2019年全球天然气安全回顾

关于本报告

Executive summary

The drive for flexibility

Demand for natural gas – and particularly for liquefied natural gas (LNG) – is growing strongly. Gas consumption rose by an estimated 4.6% in 2018, its highest annual growth rate since 2010. LNG demand is growing even more quickly, with double-digit trade growth three years in a row. The commissioning of over 50 million tonnes per annum (Mtpa) of liquefaction capacity during 2018 (equivalent to 72 billion cubic metres per year [bcm/y]) enabled LNG trading to grow by 10%, to reach 420 bcm/y.

In LNG markets, buyers are demanding more LNG on terms that are more flexible. The willingness of US LNG exporters (the main source of LNG supply growth in the medium term) to provide LNG on a destination-free basis, the rise of portfolio players as key buyers and the emergence of equity lifting as a significant business model are all signs that the LNG market is responding to these increasing demands. As a result, the share of destination-free contracts has been growing since 2015 to reach a share of 40% of total LNG delivered during 2018. Moreover, the volume of LNG spot trading transactions has expanded by almost 60% since 2015 to above 100 bcm/y, accounting for nearly a quarter of global LNG trade.

The flexibility of the global gas market in the coming years will continue to be crucial, as natural gas plays a critical role in the energy transition towards a cleaner and more sustainable energy system. This year’s Global Gas Security Review addresses three issues. First, it monitors the progress in global LNG contractual flexibility by providing an update on the LNG market flexibility metrics. Second, the report analyses the flexibility mechanisms used by traditional major LNG importers in Asia. While these importers may experience little or no growth, their considerable imports may be an important source of potential flexibility for growing markets elsewhere in Asia. Finally, this year’s report weighs the challenges facing north‑western Europe regarding gas supply security and assesses the importance of its “gas flexibility” as a major source of production – the Groningen field in the Netherlands – is phased out.

Driven by portfolio players, LNG contracting activity rebounded to its highest level in five years…

LNG contracting activity rebounded in 2018 to reach its highest level in five years, with a total of 123 bcm/y of concluded contracts. Much of this increase relates to the development and financing of new liquefaction projects.

Portfolio players continued to be key to this increased activity and have been involved in all liquefaction projects that have taken final investment decision (FID) during 2018, accounting for 45% of contract volumes. This increased activity can be attributed to the desire of portfolio players to rebuild their portfolios so they can provide market flexibility and match long-term supply with the anticipated growth in LNG demand.

The equity-lifting model is gaining popularity in the project financing structures of liquefaction projects. This model allows offtakers/partners to have access to the project’s LNG volumes proportionate to their equity stake and, as such, secures both the economic viability of the project and the volumes contracted under long-term agreements. Equity lifting has enabled some of the largest LNG liquefaction projects to reach FID, hence ensuring that additional LNG can contribute to a balanced global gas market and security of supply. LNG Canada, Greater Tortue FLNG and Golden Pass LNG all use this model.

… underpinned by longer, larger and more flexible contracts

New projects continue to be underpinned by long-term contracts. Long-term deals have dominated recent LNG contracting, reaching a share of 74% in 2018 and 92% in 2019 so far. Moreover, large contracts (over 4 bcm/y) and medium-sized contracts (2–4 bcm/y) increased significantly, representing 56% and 82% of the total volumes signed in 2018 and2019 (to date) respectively. This is in contrast to the previous three years when the majority of deals were for volumes under 2 bcm/y.

Most of the recent growth in demand for LNG in Asia comes from a new group of “emerging” buyers. The profiles of these emerging buyers are different from those of traditional buyers: they are both less dependent on LNG as a source of gas supply and more sensitive to price. Consequently, flexibility is more highly valued despite the continued reliance on long-term deals.

Notably, longer-term contracts do not necessarily mean less flexibility. Destination flexibility is becoming a common feature in contracts of all durations. In 2018, 58% of volumes contracted and linked to a project that had already taken FID had no fixed destination, reaching 89% of volumes so far in 2019. This is in addition to other forms of flexibility built into these contracts, which enable buyers to adjust the volume and timing of deliveries.

Innovation in LNG contracting to enhance regional security of supply…

The growth in the Asian LNG market is being driven by newer importers, whereas demand from traditional buyers is expected to be stagnant. Most of these traditional buyers import LNG through sale and purchase agreements (SPAs). LNG SPAs, in practice, have clauses providing both the seller and the buyer with a certain level of flexibility in relation to their respective commercial commitments to volumes, destination, delivery programme and transport.

