gas is a way to discourage this practice by making companies pay a fee for the amount of gas lost. Flares and vents are used to dispose of unwanted gases during upstream operations, be it for safety or economic reasons. Venting entails intentional release of gases into the atmosphere, while flaring involves burning of natural gas, which normally occurs at incomplete combustion rates, leading to residual methane emissions.

Nigeria has imposed flaring taxes that are differentiated according to the size of facilities (e.g. an operator that produces more than 10 000 barrels of oil per day must pay USD 2 for each 28.317 m3 of gas flared, while small facilities pay USD 0.50 per 28.317 m3 of gas flared). Greenfield projects cannot engage in routine flaring or venting at all. Nigeria has also set related recordkeeping and reporting requirements.

Brazil also maintains a fee for flaring by charging royalty payments on methane that is unnecessarily flared or vented. The regulatory agency outlines annual and monthly limits for flaring and losses, linking these to royalty fees. If limits are exceeded due to operational restrictions, operators must reduce the production of oil and natural gas.

Information-based approach

Information-based regulations are designed to improve the state of information about emissions. They aim to bridge information gaps and equip regulators and members of the industry and the public with better information about key problem sources and opportunities. Information provisions may also address other aspects of data compilation and organisation, including public disclosure, and the process for collecting and handling data.

The simplest version of this regulation is a simple reporting requirement whereby regulated entities must quantify, either by measuring or estimating, and report their emissions to the regulator. The US EPA’s Greenhouse Gas Reporting Program requires all facilities that emit at least 25 000 tonnes CO2 equivalent per year to report their emissions. For methane, emissions may be estimated using facility inventories, EPA emissions factors and process information relevant to emissions estimates.

In other cases, information provisions may be presented as a compliance means or to facilitate enforcement of other provisions such as taxes and royalties. For example, the United Kingdom requires operators to obtain consent before flaring or venting. Consent is not required for unforeseen events related to worker safety, but the operator must promptly inform the regulator of any such events.

Information provisions may also contribute more directly to emissions reduction. In some cases, companies may not be acting to reduce their methane releases because they are unaware of how much they are emitting. Requiring them to quantify their emissions equips them with better information and may encourage them to take action. Also, regulators can opt to publish information on emissions to inform interested stakeholders, such as investors, of the performance of industry actors. Alberta, for example, publishes an annual statistical report that includes a list of operators ranked by their flaring and venting emissions. Companies that are ranked near the top of this list may receive increased pressure from investors and other stakeholders to reduce their emissions.

One benefit of information-based regulations is that they generally have low implementation costs. Thus, they are usually useful throughout regulatory development, providing necessary figures early on, and often constitute a condition for the implementation of other institutional approaches. On the other hand, such regulations might have a low impact on emissions since they don’t require direct action in this direction, especially in settings where it might be unfeasible to market captured methane.

Ultimately, making information more accessible is a worthwhile undertaking. This may be particularly useful when you need additional information about your industry in order to develop regulations or as a way to raise awareness of methane emissions and linked environmental, safety, energy and economic benefits. Such policies can also play a key supporting role for other regulatory strategies.

Environmental impact assessment

Many jurisdictions require developers to undertake an environmental impact assessment (EIA) linked to project appraisal. EIAs enable the identification of consequences of a proposed action, support decision-making (e.g. granting or refusing a permit) and aid development of environmental management plans.

In Brazil, EIA practice is embedded in the environmental licensing process for oil and gas installations. EIAs also serve as a basis for requirements included in environmental management plans. An informative note summarises common practice, including timetables for the operationalisation of gas treatment and destination systems (e.g. export pipelines); authorisations to start production of wells, often linked to a platform´s efficiency regarding utilisation of produced gas; offsets required from extraordinary volumes of gas flared or vented; and flaring limits. Compensation measures are defined before operation and can take the form of reforestation projects, contributions to climate funds or acquisition and liquidation of carbon credits.

