Cite commentary

IEA (2018), US budget bill may help carbon capture get back on track, IEA, Paris https://www.iea.org/commentaries/us-budget-bill-may-help-carbon-capture-get-back-on-track

The 2018 US Budget Bill, passed by the House and Senate in mid-February, will shape funding for energy technologies for the next decade. Alongside the extension of renewable tax credits and credits for energy efficiency, nuclear and fuel cells, the bill contains a provision that could provide the first significant stimulus to the global fortunes of carbon capture for several years. It is an example of how relatively small policy incentives can tip the scales towards investment when the infrastructure and industrial conditions are already in place, as the United States is leveraging an existing market and pipeline network for enhanced oil recovery (EOR).

The Budget Bill aims to stimulate investment in carbon capture by expanding incentives to companies that can use captured CO2 and reduce emissions as a result. It raises the existing so-called “45Q” tax credit for storing CO2 permanently underground from USD 22 today to USD 50 in 2026. The figure below shows the level of credit available for different combinations of CO2 sources and uses.

Level of credit available for different combinations of CO2 sources and uses

IEA analysis suggests it could trigger the largest surge in carbon capture investment of any policy instrument to date. Based on the above levels of revenue support for commercial carbon capture projects, we estimate that the tax credit could lead to capital investment on the order of USD 1 billion over the next six years, potentially adding 10 to 30 million tonnes or more of additional CO2 capture capacity, potentially increasing oil production by 50 to 100 thousand barrels per day. This would increase total global carbon capture by around two thirds and, by incentivising industry to find the lowest-cost projects, could be cheaper than projects already operating around the world. The annual cost to the US taxpayer by 2026, supporting CAPEX and OPEX, would be under USD 800 million.

Carbon capture refers to the separation of carbon dioxide (CO2) from industrial processes before it can be released to the atmosphere and contribute to climate change. It is a key part of the climate change mitigation toolbox because it can tackle emissions sources for which no other technologies are out of the lab and commercially available. These include industrial processes for production of steel, cement and a range of fuels, from gasoline to bioethanol and hydrogen. By retrofitting carbon capture to existing polluting facilities like coal power stations, they have the option of continuing operation with lower emissions, potentially overcoming political and economic obstacles to system transformation.

Of course, something must be done once the carbon is captured. Very large volumes can be injected deep underground and safely trapped for the long term. CO2 can also be trapped underground while being used in enhanced oil recovery (EOR), for which 65 million tonnes are purchased each year by the oil and gas industry and injected into oil fields to increase their productivity. Today, 80% of this CO2 comes from natural underground CO2 deposits and its use has no beneficial impact on greenhouse gas emissions reduction. Using captured CO2 that would otherwise have been emitted instead of natural CO2 therefore gives an environmental benefit and, extending the life of existing oilfields. Besides EOR, smaller volumes of CO2 can be purchased for economic use in chemical processes but may not offer the same level of emissions reduction as underground storage if the process is energy intensive or the final product is combusted, releasing CO2 again.

For achieving the goals set out in the Paris Agreement on Climate Change, any boost for carbon capture utilisation and storage (CCUS) would be welcome. The IEA recently noted that there has been a slump in new projects, with no new projects in the pipeline for construction. The US has been a clear leader accounting for around half of the total investment in CCUS in the decade to 2017.