In general, long-term contracts allow for more commercial flexibility since contracted volumes are managed over the course of multiple years. The buyers’ obligation to take LNG cargoes or sellers’ obligation to deliver LNG may be compensated by “make-up” and “carry forward” cargoes in the following contract year(s). Such flexibility in volume has been evolving in a diverse way with increased variability in size and timing. Buyers can call upon volumes on a full-cargo basis at the time of requirement. Similarly, unwanted cargoes can be diverted and resold in other markets at the time an adjustment is needed.

Practical experience shows that the flexibility mechanisms embedded within the LNG SPAs can be better exploited through regional co‑operation, parties benefiting from the synergies that stem from short shipping distances. In addition, greater contract flexibility is being implemented as new procurement strategies emerge, including the creation of joint ventures, joint procurement with other markets and expanded reloading capabilities.

…means traditional buyers could become a larger source of additional flexibility for the Asian LNG market

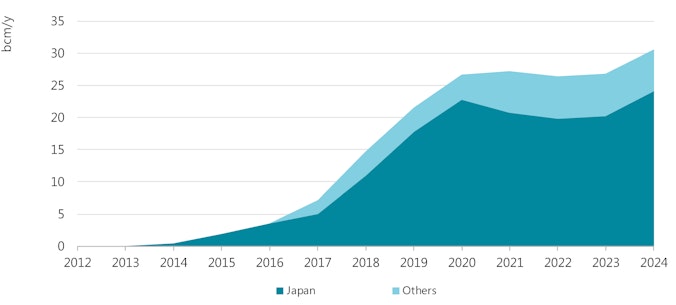

By creatively utilising such tools, traditional Asian buyers are able to become LNG sellers in the secondary market, providing intraregional flexibility of supply to emerging buyers. It is estimated that 15 bcm/y of volumes contracted to traditional Asian LNG buyers are currently considered to be flexible in destination. This destination-flexible volume would cover up to 15% of the forecast LNG demand of emerging Asian LNG buyers, if the whole amount were to be supplied.

For example, Japanese importers are now investing in their infrastructure, primarily for reloading, in order to serve the growing Asian market. Furthermore, they are actively developing their trading capabilities and fostering new LNG demand in the Asia Pacific region by entering the distribution and LNG bunkering businesses. The harmonisation of regulations related to receiving ports and regasification facilities could facilitate intraregional trade and hence improve security of supply.

The transformation of the broader energy system in north‑western Europe…

The import requirements of north‑western Europe are expected to increase by one-fifth (or almost 40 bcm/y) in the next five years, as indigenous gas production enters a phase of rapid decline, whilst domestic consumption is set to remain flat. The phase-out of the Groningen field, producing low-calorific natural gas (L-gas), will require the expansion of conversion facilities in the Netherlands, able to transform imported high-calorific gas (H-gas) into L-gas.

The gas supply challenges come at a time when natural gas will become increasingly important for electricity security. The north‑western European power system is expected to undergo a profound transformation, with an increasing share of variable renewables in the electricity mix and the announced retirement of 45 gigawatts of nuclear and coal-fired power generation in the next five to six years. Consequently, gas-fired power generation will play a progressively more important role in the balancing of the power system, driving up the overall short-term flexibility requirements of the gas system. Gas will provide nearly all the “thermal swing” required to meet high-energy demands – whether provided by gas or electricity – during a cold period.

…calls for the further enhancement of downstream gas flexibility

In this context, the need to enhance the system flexibility of north‑western Europe’s gas infrastructure calls for a regional approach. This could be pursued by developing additional import capacity, improving midstream interconnectivity and harmonising gas storage regulation. Strengthening the flexibility of the north‑western European gas system would also reinforce the region’s position within the global gas market, as internal flexibility tools allow timely and cost-efficient responses to changing global supply–demand dynamics.

The importance of Europe’s flexible energy system to the global gas market was demonstrated during past supply and demand shocks. The fuel switching capacity of the European power system played a crucial role in making additional LNG volumes accessible to the Japanese market in the aftermath of the Great East Japan Earthquake in March 2011 and the consequent shutdown of nuclear power reactors.

Over the medium term, the role of the Asian power sector (where abundant switching potential also exists) could increase by offering flexibility to global energy markets via the intermediation of destination-free flexible LNG cargoes – with Europe as a potential outlet. The rising interdependence between regional markets should provide the incentive for both Asian and European market players, as well as regulators, to enhance co‑operation towards a more flexible gas market.