EIAs can be an opportunity to identify significant methane sources and enable the introduction of effective reduction measures. This guide aims to assist practitioners in this process.

Information provision

Information disclosure is a form of promoting the management and sharing of data. It may allow individuals to have access to evidence produced in monitoring programmes or require public authorities to disclose environmental data.

Nigeria’s regulation on flaring, for example, requires operators to keep a daily log of methane flaring and venting, based on metering, and to submit them monthly. The competent administrative body then compiles an annual report, which includes a ranking of producers by associated gas utilisation. Alberta (Canada), does a similar procedure, publishing a report with a summary of flared and vented volumes for the various oil and gas industry sectors, including a ranking of operators based on gas flared, gas vented, and total oil and gas production.

The United Kingdom’s Environmental Information Regulations requires public authorities to disseminate publicly held information and promote data accessibility. It further mandates authorities to make information available upon request wherever possible, citing pertaining exceptions (e.g. for matters of national security or when it would compromise personal data).

Essential elements

What are the key aspects of successful regulatory regimes for methane?

From the IEA’s review of existing methane policies, as well as conversations with regulators, industry, advocates and researchers, we have identified a number of essential policy design elements that support methane regulations. These elements should be strongly considered for any methane abatement regime.

Monitoring, reporting and verification are key supporting elements of different regulations. These requirements ensure enforcement is viable by providing necessary information to regulators. They also enable regulators to track progress towards regulatory objectives. Further, all regulatory regimes require some mechanism for enforcement in order to be successful.

Finally, with the speed that technology is moving, your policy may be out of date before it’s even published. Therefore, it is important to develop a plan up front for how you will ensure it can be adapted to technological advances, incorporate learning and manage changing objectives.

Monitoring

Monitoring encompasses systematic observation and review of selected parameters. The identification and assessment of methane sources, including purposeful venting, unlit flares, releases due to emergency situations, and fugitive emissions all depend on recurrent surveillance efforts.

Monitoring can be deployed to detect or quantify methane releases. Detection is sufficient to verify the need for action (repairs, the closing of a hatch), but quantification is needed for a better understanding of emissions and to establish baselines and related goals (Step 6). Quantification through a bottom-up approach is the more common way to estimate general emissions. It relies on activity data (e.g. the number of facilities, the number of operations, oil and gas production volumes) and either general or specific emission factors (e.g. default values or leak rates for particular equipment types) to calculate overall emission rates. Top-down quantification features direct measurement, normally by airborne or satellite sensors, of atmospheric methane concentrations to infer emission releases. Top-down measurements often do not require support from operators and can be used on a larger scale.

Thus, regulators should consider outlining minimum monitoring requirements in a manner that is co‑ordinated with the overall policy. Periodic monitoring focused on detection, such as LDAR campaigns, may help identify unknown or intermittent fugitive emissions. Measurement campaigns, on the other hand, can support better emission factors and methane inventories. Continuous monitoring may be warranted in particular cases to both ensure better quantification and provide ongoing detection capability for quick action on high-emission events.

At the most basic level, monitoring policies can require assessments by personnel who walk around a facility and look, listen and smell for malfunctions. In a more instrumented approach, personnel may use handheld VOC detectors or infrared sensors (also known as optical gas imaging). Other options include the use of acoustic leak detectors, soap bubble screening, spectrometer sensors, laser leak detectors and quantification equipment such as flow meters or volume samplers. Chapter 2 of this guide gives more information on quantification methodologies and its Annex 2 presents a summary of related mature detection and quantification technologies.

Larger installations and industrial areas can be monitored periodically by devices set up on vehicles or aerial surveillance, through laser radars, optical imaging or other techniques. This can also be done continuously at facility level using monitoring towers and cameras.