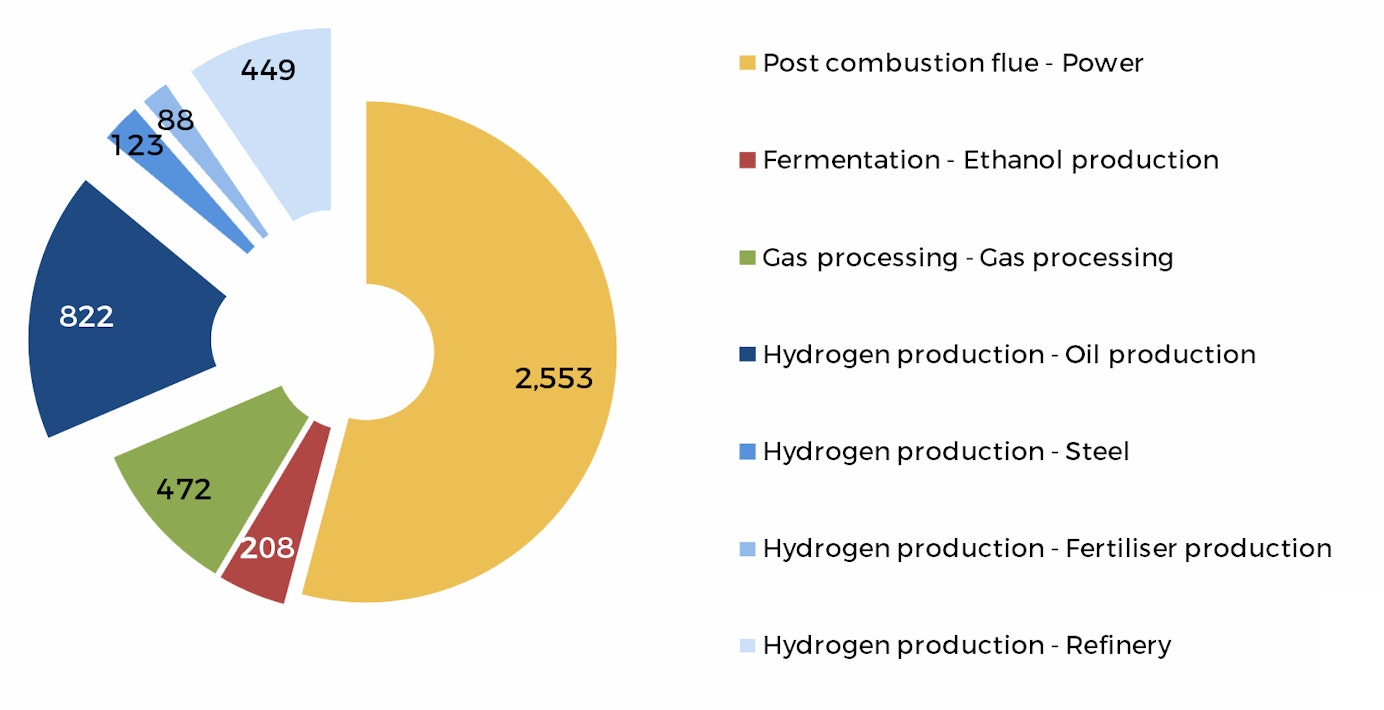

The biggest opportunities are likely to be in the capture of CO2 from hydrogen plants at refineries and from natural gas processing facilities. Along with hydrogen production at fertilizer plants and bioethanol mills, these represent the lowest cost sources of CO2 at large scale and, unlike the fertilizer and bioethanol industries; they tend to be located close to existing CO2 pipelines for transporting CO2 to oilfields. In general, the lowest cost opportunities for avoiding emissions via CCUS reflect the concentration of CO2 in the flue gases.

Breakeven CO2 price vs. estimated CO2 availability

Represents the estimates breakeven costs for average facilities in the US

Deployment of new carbon capture facilities in these sectors would reflect experience to date. Three quarters of the CO2 capture capacity built in the last decade and operating today has been on hydrogen production, gas processing and ethanol fermentation, all high purity sources of CO2. This represents almost half of all investment in CCUS made in the last decade, providing a strong indication of the sectors for CCUS that are favoured by the market. Twenty nine million tonnes of CO2 are captured today from large industrial sources, 87% of these are used for EOR, of which 78% are in the US.