Key findings

- Global gas markets continued to consolidate and evolve towards greater flexibility, driven by the increasing role of portfolio players, transforming business models, contracting trends and growing downstream flexibility requirements.

- LNG contracting activity rebounded to reach its highest level in five years in 2018, mostly resulting from newly sanctioned liquefaction projects. The contracting actions of market participants, especially portfolio players, have ensured that most contracts concluded in 2018 are destination‑flexible.

- Contract flexibility is evolving to further strengthen security of supply in Asia. Long-term contracts involving traditional buyers can provide more operational flexibility than is generally recognised. Volume options, including diversions, open up the potential for increased co‑operation via intra-regional trade between LNG buyers.

- In north‑western Europe, rapidly declining domestic production and increasing import requirements, coupled with growing volatility in gas demand, signify an emerging need to further enhance the system flexibility of the region’s downstream gas infrastructure.

Update on LNG market flexibility metrics

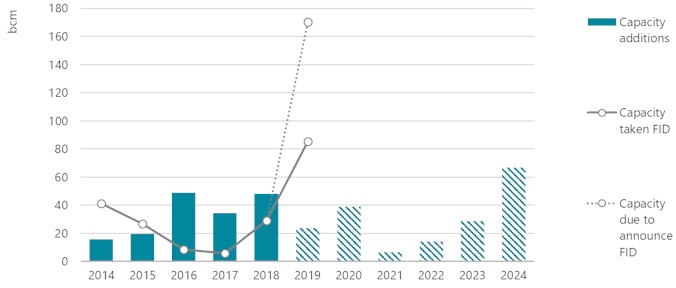

Liquefied natural gas (LNG) contracting activity rebounded to reach its highest level in five years in 2018, mostly resulting from newly sanctioned liquefaction projects. 2018 and 2019 to date have seen a step change in investment activity compared to recent years:

- After two years of low activity, several new projects took final investment decision (FID) in 2018: Corpus Christi LNG train 3, LNG Canada, Greater Tortue FLNG 1 and Tango FLNG.

- Investment momentum has continued into the current year. 2019 to date has already seen the most natural gas liquefaction capacity ever sanctioned in a single year.

A record-setting capacity of over 170 billion cubic metres (bcm) of natural gas liquefaction is due to take FID in 2019, far surpassing 2005’s previous record of 70 bcm

Figure 1. Additions to global liquefaction capacity (2014–24) and FID volume (2014–19)

Note: Capacity additions are based on the announcements of developers and only include the capacity of projects that had taken FID by the time of writing this report. Source: IEA analysis based on ICIS (2019).

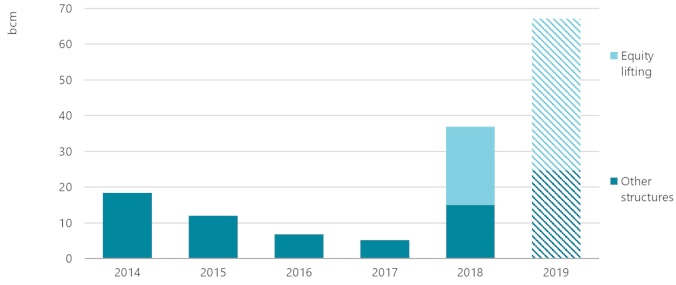

Growing adoption of the equity offtake marketing structure has contributed to this recent boost in contracting activity and project sanctioning. In an equity offtake (or equity-lifting) model, partners have access to LNG market volumes according to their equity stake, reducing the need for long-term sale and purchase agreements (SPAs) to secure a project’s funding. Since this approach couples financing and offtake for prospective projects, developing under this model can accelerate the FID process.

After 2017, a shift to the equity-lifting model among FID-enabling deals appeared to accelerate FID timelines with a novel approach to financing

Figure 2. FID-enabling contracts by signing year and structuring model (2014–19)

Note: 2019 data reflect contracts signed up to the time of writing. Source: IEA analysis based on ICIS (2019).

With more projects using an equity offtake model in 2018, long-term contracts (concluded contracts longer than ten years linked to projects that have already taken FID) grew by more than 55 bcm between 2017 and 2018. Large contracts (more than 4 bcm/year) and medium-sized contracts (between 2 bcm/y and 4 bcm/y) also increased (by almost 41 bcm), representing 56% of the total volumes signed in 2018.

