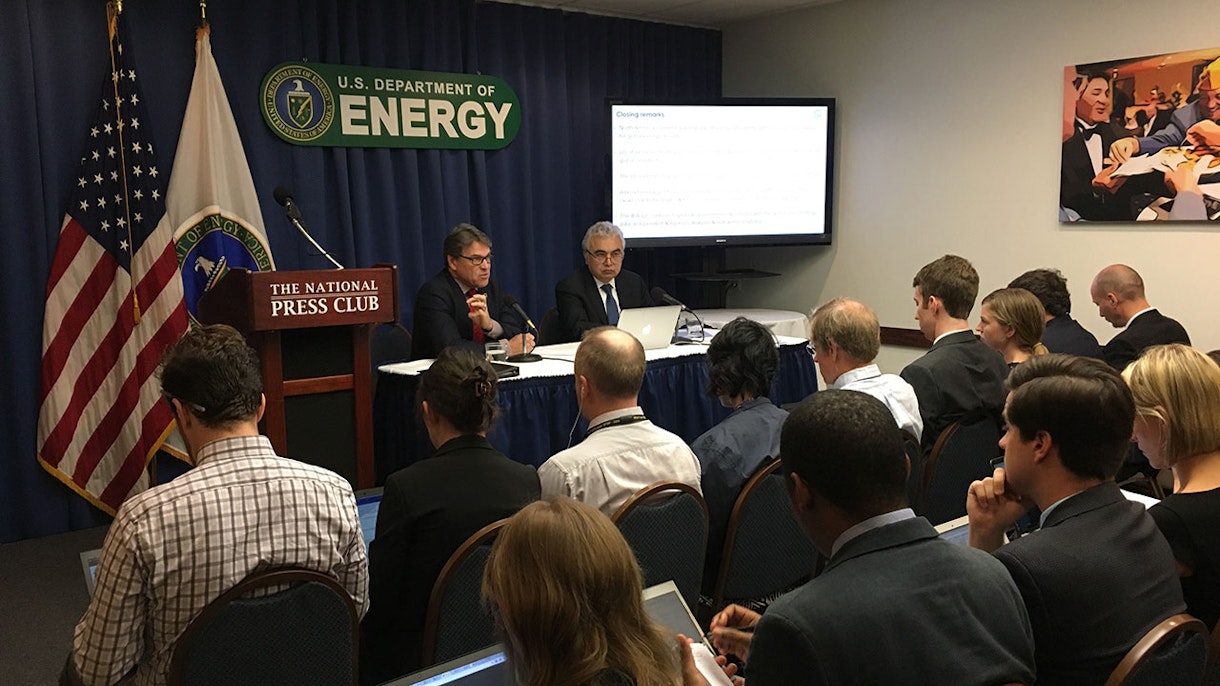

IEA Executive Director holds press conference with US Secretary of Energy

Dr Birol holding a press conference in Washington with US Secretary of Energy Rick Perry (Photo: IEA)

Dr Birol holding a press conference in Washington with US Secretary of Energy Rick Perry (Photo: IEA)

Thank you for subscribing. You can unsubscribe at any time by clicking the link at the bottom of any IEA newsletter.