Cite commentary

IEA (2024), A strong focus on oil security will be critical throughout the clean energy transition, IEA, Paris https://www.iea.org/commentaries/a-strong-focus-on-oil-security-will-be-critical-throughout-the-clean-energy-transition, Licence: CC BY 4.0

Oil security and emergency preparedness remain key priorities for the IEA half a century after its founding amid the oil shock of the early 1970s

Much has changed in the global energy landscape since the IEA was founded 50 years ago, but the security of oil supply remains a pressing concern for governments across the globe.

An enduring focus on oil security is a consequence of the continued need for oil to fuel cars, trucks, ships and aircraft, as well as to produce the petrochemicals necessary to manufacture countless everyday items.

As nearly 200 countries recognised at the COP28 climate change conference in Dubai in December, the world needs to transition away from fossil fuels if it is to avoid the worst impacts of global warming. However, while the world's dependence on oil is lessening, it remains deep-rooted, so supply disruptions can still cause significant economic harm and have a substantial negative impact on people’s lives.

Oil supply risks could increase, even as demand falls

While global oil consumption reached a record high in 2023, oil dependence is set to weaken further in many parts of the world in the coming years. The shift to a clean energy economy is gathering pace, with electric vehicle sales soaring, energy efficiency improving, and other clean energy technologies advancing rapidly. Consequently, a peak in global oil demand is in sight before the end of this decade, based on today’s policy settings.

However, the threat posed by oil supply disruptions will not disappear anytime soon. Even once demand starts declining, oil will remain an important part of the global energy mix for some time. There is also good reason to believe that oil supply disruptions are even more likely to occur in the coming decades than they are today. This is due to an elevated risk of supply-demand imbalances, increasing supply concentration for both crude oil and oil products, a highly uncertain geopolitical outlook, and a plethora of additional risks including the growing threat of cyberattacks and the increasing frequency of extreme weather events.

Investment uncertainty raises the risk of a supply-demand imbalance

Given the long-term outlook for oil demand and the risks to the climate from its combustion, the eventual need to scale back production activity is undeniable. However, there is a high degree of uncertainty around how quickly demand will fall, leaving oil companies facing difficult and commercially risky decisions around upstream investment. The consequences of these decisions will have an impact on the security of oil supply, as well as the bottom lines of oil companies.

If oil demand falls quickly and sharply, companies investing in production could struggle to make a return on their investments. But, if production activity is scaled back at a faster pace than demand falls, the outcomes would be increased market tightness, higher prices and an elevated risk of supply disruptions.

Increased crude oil supply concentration could leave importers more vulnerable

As clean energy transitions progress around the world, there will be a tendency for oil production to become more concentrated in the hands of low-cost producers, particularly those in some OPEC countries. For the moment, this tendency has been kept in check, mainly by increased production in the Americas. However, in all three scenarios outlined in the IEA’s World Energy Outlook 2023, OPEC’s share of global oil production is projected to rise well above the 33% the group of producers held in 2023.

Transitions could be destabilising for producer economies that fail to diversify away from their high dependence on hydrocarbon revenues. Therefore, a higher concentration of global oil supply among a smaller group of countries could lead to heightened concerns about security of supply, with disruptions potentially having even greater impacts than if they were to occur today.

Further declines in refining capacity will leave many countries increasingly exposed to potential disruptions in oil product supplies

Developments further along the oil value chain will also result in increased exposure to oil market risk for many countries.

In the refining sector, a significant amount of capacity has been shut down in advanced economies over the past decade, particularly in Europe where some refiners have struggled to remain competitive following the completion of numerous large-scale, highly complex refineries in the Middle East and Asia.

Faced with increased competition and a highly uncertain demand outlook in their main markets, more refineries in advanced economies are likely to close. This will leave many countries increasingly reliant on imports of oil products, such as diesel and jet fuel, even as demand declines. As a consequence of their increased import dependence, these countries will become more vulnerable to disruptions in oil product markets.

Oil supply security is also threatened by an array of additional factors

The risks to oil security are manifold and wide-ranging, extending far beyond risks emanating from structural changes in global oil markets. Governments should take particular note of the threats posed by the increasingly uncertain geopolitical outlook, climate change and extreme weather events, and cyber-attacks. In recent years, supply disruptions have been caused by events that fall into each of these categories.

In the past two years, oil markets have been roiled by Russia’s invasion of Ukraine and by conflicts in the Middle East. Meanwhile, water level changes and severe storms have caused supply difficulties across many regions, and a ransomware attack resulted in an extended closure of the largest oil product pipeline in the United States in 2021.

The IEA has built strong emergency response capabilities, aimed at minimising the risk posed by oil supply disruptions

Energy security has been at the centre of the IEA’s mission since its creation in 1974. At the IEA’s 2024 Ministerial Meeting last month, ministers responsible for energy in IEA member countries reaffirmed “the IEA’s foundational and central mission to ensure global energy security”. In the decades since its creation, the Agency’s work on energy security has expanded in scope, moving from an initial focus on oil security to promoting the security of natural gas and electricity supply, and more recently, to addressing the emerging security dimensions of clean energy transitions, such as critical mineral supplies.

However, throughout its existence, the IEA has remained focused on oil security and emergency preparedness. All IEA member countries have made a firm commitment to oil security by pledging to maintain readiness to respond to major oil supply disruptions at all times.