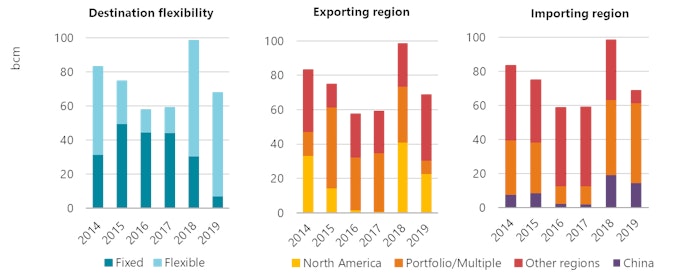

Activity from market participants known as portfolio players has a major role in creating the flexibility to accommodate consumer preferences. Even though yearly contracted portfolio sales (exporting contracts) have been falling since 2015, they still accounted for 33% of concluded contracts linked to FID projects. Because the total volumes from this contracting activity outpace the volumes from expiring contracts, the market volumes portfolio players are obligated to supply increase at a steady pace in the medium term. This market share of total export contracts held by portfolio players is set to reach an all-time high by 2024 (54% of total export volumes).

Portfolio player activity has also had implications for importing regions. In 2018 contracts without a specific destination represented the largest share of contracting activity: these made up almost 45% of all concluded contracts linked to FID projects. During 2019 so far, this share is 68%. Portfolio players are responsible for a large share of deals developed during 2018 and 2019 to date, chiefly to rebuild their portfolios. Signed under flexible destination terms, these contracts provide the main source of volumes needed to cover their position. 2018 also exhibited a shift in the strategy of trading companies, signing long-term and larger contracts instead of relying exclusively on short-term and spot deals. Just as with exports, the import volume share for portfolio players is projected to continue growing, increasing from 42% in 2018 to 48% in 2024.

Overall market flexibility has continued to improve, driven in some cases by contract commitments in North America:

- Among export contracts, North America is the main source of 2018’s newly signed commitments. Of all 2018 concluded contracts associated with FID projects, 42% originate in North America. This is mostly due to the development of new LNG projects in the United States and Canada.

- Destination flexibility is increasingly common: the number of contracts concluded with destination flexibility in 2018 was higher than in previous years. Still, many legacy contracts have destination clauses, meaning destination-flexible contracts do not yet represent the majority of market volumes.

A strong move to destination-flexible contracts is apparent as North America emerges as the key exporter and portfolio players as key buyers

Figure 3. Concluded LNG contracts by destination flexibility, exporting region and importing region (2014–19)

Notes: Data relate to contracts concluded and linked to projects that have already taken FID, as well as contracts concluded sourced from a portfolio. Data from 2019 include only the information available at the time of writing. In the exporting region chart, the Other regions category comprises Africa, Asia Pacific including People’s Republic of China (“China”), Eurasia, Europe, Middle East, and Central and South America. In the Importing region chart, the Other regions category comprises Africa, Asia Pacific excluding China, Eurasia, Europe, Middle East, and Central and South America. Source: IEA analysis based on ICIS (2019).

Some buyers with new and increasing demand for natural gas, particularly in Asia, still need to secure their supply and are actively signing new contracts. For example, the People’s Republic of China (hereafter, “China”) is rapidly expanding its imports, and among import contracts to single destinations China was the most popular destination in 2018 and so far during 2019. Of all FID project contract volumes, China’s contracts represented 20% in 2018 and 22% in 2019 to date. Driven by air quality policy measures and gas shortages seen in the winter of 2017/18 (IEA, 2018), Chinese buyers are seeking to reduce their exposure to supply risk and winter spot LNG price volatility. This willingness to contract reflects their interest in long-term supply protection.

Other contractual elements such as contract indexation have also seen further development. Gas contracts have increasingly been signed or renegotiated to include hub gas price indexation, reducing the historically predominant links to oil. North American export contracts constitute a large proportion of export contracts with gas-to-gas indexation that exist in the market today. During 2018 and 2019, diversification behaviour evolved further with the onset of new pricing structures based on the destination market and the use of the gas.

LNG supply security in Asia: An opportunity for traditional buyers

The structure of the Asian LNG market is undergoing a major shift. Demand from traditional LNG buyers, namely Japan and Korea, is likely to be flat or decline gradually depending on use in power generation. However, with or without a decline, these traditional buyers will still account for over 180 bcm/y of LNG purchases by 2024, or 60% of Asian LNG demand. Creating measures to secure robust sources of LNG supply and meeting uncertainty of demand have been key objectives for these buyers.

