Electrolysers

What are electrolysers?

Electrolysers, which use electricity to split water into hydrogen and oxygen, are a critical technology for producing low-emission hydrogen from renewable or nuclear electricity. Electrolysis capacity for dedicated hydrogen production has been growing in the past few years.

What is the role of electrolysers in clean energy transitions?

Hydrogen production today is primarily based on unabated fossil fuel technologies. In the Net Zero Emissions by 2050 Scenario, low-emissions hydrogen plays a key role in sectors that are hard to decarbonise, such as heavy industry and long-distance transport, with electrolysis powered by renewable electricity being the main route of production.

Where do we need to go?

Electrolysis capacity is growing from a very low base and requires a significant acceleration to get on track with the Net Zero Emissions by 2050 Scenario

Tracking Electrolysers

Electrolysers are a critical technology for the production of low-emission hydrogen from renewable or nuclear electricity. Electrolysis capacity for dedicated hydrogen production has been growing in the past few years, but the pace slowed down in 2022 with about 130 MW of new capacity entering operation, 45% less than the previous year. However, electrolyser manufacturing capacity increased by more than 25% since last year, reaching nearly 11 GW per year in 2022. The realisation of all the projects in the pipeline could lead to an installed electrolyser capacity of 170-365 GW by 2030.

Electrolysis capacity is growing from a low base and requires a significant acceleration to get on track with the Net Zero Emissions by 2050 (NZE) Scenario, which requires installed electrolysis capacity to reach more than 550 GW by 2030.

Progress is spread across different continents, from China, which leads on installed capacity, to the European Union and the United States, which have adopted important policies

Countries and regions making notable progress to advance electrolysers include:

- China, which leads both in terms of electrolysers capacity, with a cumulated capacity of almost 220 MW in 2022 and 750 MW under construction to be online in 2023, and manufacturing capacity for electrolysers, accounting for 40% of global capacity today.

- The European Union installed about 80 MW in 2022, more than twice that installed in 2021. In July 2022 the Commission approved funding of EUR 5.4 billion to support its first hydrogen-related Important Project of Common European Interest (IPCEI), Hy2Tech, with a focus on hydrogen technologies, including incentives for electrolyser manufacturers.

- The United States announced critical incentives in 2022 under the Inflation Reduction Act (IRA), including a credit to fund manufacturing projects. The IRA provisions have started to bear fruit and announcements for new electrolyser manufacturing facilities in the country are increasing.

Global electrolyser capacity additions slowed in 2022 despite strong momentum, but installed capacity could reach almost 3 GW in 2023

Total installed electrolysis capacity by technology in the Net Zero Emissions by 2050 Scenario, 2019-2030

|

Year |

Alkaline (MW) |

PEM (MW) |

Other/unknown (MW) |

Total (MW) |

|---|---|---|---|---|

|

2019 |

164 |

80 |

13 |

257 |

|

2020 |

197 |

108 |

14 |

319 |

|

2021 |

354 |

147 |

58 |

559 |

|

2022 |

404 |

217 |

66 |

687 |

|

2023e |

1152 |

921 |

811 |

2884 |

|

… |

||||

|

2030 – NZE |

- |

- |

- |

560 000 |

Notes: NZE = Net Zero Emissions by 2050 Scenario. PEM = proton exchange membrane. Numbers refer to capacity for dedicated hydrogen production from water electrolysis, therefore excluding electrolysers used in the chlori-alkaline industry. Capacity in 2023 is an estimate based on projects under construction and having reached final investment decision (FID), which are planned to be online in 2023. Source: IEA (2022), Hydrogen Projects Database: https://www.iea.org/data-and-statistics/data-product/hydrogen-projects-database

Electrolysers are already widely used in the chlor-alkaline industry to produce chlorine and sodium hydroxide, with installed capacity having reached more than 20 GW. However, the pace of deployment of electrolysers for dedicated hydrogen production only started to accelerate in the late 2010s. There was significant growth in annual capacity additions in 2021, a record year for deployment, with more than 200 MW of electrolysis capacity becoming operational.