One of the IEA’s key tools is an oil stockholding system that requires member countries to hold stocks equivalent to at least 90 days of their net oil imports. IEA members are also obliged to maintain demand restraint programs to rapidly reduce oil consumption during disruptions, while some members can implement measures to increase crude oil production when needed. The effectiveness of oil emergency policies and response measures in IEA member countries is periodically assessed in emergency reviews coordinated by the IEA Secretariat.

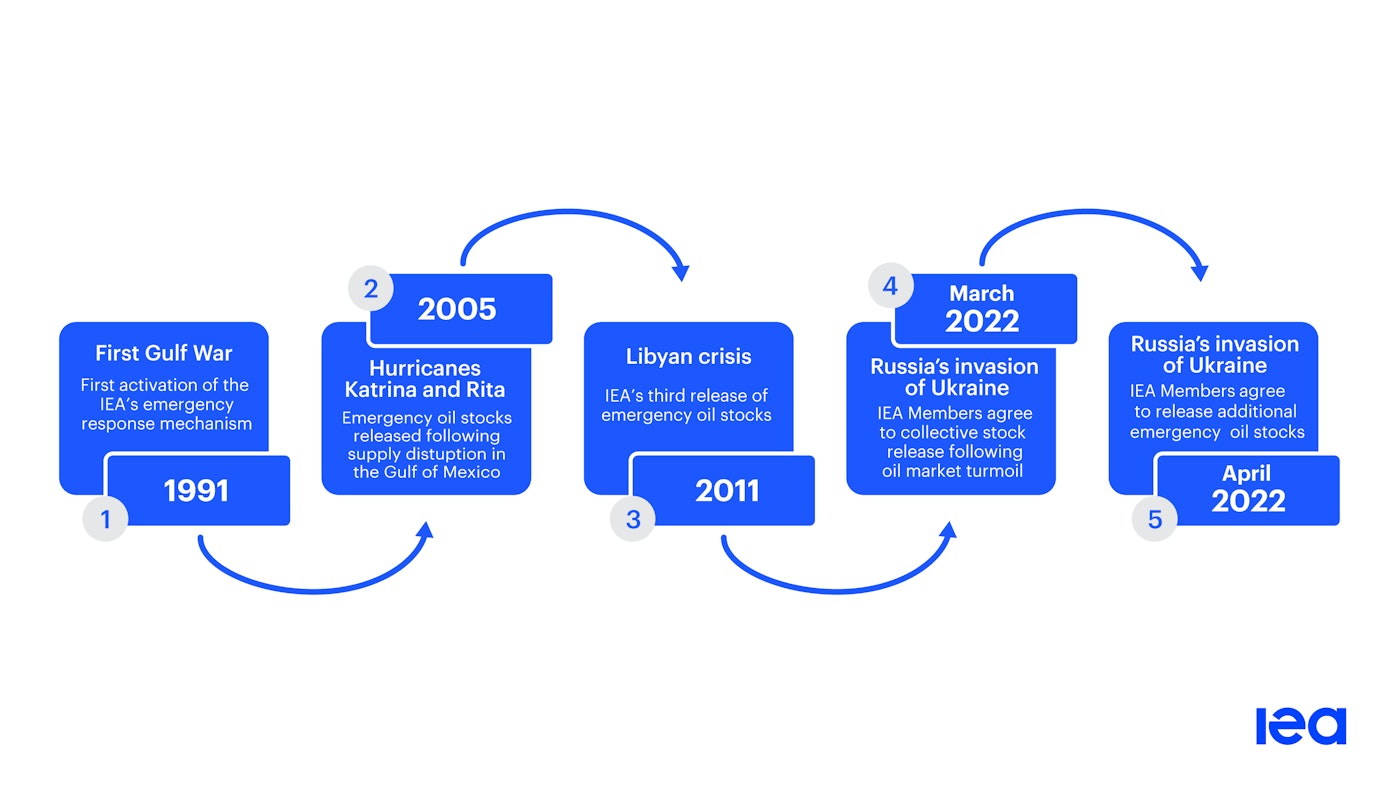

Over the past five decades, the IEA’s oil emergency response mechanisms have proven to be a lynchpin of global oil markets. Since 1991, the IEA has coordinated five collective responses to major oil supply disruptions, bringing critical additional supplies to oil markets amid turbulence triggered by wars, geopolitical strife and extreme weather events. As recently as 2022, the IEA coordinated the largest collective response in its history, involving the release of just over 180 million barrels of oil stocks in response to the market turmoil that followed Russia’s invasion of Ukraine.

The IEA will maintain an unwavering focus on oil security throughout the energy transition

Ultimately, reducing dependence on fossil fuels by promoting the uptake of clean energy solutions is the most effective means for any government to enhance energy security. Shifting to a clean energy economy should be seen as a golden opportunity to build a more sustainable energy system that minimises exposure to oil market volatility and decreases the prospect of supply shocks.

However, the journey to a clean energy economy may not be a smooth one, and oil consumption will not vanish overnight. For many years to come, oil supply disruptions will have the potential to cause significant economic harm and negatively impact people’s lives. Maintaining a resolute focus on oil security and emergency preparedness will therefore be critical throughout clean energy transitions worldwide, and the IEA’s emergency response capabilities will remain vital.

At the 2024 IEA Ministerial Meeting last month, marking the Agency’s 50th Anniversary, ministers reaffirmed the “importance of oil security to the global economy and the key role that the IEA oil stockholding system plays in contributing to global oil security”. As always, the IEA stands ready to act in the event of any major disruption to global oil supply.

Timeline of IEA emergency oil stock releases, 1991-2022

Open

A strong focus on oil security will be critical throughout the clean energy transition

Ilias Atigui, Energy Security Researcher Commentary —