Given the uncertainty in the demand level, buyers have been seeking greater flexibility in their supply contracts. The average duration of a contract in the traditional Asian LNG buyers’ portfolio is 20 years.

Over 85% of LNG procurement by traditional Asian buyers is via long-term contracts to secure stable supply

Figure 4. Structure of term contracts among traditional Asian LNG buyers and volume of LNG imports (2005–18)

Note: Short-term contracts (< 5 years) do not include spot transactions. Source: IEA analysis based on data from ICIS (2019); imported volume data from GIIGNL (2019).

Options have become the tool of choice for increased flexibility. For example, cargoes can be increased in frequency to align with expected growth in demand (tranche option). A cargo can be sourced to meet a sudden increase in demand during a tight market (call option). At times of low demand, a cargo can be diverted to another market (diversion option) and be sold to such market without the risk of the cargo remaining unsold on the spot market (put option). This is a major improvement on the historically predominant demand adjustment mechanism, whereby a certain percentage of the annually contracted volume can be adjusted after the closure of the contract year, with the obligation carried forward.

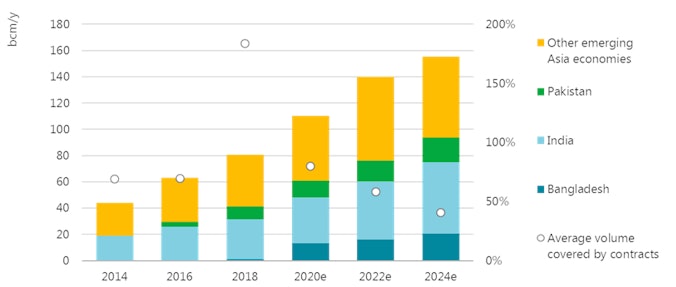

Emerging Asian buyers are also seeking increased contractual flexibility. Most of the future growth in the Asia region is set to come from these non-traditional emerging buyers, namely Bangladesh, China, India and Pakistan. They are less dependent on LNG, with domestic gas production and pipeline imports available to them. However, ever-growing gas demand is quickly surpassing domestic production, meaning that more LNG is needed. This is creating a situation where LNG is required, but it has to compete on pricing with competition from domestically produced or pipeline imported natural gas.

The growth of LNG demand among emerging buyers will be strongly affected by the pricing of the competing fuels

Figure 5. Evolution of Asian LNG buyer types (2010–24)

Note: LT = long-term. Source: IEA analysis based on data from ICIS (2019); 2024 is based on LNG forecast import data from IEA (2019a).

Expansion of LNG import capability is an urgent requirement to meet unpredictable levels of demand growth. This is where comprehensive contract flexibility becomes essential. In 2018 emerging Asian LNG buyers were overcontracted compared to actual imported volumes by 180%. Flexibility in their contracts allowed these excess contracted volumes to be managed.

Emerging LNG buyers have on average 80% of their demand secured by contracts. However, the unavailability of imports or affordability mismatches may cause sudden supply and demand imbalances

Figure 6. LNG import volumes and percentage covered by contracts, emerging Asian economies (2014–24)

IEA, 2019. All rights reserved.

The analysis shows that these emerging Asian LNG buyers are at an immature state in respect of long-term commitment to LNG over the coming years, reflecting their sensitivity to price and the ongoing development of their importing infrastructure.

One of the solutions could be in the form of traditional Asian LNG buyers, who can provide supplies of LNG using the flexibility in their contracts. It is estimated that 15 bcm/y of LNG contracted to traditional Asian LNG buyers can currently be considered destination-flexible. This destination-flexible volume would cover up to 15% of forecast LNG demand among emerging Asian LNG buyers.

LNG contracted to traditional Asian buyers with a flexible destination could cover up to 15% of LNG demand from emerging Asian LNG buyers, potentially providing them with extra flexibility

Figure 7. LNG volumes contracted to traditional Asian LNG buyers with flexible destination (2012–24)

Source: IEA analysis based on data from ICIS (2019); 2024 is based on LNG forecast import data from IEA (2019a).

