Oil Market Report - March 2023

This report is part of Oil Market Report

About this report

The IEA Oil Market Report (OMR) is one of the world's most authoritative and timely sources of data, forecasts and analysis on the global oil market – including detailed statistics and commentary on oil supply, demand, inventories, prices and refining activity, as well as oil trade for IEA and selected non-IEA countries.

Highlights

- Following an 80 kb/d contraction in 4Q22, world oil demand growth is set to accelerate sharply over the course of 2023, from 710 kb/d in 1Q23 to 2.6 mb/d in 4Q23. Average annual growth is forecast to ease from 2.3 mb/d in 2022 to 2 mb/d, and global oil demand to reach a record 102 mb/d. Rebounding air traffic and the release of pent-up Chinese demand dominate the recovery.

- World oil supply leapt 830 kb/d in February to 101.5 mb/d as the US and Canada rebounded strongly from winter storms and other outages. We expect non-OPEC+ to drive global output growth of 1.6 mb/d this year, enough to meet demand in 1H23 but falling short in the second half when seasonal trends and China’s recovery are set to boost demand to record levels.

- Global refinery throughputs reached a seasonal low in February at 81.1 mb/d, as the muted recovery in the US merged with the start of planned seasonal maintenance elsewhere. Despite the collapse in middle distillate cracks, refining margins remain healthy, especially for those running discounted Russian crude and feedstocks. We expect 2023 runs to average 82.1 mbd, up 1.8 mbd y-o-y.

- Russian oil exports fell by 500 kb/d to 7.5 mb/d in February as the EU embargo on refined oil products came into force. Shipments to the EU fell by 800 kb/d to 600 kb/d, compared with more than 4 mb/d at the start of 2022. Sailings to China and India also fell, while cargoes without a destination surged by 600 kb/d to 800 kb/d. Export revenues plunged another $2.7 bn to $11.6 bn, down 42% on a year-ago.

- Global observed inventories surged by 52.9 mb in January, following builds in both the OECD (+57.1 mb) and non-OECD (+13 mb) and a decline in oil on water (-17.2 mb). OECD industry oil stocks rose by 54.8 mb, four times the five-year average build. At 2 851 mb, stocks reached an 18-month high. Preliminary data for the US, Europe and Japan show a 7.8 mb increase in industry stocks in February.

- In range-bound trading, crude oil futures fell by about $1/bbl m-o-m in February as optimism surrounding China’s reopening faded in the face of the hawkish drift in central bank policy. WTI continued to slump in physical differentials amid ongoing US crude stock builds. Prices fell a further $3/bbl in March as macroeconomic worries escalated following the collapse of Silicon Valley Bank.