Technology is moving rapidly in this area, enabling the use of more remote detection technologies, with ever-lower sensitivity thresholds and cost. Thus, fixed-winged aircrafts, drones and satellites might constitute useful tools depending on the extent of area covered and the leak rates targeted. In general, broader coverage also means less sensitivity, so these technologies might be used in conjunction with others for optimal results. For instance, a promising approach to cost-effective LDAR is to integrate high-level screening and close-range detection technologies. In this context, orbital images may help identify accidents and super-emitters, while aerial detection pinpoints facilities that have significant methane contributions and onsite monitoring efforts assist in managing smaller leaks.

Using public satellite data may require partnering with specialised companies with processing and decoding capabilities. Monitoring solutions currently available, including TROPOMI, Sentinel-2 and Landsat 8, can provide global coverage and daily measurements. Furthermore, while technological developments are enabling the launch of satellites with increasing resolution (e.g. EnMAP, GHGSat), satellite images need to be supplemented by other detection means because they are impaired by several factors besides high detection thresholds, including cloud coverage, offshore environments and forested areas. The optimal system will combine satellite measurements with bottom-up sources, including ground sensors and activity data. Therefore, adequate means of data structuring and analysis are critical to monitoring methane emissions in a comprehensive manner.

Measurement campaigns

Measurement campaigns usually entail mandatory data collection and reporting elements, requiring operators to record, process and submit requested information. They may constitute a necessary step for the elaboration of inventories of potential methane sources or emissions estimates for operating facilities. They often support the definition of specific emission factors linked to other regulatory instruments, such as emission taxes.

The Norwegian industry, for instance, developed a handbook for quantifying direct methane and non‑methane VOC emissions, following studies showing inadequacies in its previous system. The document outlines measurement techniques for different types of devices. For example, where facilities have flow meters on vent headers, these measurements can be used as the basis instead of quantifying the individual contributory sources, and provided this yields equally accurate or more accurate data (documentable). If the gas emitted through the vent header contains large volumes of inert gases, their proportion should be measured and deducted.

The industy in Norway also set guidelines for quantifying and reporting of emissions that impose measurement obligations. This article offers a review of methane measuring and screening technologies for the upstream sector.

Satellite detection

Satellite measurements are progressively enabling the identification of large methane sources remotely. In the coming years, satellite systems are expected to provide regular global coverage of methane emissions from oil and gas operations. Orbital data can help locate super-emitters and improve our understanding of methane emission sources.

The satellite Sentinel-5P, part of the European Space Agency Copernicus programme, carries the Tropospheric Monitoring Instrument (TROPOMI), providing readings of methane concentration across areas of 5 km by 7.5 km, covering the entire world on average every four days. These data have been used by Kayrros to monitor methane emissions in the energy sector. GHGSat also used Sentinel-5P data, alongside its own observations, to develop an interactive world map of methane emissions. The list of satellite sensors is expanding, with a new satellite supported by Germany, Environmental Mapping and Analysis Program (EnMAP), due for launch by the end of 2020. Separately, the Environmental Defense Fund is planning to launch MethaneSat in 2022, targeting key regions that account for more than 80% of global oil and gas production, with enough detail to identify the location to within 400 meters of the source and detect differences in concentrations of methane as low as 2 parts per billion. Nonetheless, satellites still have some shortfalls, including coverage issues (e.g. it is difficult to detect emissions in offshore areas) and accuracy limitations.

Recordkeeping and reporting

Recordkeeping and reporting requirements go hand in hand with monitoring requirements and ensure that regulators have access to the information they need from the industry, both to verify compliance and to support emissions inventories. Typically, regulations specify the definitions and methodology that should be used for submitted information, ensuring comparability among different company reports and data. This may include guidance on how to carry out measurements or specifications regarding the methodology for calculating estimates. In this sense, they can describe what type of emission factors should be used and how these can be established.

The Oil and Gas Methane Partnership is working on a new reporting framework, scheduled to be published by the end of 2020, aiming to provide a gold standard for companies reporting on methane emissions.