Japanese buyers are expanding their LNG networks to implement contractual flexibility. Examples include the formation of joint ventures and jointly procuring contracts with other market participants. Also, the enlargement of receiving infrastructure is being observed in Japan, with additional loading capabilities at LNG terminals. This will enable these Japanese buyers to have an LNG outlet during fluctuations in demand, by reloading LNG onto another LNG vessel, into smaller-scale ISO containers, or onto LNG bunker supply vessels. All such operations are enabled by the greater flexibilities that traditional Asian buyers have secured, thanks to ample additional supply and the emergence of portfolio players.

This additional layer of supply security in the Asian LNG market, over and above traditional suppliers and global portfolio players, also contributes to the operational robustness of the fast-growing yet immature emerging buyers. The traditional Asian LNG buyers’ contractual flexibilities and implementation capabilities can further increase trading flows regionally and interregionally, serving new demand set to appear in other markets.

North‑western Europe’s gas flex: Still fit for purpose?

The inherent flexibility of the north‑western European natural gas system has played a crucial role in the development of a liquid, tradable and well-integrated regional gas market, where security of supply is ensured by adherence to market rules and the strong seasonality of demand is satisfied with adequate physical natural gas supply.

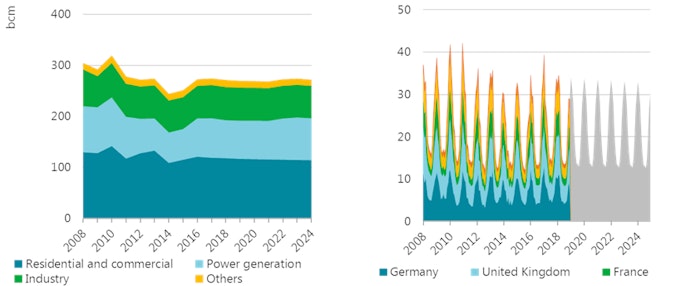

North-western European natural gas demand is characterised by a pronounced seasonal pattern, driven by the heating needs of the residential and commercial sectors

Figure 8. North-western Europe’s gas demand by sector (2005–24) and by month (2005–18)

Source: IEA (2019b).

However, rapidly declining domestic production and increasing import requirements have gradually eroded this flexibility in the past five years. The proportion of winter gas requirements met by production swing has fallen from 40% to below 5%.

European natural gas production has halved over the past decade, while its seasonal production swing fell by 90% during the same period, increasing the call on other sources of flexibility

Figure 9. Natural gas production and flexibility requirement in north-western Europe (2008/09–2018/19)

Source: IEA (2019b).

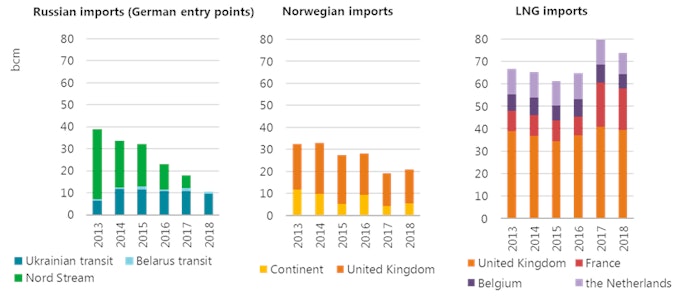

Spare import capacity via Norwegian and Russian pipelines directly servicing north‑western Europe fell to close to zero during the past two heating seasons.

Spare pipeline import capacity to Northwest Europe has more than halved since 2013, falling from 70 bcm/y to just above 30 bcm/y, while spare regasification capacity has risen by 10% to above 70 bcm/y

Figure 10. Annual spare import capacity into north-western Europe by origin of imports (2012–18)

Source: IEA (2019c).

Gas interconnectors from Germany to the Netherlands are becoming saturated as a result of the evolving supply outlook in the Netherlands.

The utilisation of interconnectors feeding into the Dutch natural gas grid is saturated during periods of high demand, hence limiting the availability of spare capacity

Figure 11. Interconnector flows to the Netherlands (2017–18)

Note: mcm/d = million cubic metres per day. Source: ENTSOG (2019).

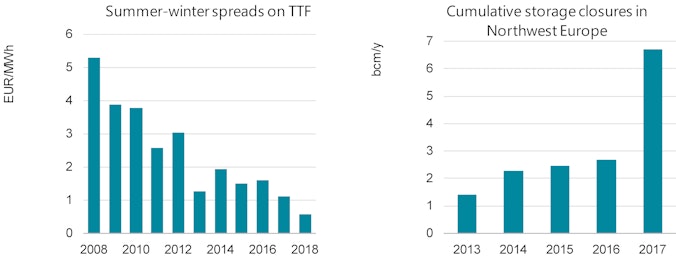

Deteriorating storage economics has led to the closure of 5 bcm of storage capacity since 2013.