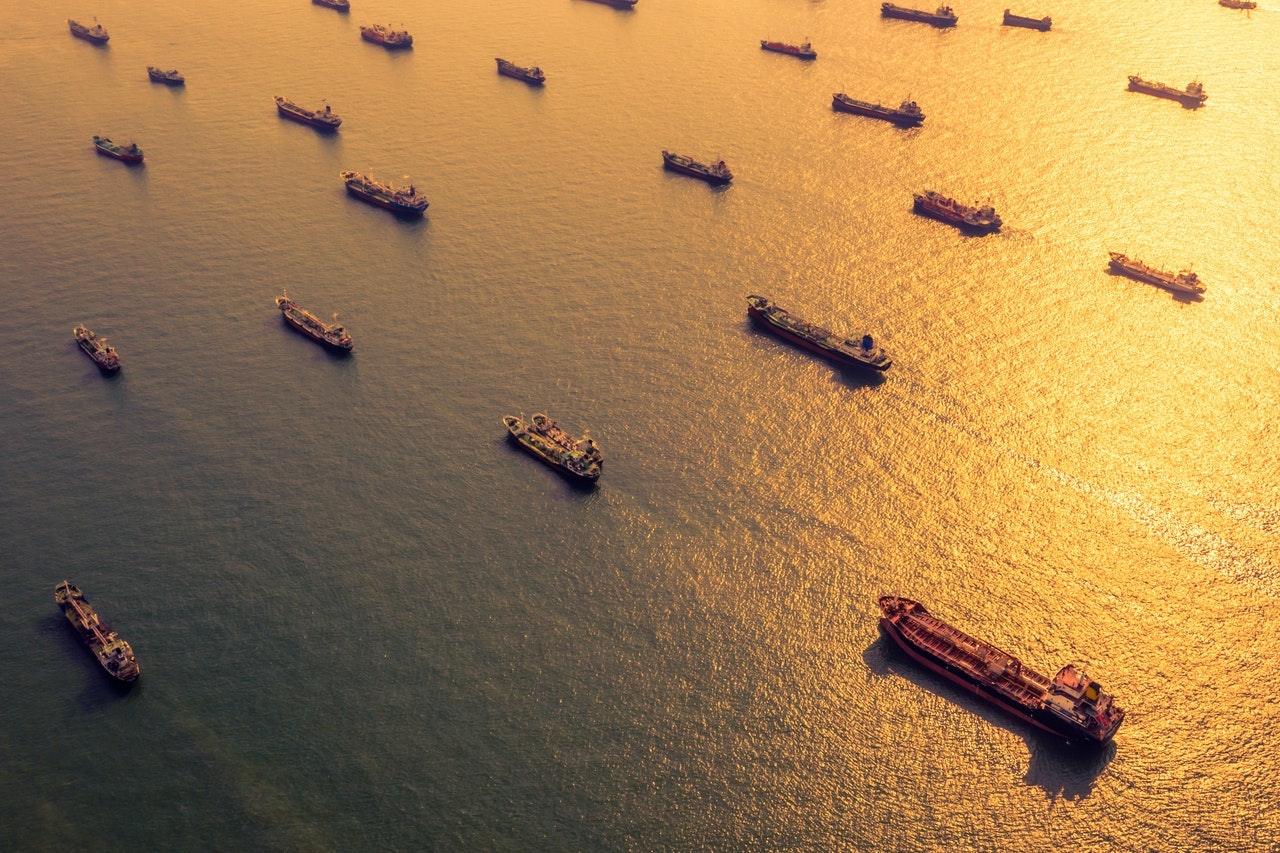

Uncharted waters

The market is caught in the cross-currents of supply outstripping still-lacklustre demand, with stocks building to levels not seen in 18 months. Much of the supply overhang reflects ample Russian barrels racing to re-route to new destinations under the full force of EU embargoes. Despite the increasing dislocation in global trade, the rising stock cover has held the Brent crude oil futures in a relatively narrow $80-85/bbl range since the start of the year.

A 52.9 mb January surge in global inventories lifted known stocks to nearly 7.8 billion barrels, their highest level since September 2021 and preliminary indicators for February suggest further builds. Despite solid Asian demand growth, the market has been in surplus for three straight quarters.

While Russian oil production remained near pre-war levels in February, Russia’s exports to world markets fell by more than 500 kb/d to 7.5 mb/d. Shipments to the EU plunged by 760 kb/d to just 580 kb/d. Over the past year, 4.5 mb/d of Russian oil previously going to the EU, North America and OECD Asia Oceania has had to find alternative outlets. Willing buyers in Asia, namely India and, to a lesser extent, China, have snapped up discounted crude oil cargoes, but increasing volumes on the water suggest the share of Russian oil in their import mix may be getting too big for comfort. Russia accounted for around 40% and 20% of Indian and Chinese crude imports, respectively, in February. The two countries took in more than 70% of Russia’s crude exports last month.

While Russian crude oil shipments are almost exclusively heading to Asia, a more diverse set of buyers for products backed out of the EU is emerging. In February, Russian product exports to the EU and its G7 allies slumped by nearly 2 mb/d versus pre-war levels. At the same time, exports to Asia grew by less than 300 kb/d. Shipments to Africa, Türkiye and the Middle East rose by 300 kb/d, 240 kb/d and 175 kb/d, respectively, while Latin America received roughly the same as before the war. The lack of buyers saw oil pile up on the water and product exports drop by 650 kb/d y-o-y.