Recordkeeping requirements set technical standards for what companies must track and maintain in their own files. These regulations may specify how long records should be kept and under what conditions. They may also set training requirements for workers conducting calculations, and establish a right of inspection for the regulator.

Reporting provisions require companies to send information to the regulator and may include guidelines regarding the specific format, collection method and mechanism for submission. Reporting requirements support compliance follow-up and help understand whether progress is being made. They are particularly relevant for the establishment of emission baselines. Baselines elaborated by companies may be subject to administrative approval or peer review. They may be established with the support of direct measurements or entirely through emissions factors and estimates. Related recordkeeping and reporting requirements should consider addressing base years, activity levels and other pertinent settings.

Apart from compliance reporting and emissions estimates, it might be convenient to require reports on activity levels, inventories of relevant equipment (e.g. venting stacks) and state of facilities (e.g. pipeline conditions), as well as a summary of significant occurrences (e.g. major maintenance campaigns, accidents or venting events). This will enable a better understanding of emissions sources and underlying events and can support the identification of critical risks and opportunities to develop new practices or implement complementary safety procedures.

In this context, regulators should aim to strike a balance between prompting enough information to follow up on aspects linked to methane emissions, and not overwhelming the industry and administrative bodies with processing and assembling low-impact data.

Greenhouse gas reporting

Greenhouse gas reporting is a common requirement related to greenhouse gas inventories and climate change provisions. It may be mandatory or voluntary. Regulations may define reporting conditions and scope, defining which sources must be covered, the time frame for data collection and related aspects.

The United States established a Greenhouse Gas Reporting Program, which includes methane and applies to facilities that emit at least 25 000 tonnes of CO2 equivalent per year (e.g. underground coal mines; onshore and offshore oil and natural gas production facilities; natural gas processing, transmission, storage and distribution facilities). Furthermore, it states that records must be kept for three years, identifies sources of emissions in each industry segment and provides methodologies for calculating emissions. The rule also indicates how to report on activity levels, defines applicable subparts for each source category, and includes provisions to ensure the accuracy of emissions data.

British Columbia (Canada) also requires greenhouse gas reporting and stipulates the format of the reports (e.g. requires a process-flow diagram). For more on this topic, see the UNFCCC reporting guidelines on annual inventories for Annex I parties to the Convention.

Reporting on flaring and venting

Reporting requirements can apply particularly to flaring and venting, covering factors such as the amount of gas released or flared, definition of what is considered a routine operation, emissions estimates or gas utilisation indexes (percentage of the gas produced that was used). They can also address the frequency and volume of emissions from operational activities such as facility ramp-up, shutdown or well testing. These reports may be used as a basis for enforcement or for tax/royalty levies.

Nigeria has Guidelines for Flare Gas Measurement, Data Management and Reporting Obligations. They require producers to submit a series of annual and monthly reports related to flaring. Thus, operators must report on the composition of different gas streams, calculate gas-to-oil ratio of associated gas, provide an associated gas utilisation factor (defined as the volume of gas that is not flared or vented), and provide routine and non‑routine flaring quantities. The regulation also has provisions on unaccounted-for flared gas.

Algeria’s law governing hydrocarbons activities includes a reporting system for greenhouse gas emissions. If flaring occurs without prior authorisation due to safety needs, a report must be sent to the competent agency to regularise the activity within ten days of the completion of the operation.

Verification and enforcement

Enforcement of a policy creates a culture of compliance, ensures effectiveness and builds trust in the methane abatement regime – the trust of the public, of importing countries, of the shareholders of multinational corporations operating in your country, and of climate-focused non‑governmental organisations around the world. Enabling compliance starts with clear communication and engaging in outreach. It further builds onto prevention efforts, including inspections that may point key issues to address before sanctions are necessary.

In order to fairly and effectively enforce the policy, you will need the technical ability to detect non‑compliance as well as the political will and power to apply penalties and remove privileges (in a number of jurisdictions, repeated non‑compliance authorises the regulator to pull or deny future permits). The ability to detect non‑compliance will depend on the nature of the requirements. If they focus on discrete actions (e.g. eliminate routine flaring), it may be easier to determine compliance than if the requirements relate to overall emissions.