Despite promising project announcements, capacity additions slowed down to 130 MW in 2022, with total installed capacity reaching about 690 MW. If the Ningxia Solar Hydrogen Project in China – a 150 MW project which accounted for almost two-thirds of the global additions in 2021 – is considered as an outlier, the 2022 growth was aligned with previous years. At the same time, announcements from the Chinese market indicate a trend toward larger projects, in the hundreds of MW scale.

Based on the current pipeline of projects under development and their expected operation dates, global electrolysis capacity could reach almost 3 GW by the end of 2023, a more than four-fold increase in total capacity compared to 2022. If all the projects currently in the pipeline are realised, global electrolysis capacity could reach 170-365 GW by 2030. Europe and Australia lead the scene, with half of the capacity together, followed by Latin America with around 15% of the announced projects. But uncertainty on the development of these projects persists, with the main barriers being uncertainty of future demand, lack of clarity on regulation and certification, lack of infrastructure to deliver hydrogen to the final consumers and, in the case of emerging economies, very limited access to low-cost finance.

To get on track with the NZE Scenario, in which more than 550 GW of electrolysers are installed globally by 2030 – between 1.5 and 3 times the capacity of all announcements – the project pipeline needs to scale up much faster.

Manufacturers have already started to expand their production capacity based on the expectation of future demand growth

Announced electrolyser manufacturing capacity by region and manufacturing capacity needed in the Net Zero Scenario, 2021-2030

OpenGlobal electrolyser manufacturing capacity reached almost 11 GW per year in 2022, a more than 25% increase compared to the previous year. Europe and China account for two-thirds of global manufacturing capacity. With the capacity additions of electrolysers for dedicated hydrogen production in the order of tens to hundreds of MW in the past few years, this technology’s global manufacturing capacity is currently largely underutilised (even including deployments related to chlor-alkali applications). Manufacturers have started to expand their production capacity based on current market growth (with an increasing number of large-scale projects announced), expectations of future demand growth, and because large manufacturing facilities represent a long-term decision.

Based on company announcements, the global manufacturing capacity for electrolysers could reach more than 130 GW per year by 2030, one-third more of the capacity in the pipeline at the end of 2022. Announced electrolyser manufacturing capacity could meet the targets in current national strategies, and it represents almost three-quarters of the capacity needed in the NZE Scenario. Europe and China would still lead, with around a fifth of this capacity each. Of all the plans by 2030, less than 10% have reached a final investment decision (FID), and 25% have been announced with an unspecified location. This indicates a degree of uncertainty for future manufacturing capacity deployment, which could be strongly influenced by each country’s supportive policy framework.

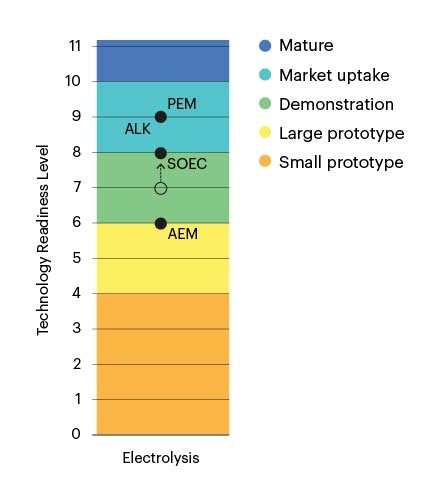

Alkaline and PEM technologies are commercially available, while SOEC and anion exchange membrane technologies are maturing

Alkaline and PEM (proton exchange membrane) electrolysers are already commercially available. Alkaline electrolysers are a more mature technology with a long history of deployment in the chlor-alkali industry. However, for the dedicated production of hydrogen, both technologies are at the same technology readiness level (TRL9) since they require policy support and improvements to stay competitive with traditional hydrogen production technologies based on unabated fossil fuels.

Solid Oxyde Electrolysis (SOEC) is quickly approaching commercialisation. In April 2023, a 2.6 MW SOEC electrolyser was installed in a Neste refinery in the Netherlands, becoming the biggest at that time. Just few weeks later, the record was broken with a 4 MW SOEC system installed in a NASA research centre in California. Bloom Energy increased its SOEC manufacturing capacity in 2022 with a new high-volume line in Newark, moving towards GW-scale operations in the United States. Topsoe is advancing construction of an industrial-scale 500 MW/yr manufacturing facility in Denmark, expected to be online in 2025.