It remains to be seen if there will be sufficient appetite for Russian oil products now that the price cap is in place or if its production will start to fall under the weight of sanctions. Revenues are already dwindling. In February, Russia’s estimated oil export revenues fell to $11.6 bn - a $2.7 bn decline from January when volumes were significantly higher, and nearly half pre-war levels. Russian fiscal receipts from oil sales were up 22% from January after export taxation rules were adjusted, but at $6.9 bn, just 45% of the level from a year earlier, according to the Russian finance ministry.

At least for this month, Moscow has signalled it will cut output by 500 kb/d. Even so, world oil supply should comfortably exceed demand in the first half of the year. Building stocks today will ease tensions as the market swings into deficit during the second half of the year when China is expected to drive world oil demand to record levels. Global demand is set to surge by 3.2 mb/d from 1Q23 to 4Q23, taking average growth for the year to 2 mb/d. Matching that increase would be a challenge even if Russia were able to maintain production at pre-war levels.

OPEC+ crude oil production1

million barrels per day

| Jan 2023 Supply |

Feb 2023 Supply |

Feb Prod vs Target |

Feb-2023 Target |

Sustainable Capacity2 |

Eff Spare Cap vs Feb3 |

|

|---|---|---|---|---|---|---|

| Algeria | 1.01 | 1.02 | 0.01 | 1.01 | 1.02 | -0.0 |

| Angola | 1.11 | 1.06 | -0.4 | 1.46 | 1.17 | 0.11 |

| Congo | 0.26 | 0.28 | -0.03 | 0.31 | 0.28 | 0.0 |

| Equatorial Guinea | 0.05 | 0.06 | -0.06 | 0.12 | 0.09 | 0.03 |

| Gabon | 0.19 | 0.2 | 0.02 | 0.18 | 0.2 | 0.0 |

| Iraq | 4.42 | 4.37 | -0.06 | 4.43 | 4.7 | 0.33 |

| Kuwait | 2.68 | 2.68 | 0.0 | 2.68 | 2.8 | 0.12 |

| Nigeria | 1.25 | 1.3 | -0.44 | 1.74 | 1.37 | 0.07 |

| Saudi Arabia | 10.41 | 10.47 | -0.01 | 10.48 | 12.22 | 1.75 |

| UAE | 3.23 | 3.23 | 0.21 | 3.02 | 4.12 | 0.89 |

| Total OPEC-10 | 24.61 | 24.67 | -0.75 | 25.42 | 27.98 | 3.32 |

| Iran4 | 2.63 | 2.65 | 3.8 | |||

| Libya4 | 1.14 | 1.16 | 1.2 | 0.04 | ||

| Venezuela4 | 0.72 | 0.69 | 0.76 | 0.07 | ||

| Total OPEC | 29.1 | 29.17 | 33.75 | 3.43 | ||

| Azerbaijan | 0.53 | 0.53 | -0.15 | 0.68 | 0.58 | 0.05 |

| Kazakhstan | 1.67 | 1.61 | -0.02 | 1.63 | 1.65 | 0.04 |

| Mexico5 | 1.65 | 1.65 | 1.75 | 1.66 | 0.01 | |

| Oman | 0.84 | 0.84 | 0 | 0.84 | 0.86 | 0.02 |

| Russia | 9.78 | 9.91 | -0.57 | 10.48 | 10.2 | |

| Others 6 | 0.78 | 0.82 | -0.24 | 1.06 | 0.93 | 0.11 |

| Total Non-OPEC | 15.26 | 15.36 | -0.98 | 16.44 | 15.88 | 0.23 |

| OPEC+ 19 in cut deal4 | 38.22 | 38.38 | -1.72 | 40.1 | 42.2 | 3.54 |

| Total OPEC+ | 44.36 | 44.53 | 49.63 | 3.66 |

1. Excludes condensates. 2. Capacity levels can be reached within 90 days and sustained for an extended period. 3. Excludes shut in Iranian, Russian crude. 4. Iran, Libya, Venezuela exempt from cuts. 5. Mexico excluded from OPEC+ compliance. Only cut in May, June 2020. 6. Bahrain, Brunei, Malaysia, Sudan and South Sudan.