One approach to verification is to rely on third-party audits. This has a main benefit of allowing the agency to rely on external verifiers rather than developing significant in-house audit resources. Third-party verifiers may carry out some of the same activities as government auditors, including external inspections, report reviews or new monitoring measurements. There may be potential challenges if no third-party verification business already exists in your jurisdiction, and it may take some time for these businesses to develop. Furthermore, auditing regimes may prove to be expensive for companies or require guidance from regulators as to what aspects should be covered and how to proceed with their assessments.

Many jurisdictions have imposed specific notice requirements directing operators to alert the regulator or nearby communities when high-risk activities will take place. In Maryland, for example, companies must provide public notice prior to blowdown events. Such activities might include completing a well or performing maintenance on a storage tank. The regulator then has the option to come to the site to supervise the activity, perhaps taking methane measurements while the activity is under way. And in any event, with this information reported events might be correlated with spikes in methane emissions, provided this reporting requirement is coupled with surveillance.

Regulations may also empower the regulator to carry out inspections where regulators can enter a company’s site and inspect activities or infrastructure. Argentina’s regulations, for example, authorise regulators to visit without notice. This can be more difficult for offshore facilities where the regulator will likely have to arrange a flight to the facility from the operator. Instead of onsite inspections, regulators may conduct fence-line surveys from outside the facility, with either ground or aerial measurement instruments. Results might trigger a follow-up inspection or discussion with the company.

Finally, regulators need the ability to bring enforcement actions for non‑compliance, including authority for monetary penalties or other sanctions. In addition to covering instances of failure to meet a standard, these should also be available for failure to accurately report or keep records.

Third-party verification

Third-party verification is a process where independent organisations or professionals observe and report on the validity of the information provided by oil and gas operators. It may entail examination of records and books, inspection of facilities, interviews, or other verification procedures to ensure that projects are in compliance with established criteria and requirements. The procedure allows the identification of improvement opportunities and the conformance to codes and standards. Related regulations may specify assessment contents, methods and frequency, or necessary qualifications.

Mexico requires companies to contract annually the services of an authorised third party to verify the fulfilment of the related programme. All compliance submissions must then be submitted to the regulator following review by an authorised third party. Ideally, these third-party verifiers will be a multidisciplinary group with experience on emissions reductions, including know-how on the management of such programmes, familiarity with oil and gas projects, and emissions quantification skills.

For another case, see Argentina’s National Program for Control of Losses of Air Tanks for Storage of Hydrocarbons and their Derivatives, which requires independent audits of covered facilities.

Sanctions

Sanctions are penalties or other means of enforcement that ensure conformity to the law. They are often progressive, with larger sanctions for repeated violations depending on the magnitude of the infringement. Sanctions include fees, suspension or revocation of permits or operations, as well as prohibition of entering into new contracts and other forms of punishment.

Gabon outlines different sets of penalties according to particular categories of violation in its sectorial regulations (e.g. for contractors who fail to submit required studies and reports; for non‑compliance with requirements on safety, hygiene, health, security and the environment). Thus, any contractor that violates the ban on gas flaring is liable to a penalty of 50 million to 2 500 million Central African CFA francs (XAF) (about USD 1.8 million to USD 4.6 million). Contractors who do not duly execute their flaring reduction plan or do not comply with the flaring thresholds are also subject to sanctions. Moreover, failure to follow measurement, recordkeeping and calibration provisions is subject to penalty of XAF 1 billion to XAF 2.5 billion (about USD 90 000 to USD 4.6 million).

Colombia, in its resolution to maximise recovery and avoid waste of hydrocarbons, also lays out applicable sanctions. Drilling permits can be suspended or revoked for noncompliance and penalties for violations can reach up to USD 5 000.