Seasonal spreads on the TTF have more than halved since 2012 to an average below EUR 1.5/MWh, insufficient to cover the operating costs of some storage sites and leading to the closure of over 5 bcm of storage capacity since 2013

Figure 12. Spread between summer and winter gas prices on TTF (2008–18) and gas storage closures in north-western Europe (2013–17)

Note: MWh = megawatt hour; TTF = Title Transfer Facility. Source: Bloomberg Finance LP (2019).

The flexibility of the north‑western European gas system could further decline amidst the increasing import requirements of the region, expected to grow by 40 bcm/y by 2024, primarily due to declining domestic production. Moreover, the challenging storage economics coupled with the expiry of long-term storage contracts could lead to the retirement of further storage capacity in the region.

In the medium term, the north‑western European power system is expected to undergo a profound transformation, with an increasing share of intermittent renewables in the electricity mix and the announced retirement of 45 GW of nuclear and coal-fired power generation in the next five to six years.

The growing share of intermittent renewables, coupled with declining coal-fired and nuclear power generation, is set to increase the volatility of gas-fired power generation

Figure 13. UK volatility in gas-fired power generation (2015–17) and announced power plant closures in Northwest Europe (2018–25)

Source: Share of renewables: IEA (2019); gas-fired power generation: ENTSO-E (2019).

As a consequence, gas-fired power generation will play an increasingly important role in the balancing of the power system, i.e. as a backup to variable renewables and to meet peak demand. This in turn could drive up the volatility of gas-to-power demand and hence the overall short-term flexibility requirements of the gas system.

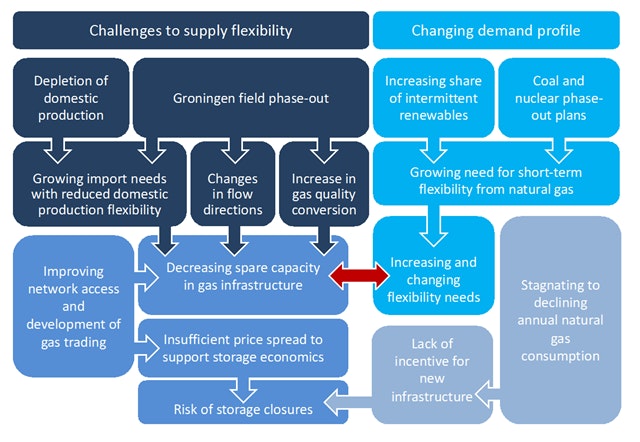

While the flexibility of gas supply is decreasing, the call for flexibility in north-western Europe’s gas system might increase over the medium term when considering the broader energy complex

Figure 14. North-western Europe’s changing gas flexibility landscape

IEA, 2019. All rights reserved.

In this context, the need to enhance the systemic flexibility of north‑western Europe’s gas infrastructure should be considered using a regional approach and include:

- Development of additional import capacity to meet both incremental import requirements (pipeline and LNG) and the need to further diversify supplies (via LNG).

- Improvement of midstream interconnectivity, in particular on the border between Germany and the Netherlands, via either new interconnectors or the reconfiguration of existing exit/entry capacities.

- Harmonisation of gas storage regulation, with the eventual development of support mechanisms to prevent further storage site closures.

Strengthening the flexibility of the north‑western European gas system would also reinforce the position of the region within the global gas market, as internal flexibility tools allow a timely and cost-efficient response to changing global supply–demand dynamics.

This has been clearly demonstrated during the first half of 2019, when north‑western Europe has been able to profit from a loose global LNG market by increasing LNG imports in a counterseasonal fashion, exploiting existing synergies between spare regasification and storage capacity. Consequently, trading on the TTF soared to record levels, with an increasing number of market players hedging their LNG positions on the Dutch hub.

This indicates that if TTF continues to be supported by a strong and flexible natural gas grid, it could further reinforce its position as a global gas price benchmark and hence the role of north‑western Europe in the global LNG trade.

References

Full references for the data behind IEA figures and/or tables featured on this page can be found in the PDF of the full report.

Reference 1

Full references for the data behind IEA figures and/or tables featured on this page can be found in the PDF of the full report.