Anion exchange membrane (AEM) electrolysers are at earlier stages of development: they are produced and commercialised, but still at very small scale. Alchemr has a readily available AEM electrolyser at the kilowatt scale, and Enapter aims to produce them at scale from 2023 thanks to a new factory being built in Germany.

Technology readiness levels of electrolyser technologies

Open

Capital cost reduction remains critical for electrolyser deployment, while system efficiency and critical minerals intensity reduction have improved

Electrolyser capital costs are difficult to compare across systems as there is often a lack of information about the system’s scope or key parameters. However, cost reductions for the alkaline technology have generally been moderate over recent decades, while PEM technology has shown significant cost reductions, although it still remains around 30% more expensive than alkaline systems. These cost reductions have mostly been realised through R&D in the absence of significant market penetration. CAPEX requirements for an installed electrolyser system are currently in the range of USD 5001 400/kWe for alkaline technology and USD 1 100-1 800/kWe for PEM, while estimates for SOEC range from USD 2 800-5 600/kWe.

Electrolysers for dedicated hydrogen production have traditionally been built in small volumes for niche markets, but the anticipated increase in production volumes and associated growth in factory size are expected to reduce investment costs for all electrolyser technologies through economies of scale and automation. Optimisation of electrolyser supply chains is also expected to generate cost reductions.

Tracking the evolution of electrolyser efficiencies is similarly complicated, as efficiency is dependent on the system design and optimisation goals. Alkaline and PEM electrolysers have comparable efficiency and – depending on design – can operate flexibly to allow direct coupling with variable renewable electricity sources. SOEC systems have reached higher electrical efficiency (84% achieved by Sunfire, although this is not directly comparable with other technologies, given the additional heat input needed in SOEC systems) and can be a promising solution where waste-heat is available, such as in industrial hubs, given their operation requires temperatures higher than 650 °C. In the past few years, new electrolyser designs have reported very high efficiencies, such as Hysata’s capillary technology (80% efficiency on a low heating value basis).

Innovation in critical materials intensity reduction is also progressing. For example, in 2023 start-up Bspkl raised capital to commercialise a catalyst coated membrane (CCM) with 25 times less iridium and platinum compared to traditional PEM designs. Clean Power Hydrogen (CPH2) has developed a membrane-free electrolyser that uses no platinum-group metals (PGM) and, at the same time, can increase the lifetime of the system.

For more information

Governments have significantly raised their ambitions to deploy electrolysis capacity

An increasing number of governments are establishing targets for the deployment of low-emission hydrogen production capacity to signal their long-term vision for hydrogen technologies. This is creating some momentum in the industrial sector, particularly for projects aiming to deploy electrolysis capacity. The sum of all national targets for the deployment of electrolysis capacity has reached around 160-210 GW, a 10% increase from 2022.

Governments have started to adopt new mechanisms to support project developers and mitigate investment risks

Several governments have begun to implement policies in the form of grants, loans, tax breaks and carbon contracts for difference (CCfDs) to support first- movers, with several significant announcements over the past few years:

- United States: In 2021 the US Congress passed the Bipartisan Infrastructure Law, which includes grants for the creation of hydrogen hubs, with selected projects due to be announced in Q3 2023, and incentives to foster infrastructure and electrolysis manufacturing. The IRA, signed in August 2022, offers several tax credits and grant funding to support hydrogen technologies, with an expected impact on electrolyser deployment and manufacturing facilities.

- European Union: In July 2022 the European Commission approved funding of EUR 5.4 billion to support its first hydrogen-related Important Project of Common European Interest (IPCEI), with a focus on hydrogen technologies. In February 2023, the Commission adopted the Delegated Act defining production criteria for hydrogen to be considered renewable. In March 2023, the EU Hydrogen Bank was launched, with the aim of covering the initial green premium for renewable hydrogen, both produced inside the EU and imported. The first auction will be launched in Q3 2023.