Policy co‑ordination

Oil and gas companies are typically subject to multiple regulations and must take into account different concerns, including environmental requirements, the safety of their operations, economic needs and social imperatives. Policy alignment is a key part of regulatory effectiveness. It avoids mixed incentives and allows the co‑ordination of enforcement and compliance efforts. This can relate to other policy fronts, such as gas pricing, existing subsidies or the contract structure for distribution operations.

You may want to consider how to achieve the right mix of incentives and sanctions to fulfil your regulatory objectives. Policies can incorporate financial incentives, such as loans and grants, in order to offer benefits to companies that want to take action on methane. Meanwhile, regulations may also include charges and fees, such as when unaccounted-for gas is included in the calculation of royalties. Moreover, certification schemes can add to the picture, acting on the information axis and affecting companies’ reputation. A mixture of instruments can provide different types of economic motivation to encourage the industry to take action.

It is common for multiple agencies to have jurisdiction over methane. As noted in Step 2 of the Roadmap, all relevant agencies should co‑ordinate to ensure that agencies avoid working at cross-purposes and reinforce each other’s regulatory objectives.

Economic and market regulations can also take into account the need to create necessary infrastructure for gas utilisation, particularly where associated gas may not have a path to market. Moreover, planning within the power sector can consider future gas developments and how to incorporate gas surpluses. Otherwise, a possibility is to aim for the development of exporting facilities, working with other jurisdictions to secure demand from different sectors.

Often existing executive bodies can support enforcement. Your government might have specialists in geospatial data processing that could help define the appropriate requirements for satellite monitoring or metrology branches that can assist with measurement specifications. Worker safety and health inspectors may also be able to communicate to emissions regulators when methane leaks are encountered or when they become aware of critical equipment maintenance schedules.

Furthermore, non‑regulatory actions can support methane abatement. Research and development support can encourage development of new abatement technologies, while policies encouraging voluntary action, such as through labelling or certification programmes, can promote industry engagement and further the competitiveness of the industry.

Integrating different policy spheres and regulatory actors provides opportunities to make the best use of existing resources and enforcement means. Frequently it also provides a clear path for companies to follow and enables them to reduce costs related to compliance.

Loans and grants

Policy makers can use financial incentives, such as funds, loans, subsidies or grants, to support emissions reduction efforts. Loans and grants are a way of ensuring interested companies have capital to invest in methane abatement options.

Alberta (Canada) is working to address the issue of inactive and abandoned oil and gas sites by implementing a new upstream oil and gas liability management system, and by providing a loan for the Orphan Well Association to speed up work on legacy sites. Wells from oil and gas companies that no longer exist often have active methane leaks. This loan will ensure that approximately 1 000 more wells will be properly decommissioned and enable the creation of up to 500 direct and indirect jobs in the oil services sector. The loan will be repaid by the industry through an existing orphan fund levy. This regulator has also recently launched a Site Rehabilitation Program – mainly funded by the federal government’s Covid‑19 Economic Response Plan – that will provide grants to oilfield service contractors to perform well, pipeline, and oil and gas site reclamation work.

Canada’s Federal Government also established a 750 million Canadian dollar (about USD 586 million) Emissions Reduction Fund to address emissions in the oil and gas sector, with a focus on methane reduction.

Research and development

Governments often play a large role in funding research and development efforts through the development of strategic plans and direct support for developing new technology and best practices that can support methane abatement.

In 2014, the US Department of Energy’s (DOE) Advanced Research Projects Agency – Energy (ARPA-E) launched a round of funding designed to further develop innovative technologies to identify and measure sources of methane emissions from natural gas operations. The DOE ultimately provided USD 30 million to 12 projects, including the development of a field test facility at Colorado State University that provides a testing ground for researchers and companies that are developing innovative methane detection technology.

The DOE has also announced further direct research and development funding in successive rounds (2016, 2019, 2020) to fund projects designed to reduce or mitigate methane emissions from the oil and gas sector.