Investment by capture process and sector 2007-2017 (USD million)

The overall impact of the 45Q tax credit on stimulating a more sustainable CCUS industry will depend on a number of uncertain factors. We think the following factors are mostly upside risks:

- CO2 demand for EOR: Our estimate of the impact of the tax credit assumes that neither CO2 demand nor supply are strongly limiting factors. The 45Q incentive should reduce the price of CO2 from carbon capture facilities to a level in line with that from natural CO2 deposits and unlock demand that is currently limited by the constraints on natural CO2. Taking these constraints into account, the shift of the supply curve resulting from this price reduction should ensure that any future EOR growth is based on captured CO2, not further production of natural CO2 that is already trapped harmlessly underground. From the supply side, it seems feasible that the construction of carbon capture projects could ramp up quickly enough by 2024 to meet much of this demand as long as CO2 offtake contracts and pipeline extensions can be put in place to trigger investment. Ultimately, however, this will depend on the evolution of the oil price – which is currently below the level needed for some, but not all, EOR projects – and the allocation of capital between light tight oil plays and EOR at mature fields.

- CO2 demand for non-EOR uses: While the new legislation opens up the tax credit to industrial uses of CO2 – and, by changing the terminology, to industrial uses of carbon monoxide (CO) – the extent of uptake from these businesses is uncertain, and will likely be limited. In addition to being in construction by 2024, three conditions need to be satisfied to claim the credit: the carbon oxide would have otherwise been released to the air; over 25 000 tonnes per year from each carbon capture facility must be converted to products; a life cycle assessment by the regulator must show a benefit to the climate and the tax credit reduced accordingly if the benefit is lower than for long-term CO2 storage. For carbon monoxide, which already has economic value as a fuel and chemical, we think the tax credit will not be high enough to divert much to new uses. For example, $35 per tonne of CO is around $12 per MWh, so it would not outbid the fuel value of CO. Using CO2 to convert hydrogen to hydrocarbon fuels could potentially exceed the annual volume condition by 2026, to help overcome the difficulties with storing electricity as hydrogen, but this will have a harder time with the life cycle assessment condition. Because the carbon is released when the fuel is burned, we foresee less than half of the tax credit (no more than $17) being available for such uses, which would probably need to be combined with other incentives to kick start an industry (a price of €300 per tonne was suggested by German industry).

- The speed with which dedicated CO2 storage sites can be developed: Given that it can take 5-10 years to develop a storage site, with considerable capital put at risk upfront, we expect most CO2 captured to be used for EOR in the near term. Dedicated storage sites, particularly in regions without CO2 pipelines or EOR production, may start to come on line as the tax credit approaches $50. One of the biggest opportunities for using the 45Q tax credit is to capture CO2 from bioethanol plants, which are not only numerous in the United States but emit CO2 of biogenic origin –as a result, storing this CO2 effectively pumps CO2 out of the atmosphere. Many of these plants are not near CO2 pipelines for EOR but the CO2 could be stored permanently underground and qualify for the higher level of tax credit, as at Decatur in Illinois. $22-52 is certainly enough to cover the levelised costs of CO2 storage over the long term, but the geology is not ideal in every location.

- Longer term developments: The level of credit rises over time, and then is inflation linked after 2026. As such, 45Q will have limited uptake in the next few years and investment will target carbon capture projects coming online in the mid-2020s, when the higher level of tax credits will be available. Any electricity sector projects – such as coal or gas power plants – would not be expected until the second half of next decade and, even at USD 50, would be limited in number without additional policy measures. Policy measures that could combine with 45Q to significantly multiply its uptake include low carbon fuel standards, in discussion in California, and modifications to the treatment of private activity bonds and master limited partnerships in this area. For direct capture of CO2 from the air, which has estimated costs well in excess of $200 per tonne, a higher level of additional policy support would likely be needed. Technologists with plans to remove carbon from the atmosphere will likely see 45Q as a “nice-to have”, rather than a cue to establish a market for guilt-free CO2. In a supportive move on the other side of the Atlantic, EU legislators agreed in January 2018 to let fuels produced from hydrogen combined with CO2 count towards renewable policy goals only if the CO2 is captured from ambient air.

US budget bill may help carbon capture get back on track

Tristan Stanley, Former Energy Technology Analyst Commentary —