- Germany: In 2021 Germany launched the H2Global initiative, which uses a mechanism analogous to the CCfD approach, compensating the difference between supply and demand prices with grant funding from the German government. The bidding process was launched in December 2022, with deliveries expected for the end of 2024, although tender deadlines have recently been extended.

- United Kingdom: In 2021 the United Kingdom presented a business model for low-carbon hydrogen, based on similar approach to CCfDs, that went through public consultation in 2022. Between July 2022 and January 2023, the government opened the first Electrolytic Allocation Round and pre-selected projects, with the aim to support at least 250 MW of capacity. The second allocation round will open by the end of 2023.

View all hydrogen electrolysis policies

Investment in electrolyser deployment continues to grow, more than doubling from the previous year

Despite electrolyser capacity additions in 2022 being lower than the historic high of 2021, investments in this area continue to grow, driven by the whole projects pipeline and policy support. Several projects are under construction and expected to be online in 2023, including a 260 MW facility in China, and capital has already been committed. We estimate that investments in 2022 have exceeded USD 0.6 billion globally, more than double compared to the previous year’s spending. Much of this relies on government funding, support that continues to underpin project viability. However, it is still too early to see the full impact of recent major hydrogen policies reflected in projects investments.

We would like to thank the following external reviewers:

- Tim Cholibois, Enapter, Reviewer

- Leif Christian Kröger, thyssenkrupp nucera, Reviewer

- Agustín Rodríguez Riccio, Topsoe, Reviewer

- Alan Tan, HyGreen Energy, Reviewer

- Hergen Thore Wolf, Sunfire, Reviewer

Recommendations

-

The large-scale deployment of electrolysers for the dedicated production of hydrogen depends on the development of large-scale projects and an increase in manufacturing capacity that can allow electrolysers to benefit from economies of scale and learning by doing.

Stimulating demand can prompt investment in these areas, but without further policy action, this process will not happen at the necessary pace to meet climate goals. Providing tailor-made support to selected, shovel-ready flagship projects, as well as clear and internationally agreed standards on hydrogen emission intensity, can mobilise the necessary investment and kick-start the scaling up of low-carbon hydrogen. This will also help manufacturers to gain clearer visibility of the demand for electrolysers and move towards firm investment decisions for mass-manufacturing in industrial scale facilities, which can significantly reduce the production cost of electrolysers.

-

Innovation in electrolyser technologies will be critical to ensure that this technology plays its role in the transition to a net zero energy system. Despite some electrolyser designs already being commercial (alkaline and PEM), they cannot compete with traditional hydrogen production technologies without policy support. Supporting the already strong innovation activity in the sector will help achieve higher efficiencies, enhanced resistance against degradation and decreased material needs. These would significantly decrease both the cost of manufacturing electrolysers and the cost of producing hydrogen.

In addition, supporting those technologies that are not yet commercially available (SOEC and AEM) will help them to reach commercialisation faster. Having a larger portfolio of commercial technologies would decrease demand for critical materials and increase competence among the developers, which in turn can enhance innovation activity and accelerate technology development.

-

The private sector and governments should work together to make sure that supply chains for electrolysers are able to respond to a large increase in demand, in a short period of time and in geographically distributes areas. Making sure that supply chains are resilient and can respond to this challenge requires them to have the ability to scale up and diversify. Early engagement with governments can help to identify potential bottlenecks as well as regulatory and supportive actions that can overcome those barriers. Diversification of the upstream supply chain and co-operation with partners can help secure the supply of critical components and prevent long lead times.

Programmes and partnerships

Promising signs in electrolyser manufacturing

Momentum continues to build behind low-emissions hydrogen amid the global energy crisis, with electrolyser manufacturing expected to grow strongly and pilot projects proliferating in new applications such as steel and transport. But these areas remain a small part of the overall hydrogen landscape, highlighting the need for greater policy support.

Authors and contributors

Lead authors

Francesco Pavan

Contributors

Jose M Bermudez

Stavroula Evangelopoulou

Simon Bennett