Natural Resources Canada has also provided funding for methane reduction research and development through its Energy Innovation Program (including ten projects in 2017‑18).

Adaptive regulation

The oil and gas sector is dynamic and new technologies are always under development. Further, over time, regulatory objectives may change with increasing ambition. Thus, it is important to consider provisions up front to provide opportunities to review the effectiveness of policies and provide an avenue to update and incorporate new learning. Using an adaptive approach may enhance the effectiveness of policies and reduce the impact of errors, but it does lead to additional costs for data collection and decision analysis, as well as potential policy instability.

An adaptive approach foresees continuous learning, retaining flexibility and dealing with risk. It builds upon the principles of experimentation and dynamic adjustment, resulting from information and knowledge advances, changing system conditions and stressors, as well as the observed effects of past actions. The following items aim at enabling repeated rounds of optimisation and feedback links between policy design and follow-up.

Scheduled, periodic reviews provide an opportunity to review targets, procedures and requirements. If the programme is authorised by the legislature, statutory language could include discretion for adjustments within a certain band or authority to make modest changes without having to seek new statutory authority or undergo another rule-making process.

Built-in flexibility mechanisms allow regulations to incorporate new technologies as long as they meet certain performance metrics or present relevant advantages in view of policy goals. Regulations might also allow firms to choose among different compliance paths (e.g. reducing emissions or buying certified offsets), enabling companies to align governance and business strategies.

Provisions regarding phased requirements allow regulatory objectives to be ramped up over time while smoothing planning and adaptation for regulated entities. A common approach is to set different compliance deadlines for new facilities and existing ones. Another possibility is to establish incremental standards, with different timelines for installations to adapt to stricter requirements.

Finally, depending on the administrative procedures required in your jurisdiction, you may find that the simplest approach is to make amendments to your regulation. If you can adopt regulations relatively quickly, you may be able to keep abreast of new developments.

Adaptive regulatory provisions are a way to deal with uncertainties and improve regulations over time. They may be applied to all regulation types, but depend on functional monitoring and information systems to be effective.

Goal review

Policy and goal review are part of the process of continuous improvement and development of the regulatory system. This can involve assessing established targets, performance standards or the effectiveness of procedural requirements. Review may be tied to predefined timelines, be performed on an ongoing or ad hoc basis, or result from stakeholder request.

Victoria’s (Australia) Climate Change Act of 2017 outlines the long-term emissions reduction target for this province, reaching net-zero greenhouse gas emissions by the year 2050. It also refers to interim emissions reduction targets, stating that the premier and the competent minister must determine reduction targets every five years, starting in 2025. It further defines 2005 as the baseline year and requires that goals be set in view of independent expert advice and must consider opportunities across the Victorian economy for reducing greenhouse gas emissions in the most efficient and cost-effective manner.

Brazil also uses review provisions, which are applied by the competent agency for annual operational limits regarding methane losses and flaring.

Alternative means of compliance

Alternative means of compliance refers to provisions that allow regulated entities to comply with established requirements through technologies or procedures that are not mentioned in the normative framework. Such alternatives can be subject to pre‑approval by regulatory bodies or demonstration on a case-by-case basis as a way to ensure their adequacy.

Colorado (United States), in its regulation on the control of emissions from the oil and gas sector, allows for the use of alternative methods and strategies. Sources covered by the regulation can submit for approval alternative emissions control plans or compliance methods that provide control equal to or greater than the emissions control or reduction required by the regulation. Furthermore, test methods or procedures not specifically allowed in the applicable regulation are also subject to approval, and may be utilised if approved through a revision to the State Implementation Plan.

Mexico also allows for alternative methodologies in the measurement or estimation of greenhouse gas emissions, including methane. For more on this topic, see this report from the Environmental Defense Fund on pathways for alternative compliance.

The aforementioned regulation from Alberta has a section enabling innovative and science-based alternatives to fugitive emissions management programmes.